Bitcoin’s looming ‘death cross’ could spark 50pc fall, Mina plunges, Dogecoin gains on Coinbase news

Examples of a golden cross (bullish indicator) and a death cross (bearish indicator). (Getty Images).

Bitcoin is on the cusp of a “death cross” – a technical pattern that would likely presage another major selloff for the original cryptocurrency, a prominent crypto trader has warned.

In a Twitter thread overnight, Rekt Capital, an account with 144,000 followers, wrote that the death cross would occur in mid-June if Bitcoin doesn’t increase its price soon. The bearish pattern could see BTC fall to US$18,000 or so, he wrote.

15.

So since #BTC has crashed -54% already and should this symmetry hold, BTC could crash an extra -54% if a Death Cross happened today

This would result in a ~$18,000 $BTC pic.twitter.com/01Dc41PtK1

— Rekt Capital (@rektcapital) June 1, 2021

A death cross is when the short-term moving average moves down and crosses under the long-term moving average. (The opposite pattern is known as a “golden cross”.)

However Rekt Capital indicated they were still bullish long-term and that the Death Cross didn’t have to occur.

Still macro bullish but more downside will likely be confirmed when the Death Cross occurs. It hasn’t occurred and doesn’t have to occur if BTC recovers

— Rekt Capital (@rektcapital) June 1, 2021

Bitcoin has been trading in an increasingly narrow range since the May 19 liquidation event so a major move in one direction or the other seems imminent.

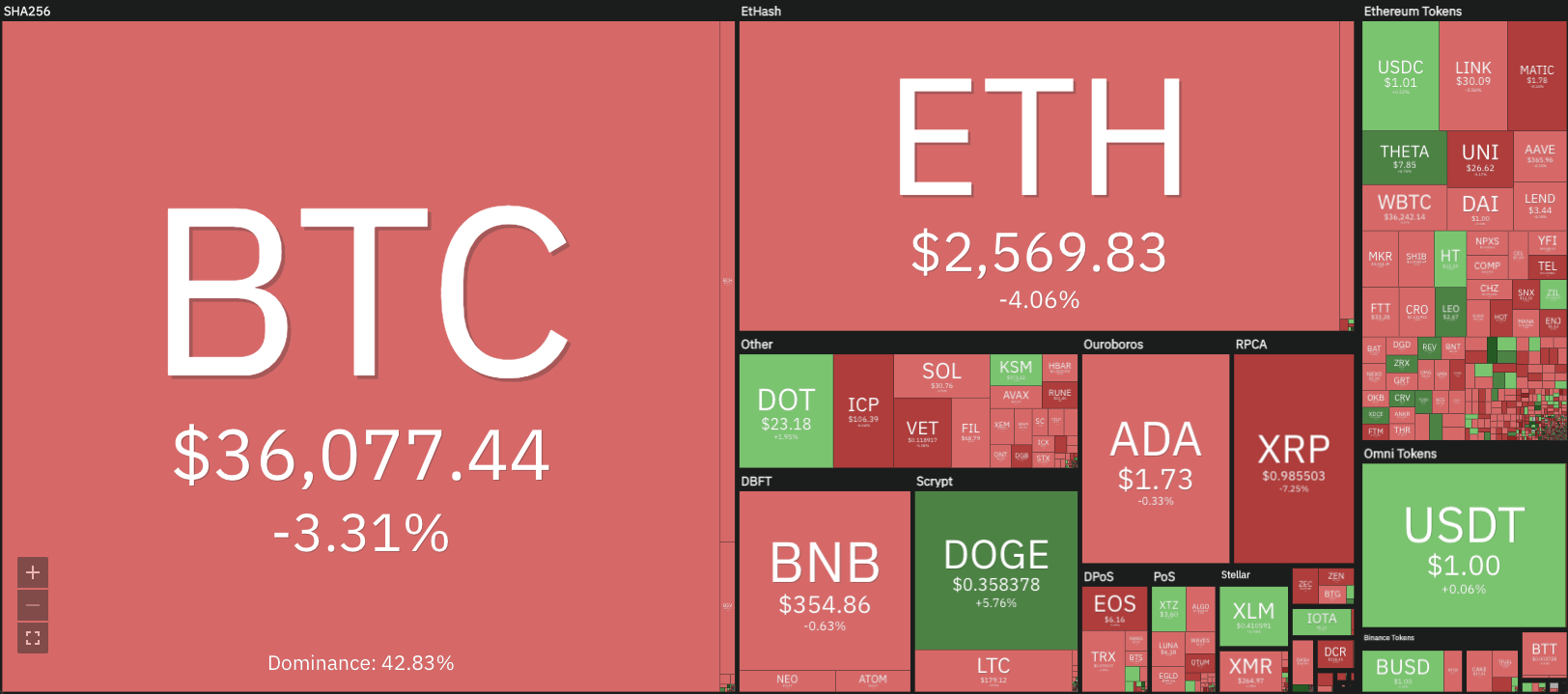

At 11.36am AEST, BTC was trading for US$36,100 ($46,575), down 3.9 per cent in the past 24 hours.

Ethereum was changing hands for US$2,571 ($3,313), down 4.0 per cent.

Most coins down

Just 20 of the top 100 coins were in the green, with 0x (ZRX) tokens gaining the most, 12.5 per cent.

Dogecoin had also jumped 6.0 per cent to US35.9c after leading US exchange Coinbase Pro said it would list the meme coin on Thursday.

#Dogecoin is on the rise again because it’s being added to @coinbase on June 3rd #CRYPTOTRADE pic.twitter.com/BEQfDiQjQL

— JamesBlonde (@007_JamesBlonde) June 1, 2021

Coinbase is the most popular exchange in the United States and listings tend to be coveted.

Mina Protocol problems

Mina Protocol plunged by two-thirds, to US$3.13, after setting an all-time high yesterday on new exchange listings.

According to social media posts, the plunge appeared to be related to issues with the token’s initial coin offering (ICO).

Mina sold US$18.75 million worth of tokens to 40,500 participants at a US25c apiece in just four hours early May. More than 375,000 had registered for the pre-sale and token purchases were capped at US$500 to allow most to participate.

Earlier seed rounds had been limited to institutional investors.

With IOU tokens trading for as high as US$60 or US$90, expectations were high for the launch.

But initially, people who bought those tokens on Coinlist had issues withdrawing them.

It seems when they were finally successful, the price crashed.

.@CoinList still hasn’t opened @MinaProtocol trading.$MINA is now trading at ~25x from the token sale price on @OKEx, @krakenfx and @gate_io, but the withdrawals on CoinList are disabled.https://t.co/JaBNvsrVfh pic.twitter.com/NkO5MbAWzT

— ICO Drops (@ICODrops) June 1, 2021

Mina Protocol labels itself as the “world’s lightest blockchain” — just 22kb, compared to hundreds of gigabytes for Bitcoin and Ethereum.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.