Analyst: BTFD for BTC at US$57.5k, Eth at US$3.9k in preparation for a huge November

Getty Images

An Aussie market analyst has noted that November is seasonally the best month for crypto — but he’s cautioning against rushing into a trade right now.

Think Markets technical analyst Carl Capolingua said in his regular Ausbiz TV appearance on Friday that he believes the high was in for Bitcoin for the short term.

“I know that’s a pretty brave and big call, but last night’s trading, just the way it was going, the volatility, some of the volume that came in just tells me that we have hit a pocket of supply,” the Perth-based analyst said.

Bitcoin flash-crashed on the Binance.US exchange late last night, momentarily dropping all the way from US$65,500 to US$8,200, with Binance blaming the sell-off on a bug in an institutional client’s trading bot.

The original cryptocurrency was still recovering around lunchtime (Sydney time), changing hands at US$62,954, down 4.1 per cent from 24 hours ago.

Capolingua acknowledged that his prediction from last Friday hadn’t quite gone according to plan. He had expected Bitcoin to consolidate under $60,000 for a while, but BTC instead surged over $60,000 later that day on indications that a Bitcoin ETF would be approved.

Still, Capolingua said that the excitement in the market was now over, and he was expecting Bitcoin to hit a higher low as some of the smaller players in the market get uncomfortable with their long positions.

“I think somewhere around the $57,500 level, is the key support level to hashtag BTFD,” Capolingua said, using an acronym to refer to especially vigorous dip-buying activity.

Capolingua noted that Ethereum had topped out yesterday at about US$4,380, failing to hit the same heights as Bitcoin.

“That’s interesting in itself, tells me that we’re not seeing as much positivity in Ethereum as in Bitcoin.”

“However, having said that, the trend is still immensely strong now, so if I had Ethereum and you’re a long term ‘hodler’, definitely hang on to that position,” he advised.

But those without Ether don’t need to rush to buy right now, he added.

“We could see it print again in threes, so $3,900 to $4000 is the level that you start to take positions.”

At noon, Ethereum was down 1.9 per cent to US$4,118.

Capolingua reiterated his view seasonally, November was the best month for crypto, “so I think you want to find that entry point, and then hang on”.

I scanned all Top 100 #Crypto charts

Favorites (Top Pick= )#Cardano #ADA#Solana #SOL #Polkadot #DOT #ALGO#MATIC#ATOM#FTT#Fantom #FTM #XTZ#HBAR#NEAR#KSM#HarmonyONE #ONE #HNT#OMG#ICX#KCS#NEXO#REN

Expect #Bitcoin move now flows to #altcoins!#BTFD #HODL pic.twitter.com/2RnQ1T0Evi

— Carl Capolingua (@CarlCapolingua) October 21, 2021

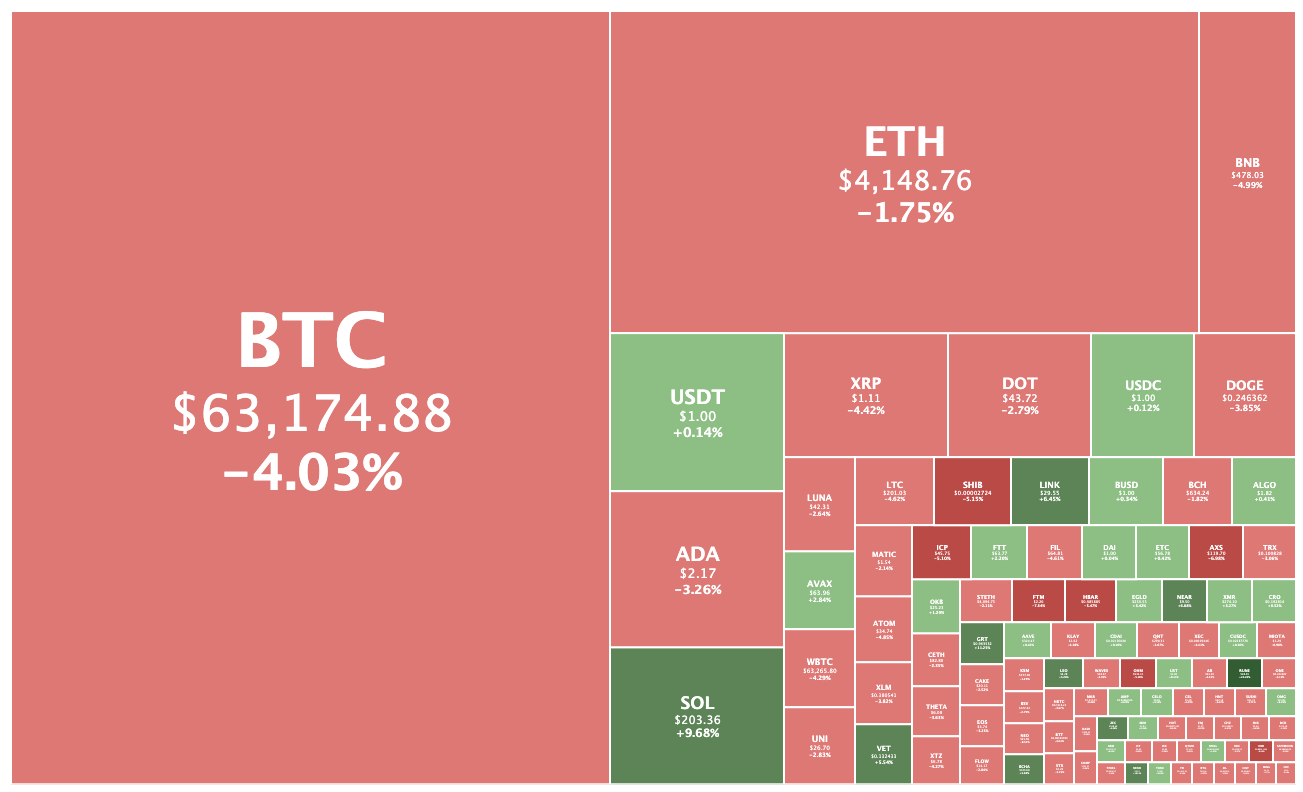

Crypto market down 2.8%

Overall the crypto market was down 2.84 per cent to US$2.57 trillion at lunchtime, with all the top 10 coins except Solana in the red.

SOL had surged 9.3 per cent to US$202, not far from its all-time high of $216 set on September 9, and had reclaimed its No. 6 spot on the coin rankings.

THORChain had been the biggest gainer in the top 100, rising 23.6 per cent to $10.14.

The Graph and Nexo were up by double-digits as well.

On the flip side, Telcoin had been the biggest loser, falling 8.6 per cent, followed by Axie Infinity and Fantom.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.