US$42k incoming? Cryptos plunge again with Bitcoin dropping under US$46k

Getty Images

So much for all those predictions of a huge parabolic crypto-rally to ’round out the year.

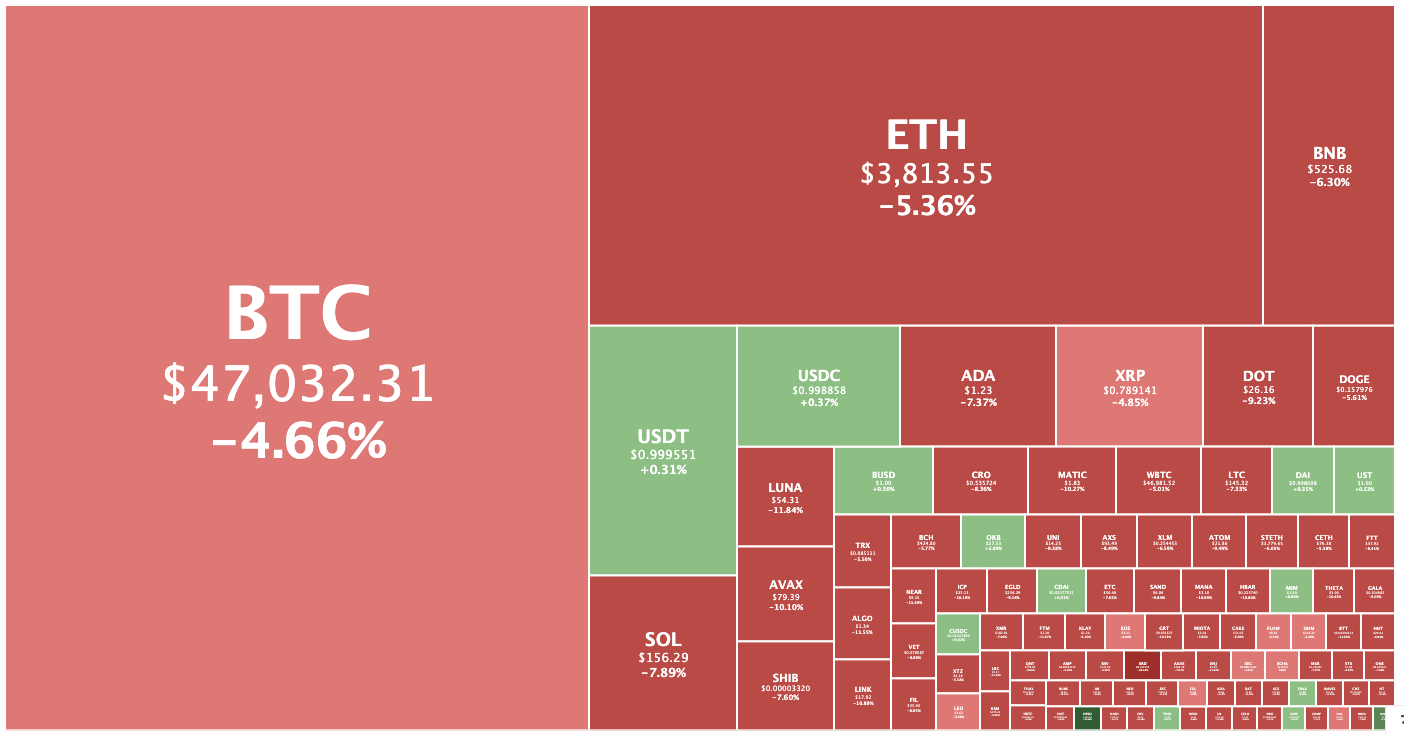

Digital assets are plunging, again, with around half of the top 100 coins down by double-digits.

Bitcoin plunged as low as US$45,900 around 6.45am AEDT, its lowest level since the December 4 flash-crash.

At 11.50am BTC had recovered slightly to $47,100, down 5.5 per cent from 24 hours ago.

Ethereum was down 7.0 per cent to US$3,821 after dipping as low as $3,700 at 6.45am.

Current market sentiment#BTC pic.twitter.com/NRq778izVr

— Devchart (@devchart) December 13, 2021

Gold bug Peter Schiff was back to taunting Bitcoiners on Twitter – which some use as a bottom signal – but others thought more carnage was still to come.

This is my primary scenario right now.

We have a breakdown and a retest which is currently rejecting.

A close above $48k would invalidate and likely set us up for more choppy price action.

Seems most likely we fill somewhere in this green area. Not sure how low yet. pic.twitter.com/T38sMvJj24

— Nebraskangooner (@nebraskangooner) December 13, 2021

The losses come ahead of Wednesday’s US Federal Reserve meeting (early Thursday, Australia time), which could see the US central bank announce an accelerated taper of its quantitative easing policies given the inflation anxieties. That stimulus programme is credited with being a big driver of the rally in cryptocurrencies and equities over the past year and a half.

Crypto market down 6%

Overall the crypto market stood at US$2.14 trillion, down 5.99 per cent from 24 hours ago and its lowest level since early October, apart from the December 4 flash-crash.

Decred was the biggest loser in the top 100, falling 16.4 per cent to US$63. WAX, OMG Network, Waves, Fantom were all down around 13 to 12 per cent.

Blockchain-based review platform Revain was the only significant gainer in the top 100, rising 23.6 per cent to 1.15c.

There wasn’t an obvious catalyst, although last week it did upgrade its platform. Revain allows users to earn crypto rewards in exchange for activity on the site.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.