Crypto roundup: Bitcoin climbs above resistance; Solana back in business; DeFi coins pump

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Is Bitcoin’s golden cross actually a price-pumping prophecy that’s beginning to play out? Time will tell, but BTC has broken through heavy resistance today at US$47K, bringing up much of the market with it.

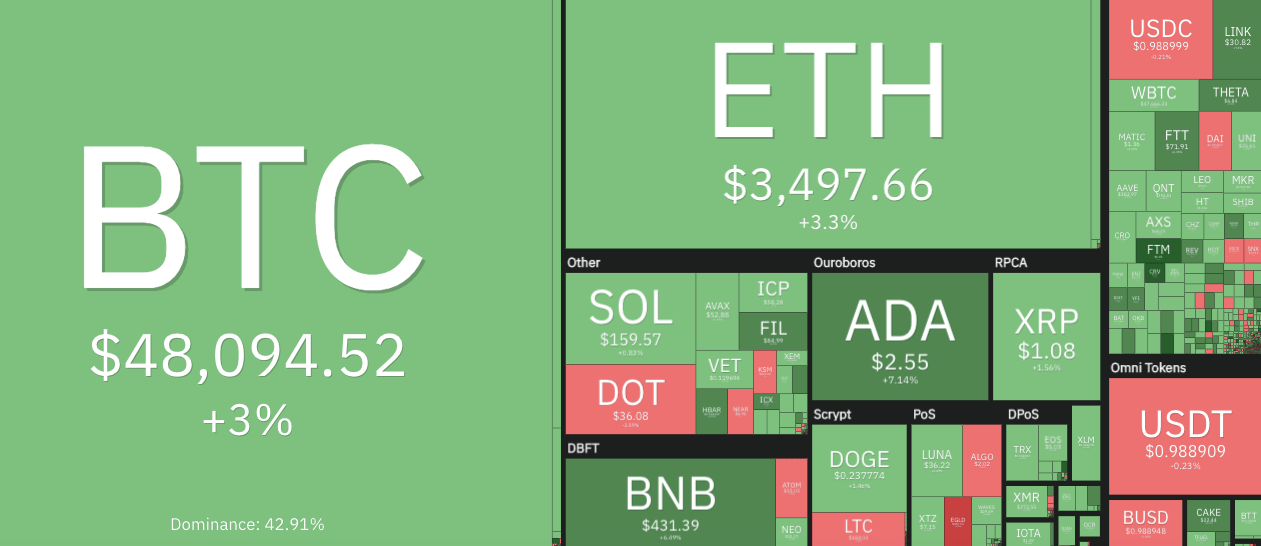

At the time of writing, the entire crypto market cap is up 3.5% from this time yesterday, hanging around US$2.26 trillion.

Kingpin crypto Bitcoin (BTC) has presently broken through to US$48,094, up about 3% in the past 24 hours.

#BTC is still successfully retesting this current orange area as support and recently formed a new Higher Low via downside wicking$BTC #Crypto #Bitcoin pic.twitter.com/rdfoFjbKKs

— Rekt Capital (@rektcapital) September 15, 2021

And whenever the OG crypto is having a good day like this, it almost always spurs the Stock to Flow model creator into Twitter action…

Although I focus on averages (green lines), and have no model for when or how high the top is, I expect the top to be in the yellow area:

– relatively later than 2013 & 2017 tops ("lengthening cycle"?)

– above 2017 top (no "diminishing returns"?)

So this cycle will be different. pic.twitter.com/2H3hzOg17n— PlanB (@100trillionUSD) September 14, 2021

Meanwhile, Ethereum (ETH) – something else Cathie Wood is bullish on besides Bitcoin – is closely following Bitcoin’s chart pattern, as usual, and is also up roughly 3% per cent, changing hands for US$3,497.

