Mooners and Shakers: Crypto market slumps (a bit) as US inflation hits another 40-year high

Getty Images

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

CPI inflation data in, new 40-year high, US dollar up, Bitcoin and crypto market down a tad. This episode’s definitely playing on a loop. Are these high-inflation figures becoming largely “priced in” yet?

Maybe. Generally speaking crypto dipped on the news, but at the time of writing it’s not much more than a paper cut.

The US Consumer Price Index (CPI) inflation figures were released at 8.30am EST on Wednesday. And at 9.1% as opposed to the largely expected 8.8%, it’s the largest year-on-year increase since 1981. Fun times.

At least US financial analyst Jim “As Seen on TV” Cramer’s calling the inflation peak pretty much right here. Although that doesn’t inspire much confidence according to some/many…

Great, we now have confirmation that inflation will continue to explode

— Stonk Doctor 💎🙌 (@stock_doctor) July 13, 2022

Actually… says Cramer, let’s see if the Fed sticks to its .75bp rate-hiking guns on July 26-27…

https://twitter.com/Krisssskros/status/1547228560275947522

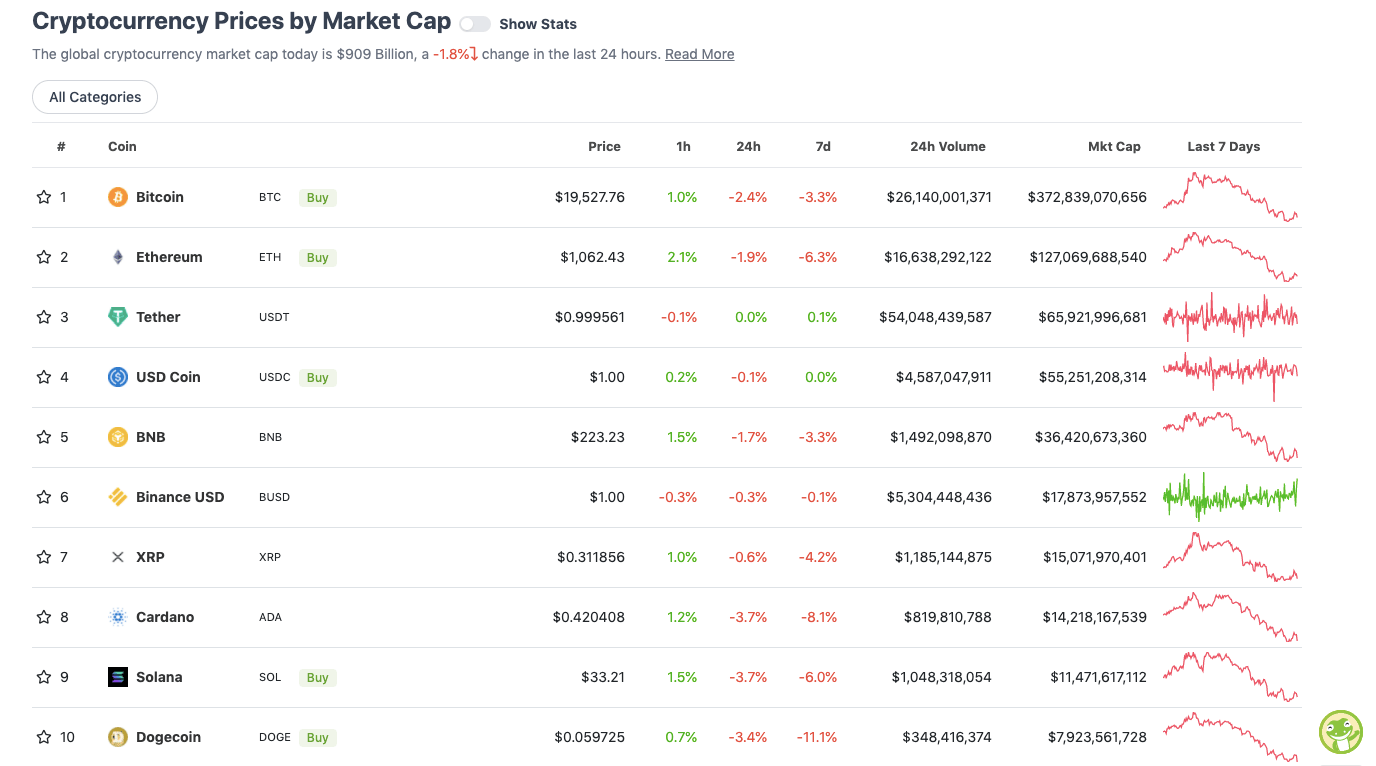

Top 10 overview

With the overall crypto market cap at US$909 billion and down another 1.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So, given today’s macroeconomic bombshell (sort of), things could be a whole lot worse for Bitcoin, Ethereum and the rest of crypto than they actually are right at this moment. Maybe that’ll be a different story by the time this is read.

