Crypto roundup: Bitcoin’s golden cross arrives; Floki coins still pumping

Coinhead

Coinhead

A bullish technical chart indicator know as a “golden cross” has just played out for Bitcoin. Meanwhile, “Floki” dog-meme tokens are still pumping on the back of an Elon Musk tweet.

Just another day in crypto, then? Not exactly – SMA (simple moving average) golden crosses don’t come around all that often.

As Coinhead’s Cryptionary explains, a golden gross is a bullish technical trading indicator in which a short-term moving average line (the 50-day MA in this instance) crosses back above a longer-term moving average (the 200-day MA in this case).

This can potentially signal major upwards price movement and is the opposite of a “death cross”, which last played out in June.

According to many analysts, these crosses are “lagging indicators”, which might not necessarily mean Bitcoin will see an overly decisive positive move immediately. (Or at all, for that matter.)

#Bitcoin technical update: On the cusp of a Golden Cross (a lagging bullish indicator), within a short-term bearish pennant.

Macro: Bullish

To news: Neutral

On-chain: BullishOpinion: Continued rangebound price action with $43,650 serving as baseline support. Awaiting breakout. pic.twitter.com/ZoVX4XmVSb

— Dr. Jeff Ross (Pleb counselor) (@VailshireCap) September 14, 2021

But, as analyst “Dom’s Crypto” points out, the last time the market saw a Bitcoin golden cross (in May 2020), BTC did embark upon a massive, 11-month-long, 700 per cent rally.

#Bitcoin #BTC #Crypto #cryptocurrencies 1d#Bitcoin is about to face a very important moment ❗️

'Golden Cross' 🪙✖️is upon us 🔥

The last time #BTC had this moment, it has led to a impressive rally of est. ~ 700% gains💥

➡️Market likes to shake people out before major events pic.twitter.com/yYfbvbBDCw

— Dom's Crypto (@Doms_Crypto) September 10, 2021

Meanwhile, as well as highlighting the golden cross, fellow analyst and trader Rekt Capital was looking at another technical indicator that could also be a harbinger for bullish action – the 21-week EMA (exponential moving average).

#BTC has successfully retested the green 21-week EMA as support for the second week in a row

The 21 WEMA is a time-tested Bull Market Indicator for $BTC#Crypto #Bitcoin pic.twitter.com/W5tUephzOC

— Rekt Capital (@rektcapital) September 14, 2021

Holding this level of support (currently just below US$44K) tends to characterise the movement of a bull market, according to Rekt Capital.

Comparing this bull run with that of 2013’s, which had a mid-cycle dip, the analyst said that, “this is very similar to what we’re seeing right now. But it’s really important for this current retest of the 21-week EMA to amount to something [for a bull market return]”.

Yet another professional chart watcher, who has been targeting a US$47K breakout in his analysis, certainly sounds confident the bull market is back in play…

Still standing by, peak high bull cycle prediction; #Bitcoin to $250,000-300,000#Ethereum to $15,000-20,000#Polkadot to $250-350#Chainlink to $250-350#Cardano to $10-20#Zilliqa to $5-7#Elrond to $750-1000#DIA to $50-75

The other one was January.

— Michaël van de Poppe (@CryptoMichNL) September 14, 2021

Van de Poppe is an insightful analyst and one we frequently rely on to help read the market, but it might be prudent to take any lofty predictions you see with a grain of salt for now.

The market-moving OG crypto (that’s BTC, btw) may be up 5.5 per cent since this time yesterday and trading at US$46,583, but it still has quite a bit to prove just yet.

Before we look at the day’s winners and losers more broadly, let’s take the dogs for a walk…

On the back of Tesla and SpaceX CEO Elon Musk tweeting about his Shiba Inu puppy “Floki”, meme coins using the dog’s name soared the other day. And some of them are still off the leash and running wild.

Shiba Floki (FLOKI), self-described as “the world’s best meme coin”, is having the opposite of a dog-day afternoon and is currently the entire market’s top performer, up a leg-humping 632% and rising at the time of writing.

