Crypto news: Big investors still piling into Bitcoin; KISS star Gene Simmons owns 14 cryptos

Lick it up: Gene Simmons might be making a killing from crypto (Getty Images)

The cryptocurrency market might still be looking for definitive direction at the present moment, but institutional interest hasn’t waned, according to a new report. Meanwhile, Gene Simmons owns a crapload of crypto.

Big institutional players were made for loving Bitcoin, judging by CoinShares’ latest report published today. CoinShares is a large, global digital asset investment service, which launched the first ever regulated Bitcoin investment fund back in 2014.

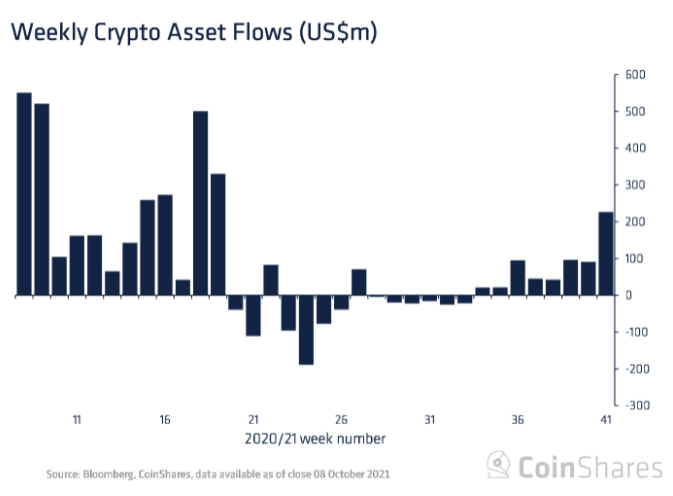

According to its Digital Asset Fund Flows Weekly report, more than US$226 million in capital has flowed into institutional crypto products in the past week. It also brings a strong run of eight-week inflows up to US$638 million. (Inflows equals investment interest, while outflows can mean profit taking.)

Bitcoin (BTC), in particular, has dominated the inflows this past week – by a significant margin, accounting for about US$225 million alone.

It’s a confidence-boosting sign that big players could be expecting Bitcoin’s price to increase, especially at a time when the OG crypto has already pumped by more than 15 per cent in the space of seven days.

At the time of writing, Bitcoin is changing hands for US$57,308 – a 1.5 per cent increase since this time yesterday.

“We believe the turnaround in sentiment towards Bitcoin is due to constructive statements from SEC chair Gary Gensler, potentially allowing a Bitcoin ETF in the US,” reads the report. “Our recent survey data also highlights greater institutional participation in the asset class.”

Bitcoin favoured while the altcoins are a mixed bag

The spike in these Bitcoin inflows now sees the combined assets under management (AUM) of institutional crypto products surge up to about US$66.7 billion, just five per cent shy of the sector’s all time high, according to the report.

Altcoins, however, have seen less exuberance from institutional players, and this is to be expected while Bitcoin continues to steal the show for the moment.

Ethereum (ETH), for instance, saw minor outflows last week – totalling US$14 million. And, despite more Ethereum miners holding their coins than usual at present, the no.2 crypto continues to lose market share to Bitcoin for now, having apparently “fallen 1 per cent to 24 per cent of AUM over the last week alone”.

Decent news, on the other hand, for Solana (SOL) and Cardano (ADA), which both saw comparatively modest institutional inflows compared with Bitcoin last week.

Rock’n’roll all night, and HODL crypto every day

In slightly less statistically dry news, Gene Simmons, the monster-tongued bassist and co-singer/songwriter from KISS, holds 14 different types of crypto.

Simmons was interviewed by one of YouTube biggest crypto channels earlier this week, Altcoin Daily, and displayed a half-decent knowledge of the crypto market and various altcoins and NFTs.

https://twitter.com/WAGMInews/status/1447268867471028225

Back in February, the star dropped the tweet bomb that he’d bought US$300,000 worth of Cardano (ADA), telling the world that it was “one I believe in”.

Not bad foresight for an old rocker – the price has more than doubled since that investment, so if he’s HODLed on, which he indicated he has in the interview, his ADA stash alone would be worth more than US$700,000 right now – almost one million Aussie dollars.

“I like Cardano, although it’s an idiot name,” Simmons told the Altcoin Daily twin brothers Aaron and Austin. “Get rid of that thing. Just call it ADA. Call it by the trading name.”

The no.3 altcoin is actually named after Gerolamo Cardano – one of the most influential mathematicians of the Italian Renaissance. Unusual, yes, but not exactly an idiot’s name. Maybe founder Charles Hoskinson, a fan of old-school rock, will forgive him for that slip of the tongue.

Simmons also said that, among his 14 cryptos, Bitcoin and Ethereum are the two biggest he holds on a portfolio percentage basis. And he apparently sold Dogecoin (DOGE) earlier this year after an Elon Musk tweet about it, but plans to HODL his remaining digital assets for “at least a decade”.

Without disclosing his full portfolio in detail, the rock legend claimed, “all my cryptos have done very well”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.