Chain Reactions: Crypto community lays into SEC boss; Ethereum co-founder allays ETH crackdown fears

Getty Images

It’s been quite an end to the week in the Cryptoverse, especially for the Kraken crypto exchange, which has received a hammering from the SEC. Here, we cover some of the leading stories and Twittering reactions floating about today.

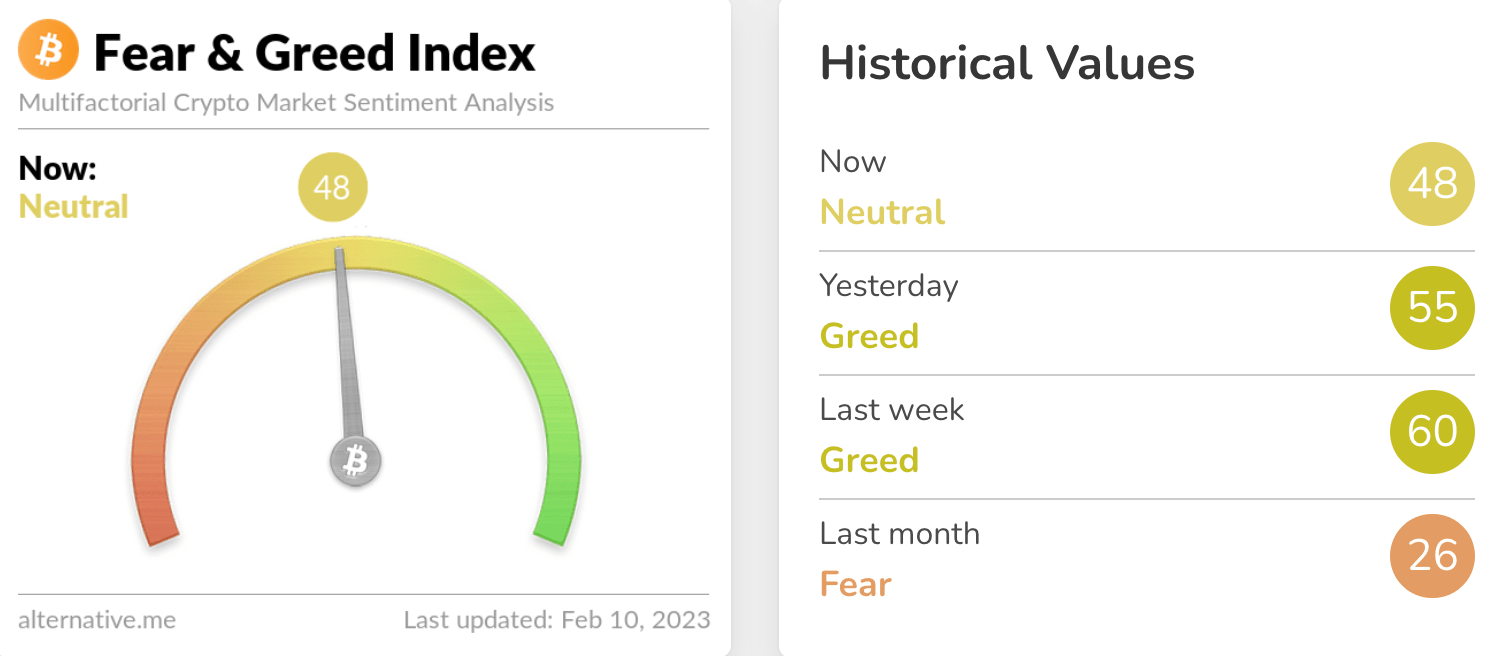

First, though, let’s just get a crypto market sentiment check…

Yep, as we suspected, the Crypto Fear & Greed Index has pulled back some of its recent “greedy” exuberance. The price of Bitcoin and many other leading cryptos reflect this today.

Ethereum co-founder not worried about SEC crackdown

Ethereum co-founder Joe Lubin has told Cointelegraph in an interview that the buying and selling the token of the leading Proof-of-Stake protocol has as much chance of becoming illegal in the US as the ride-sharing service Uber.

In other words, he thinks ETH has little chance of being classified as a security by the likes of Gary Gensler over at the Securities and Exchange Commission.

This comes on the back of news today that the Kraken exchange has withdrawn its crypto staking service for US customers, and has settled a US$30m fine with the US regulator, which is said to be cracking down even harder on what it believes to be the sale of unregistered securities in the crypto industry. A bit more on that in a sec.

“I think it’s as likely, and would have the same impact, as if Uber was made illegal,” Lubin told the crypto media outlet, with reference to Ethereum.

“There would be a tremendous outcry from not just the crypto community but different politicians and certain regulators,” he added.

Lubin also said he believes ETH continues to be “sufficiently decentralised” and has “many use cases that don’t implicate it as a security”.

“There is no centralised set of promoters or builders that is specifically trying to raise the value of Ether and enrich investors,” he added.

“There’s a court system in the United States of America that I think would be supportive of arguments that would be made that it is not.”

Further reactions to the Kraken staking drama

Actually, before we dig into some Crypto Twitter reactions, let’s look at the official line from Kraken on its settlement with the SEC and on its staking-service withdrawal.

We’ll be hoping to chat with the managing director of Kraken in Australia, Jonathon Miller, about it all once the dust settles a bit more next week. But in the meantime, we’ve read Kraken’s blog post statement on the matter and have also been given the following information from the exchange:

“Kraken reached a settlement with the U.S. Securities and Exchange Commission (SEC) regarding its on-chain staking program. Kraken has agreed to end its on-chain staking services for U.S. clients only.

“Starting today, with the exception of staked ether (ETH), assets enrolled in the on-chain staking program by U.S. clients will automatically be unstaked and will no longer earn staking rewards. Further, U.S. clients will not be able to stake additional assets, including ETH.