Meanwhile a coin using the same FLOKI ticker – Floki Inu – is up 20.38%; FlokiPup Inu (FLOKIPUP) is +24%; and Floki Shiba Inu (FLOKISHIB) is +65%. There are a few others in the pack, such as Baby Floki Inu (BFLOKI) but we’re just highlighting the double and triple-digit gainers.

Father and son are tired after a long day of playing. #FLOKI @elonmusk pic.twitter.com/h330vL4UTQ

— 🗒🗒🗒.eth (@YLN_Tee) September 13, 2021

Moving on from ridiculous dog-meme coins then…

At the time of writing, most “layer 1” projects were faring better than 24 hours ago, which is relieving for bag holders of these tokens, as yesterday was a bloody one in smart-contract town.

The original smart-contract platform and no. 2 crypto by market cap, Ethereum (ETH), is looking pretty solid right now, at US$3,394 (+6.34%).

The highest-valued proof-of-stake smart-contract platform, meanwhile, is Cardano (ADA) and it’s flatlining at US$2.40 for now, barely moving since this time yesterday. The potential “buy-the-rumour, sell-the-news” event predicted around the project’s smart contracts upgrade has so far actually been a non-event in itself.

Another lofty layer 1, Avalanche (AVAX), has also been doing very little in terms of price action since yesterday, but at least it’s a functioning network at the moment. Solana (SOL) has literally been doing nothing, completely stalling for several hours, while its token price has currently moved down about 6.7% as a result.

(This is a developing story. We’ll update when we learn more.)

Resource exhaustion in the network is causing a denial of service, engineers are working towards a resolution. Validators are preparing for a potential restart if necessary.

— Solana Status (@SolanaStatus) September 14, 2021

Meanwhile, Elrond (EGLD) is 11% to the positive, while Cosmos (ATOM) is down 9.6% in the past 24 hours, after an impressive recent run that still has it +36% on the week.

Elsewhere in the market, some of the day’s biggest winners include: low-cap IOT project CPChain (CPC), ranked #891 on CoinMarketCap and now surpassing FLOKI with a whopping +751% gain; insurance play Cover Protocol (COVER) ranked #727, up +102.4%; and DeFi project Rari Capital (RGT) making a bit of a comeback after a hack in May, up 37.56% in the past 24 hours.

It’s hard to ascertain what’s causing these pumps, exactly, although there’s plenty going on at Rari Capital, according to one of its founders…

List of random things going on @RariCapital:

+ Nova

+ Plugins

+ Reactive interest rates

+ Arbitrary liquidity mining (any asset)

+ Arbitrary yield agg (any asset)

+ Updated emissions

+ Market and stablecoin Task Forces popping off

+ Integrations focused team abt to materialize— jai.eth (@jai_bhavnani) September 13, 2021

As for CPChain…

CPChain $CPC up 751.5%

Went all-in yesterday 😌

said no-one 😂 pic.twitter.com/DLI7SNFv5C

— Kyle MacLean 🍁 (@KyleMacLeanX) September 14, 2021

Handpicking out a few notable “losers” today, as mentioned, Cosmos (ATOM) is not quite in double-digit red percentage territory, Harmony (ONE) is down 6.34%; and fellow layer 1 platform Fantom (FTM) is down 4.3% since this time yesterday.

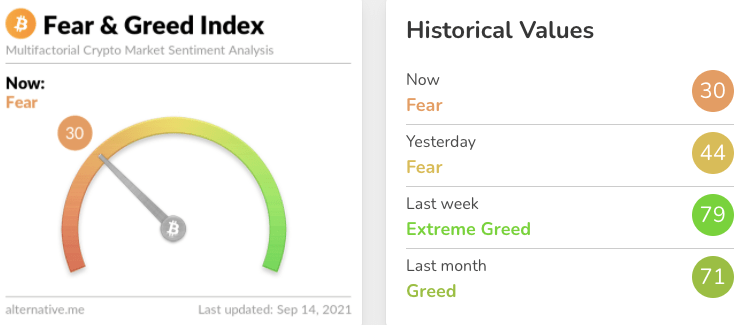

Interestingly, despite today’s golden-cross action there’s still a fair bit of fear in the market hanging over from the past couple of days, if you believe the Fear & Greed Index sentiment indicator…