Bitcoin stumbles; US dollar index pumps; Twitter CFO gives crypto a ‘yeahnah’

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

The crypto market continues to slip and slide a bit further today amid a buffet of reasonably bearish news and events that might be churning the odd stomach.

Before we look at a few of those things, though… just a reminder, if it’s needed, that the type of volatility we’re seeing so far this week is commonplace in crypto – and particularly in crypto bull markets.

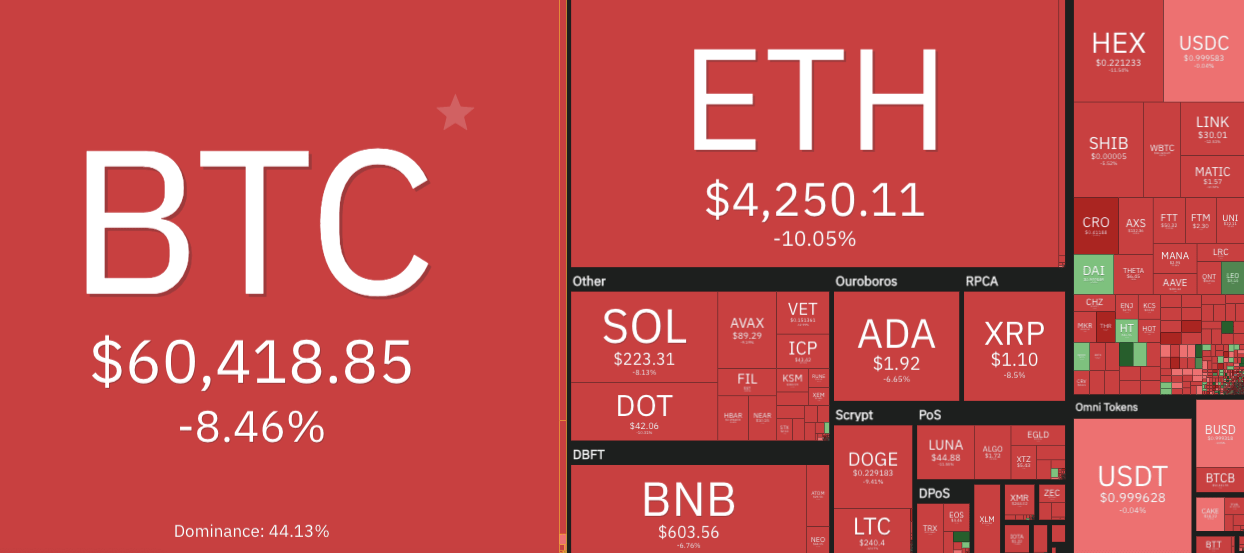

At the time of writing, Bitcoin has dropped from its peak of about US$69,000 attained a week ago, down to about US$60,400. And a short time ago, it reached as low as $59,162. (Sydney-based City Index analyst Tony Sycamore called it pretty well.)

That’s a bit over a 14 per cent dip – pretty big, although Bitcoin is used to occasionally seeing 20 per cent, 30 per cent retracements and lower – sometimes even in single days of trading.

And, needless to say, Ethereum and the altcoins aren’t looking in great shape just at the minute, either. It’s double-digit percentage losses a-go-go, just about everywhere you look on the market cap charts today.

Crypto… causing wild euphoria and runny bottoms in equal measures, since 2009.

So, what’s happening?

Why, dear crypto gods… why is my portfolio hemorrhaging those sweet, sweet, sick gainz? There are various possible contributing factors. We’ll look at a few, although we’re certainly not saying these are the only reasons…

Ned Segal, the Chief Financial Officer of Twitter, was yesterday quoted by the Wall Street Journal as saying investing in cryptocurrencies “doesn’t make sense right now” for the social media giant.

A move into crypto investing would mean a departure from Twitter’s strategy, Segal inferred, adding that the company prefers to hold less volatile assets, such as securities.

Although there wasn’t any particular hopium or building speculation that Twitter would be adding crypto to its balance sheets, the market may be reacting with a little surprise, given CEO Jack Dorsey’s positive outlook on Bitcoin and decentralised technologies.

Dorsey’s fintech firm Square, however, does meanwhile continue to hold crypto on its balance sheet.