“Staking services for non-U.S. clients will continue uninterrupted.”

The exchange was also keen to note that as part of the settlement with the SEC, Kraken has neither admitted nor denied the SEC’s allegations.

The SEC’s allegations are pretty much as follows in this tweet from Gary Gensler, in which he also once again makes a hilarious (er, hand up, we’ve been guilty of it, too) reference to proof of “steak”.

Today @SECGov charged Kraken for the unregistered offer & sale of securities thru its staking-as-a-service program.

Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.

— Gary Gensler (@GaryGensler) February 9, 2023

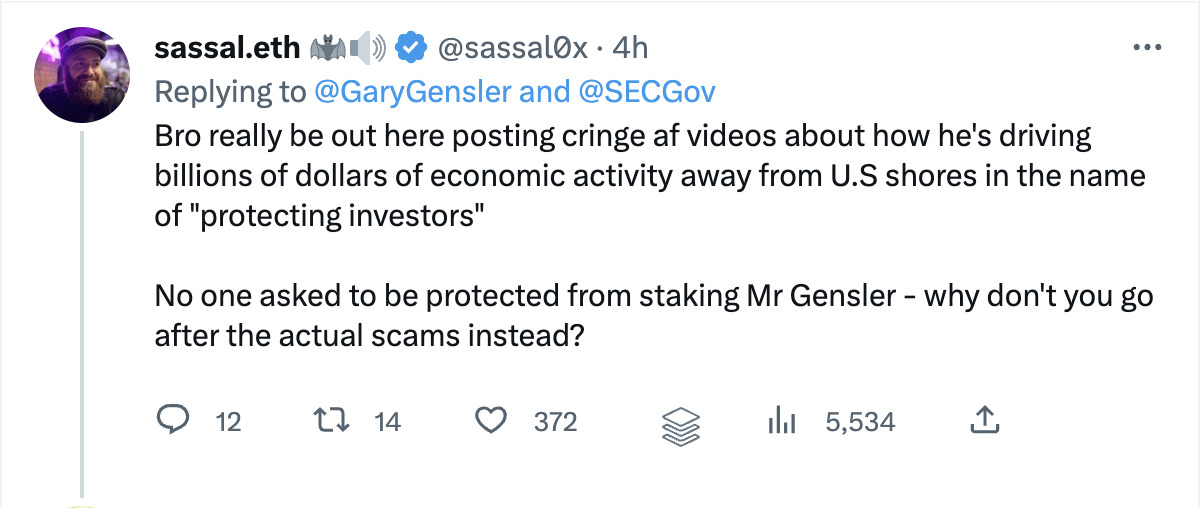

Meanwhile, here are some reactions from an outraged crypto community…

Congress, does Gary Gensler speak for you on crypto? Will you let him drive the most important technology of our generation offshore?

Time to speak up.

Rein him in.

Tag your representative.

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) February 10, 2023

Attorney and chief policy officer of the Blockchain Association, Jake Chervinsky, had a good take. He pointed out that settlements such as the one the SEC has driven Kraken to “are not law” and that the exchange’s decision to comply was likely due to the fact it decided cutting its economic losses on the issue was a better course than entering into a long and bitter legal dispute with the regulator.

Settlements are not law. They're a decision that the economics of settling are better than fighting, no more.

The SEC thinks staking-as-a-service is a security. Kraken didn't admit or deny either way.

It may be a tough question, but the SEC hasn't answered it either way today.

— Jake Chervinsky (@jchervinsky) February 9, 2023

Meanwhile, Fox Business journalist Eleanor Terrett has tweeted that she believes there is plenty more to come from Gensler and his SEC, who she says is “embarking on a midnight massacre in an attempt to bring all of crypto under his control”.

and entities that mint tokens in an attempt to label the majority of them as securities. I'm told Gensler's strategy is to bring as many enforcement actions as possible while the 118th Congress is still getting its bearings.

— Eleanor Terrett (@EleanorTerrett) February 9, 2023

The only thing missing is an image of Gensler struggling to crush a paper cup, a la Mr Burns, while attempting an evil laugh that ends in a coughing fit.

Interestingly, one of his colleagues, SEC commissioner Hester Peirce is not on board with the Gensler crypto pain train, which we covered earlier today in Mooners and Shakers.

i'm confused, is this the SEC arguing with itself?

— Patrick McCorry (💙,🧡) (@stonecoldpat0) February 9, 2023

Sadly, though Bitcoin maxis, such as Michael Saylor and Samson Mow have pretty much been cheering on Gazza’s spin.

Just devastated hearing about the crackdown on Etherium staking.

— Samson Mow (@Excellion) February 10, 2023

"Not your keys … " – @GaryGensler. The @SECGov understands the importance of self-custody. https://t.co/oxPkFeJ77k

— Michael Saylor⚡️ (@saylor) February 9, 2023

Finally, there have at least been some tokens scraping some sort of silver lining out of the SEC’s staking crackdown on Kraken.

As young Aussie crypto analyst and airdrop hunter extraordinaire Miles Deutscher points out, decentralised “liquid staking” protocols could well be a sustained beneficiary if the SEC continues to go after exchange staking programs.

If the SEC continues to crack down on staking amongst centralised exchanges, where is that liquidity going to flow?

Liquid staking.

The upcoming Shanghai upgrade was already a strong catalyst for LSDs, but regulatory FUD is another reason to watch $LDO, $FXS, $RPL, $ANKR etc.

— Miles Deutscher (@milesdeutscher) February 10, 2023

Some of them were certainly “outperforming” the rest of the crypto market over the past 24 hours a little earlier, although Rocket Pool (+5%) is about the only one still in the daily green at the time of writing.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.