Mooners and Shakers: ‘First it happens slowly, then all at once’ – Fidelity files for Bitcoin ETF

Getty Images

So the rumour was true, then – Fidelity Investments, another asset-managing titan of the financial world, has reportedly filed for a spot Bitcoin ETF in the US.

Gary Gensler over at the SEC must be drowning in paperwork right now. “First it happens slowly, then all at once,” wrote “Tedtalksmacro” on Twitter, with reference to BlackRock’s pied piper act with its own BTC ETF filing last week.

https://twitter.com/tedtalksmacro/status/1673694849873113090

Fidelity joins BlackRock in the latest ETF hunting expedition, along with several other notable players, including WisdomTree, Invesco, Bitwise, Valkyrie, 21Shares and Ark Invest. In fact, Cathie Wood believes her Ark Invest filing is the first in line to be approved.

“Other applicants will be able to amend their filings with similar agreements at little cost,” ARK analyst Yassine Elmandjra reportedly said.

In April, “ARK and 21Shares filed an application with the SEC for a bitcoin ETF that now is the only one ahead of BlackRock’s”, wrote Elmandjra.

Bloomberg Intelligence ETF analyst James Seyffart also agreed that ARK and 21Shares should be ahead of anyone for a spot Bitcoin ETF.

JUST IN: Cathie Wood’s ARK Invest says it’s first in line to get potential approval for a spot #Bitcoin ETF, ahead of BlackRock – Bloomberg pic.twitter.com/zjneCeo6bB

— Bitcoin Magazine (@BitcoinMagazine) June 26, 2023

Bloomberg Intelligence, however, believes a spot Bitcoin ETF only has a 50% chance of approval this year. Well, we say only… a bit more than a week ago, that percentage would probably have been far lower than that.

And our bull case for spot bitcoin ETF approval can basically be summed up in four words: pic.twitter.com/0OXSGaJIuD

