Apollo’s Alpha: What gives crypto assets their value?

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Capital, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

In this week’s Apollo’s Alpha column, we’re taking a break from crypto-project specifics as David Angliss has pointed us to some in-depth research put together by his colleague Tim Johnston. And it helps us deal with a pretty damn vexing and hard-to-answer question – what gives crypto assets* their value?

It’s tricky enough attempting to explain what blockchain, Bitcoin, Ethereum and DeFi actually are in simple terms, let alone providing an intelligent response to the crypto-value head scratcher often posited by those outside the sector’s bubble.

In great detail, though, Apollo has done an incredible job with it, which we’ll, with David’s help, attempt to break down for you here.

(*Note: Apollo Capital generally prefers the term “crypto assets” over “crypto currencies, largely because it’s “a broader and more accurate description”.)

Crypto-asset categories

To begin answering the question we’ve headlined, Apollo first identifies the fundamental crypto-asset categories as such, with Bitcoin in its own class altogether:

• Digital gold (Bitcoin)

• Commodity-like crypto assets

• Equity-like crypto assets backed by cash flows

• Debt-like crypto assets

• Currency-like crypto assets

“In understanding how crypto assets become valuable, it can be helpful to see that many are valuable in the same way as traditional assets,” reads the Apollo analysis.

And “value in established asset classes comes from one, or a combination, of”:

• Rights attached to the asset

• Utility the asset provides

• Belief in the value of the asset

Bitcoin’s value is a powerful story

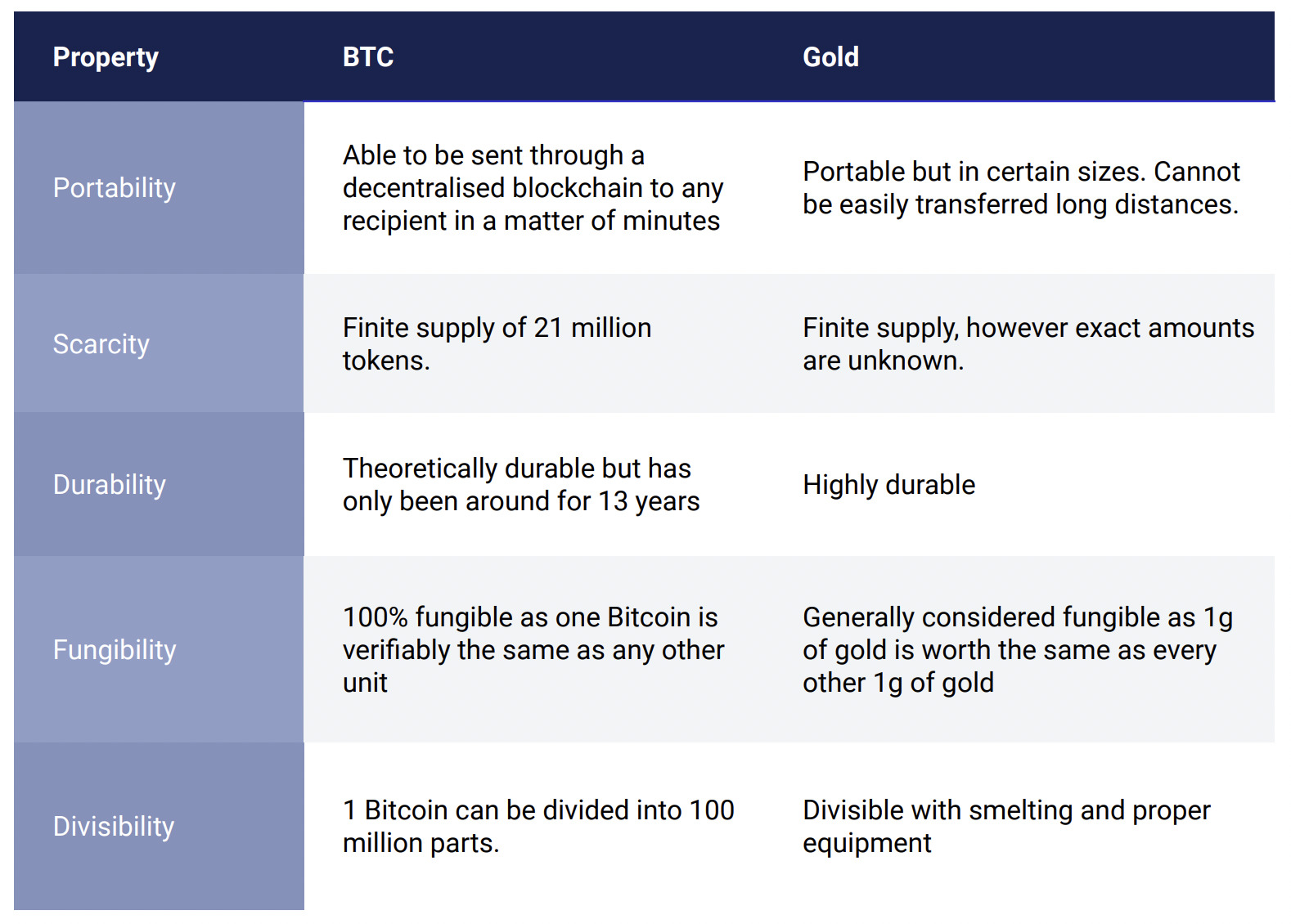

Apollo’s analysis of Bitcoin’s value, which compares the asset to gold, is particularly interesting as at first glance it sounds like the fund manager thinks BTC has barely any value at all. But that’s not the case.

“Bitcoin has no rights attached to it. Bitcoin has no intrinsic value. Bitcoin has limited utility – it can be stored, sent and received,” writes Johnston.

“Yet, as we will see, Bitcoin’s value does not come from its utility. Despite these limitations, at the time of writing, Bitcoin has amassed around $400bn worth of value. Bitcoin is a story – an immensely powerful story based on what it stands for and its unique properties.”

The analysis touches on Bitcoin’s evolution from its anonymously founded origin off the back of the 2008 Global Financial Crisis through to the point where it “could stand to accrue enormous amounts of value as a non-sovereign, apolitical form of money or store of value that is open to everyone”.

“Many countries around the world are searching for an alternative to the US Dollar as the global reserve currency. It is easy to see the appeal of a state free, independent, global reserve currency. Some may suggest that gold plays this role, but it is limited by its properties, especially its physical nature.”

Apollo compares Bitcoin’s story with that of currency and gold. Currency also has no “intrinsic value”, believes Apollo, but it’s a story people believe in.

