Chain Reactions: Pepe takes a break as Bitcoin looks to consolidate above $29k

Getty Images

The week’s almost done, Bitcoin’s holding on above $29k, and viral, no-utility-whatsoever altcoin hit Pepe has frog-stomped its way up the charts.

It was “going off like a s**tcoin meme frog in a sock”, as Stockhead‘s resources and mining stonks-focused guru Reuben Adams put it earlier, in an article that isn’t about crypto at all, but maybe you should read it anyway for the sake of potentially diversifying into something a little more sensible.

#PEPE up 3600% and now the 59th largest cryptocurrency in existence!!

No marketing team on 🌎 can beat the power of a good meme 🚀

— Altcoin Daily (@AltcoinDailyio) May 5, 2023

But regarding PEPE, we were shamelessly willing it on to hit a billion-dollar market cap when it was on a tear earlier, but it took a breather this arvo and is chilling on a lily pad somewhere around a US$800 million valuation.

It’s still up more than 58% over the past 24 hours at the time of writing, however, and more than 581% over the past week. Is it due a dramatic dump? Maybe we’ll have to wait and see what the weekend whale traders have in store.

WE’VE GONE FULL BIBLICAL 🐸🙏 pic.twitter.com/S9abx0rk1e

— beeple (@beeple) May 5, 2023

Here’s an interesting tweet from popular account 3LAU, though, and something we’ve been half wondering ourselves, considering the $PEPE token has no official affiliation with, or approval from, the actual intellectual property-rights holder for the cartoon frog – Matt Furie.

Fun fact about $pepe

It could be construed as copyright infringement.

Matt Furie owns the copyright.

If the token issuer was identified, things could get spicy pretty quickly.

He has won on copyright claims surrounding pepe in the past.

— 3LAU (@3LAU) May 5, 2023

3d chess move there to buy a dip pic.twitter.com/iMQi4V59qW

— Goodfoot (@GoodfootLIVE) May 5, 2023

Let’s take a quick look at the overall market sentiment, courtesy of the Crypto Fear & Greed Index…

It’s not particularly surprising to see a healthy amount of Greed in the market right now, seeing how awash with meme coin frenzy Crypto Twitter has become over the past week or so.

Aussie crypto momentum trader Eunice Wong (a favourite of original Coinhead Derek Rose) has even noted she’s giving up trading to become a “full-time degen”. Not sure if she’s completely serious about that, but her latest tweets are certainly focused on meme coins and lower-cap meme-coin hunting.

Probably topping the market but..

I’m about to quit being a trader and become a full time degen.

