Crypto roundup: Bitcoin ETF rumours grow as market waits for moon mission

Coinhead

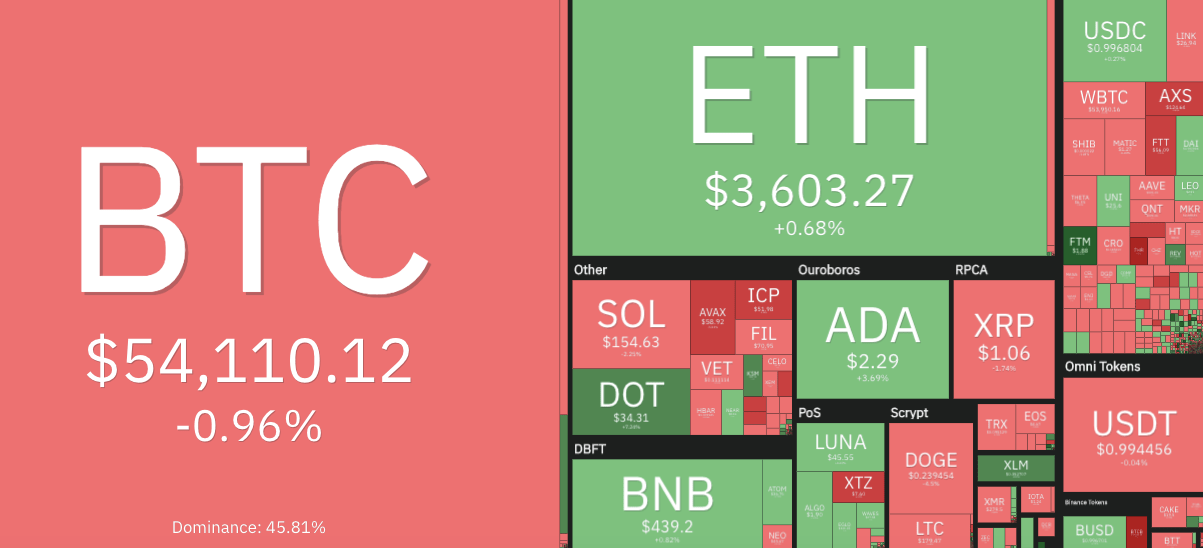

As Bitcoin continues to float around US$54K, the cryptoverse is hoping it’s simply refuelling for the moon mission. Meanwhile, there are whispers of an ETF approval landing this month.

It may well be that Bitcoin needs to delve lower to fill up – a retest of previous resistance back around US$50K wouldn’t be a shocker. And, in fact, it would be an extremely bullish thing if that level acts as support, like Bloomberg strategist Mike McGlone forecasts it might.

But for now, it’s in zero gravity around US$54,100 at the time of writing, down almost one per cent since this time yesterday when engines were roaring.

The entire crypto market cap is currently US$2.39 trillion – so, generally speaking, not much has changed there in the past 24 hours (give or take a few hundred million dollars, that is).

Ethereum (ETH), something else McGlone, and probably at least two thirds of crypto fans*, are bullish on, is up just slightly, moving above US$3,600 at press time.

(*We did a poll of three people. Two think it’s going “to the moon” before the end of this year. For infinitely better quantitative and qualitative crypto research, though, we’ll point you in the direction of Finder.)

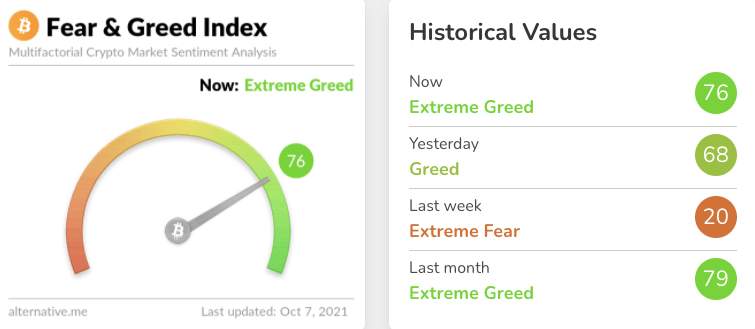

After yesterday’s pump, sentiment has been running pretty hot on Crypto Twitter, YouTube and elsewhere, and that’s reflected in the latest needle move from the Fear & Greed Index.

If you’re invested, and this dial manages to pushes its way to full Canberra Raiders green in the coming weeks or months, then here’s hoping you took some profits along the way. We know how hard the needle can swing back and to the left.

As for the chart-focused analysts today, they’re mostly saying the same stuff – a pullback and retest of prior resistance is very possible before a potential blast higher. But here’s something that caught our eye…

The #BTC crash in May 2021 was just a Bear Trap$BTC #Crypto #Bitcoin pic.twitter.com/qCBNlVDB6y

— Rekt Capital (@rektcapital) October 7, 2021

If Rekt Capital is correct, and the crypto market has only just been coming out of the “Bear Trap” phase, then the moon might just be a stopover on the way to Mars… or some other stellar body. (Trip back to Earth looks like a crap journey, though.)

Today, the US Securities and Exchange Commission (SEC) approved an ETF (exchange-traded fund). Good for it, right?

It’s not a Bitcoin one, though, so why are we bringing it up?

It’s because it’s an ETF that consists of firms holding large amounts of Bitcoin on their balance sheets. The Volt Crypto Industry Revolution and Tech ETF gives investors exposure to about 30 different companies including Tesla, Coinbase, Square and PayPal.

“A year ago, an ETF like this wouldn’t have been possible,” said Volt founder Tad Park in an interview with Decrypt. “We hope this is a crack in the dam.”

It’s not the real thing for Bitcoin fans, of course, but it’s still a positive step from the SEC.

And meanwhile, rumours still circulate that a BTC Futures ETF could get the green light extremely soon.

Bloomberg Senior ETF Analyst Eric Balchunas gave his odds on when he thinks it’s most likely. Maybe October 18 could be an interesting day in the market, judging by his tweet, below. If anyone’s going to call it correctly, it’s probably a bloke who studies ETFs for a living.

Yes, the SEC has kicked can on bitcoin ETF approval BUT that is for the physically-backed ones under '33 Act. The futures ETFs filed under the '40 Act (which Genz loves) are very much alive and likely on schedule (we think 75% chance approved in Oct). Here's our odds: https://t.co/cSZ8aDsITl pic.twitter.com/DUEvRANvO7

— Eric Balchunas (@EricBalchunas) October 2, 2021

Including the ETF news for the coming month or perhaps an ETF, it will probably kickstart bullish continuation on the markets for #Bitcoin and later also, on the #altcoins, when retail starts to join again.

— Michaël van de Poppe (@CryptoMichNL) October 7, 2021

The possibly undervalued “layer 1” blockchain Fantom (FTM) has put the afterburners on today. It’s up 33.84% since this time yesterday on the back of several recent inter-crypto partnerships, including this one…

#Geist, a lending platform based on #Aave, launched on #Fantom yesterday. In a short period of time it has gained a TVL of over $2 bln according to https://t.co/wZDWpmPbxS. This gives the #Fantom ecosystem a massive boost. Will have to wait and see how sustainable this is.

— Eight (@eight_global) October 7, 2021

Other than that, double-digit gains (and, in some instances, triple-digit) are still being populated by dog meme coins today – like it, or not.

Something called Safe Moon Inu (SMI), for instance, is up a crazy 315 per cent at the time of writing. Not financial advice, of course, but it wouldn’t be surprising to see that one have a ruff comedown after such a bolt up.