BTC will bottom out at… US$13,676, according to Finder Bitcoin prediction report

A Bitcoin bottom searcher, yesterday. (Getty Images)

Product-comparison platform Finder.com has published its latest Bitcoin prediction report and results suggest the OG crypto asset has a ways to go yet before finding its bottom, which apparently could be US$13,676… to be precise.

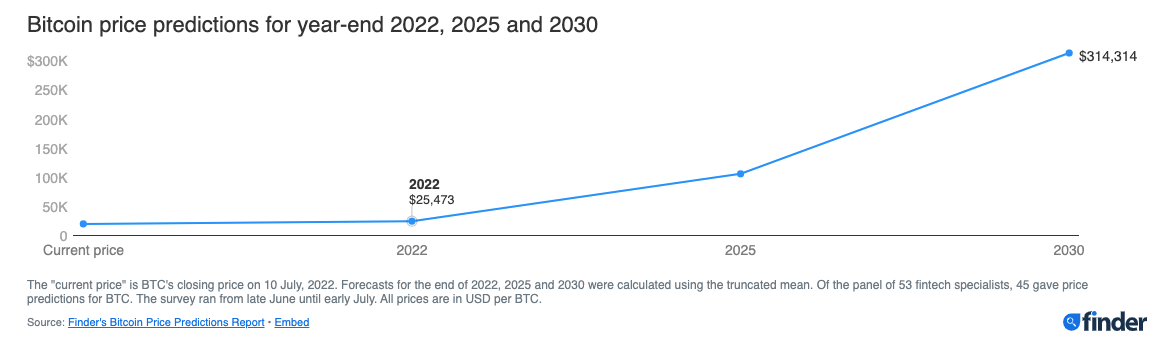

Finder’s latest survey data also puts forward the general prediction that BTC will surpass US$100k by 2025, but will end 2022 at only US$25,473. Seems fair, given the prevailing macroeconomic conditions dominating financial narratives this year.

The bottom prediction also seems fair, if you believe Bitcoin will follow the same sort of pattern as previous bear cycles – that is, falling more than 80% from previous all-time highs. BTC is presently down about 72% from its US$69k ATH of last November.

According to Finder, it measures its predictions on data from two surveys – a weekly poll of a rotating panel of “five fintech specialists”; and a larger, quarterly survey of 53 industry experts, most recently conducted this month.

Some of Finder’s key, er… findings

• Some 77% of those surveyed believe the market is officially in a “crypto winter”.

• Only 29% think the bear market/crypto winter will end in 2022.

• Good news: the experts expect Bitcoin to surpass $US100k by 2025 and hit as high as US$314k by 2030.

• Not-so-good news: the no.1 crypto could sink as low as US$13,676 in 2022, and end the year at US$25,473.

• 46% of those surveyed believe the crypto winter will continue until 2023 and 24% believe it could last until 2024.

Of course, due to everything that’s happened to suppress crypto this year (macro events such as war and global inflation, plus the crypto contagion), the industry-expert findings are far more bearish compared with some of Finder’s previous Bitcoin report results.

“The panel’s end-of-2022 prediction of $25,473 in July is a far cry from the $65,185 prediction back in April 2022 and $76,360 in January 2022,” the platform acknowledged, adding:

“However, while the current predictions are lower than previous reports, the panel still expects a similar upward trajectory for the price of Bitcoin, only starting from a lower base.”

What the experts said

Finder report participant Vetle Lunde, an analyst at Arcane Research, put forward an end-of-year prediction of US$20,000, a bit below the panel average of $25,473, and suggested further rough seas ahead for the asset class…

“Interest rate hikes and balance sheet tightening forced the initial downward pressure in an environment of high correlation to US equities,” noted the analyst. “The Luna/UST collapse had an enormous impact on various funds and lenders, causing contagion and the collapse of 3AC.

“Further tightening and unwinding of bad crypto debts will create sobering times onwards, and investors should buckle up for more difficulty,” concluded Lunde.

Senior lecturer at the University of Canberra John Hawkins, who is usually the most savage of bears on these Final panels, meanwhile thinks BTC will land around US$10k at year’s end. Worse than that, though, he thinks the cryptocurrency is a flop overall.

“BTC is clearly not a store of value given its price volatility,” said Hawkins. “It is not a medium of exchange – almost no stores accept it. It is not a unit of account – the only things priced in it are other cryptocurrencies. So it is not money or really a currency, it is nothing but a speculative bubble in the process of imploding.”

Ouch. But let’s end on a more positive note, eh?

According to the report, Gavin Smith, general partner at Panxora Hedge Fund, thinks BTC will close out the year at US$48,000, partly due to H2 2022 seeing “declining pressure for higher rates combined with a negative real yield”.

And Finder’s founder, Fred Schebesta, is even more positive, crystal balling Bitcoin around $75k at the end of 2022.

“The market is currently fearful. However, the technology hasn’t changed and is still strong. Bitcoin is following the downturn of other parts of the economy, but I have strong conviction that it will bounce back,” said Schebesta.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.