Shill me new low MC meme coins $PEPE $WOJAK $MONG pic.twitter.com/kvdjMQgkdd

— Eunice D Wong 🦄 (@Eunicedwong) May 5, 2023

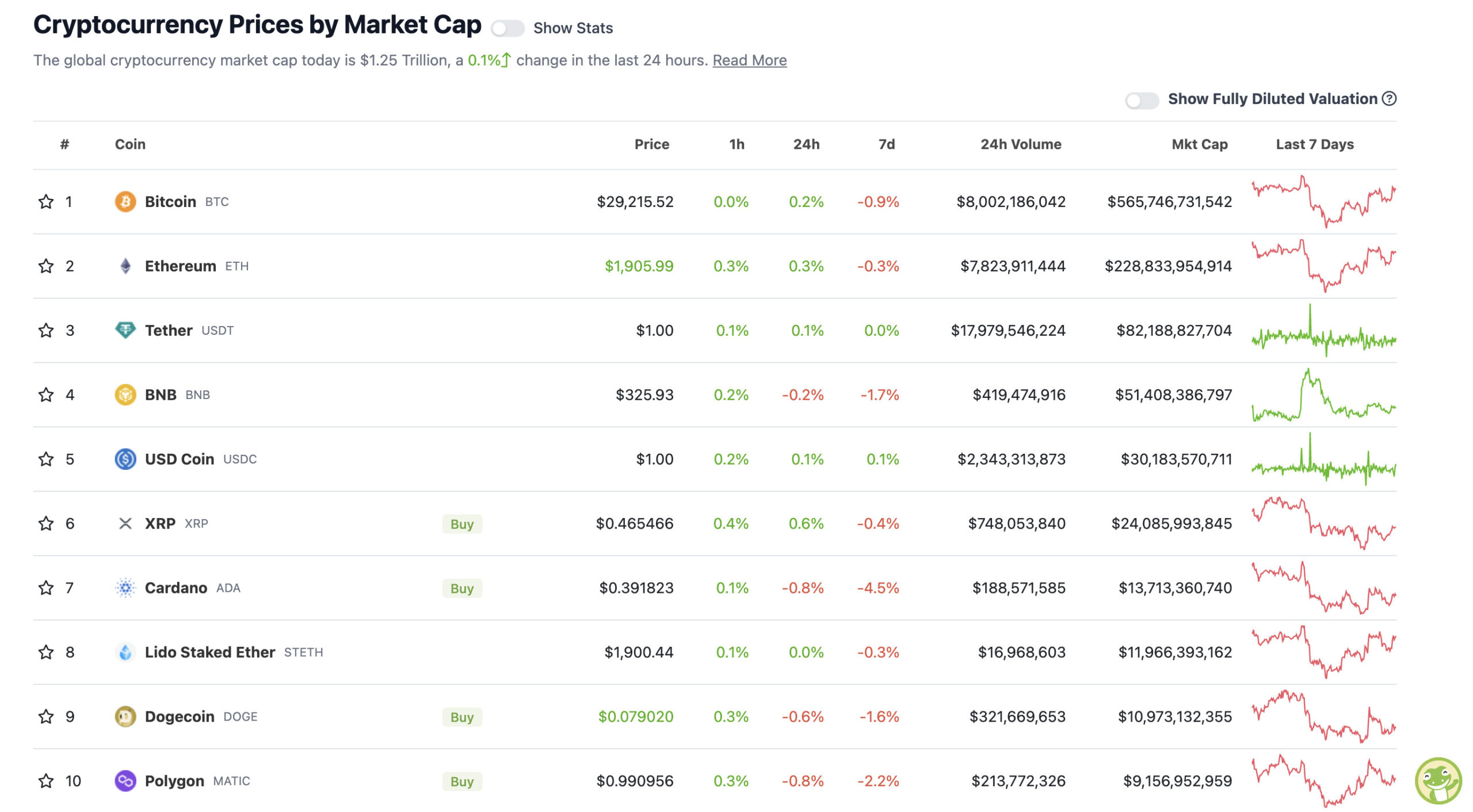

Top 10 overview

With the overall crypto market cap at US$1.25 trillion, up about 0.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Did we mention Ethereum was struggling to get back over US$1,900 earlier? We did, but it’s just scraped over the line at the time of writing, while Bitcoin (BTC) investors might be hoping the bull goose crypto can keep this US$29.2k level as support for some potential continuation.

It’s currently trading well above the 200-week moving average line, reports Rekt Capital, which is a decent sign.

#BTC has maintained these highs for weeks

And as a result, the 200-week MA has continued to lift up

A few weeks ago, the 200 MA represented the price point of $25000

Today the 200 MA is at $26,000$BTC #Crypto #Bitcoin pic.twitter.com/6OeLwpkOOT

— Rekt Capital (@rektcapital) May 4, 2023

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

BREAKING: The state of Montana signs into law a bill prohibiting any taxation on the use of #Bitcoin as payment.

— Dennis Porter (@Dennis_Porter_) May 5, 2023

BREAKING‼️ Western Alliance Bank down 61% today!

Banking system "sound and stable" says J. POWELL 🤨 pic.twitter.com/3SzOVi7wpB

— Radar🚨 (@RadarHits) May 4, 2023

Non-holders looking at $PEPE holders like pic.twitter.com/Sy0duTMUar

— Miles Deutscher (@milesdeutscher) May 5, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.