Apollo’s Moonshots: Clearpool has a good shot at becoming DeFi 2.0’s ‘killer app’

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Capital, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

It’s usually not long before a fresh investment and utility narrative grabs the bulls by the horns in the crypto space, and a hot new one appears to be emerging – DeFi 2.0. Clearpool (ticker: CPOOL) is one of a few building in this area that have really caught Apollo Capital’s attention.

The new decentralised finance wave is focused on opening up previously untapped undercollateralised lending opportunities to the crypto market. And that’s a big deal, because over the next few years it could potentially bring more than a trillion dollars’ worth of capital flow into DeFi from traditional credit markets.

No ‘killer app’ for DeFi 2.0… yet

Angliss told Stockhead that there hasn’t really been a “killer app” emerge yet for undercollaterised lending, but that Clearpool “definitely has a shot”, along with other competitors such as Maple Finance and TrueFi. (BNPL Pay is another promising DeFi 2.0 protocol Stockhead‘s been looking into, which has Australian VC backing in Clee Capital.)

Clearpool is an Ethereum-based protocol operating as an institutional-lending service. It provides users with undercollateralised liquidity directly from DeFi. Up until this recent emergence of DeFi 2.0, borrowers would have to stump up more capital (e.g. 150%) than the loan itself as collateral, also known as overcollateralised lending.

And Clearpool also introduces two new core concepts to DeFi — single-borrower liquidity pools and tokenised credit.

“Clearpool benefits borrowers who want to take advantage of unsecured, uncollateralised, decentralised loans,” says Angliss, “as well as giving lenders, essentially everyday DeFi users, the same sort of opportunities for yield that institutional investors, VCs and whales would normally have.”

What sort of yield are we talking for liquidity providers?