At time of publishing, BTC’s daily low is pretty much bang on US$19k – which came not long after the CPI news. It’s bounced back a bit since and at least one crypto analyst of some note is still calling for a relief rally…

The first move is usually a fake-out.

Sweeping the lows on peak inflation, bouncing back up now.

Dollar dropping, mostly topping out, indices bouncing up, yields going down.

Time for the summer relief rally. 🙂

— Michaël van de Poppe (@CryptoMichNL) July 13, 2022

Cool, but what are the bears saying?

When $BTC breaks $19k and $ETH breaks $1k, the real dump starts.

Main supports for most altcoins are much lower than this, meaning that they could dump 40-50% on average.

Bottom shouldn't be far timewise.

— il Capo Of Crypto (@CryptoCapo_) July 13, 2022

Don’t feel like I need to make this complicated.

CPI came out at 9.1%. I fully expect new lows if we lose the red box.

USDT.D is also attempting to confirm a double bottom which is bearish for crypto.#bitcoin #cryptocurrency pic.twitter.com/8FkYVps0Qw

— Roman (@Roman_Trading) July 13, 2022

Meanwhile, those who’ve been waiting to again buy a triple-digit ETH, join the queue. Melbourne-based Ethereum educator and investor Anthony Sassano seems keen…

We are about to get another chance to buy ETH in the triple digits

Truly blessed

— sassal.eth/acc 🦇🔊 (@sassal0x) July 13, 2022

ETH fans are still champing at the bit for the no.1 smart-contract platform’s Merge event – the transition from Ethereum’s proof-of-work consensus model to proof of stake. That’s coming soon to a cinema near you (well, the latest estimate is apparently some time in September).

7. After the Merge, ETH will complement BTC's use cases as pristine collateral and a store of value

BTC has cemented its narrative as "digital gold" – and that's great

ETH's will be both a "digital bond" (staking yield = risk free rate) and DeFi's main collateral asset

(7/11)

— VivekVentures.eth 🦇🔊 (@VivekVentures) July 10, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.12 billion to about US$371 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Lido DAO (LDO), (market cap: US$374 million) +23%

• Curve DAO (CRV), (mc: US$373 million) +6%

• Arweave (AR), (mc: US$578 million) +5%

• Serum (SRM), (mc: US$388 million) +5%

• Aave (AAVE), (mc: US$1 billion) +5%

DAILY SLUMPERS

• ECOMI (OMI), (market cap: US$396 million) -9%

• Evmos (EVMOS), (mc: US$430 million) -7%

• Loopring (LRC), (mc: US$450 million) -7%

• Synthetix Network (SNX), (mc: US$532 million) -6%

• Chain (XCN), (mc: US$2 billion) -6%

Around the blocks

A selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse…

https://twitter.com/BitcoinBaddiez/status/1547237726663106561

9.1%. so much tightening so little result.

— Sven Henrich (@NorthmanTrader) July 13, 2022

Annual Inflation in USD CPI is +9.1%, Other currencies continue to weaken against the dollar: YoY USDAUD is +10%, USDGBP is +16%, USDEUR is +17%, USDJPY is +24%, USDTRY is +102%. It is just a matter of time before the world discovers 1 BTC= 1 BTC. pic.twitter.com/40VWgP9j9U

— Michael Saylor⚡️ (@saylor) July 13, 2022

The Fed saving the economy: pic.twitter.com/ef6vzLWEAo

— LilMoonLambo (@LilMoonLambo) July 13, 2022

💥JUST IN: 51% of Saudi investors in #Bitcoin and crypto believe it is the future of finance – KuCoin #MAXBIDDING

— Bitcoin Archive (@BTC_Archive) July 13, 2022

New South Park movie aired tonight.

They made fun of Matt Damon selling out for Crypto and

uh

well pic.twitter.com/FTIXSbRRbL

— Dyme (@CryptoParadyme) July 13, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.