Bitcoin flash crashes on Binance US; market pulls back a bit; ‘supercycle’ predicted

Getty Images

Bitcoin and the crypto market have pulled back today. In fact, very briefly and exclusively on the Binance US exchange, BTC did way more than that – “flash crashing” by a knuckle-whitening, pencil-snapping 87 per cent.

It was only a “one-minute candle”, but what a sickening 60 seconds that was for any traders adversely affected, or anyone watching and not quite comprehending what the hell was going on.

BTC fell from about US$65,500 right down to US$8,200 on the exchange, with some calling it a “scam wick”. It’s certainly not the first time this sort of thing has happened, and likely won’t be the last.

(Update: Binance reached out to us this morning with this statement: “One of our institutional traders indicated to us that they had a bug in their trading algorithm, which appears to have caused the sell-off that was reported this morning. We are continuing to look into the event, but understand from the trader that they have now fixed their bug and that the issue appears to have been resolved.”)

All is well, then. But what follows is the kind of panic such events can cause in fragile crypto circles.

‘Forced onto exchanges’

Sales of 592.8 bitcoins today at 2:43 pm on Binance US caused a flash crash of -87%.

Hope you weren't levered. pic.twitter.com/VavPqsGoF0

— Heikki Keskiväli (@hkeskiva) October 21, 2021

The popular (on Twitter) trader Crypto Chase sarcastically congratulated Binance US for its thin order books, which at one stage looked to be at least one cause for the short-lived, localised mega dump.

“Good thing Americans are forced on to these dogshit exchanges where they can get completely scammed on unreasonably thin books,” wrote Chase, who said it simply shouldn’t be something that happens. “It’s not fair that some get stopped out and some stay in, some get fills and some don’t.”

This move by shitty exchanges was not the flush I previously discussed btw. These scam wicks (legit sells on thin books) are nothing but unfortunate events that spook everyone and slow down the natural progression of the market. A waste of time for us all. https://t.co/crgBKAwEl0

— Crypto Chase (@Crypto_Chase) October 21, 2021

And, as Cointelegraph notes, “the debacle was tinged with irony”, with Binance CEO Changpeng Zhao (aka CZ) tweeting beforehand about likely volatility incoming over the next few months.

Another full-time crypto analyst, Dutch trader Michaël van de Poppe explains the flash crash all pretty clearly in his latest YouTube video, posted a short time ago.

He said that when someone with a big-sized stack jumps on an exchange with thin order books and starts market selling, it goes through the entire order book, resulting in a big and fast downwards wick, “which is often quickly recovered as people have positions and orders in place… bringing things back to equilibrium”.

Day trading, eh? Not for the faint-hearted… or for anyone who doesn’t know what the hell they’re doing.

How’s the Bitcoin price now, then?

