Chain Reactions: ‘This time, the herd really is coming’ – bulls dominate as Greed grips crypto market

"Haha, retail losers. You have NO IDEA what we're doing." (Pic: Getty Images)

Sentiment is suddenly quite high again in the Fear & Greed-fuelled crypto market. Let’s sift through some of the froth to see who’s snorting loudest…

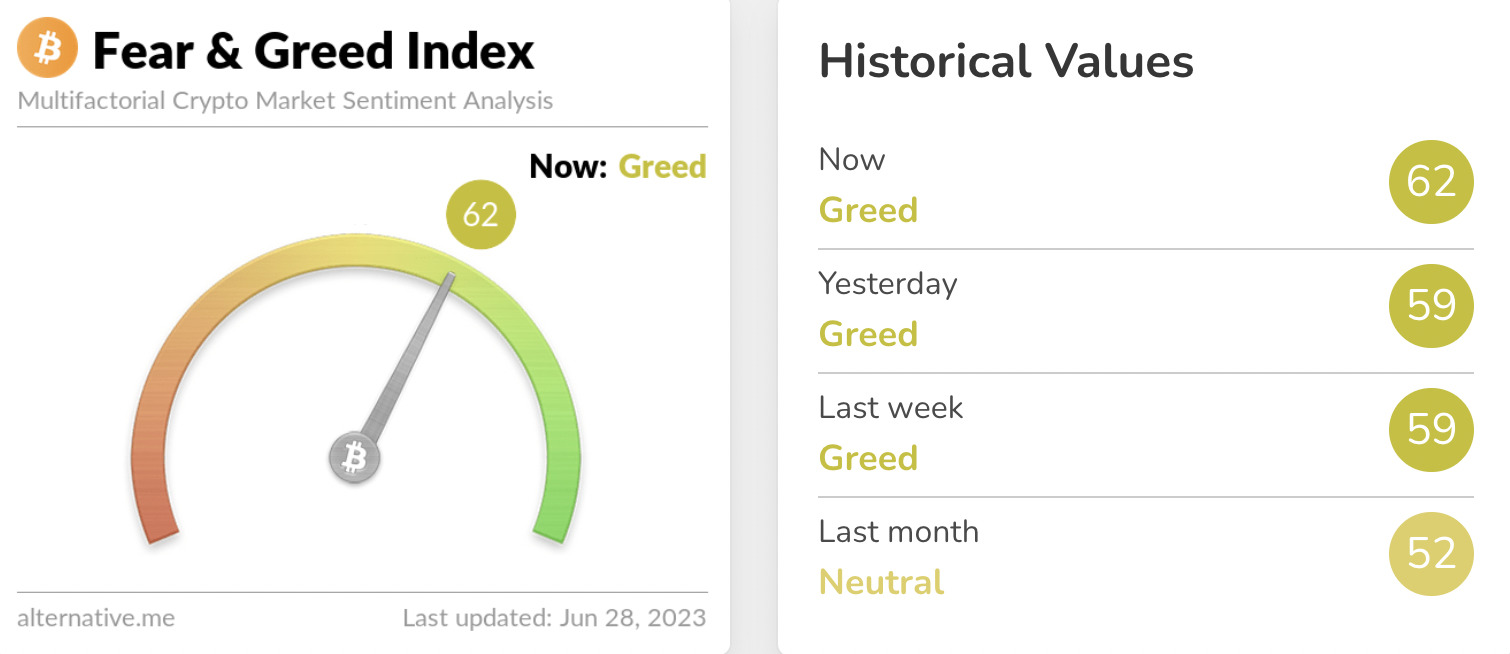

Firstly, just some confirmation here about that greed-related point. A quick look at the trusty Crypto Fear & Greed Index tells us…

… that things have been turning citrussy green on the sentiment dial ever since the BlackRock BTC ETF filing news hit the Cryptoverse last week, with several other institutional players now emerging from the shadows and showing their hands, too.

Crypto will be one of the ‘fastest horses’: Raoul Pal

Former Goldman Sachs exec/Wall Street trader turned Raoul Pal (now CEO of financial media outlet Real Vision) has a bold-as-ever prediction about crypto as an asset class.