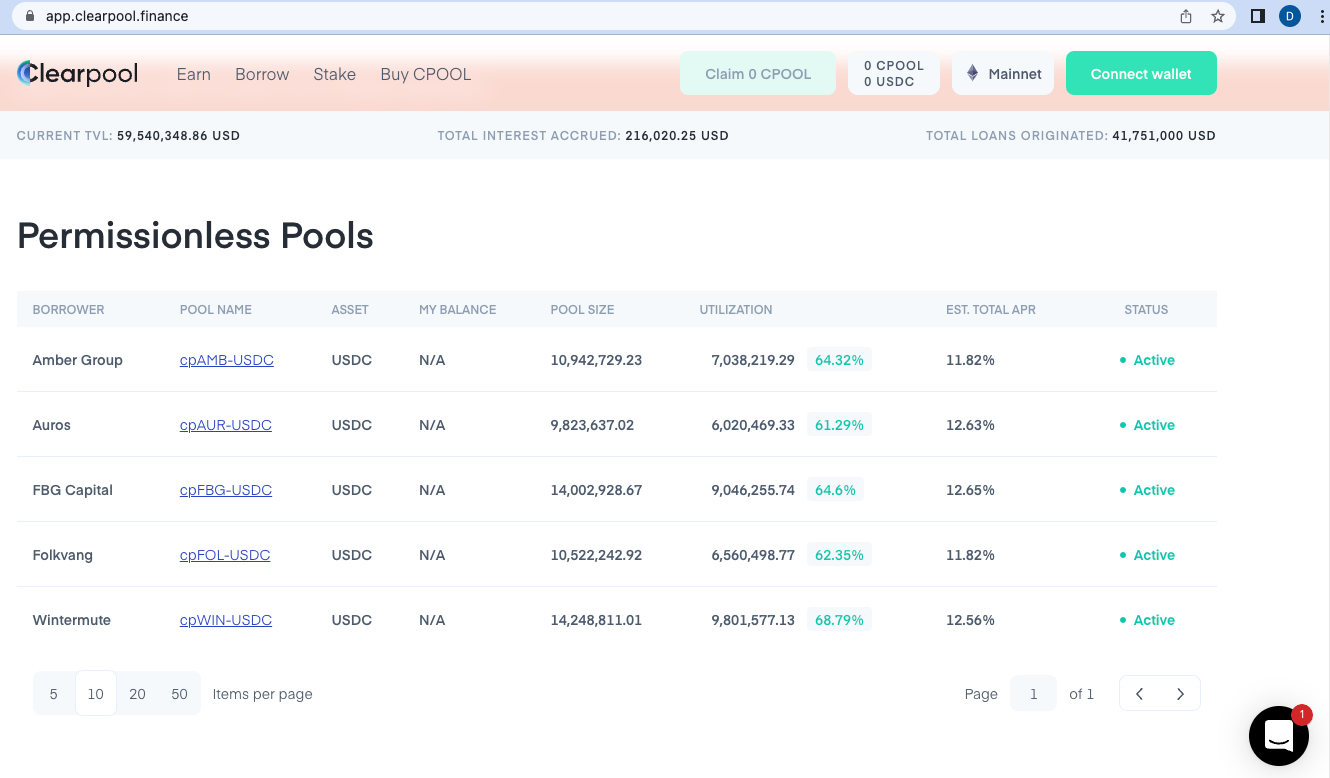

Judging by the yield-farming liquidity pools shown to us by Angliss, APR gained from Clearpool lending has been ranging between about 12% to 17.5%*. And that’s pretty good in the current DeFi climate, which Angliss says has been in a bear market for a while now, despite LUNA and the Terra ecosystem stealing the show lately.

Is there a chance DeFi 2.0 protocols can bring back the heady days of even higher returns than these, though?

“It depends,” says Angliss. “A lot of people have been writing off that it’s never gonna happen again. But if we get a strong catalyst, such as the Eth 2.0 Merge or further layer 2 token releases such as $OP, Optimism’s native token… then yields on Ethereum DeFi could easily drive back up to the mid 20s, 30s, maybe 40s, depending on risk tolerance.”

He adds that Apollo is “really excited about Clearpool’s permissionless pools”, revealing that they’re already using them for their two yield-farming funds – Opportunities Fund I and II. And this is “because these yields are some of the best you can get in DeFi at the moment”.

🧑🏫 With 5⃣ borrower pools now live, here's what you need to know about lending on the #Clearpool app!

🔎 When can I withdraw my funds?

🔎 How is the interest rate calculated?And many more questions answered!

Learn more 👇https://t.co/rPtPDyoZ3i$CPOOL #DeFi

— Clearpool (launching Ozean🌊) (@ClearpoolFin) April 27, 2022

The Clearpool investment thesis

All in all, what puts Clearpool in “moonshot” investment territory? Angliss helped us break it down like this:

Low market cap

Clearpool’s market capitalisation is about US$10.1 million at the moment, with a fully diluted valuation of about US$123 million. Angliss says that’s quite a ratio but that Maple Finance, for example (an Apollo favourite) has a fully diluted valuation of US$538 million (current market cap: US$302m), while TrueFi’s is about US$242 million (current market cap: US$112.5m).

The upshot is that Clearpool is operating in similar territory, doing similar things to those two competitors, yet is comparatively flying under the radar.

Solving a unique problem

As mentioned above, uncollateralised lending is the missing link in DeFi, and Angliss says Clearpool is “one of the more exciting solutions to uncollateralised lending in DeFi right now”.

Proving itself with TVL

The project’s liquidity pools have only been up and running for about a month, and the protocol’s TVL (total value locked) figure is now more than US$59 million. “That’s already very good,” says Angliss, “and is a great indication of adoption.”

Reputable borrowers

As you can see from the Permissionless Pools table above, Clearpool has very recognisable borrowers taking part, adding heft and legitimising the protocol. These are led by FBG Capital, a “top-tier VC and digital-assets management firm” with one of the biggest pools at this stage.

Strong team, big backers

Apollo Capital has met members of the Clearpool team, including its British CEO Robert Alcorn. “They’ve got a really strong mix of traditional finance and DeFi backgrounds and experience,” notes Angliss.

And they’ve managed to attract some serious backers, notably Sequoia, Arrington Capital, and GBV, among others. “This brings robustness and is always a great sign for the growth and longevity of a project.”

Final thoughts

“We’re 100 per cent bullish on this one,” affirms Angliss, concluding:

“Just really impressed with how far the protocol’s come in a very short timeframe. It’s down 94 per cent from it’s all-time high, has a working product and, at this stage, low marketing. Once the market catches on that this is another Maple or TrueFi play, then we could see some good price appreciation.”

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.