Bull market over? Crypto traders turn fearful after Saturday’s flash crash

Getty Images

The overall crypto market remains at its lowest level in two months following Saturday’s flash crash, while by one measure the market is more fearful than any time in the past four and a half months.

The Crypto Fear and Greed Index was at 16, meaning “extreme fear,” its lowest level since late July.

You survived the -84.5% #BTC Bear Market

You survived the -63% $BTC crash in March 2020

You survived the -53% BTC crash in May 2021

You’ll survive this crash as well#Crypto #Bitcoin

— Rekt Capital (@rektcapital) December 5, 2021

The total crypto market stood at US$2.25 trillion this morning, down 1.4 per cent from yesterday and its lowest level since October 6, excluding the last two days.

Two months of sideways action?

Aussie crypto-trader Kyle Stagoll, the administrator of the Crypto Paradox Facebook group, told Stockhead that he thought where the market headed next depended a lot on the US Federal Reserve and its chairman Jerome Powell and his talk of tapering the monetary stimulus measures.

“Crypto and Bitcoin is a risk asset and is affected by the macro cycle which atm (at the moment) is fairly uncertain,” he said in a message.

“My trading plan atm is expecting a full 60-day cycle going sideways in accumulation similar to the action we had in June and July this year.”

“Strong chance of a sweep of the lows of 42k which would create a lot of panic and perfect chance for funds and bigger fish to scoop up retail panic sells. Then we could see a rally around the start of February.”

Bitcoin breaking out above $60,000 would invalidate this scenario, Stagoll warned, and there’s also “the potential we have already entered a bear market.”

Weekend sell-off

On Saturday, the market fell from $2.59 trillion at 1am AEDT to $2.35 trillion at 3.25pm – and then plunged all the way down to $1.92 trillion in the space of 45 minutes.

Hundreds of thousands of overleveraged traders were rekt, with $2.09 billion in positions liquidated, according to Coinglass.

Over $2.5B (417,646 traders) were liquidated on Saturday. Imho leverage trading in the volatile, unpredictable crypto market is fucking stupid & just asking to get rekt.

— Aleksandra Huk (@HukAleksandra) December 5, 2021

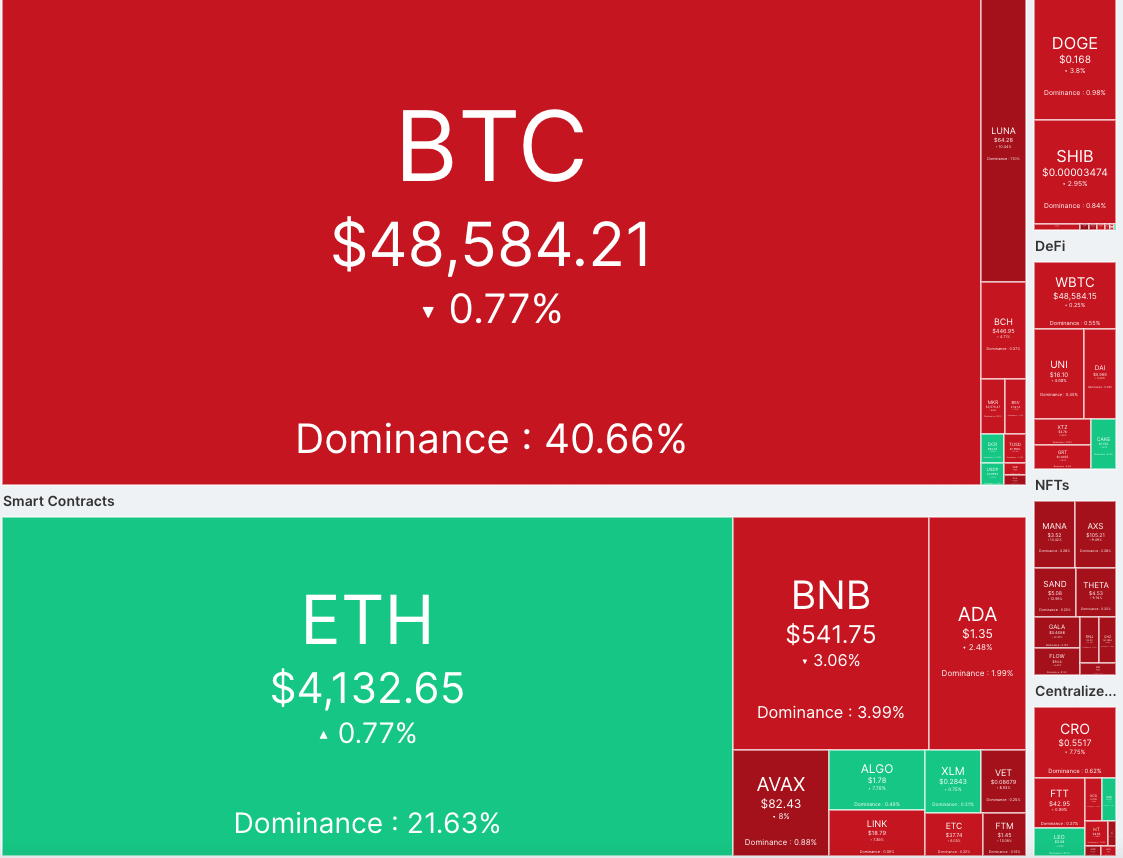

At 11.50am AEDT on Monday, Bitcoin was trading at US$48,607, down 0.8 per cent from 24 hours ago and down 15.7 per cent from seven days go. It fell from US$56,000 on Friday to as low as $42,000 on Binance during the flash-crash.

Ethereum was changing hands at US$4,119, up 0.3 per cent from yesterday and 5.0 per cent from a week ago.

‘Pretty ugly’

Perth-based Thinks Markets analyst Carl Capolingua told Ausbiz TV this morning that it was difficult to pinpoint a reason for the selloff, naming as possibilities everything from Evergrande’s restructuring to fears of the Omicron variant to the Federal Reserve taking a more hawkish stance.

“The bottom line is what we see on the screen, which is pretty ugly,” he said.

The sell-off really damaged the trend-line for Bitcoin, Capolingua said, while the bounce for Ethereum was “so much better. I mean, so much better than Bitcoin. And that trend is still pretty much intact.”

Ethereum was trading for 0.085 BTC, its highest level since May 2018.

Most coins in red

Over 80 of the top 100 coins were in the red, compared to where they were Sunday.

Cosmos (ATOM) had been the biggest loser among the top 100 coins in the past 24 hours, falling 14.0 per cent to US$23.59.

Immutable X, Fantom, The Sandbox, Qtum, Gala Games, Harmony and IoTeX were all down by between 12.8 and 11.5 per cent.

Most top 100 coins were also in the red for the week, with notable exceptions including Terra (LUNA), up 28.7 per cent; Polygon (MATIC), up 18.0 per cent, and Stacks, 13.4 per cent.

Ankr had been the biggest loser among top 100 coins for the past seven days, falling 37.0 per cent. Kadena, Loopring, Qtum, Harmony, Immutable X, Thorchain and Gala Games had all dropped by more than a third.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.