In his new Global Macro Investor newsletter, Pal describes crypto as the “fastest horse” among asset classes amid a situation in which global liquidity rises.

“Since last October, we have been suggesting that the two fastest horses in this race (the debasement and liquidity cycle) will be crypto first, followed by Exponential Age stocks and then tech. It is playing out perfectly.”

By “Exponential Age” stocks, Pal is essentially referring to technological advancements of significance, such as AI. Crypto is at the helm of this thesis.

The Exponential Age theme, continues, well exponentially….

The Exponential Age basket is up over 60% YTD… 1/ pic.twitter.com/zFrGQPS1HM

— Raoul Pal (@RaoulGMI) June 21, 2023

While the macro man believes stock markets could well see a significant sell-off, he is also of the opinion that this may not stymie the crypto market too much. In fact, he thinks market liquidity will continue to rise, which has historically been conducive to bullish crypto market conditions.

“Short-term, the NDX (Nasdaq) has entered overbought territory versus global liquidity conditions and is likely overdue for a correction some point soon after the monstrous 40% rally off the lows … but the CRUCIAL point to understand is that liquidity will continue to rise,” wrote Pal.

This time, the herd really is coming

“The herd is coming”, if you’ll recall, was a catch-cry a couple of years back popularised by another ex-Goldman/Wall Street trader turned crypto evangelist, Mike Novogratz (who now heads up crypto investment firm Galaxy Digital).

Not that Novogratz wasn’t ultimately correct, but as lookintobitcoin.com data site founder Philip Swift notes, the term became a bit of a meme.

Last cycle 'big institutions are coming' was a meme.

This time they really are coming.

— Philip Swift (@PositiveCrypto) June 27, 2023

Swift, however, is adamant that “this time” institutional bulls “really are coming”.

Placeholder partner Chris Burniske, a prominent venture capitalist in the crypto space, agrees…

Giving up hope that the institutions will come because of the ongoing regulatory crackdown in the US is mistaken momentum thinking — the exact opposite will happen, per Mr. Swift 👇 https://t.co/rwgu2GkWAO

— Chris Burniske (@cburniske) June 27, 2023

Burniske went on to write in a recent Twitter thread that:

“Institutions need the type of clarity the USA is going to get out of the ongoing judicial and legislative processes in motion, not to mention the rest of the world is clearly already on the path to reg clarity,” adding:

“Bullish regulated front-ends that ‘get institutions’, is part of the maturation into the Internet Financial System.”

As for decentralised finance? It’s ingrained forever, reckons Burniske. Like rock’n’roll (hopefully), it will “never die”.

“DeFi will never die, nor will unregulated, non-KYC/AML crypto,” wrote the VC. “But there is a high likelihood that the ‘regulated systems’, built on the more transparent and capital efficient architectures of blockchains, will grow larger.”

Just for good measure, somebody short-term bearish

Too much Greed for you? Prefer some Fear with your arvo cup of tea instead? Forex and crypto trader Justin Bennett has you covered.

He notes that “after a quick liquidity grab” Bitcoin bears were hoping for a sub US$30,400 close (UTC). That didn’t happen, although, at the time of writing, BTC has now dipped below that mark (US$30,354).

After a quick liquidity grab this morning, #bitcoin bears are trying to force a sub $30,400 close.

Markets are being stubborn across the board.

Let's see what we get. https://t.co/XJ5y2XjOYB pic.twitter.com/3Ljiy1BQLF

— Justin Bennett (@JustinBennettFX) June 27, 2023

In a recent blog post, Bennett was floating the idea that BTC and the crypto market might be due a pull-back this week after a particularly strong few days late last week and into the weekend.

“If so, a pullback into the $28,000 area to flush late BTC longs seems likely,” wrote the analyst, adding:

“How the Bitcoin price action develops at $27,000-$28,000 if and when tested will determine where BTC trends in July.”

Note, this possible path hasn’t yet played out this week, but for full invalidation, Bennett needs to see Bitcoin nail the highly resistant US$31k level.

“Alternatively, a sustained break above $31,000 would suggest bulls remain in control and expose $32,500,” he wrote.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.