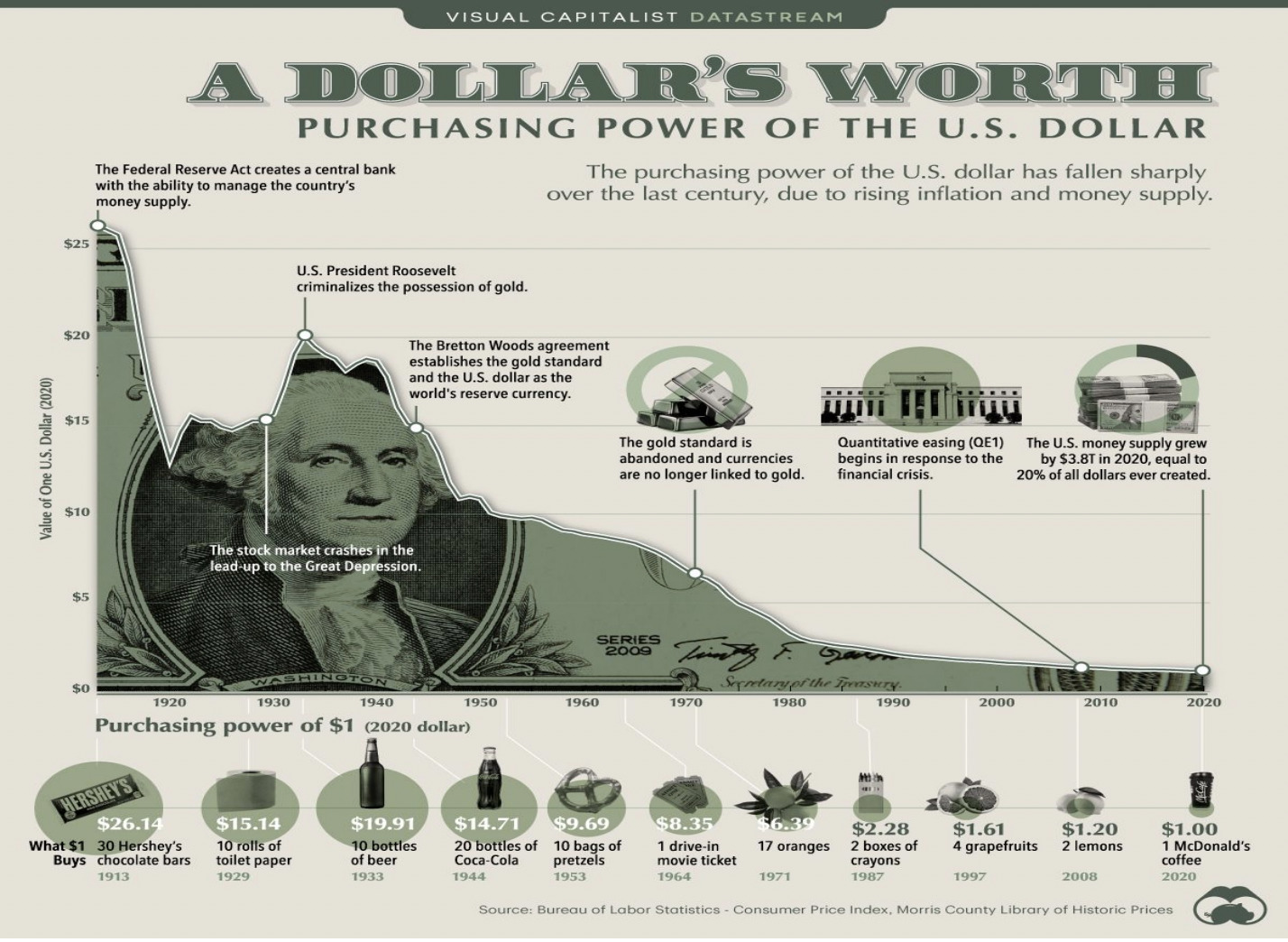

And that’s in spite of charts like this…

For the purposes of the Apollo report, by the way, “assets like gold, Bitcoin, currencies and commodities generate no cash flows and therefore have no intrinsic value”.

And as can be seen from the image above, the value of the US Dollar has fallen dramatically over the past 100 years. “We are confident that it will continue to fall further”, says Apollo.

Gold, meanwhile, is another story people believe in. “Gold’s value is ultimately a social construction: it is valuable because we all agree it has been and will be in the future,” details the report.

But Apollo explains (as shown in the chart below) why it thinks Bitcoin has become a superior asset in comparison, and why the asset would reach as high as US$600,000 per coin if it were to ever achieve the same market capitalisation that gold currently enjoys.

Ethereum as a commodity

Apollo identifies smart-contract platforms, aka layer 1s, as commodity-like assets and it singles out Ethereum as the bull goose smart-contract platform. And that’s with good reason given the asset has the overwhelming advantage of network effect compared with its growing number of competitors.

With reference to Bitcoin’s comparatively limited utility, “Ethereum was developed in part due to Bitcoin’s inflexibility, writes Apollo”, adding:

“We can think of Ethereum as a more flexible, general purpose blockchain which offers builders and users far greater utility than Bitcoin. We suggest that Ethereum is a commodity-like asset whose value comes from demand based on the utility it provides.”