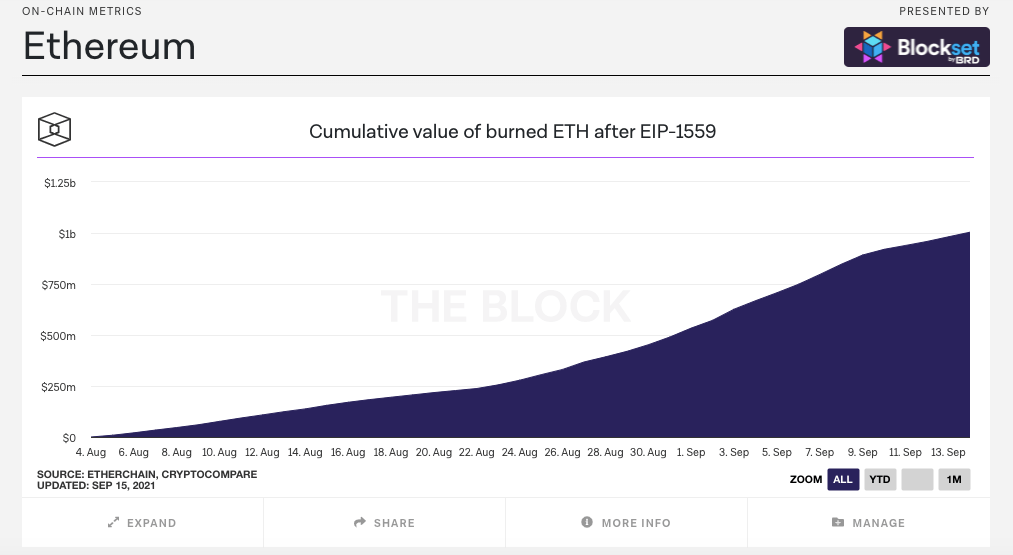

More than one billion in Ethereum has now been burned since the protocol’s London hardfork and EIP-1559 upgrade, according to The Block’s Data Dashboard.

Why’s that a good thing, then? It means Ethereum’s inflation rate is decreasing and its chances of becoming a deflationary asset are growing.

A decreasing supply, coupled with growing demand… it’s a recipe for price-rocketing success. (Possibly. Not financial advice. It never is.)

Mooners and shakers: Solana recovers, Fantom steals layer 1 opera

The biggest news today from the crypto sub-sector of layer 1 smart-contract platforms relates to Solana and Fantom.

After nearly 18 hours of outage operatics, Solana is back up and running today, to the relief of all bag holders, not to mention its founder and CEO…

The life of an engineer is to always work on stuff thats broken, never on anything that already works.

— toly 🇺🇸 (@aeyakovenko) September 15, 2021

Seems reassuring…

But here’s what the Polkadot (DOT) founder had to say on the matter…

Events of today in crypto just go to show that genuine decentralisation and well-designed security make a far more valuable proposition than some big tps numbers coming from an exclusive and closed set of servers. If you can't run a full-node yourself then it's just another bank.

— Gavin Wood (@gavofyork) September 14, 2021

Strong words, although scroll through the Ethereum community’s social channels and you’ll probably find stronger.

Nevertheless, it’s hopefully just a bump in what many believe will be a successful road for Solana. The SOL token’s price has certainly been in recovery mode today, looking sunnier at US$159.7, steadily pulling back some of the ground it lost.

As for another layer 1 with big potential, Fantom (FTM) has been on a comparative surge, and is the best-performing smart-contract platform of note today: +17.38% and back up to US$1.47 after also dipping heavily in the past few days.

Today’s Fantom pump probably has something to do with its new exchange listing…

https://t.co/vCNztABJoG Exchange lists Fantom $FTM and Internet Computer $ICP.

Trade these tokens in #USDT pair now.Sign Up 👉 https://t.co/qE92OijleG pic.twitter.com/oWW4VmuYuq

— Crypto.com (@cryptocom) September 14, 2021

Although that same news isn’t exactly doing that much (in crypto price action terms) for Internet Computer (ICP), which is up 1.3% since this time yesterday.

Elsewhere in the market today, other notable gainers include several DeFi coins, such as: TrueFi (TRU) +33.7%; Ren (REN) +26.2%; Keep Network (KEEP) +23.9%; Curve (CRV) +19.8%; Orion Protocol (ORN) +18.4%; and Quickswap (QUICK) +18.4%.

In addition to Curve in that list, some of DeFi’s other big players are also doing quite well again, including Chainlink (LINK) +6.7%; Aave (AAVE) +5.6%; and Uniswap (UNI) +4%.

According to the decentralised finance data analytics platform Defi Llama, the DeFi sector’s total value locked (TVL) is now back up to US$184.5 billion, recovering more than $24 billion since September 10, when it had dropped down to about US$160 billion.

No time for losers? Yeah, here’s a few coins taking some heavy damage today: CPChain (CPC) -48% after pumping yesterday; and same story with Cover Protocol (COVER) -20.9%; plus Avaxlauncher (AVXL), the Avalanche launchpad token, is also well down and taking a 34.2% beating in the past 24 hours.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.