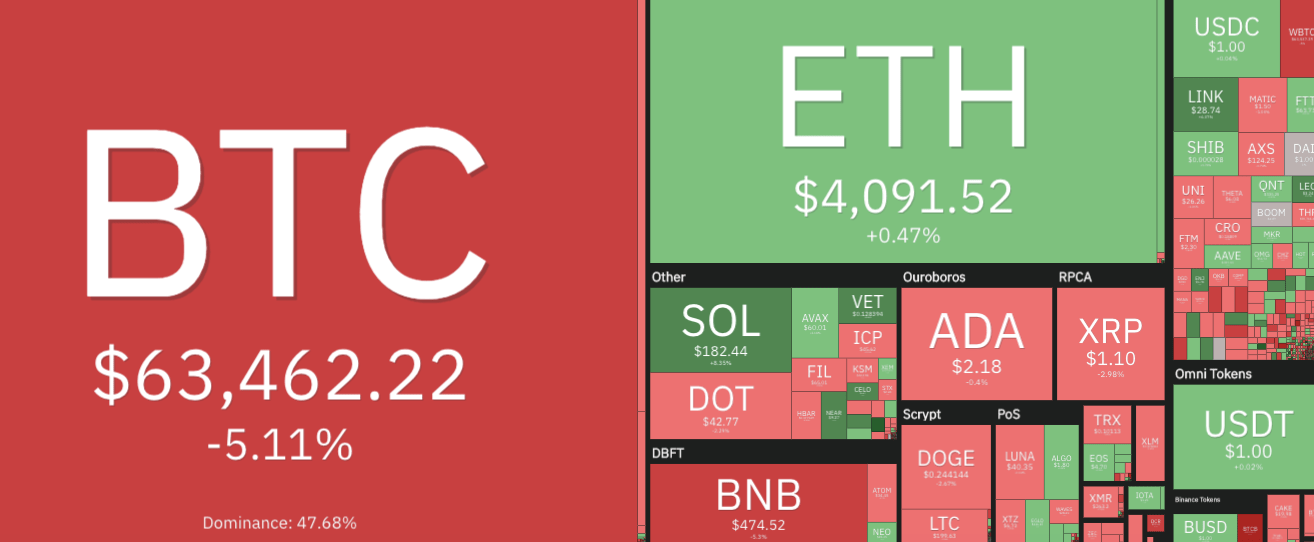

At the time of writing, it’s possible some sections of the market, newer entrants most likely, are shaken by the event, with Bitcoin (BTC) dropping 4.78 per cent in the past 24 hours. A few hours ago, it was trading up around US$66K, but it’s currently changing hands for about US$63,590.

But, no need for panic (not financial or psychological advice) – this is just another regulation day in crypto. (Probably.)

At press time, the overall crypto market cap valuation has retraced by about two per cent, and is sitting back under US$2.7 trillion, at about US$2.69 trillion, give or take a few hundred million.

If you’re freaking out today because #BTC is down 3.5% this should be a sign that your position sizing is too large or that you simply are NGMI.

This is crypto. -3.5% is nothing. We’ll have way more volatility on the way up to 100k than what we’re seeing today. Buckle up.

— Wick (@ZeroHedge_) October 21, 2021

B… but wait, aren’t we meant to be in a supercycle?

Supercycle? What’s that? Something from the movie Tron? In this instance, it refers to a sustained period of market positivity and growth in an asset or asset class, often driven by strong, genuine demand.

Some even reckon Bitcoin and crypto are heading into one, although many market participants (in fact, likely most) are sceptical of such an idea.

It’d be understandable to be wary of such hopium, given the crypto market’s bull-and-bear market history. Crypto is known for long, brutal, desperately chilly crypto winters in between insanely euphoric months or weeks of bull-market pumps.

But, if it’s hopium you want, it’s very easy to find someone to give you a fix. We at least had a bit of a scout around for a credible source, though, and got a nice hit from this tweet posted by Bloomberg’s senior commodity strategist, Mike McGlone.

(Note, it was posted earlier today, well before the flash-crash event possibly helped cause a market dip.)

A supercycle is happening in #Bitcoin, which appears in early price-discovery days, positioning the cryptocurrency to outperform #commodities in 2022. Commodities face rising risks of sharp price reversion under pressure of rising supply and demand elasticity. pic.twitter.com/731xOowKlq

— Mike McGlone (@mikemcglone11) October 21, 2021

McGlone is clearly bullish on Bitcoin, also describing it the other day as an “asset-eating Pac Man” amid the launch of the ProShares Bitcoin futures-based exchange-traded fund (BITO) on the New York Stock Exchange.

This ETF has been extremely successful so far, and there are at least a couple more SEC-approved US Bitcoin ETFs on the way, too… just to keep the positivity flowing on a reddish, choppy day in the market.

Nice look at just how ridic $BITO's first two days of volume were. Here it is vs the next most successful ETF launches of all time. It did double any of them, and is in good co w/ second day growth (see $QQQ, $GLD) via @tpsarofagis pic.twitter.com/WLzQt7yD3t

— Eric Balchunas (@EricBalchunas) October 21, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.