‘Next stop likely to be 59.7k’: Bitcoin loses crucial short-term support, falls $5k

Getty Images

Crypto is fading fast this morning, possibly prompted by the US regulators issuing a subpoena on a prominent Bitcoin mining facility.

The US Securities and Exchange Commission has demanded that Marathon Digital Holdings produce documents and communications regarding its Hardin, Montana, mining facility, Coindesk reported.

Bitcoin dropped from over $66,000 at 8pm AEDT yesterday to $64,000 at 4am, and then around 11am (midnight UTC) lost that support and started dropping drastically.

At just past noon BTC was down 6.4 per cent to US$61,600, and had (momentarily) traded as low as US$60,980 on Binance.

“Main thing is that both Bitcoin and Ethereum have broken and closed below important short term support levels which warm of further short term weakness,” Sydney-based City Index analyst Tony Sycamore told Stockhead.

“So I have moved to a neutral bias and will look to re-buy weakness targeting broadly the $59/55k region in Bitcoin.”

#Bitcoin closed below the support noted yesterday at $64k…next stop likely to be $59.7k. #BTC #Crypto https://t.co/Xue4sFFg3O

— Tony Sycamore (@Tony_Sycamore) November 16, 2021

Ethereum was changing hands for US$4,370, down 6.7 per cent from the same time yesterday.

Veteran futures trader Peter Brandt tweeted he was looking to buy BTC around $53,000 and Eth around $4,030, but added that these weren’t “predictions or recommendations. I’m simply interested in buying at these prices if it happens.”

Charts of interest to me

I am interested in buying $BTC around $53,000 and $ETH around $4,030 pic.twitter.com/neTqSkEFOR— Peter Brandt (@PeterLBrandt) November 15, 2021

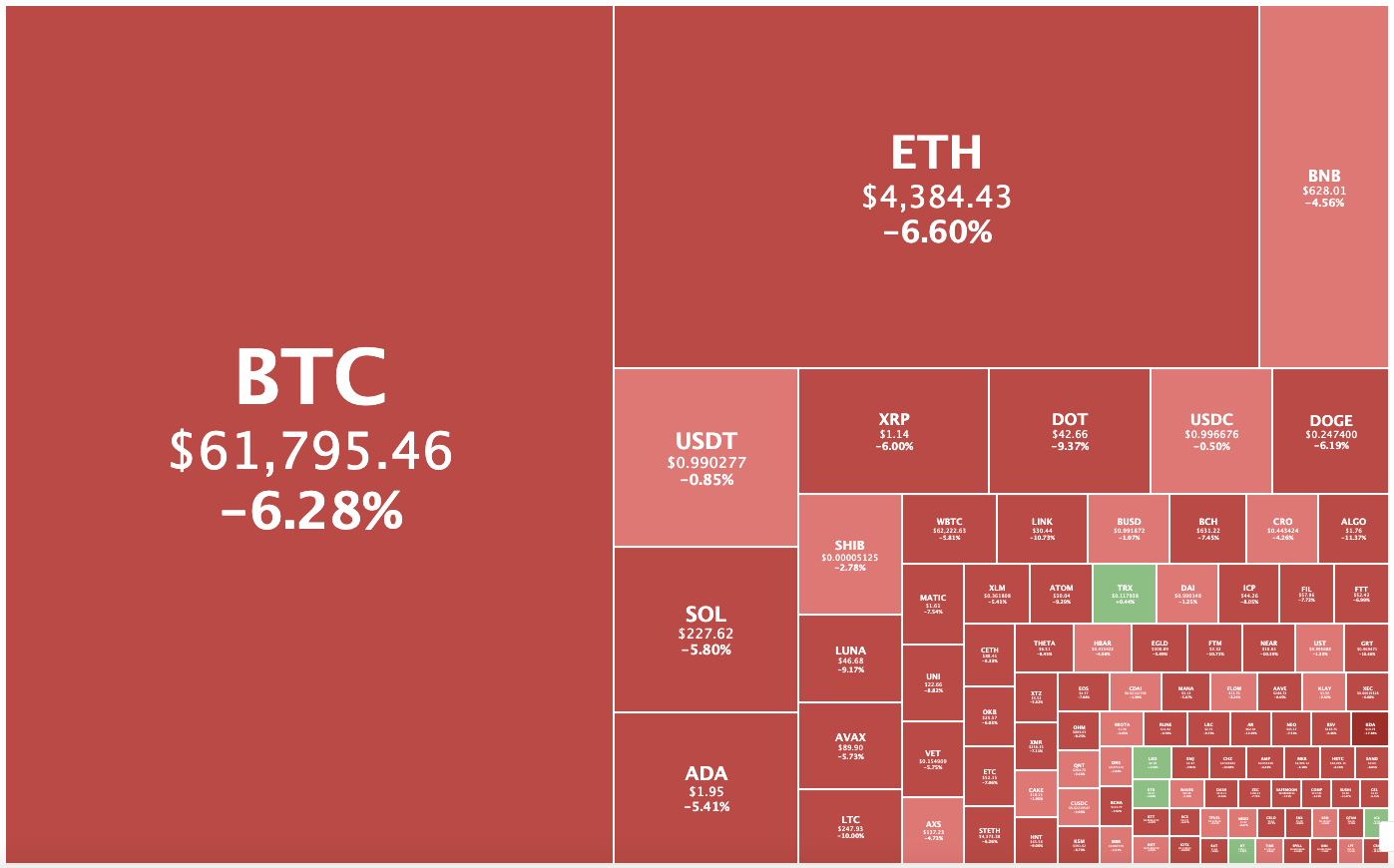

Crypto market down 5.9%

Overall the crypto market was down 5.93 per cent to US$2.69 trillion, with all save four of the top 100 non-stablecoin cryptos in the red.

Kadena was the biggest loser, dropping 19.6 per cent to US$18.38, although that still puts the layer 1 blockchain up 9.1 per cent for the past seven days.

Chiliz, Algorand and Arweave had all fallen by 14 to 12 per cent.

Synthetic asset protocol UMA (Universal Market Access) was the only significant gainer in the top 100, rising 18.6 per cent to US$19.42.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.