“We can think of Ethereum as the electricity powering the development and operation of decentralised applications. Ultimately the demand for both electricity and Ethereum depend on utility. If people stop demanding electricity because of a construction slow down, the price will fall.”

Conversely, though, as long as people continue to build on and use Ethereum – eg. for the purposes of decentralised finance, then you would think ETH’s price would retain or gain value.

DeFi as equity-like crypto assets

This is the category that Apollo Capital is most interested in, says David Angliss. Simply put, they derive their value from the “rights attached to the assets”.

What does that mean? As the report explains it, “these rights are usually in the form of cash flows which automatically flow to the assets according to the code on which these assets are based.”

“Many DeFi applications are equity-like and backed by cash flows,” the report notes. “Traditional financial markets participants value equities as the present value of their future cash flows. If Apple is expected to increase earnings in future, all else being equal, the Apple share price will rise.

“DeFi assets operate and accrue value in a similar manner. If the expected future cash flows of these applications increases, the value that accrues to these tokens will also increase.”

For the purpose of its report, Apollo uses the DeFi assets Synthetix (SNX) – a decentralised derivatives liquidity protocol, and GMX – a decentralised spot and perpetual exchange.

Over the past several months, we’ve covered several other DeFi projects and assets with Apollo that fit into this category, for example dHedge (DHT) and Clearpool (CPOOL).

Debt-like crypto assets and crypto… currencies

Let’s very quickly cover these last two of Apollo’s categories before we get on out of here.

We’re treating them like a bit of a footnote, because Apollo Capital’s investment activities are clearly focused on commodity-like crypto assets and equity-like crypto assets. “We believe the utility and applications provided by these assets is groundbreaking,” says the digital fund manager.

That said, they’re still big players in the world of crypto, and worth going into quickly for purposes of drawing their distinction from the other categories.

Debt-like crypto assets

Debt-like crypto assets are also linked to DeFi, explains Apollo – specifically to lending and borrowing-focused protocols such as Aave (AAVE), a pioneer in that area of crypto.

The assets accrue their value over time, through interest payments from borrowers.

And many decentralised lending protocols have their own debt-like crypto assets that they distribute to the lenders on the platform. Lenders are entitled to these debt-like crypto assets for providing collateralised lending on decentralised platforms.

“The simplest debt-like crypto assets in DeFi are known as a-Tokens,” reads the report. “A user receives an a-Token token when they deposit a crypto asset into a major decentralised lending protocol, such as AAVE. An a-Token represents a deposit into the lending market, the same way a certificate of deposit represents a deposit into a bank with the intention of earning yield.”

Currency-like crypto assets

Stablecoins are the assets that immediately spring to mind here – such as Tether (USDT) and US Dollar Coin (USDC), which are designed to be pegged to the US Dollar.

Speaking more generally, “it’s hard to define why currencies are valuable”, says Apollo. “There is no intrinsic value in a $50 note.”

“It’s valuable because the recipient accepts it as such, and unfortunately history is littered with examples of currencies becoming worthless.”

Other examples of currency-like assets include crypto assets that are designed to function as a medium of exchange. And Apollo cites Litecoin (LTC), Bitcoin Cash (BCH) and Bitcoin SV (BSV) as prominent examples.

“We believe it is very hard for currency-like crypto assets to accrue significant value and we do not invest in currency-like crypto assets,” explains the digital fund manager.

“It is an enormous challenge for a volatile crypto asset to be used as a widespread medium of exchange. We would argue the same for Ethereum and Bitcoin. Even though currency-like crypto assets might have large throughput, we think it is highly unlikely that they will replace fiat currencies as the de facto medium of exchange.

“Stablecoins are much more likely to succeed as they combine the stability and acceptance of fiat currencies with the digital nature of crypto assets.”

This Apollo-led Coinhead summary, of course, just scratches the surface of the report, which we highly recommend reading in full.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.