Animoca Brands is lining up Wall Street debut through fintech merger

Animoca Brands and Currenc are planning a merged listing to the Nasdaq by the end of 2026. Pic: Getty Images.

- Animoca Brands proposes merger with Nasdaq-listed fintech Currenc

- Reverse merger would see Animoca Brands shareholders own 95pc of issued shares

- Entity will operate under Animoca Brands name with board members from both companies

Special Report: Animoca Brands may soon list to the US Nasdaq, after proposing a merger with Nasdaq-listed fintech Currenc Group Inc.

The cryptocurrency investor and blockchain developer has entered into a non-binding term sheet with Currenc for a reverse merger that would see Currenc acquire 100% of Animoca Brands’ issued shares.

Under the proposed structure, Animoca Brands shareholders would collectively own about 95% of the resulting merged entity, with Currenc shareholders retaining a 5% holding.

The new company is expected to operate under the Animoca Brands name, with directors of the board nominated from both merging entities.

Animoca Brands co-founder and chair Yat Siu said the merger would result in the world’s first publicly-listed, diversified digital assets conglomerate, giving investors on the Nasdaq direct access to the growth potential of the trillion-dollar altcoin digital economy.

“We believe that this proposed transaction would usher in a new asset class that should position investors at the forefront of one of the greatest opportunities of our generation,” he said.

The two companies expect to finalise the terms of the merger within the next three months, with the closing of the transaction to occur in 2026, subject to shareholder and regulatory approvals.

Institutionalising cryptocurrency

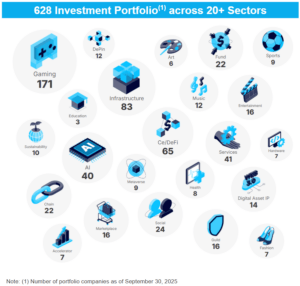

Animoca Brands has been a global pioneer in the blockchain and digital asset ecosystem since its inception in 2014, building out a portfolio of more than 600 crypto-related investments in the years since.

Companies within Animoca Brands’ portfolio as of Sep 30, 2025.

Pic: Animoca Brands

The company has made several forays into institutional finance and corporate advisory services in recent years, including participating in a joint venture focused on launching a regulated stablecoin .

Animoca Brands is also building a blockchain platform alongside Provenance Blockchain to increase access to real world tokenised assets (RWAs) and a Web3 strategic partnership with SK Planet, one of South Korea’s largest information and communications technology platforms.

Currenc Group founder, CEO and executive chair Alex Kong said the merger with Animoca marked a milestone for Currenc.

“This proposed transaction provides a compelling path forward for the evolution of both companies and would unlock significant value for our shareholders,” he said.

“We are excited to facilitate this evolution, which will give our investors ownership in a global leader at the forefront of the digital asset economy.”

Currenc processed over US$5.4 billion in digital payments in 2024 alone, facilitating more than 13 million cross-border transactions.

The fintech’s digital remittance platform enables e-wallets, remittance companies, and corporations to provide real-time, 24/7 global payment services, while its AI solutions include call centre and AI agents targeted at banks, insurance, telecommunications companies, government agencies and other financial institutions.

This article was developed in collaboration with Animoca Brands, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.