— Eric Balchunas (@EricBalchunas) June 26, 2023

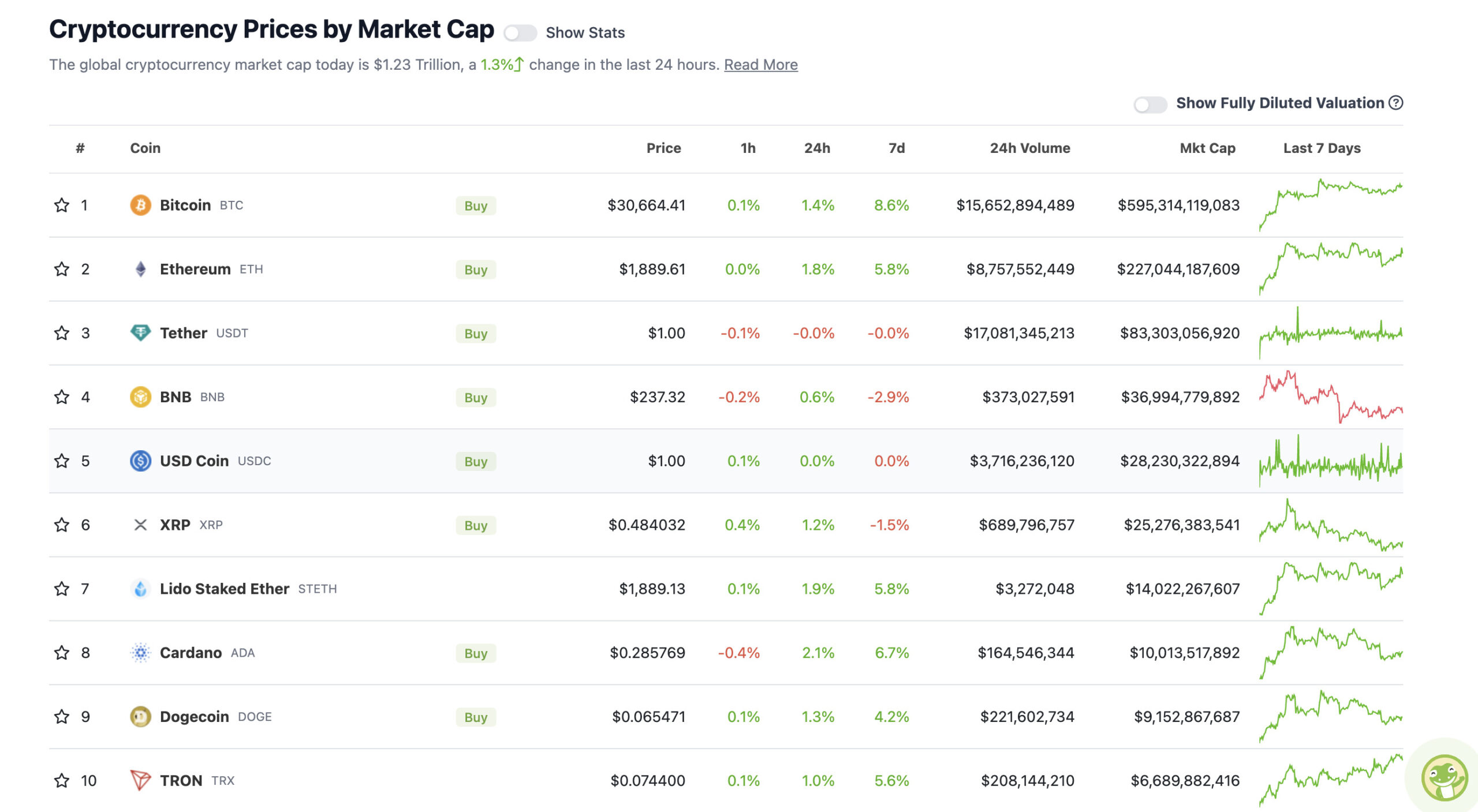

Top 10 overview

With the overall crypto market cap at US$1.23 trillion, up about 1.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Still don’t know what you’re doing in the top 10 cryptos by market cap, TRON, but Solana, Litecoin, Polkadot and Polygon are looming just below you, ready to pounce on any sign of weakness.

As for Bitcoin (BTC), it actually made a surge near US$31k overnight as the Fidelity ETF filing came to light. It’s since pulled back a tad, but has held onto all its initial ETF-related gains thus far.

Trader Roman wants that $31k resistance broken, however, before “full send”.

$BTC H4

Diagonal break of our bull flag.

Lots of confluence with bull divs, MACD/RSI reset, HTF bullishness, etc.

Break 31k resistance and we can full send once again.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/L3sWrbqoe4

— Roman (@Roman_Trading) June 27, 2023

Meanwhile, Rekt Capital sees good signs, noting BTC has broken a multi-month downtrend, signalling a possible new multi-month uptrend.

The trend is your friend, until the end (erm, of the trend).

When #BTC breaks a multi-month downtrend…

A new multi-month uptrend emerges$BTC has broken its multi-month downtrend last week#Crypto #bitcoin pic.twitter.com/eTG8LxfZWP

— Rekt Capital (@rektcapital) June 27, 2023

(As always, none of the tweets posted here, or any information posted in Coinhead for that matter, represent financial advice.)

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Stellar (XLM), (market cap: US$2.75 billion) +11%

• WOO Network (WOO), (market cap: US$392 million) +10%

• Kaspa (KAS), (market cap: US$533 million) +10%

• Pepe (PEPE), (market cap: US$681 million) +7%

• Arbitrum (ARB), (market cap: US$1.53 billion) +6%

SLUMPERS

• BitDAO (BIT), (market cap: US$528 million) -10%

• Frax Share (FXS), (market cap: US$411 million) -5%

• Kava (KAVA), (market cap: US$584 million) -4%

• Stacks (STX), (market cap: US$988 million) -4%

• Algorand (ALGO), (market cap: US$928 million) -3%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Is Bitcoin about to have its “hold my beer” moment?

Bitcoin about to have its 'hold my beer' moment.

— Copiosa (@CopiosaOfficial) June 27, 2023

The Cryptoverse is certainly excited, but, and not to be a Debbie Downer or anything… this can all cool off pretty quickly, especially if the SEC makes one quick stamp of denial on one of these big ETF applications, or even if it delays its decision for months, as is customary.

One thing of note on the Fidelity filing, as Collective Shift’s Matt Willemsen points out here, Fidelity “is nearing a decade of participating in crypto in some capacity, starting with mining bitcoin in 2014. If any ETFs are approved, hopefully it’s not just BlackRock’s. Other applicants have supported crypto for much longer.”

Reports coming in that Fidelity is preparing to file for a spot bitcoin ETF after its first attempt was declined last year.

Fidelity is nearing a decade of participating in crypto in some capacity, starting with mining #bitcoin in 2014.

If any ETFs are approved, hopefully it's… pic.twitter.com/Lwtj0Ypu0Z

— Matt Willemsen (@matt_willemsen) June 27, 2023

JUST IN: SEC may approve BlackRock ETF before losing court case to Grayscale – Bloomberg pic.twitter.com/qr466mV4vJ

— Bitcoin Archive (@BTC_Archive) June 27, 2023

— naiive (@naiivememe) June 26, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.