Twitter CFO: investing some of Twitter’s cash in crypto assets such as bitcoin “doesn’t make sense right now"

Square CFO: “We’ve purchased bitcoin for our own balance sheet, which… could provide attractive financial benefits over the long term”

Both companies are run by Jack

— zerohedge (@zerohedge) November 16, 2021

The Greenback

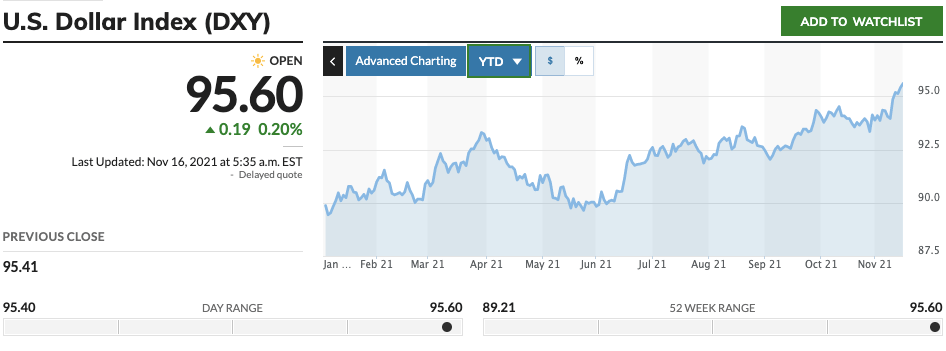

The US Dollar Index (DXY), which tracks the dollar’s value against major fiat currencies, has hit a 16-month high of 95.60.

This comes amid some concerns on Wall Street that Jerome Powell and his buddies at the US Federal Reserve may look to bring in interest-rate hikes earlier than expected – in an attempt to contain the highest levels of inflation in the US seen since 1990.

The simplistic take on that for crypto is this… inflation-hedges such as gold and Bitcoin/crypto generally correlate positively to a weakened, or weakening US dollar. But a strengthening US dollar, and interest-rate hiking, can weigh heavily against inflation-hedge bets, meaning potential bearish outlooks for those assets.

It’s certainly something to keep an eye on, although the inlfation-hedge narrative remains as strong as ever on Crypto Twitter…

Crypto is the only protection against inflation

– Kevin O'Leary pic.twitter.com/biY9IEnfhT

— Blockworks (@Blockworks_) November 14, 2021

US infrastructure bill

The “historic” US$1 trillion bipartisan infrastructure bill has now been signed off by President Joe Biden, and it includes the controversial crypto-tax reporting requirement, slipped in by sneaky Treasury department officials (possibly) at the last minute.

Another trillion dollar advertisement for bitcoin https://t.co/Voh8ARPKes

— Tyler Winklevoss (@tyler) November 15, 2021

As it stands, the eleventh-hour amendment to the bill requires “brokers” to provide the Internal Revenue Services (IRS) information about traders and transacting amounts above US$10K.

Why’s that such a problem? It lies in the open-ended, undefined term “brokers” and who it extends to – meaning DeFi operators, crypto miners, and node operators could all fall under the reporting cosh. Providing exact details of all these transactors and transactions will prove to be a next-to-impossible task for the crypto industry.

The fear is, it’s a deliberately opaque requirement and open to interpretation for those in power who would seek to stifle the crypto industry in the US.

https://twitter.com/jerrybrito/status/1460300873477894150?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Etweet

The fight to, er, amend the amendment, however, has only just begun, and there are a raft of legal bods and US senators on both sides of the political spectrum who vehemently oppose the clause – which isn’t actually set to take effect until early 2023.

In other words, there is time to contest it, although governmental gears grind painfully slowly.

BoE bloke; Marathon mining subpoena

There are are a few other strong bearish voices and factors at play this week. So, just for good (or bad) measure, here are a couple more to lob into the mix…

• Not that hoodie-wearing “shadowy super coders” (coined by US Senator Elizabeth Warren) could care less what this bloke thinks, but Sir Jon Cunliffe, the deputy governor for Financial Stability at the Bank of England (BoE), has ongoing crypto-related concerns.

It seems that Sir Jon Cunliffe of the Bank of England sees mixing traditional finance with crypto as a threat to the financial system. Will the British legislators think the same? https://t.co/IO4TK7W4ZT

— Cointelegraph (@Cointelegraph) November 16, 2021

During a Monday interview with the BBC, Cunliffe warned that the rise of digital assets and their integration with traditional financial systems could pose a systemic risk.

“The point at which they pose a risk is getting closer,” said the Savile Row-bespoke-suited (probably) knighted central banker. “I think regulators and legislators need to think very hard about that,” he added, before calling for another pot of Earl Grey and the latest news about former England cricket captain Michael Vaughan (possibly).

• And, just quickly, the US Securities and Exchange Commission (SEC) has demanded that Marathon Digital Holdings produce documents and communications regarding its Hardin, Montana, mining facility, as reported by the New York-based crypto media outlet CoinDesk.

Marathon is one of the largest publicly traded Bitcoin miners in the US, with approximately 133,120 miners in operation.

One more thing…

We’ll give the final word in this news roundup to journalist/influencer and host of the popular “What Bitcoin Did” podcast, Peter McCormack…

Leveraged longs have been rekt.

You know how this works, shorts are next.

Don’t give them easy money, buy spot, hodl, relax and get yourself a mint Cornetto.

Gm famalam 🙌🏻 pic.twitter.com/68HSl3UsrN

— Peter McCormack 🏴☠️ (@PeterMcCormack) November 16, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.