Zero to Hero: How Avita Medical rose over 500 per cent in 2 years

Health & Biotech

Health & Biotech

In just two years, skin regenerator Avita Medical (ASX:AVH) has shot up from 6c to 40c and was granted entry into the ASX 200, but the company says it hasn’t made it yet.

Chief financial officer David McIntyre, who joined Avita in November last year, says there’s a long way to go but admits the company’s life now is a different one to a couple of years ago.

“I wouldn’t say we’ve made it yet, we’ve got a lot of work to do to build markets up over time,” he told Stockhead.

“There is the life it was before the randomised clinical study in the US and there’s the life after it. Once you get the study, everything changed.”

The trial he is talking about led to the US Food and Drug Administration’s (FDA) approval of Avita’s Recell product in September 2018.

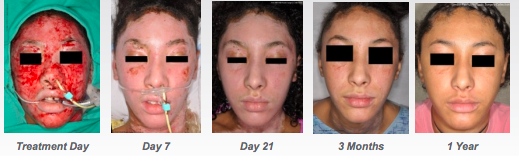

Recell is a rapid cell harvesting device that enables surgeons to treat skin defects using patients own cells collected during surgery.

It means surgeons can prepare a small quantity of cells on site, rather than sending a biopsy to the lab.

While the process does involve cutting skin, it is ready for use in 30 minutes, works as a ‘spray-on’ and can cover 80 times the area of a skin graft with the same amount of material.

In effect, the donor area is multiplied 80 times, and less skin is needed from one part of a body to heal another part.

“The standard of care is in skin graft. If you have a burn the standard is to take fresh skin from somewhere else,” McIntyre says.

“There is no cost with taking your own skin and transplanting it.

“There’s an obviousness and intuitiveness to the product. You don’t need a PhD to understand this, if you do less and get the same outcomes it’s best for everyone.”

As groundbreaking as the approval was, no analysis of Avita would be complete without a step back in time before the watershed moment in 2018.

Recell was first used in the 1990s by Perth-based burns specialist Professor Fiona Wood. But it took the 2002 Bali bombings for the world outside her practice to take notice of the advancement.

Within 24 hours of the bombings, she had 28 repatriated patients in her care — more than any other hospital. Many of these had burns covering over 90 per cent of their bodies.

Of the patients under her care, 25 survived and she was named Australian of the Year in 2005.

Professor Wood founded the company and stayed with it until 2016. Until 2008 it was known as Clinical Cell Cultures.

For around 15 years it did not appear to be going anywhere, but the wheels began to turn in 2017. Michael Perry took the top job and decided to put everything on the table to break into the US.

One early sign the company could crack the market was receiving assistance from the Biomedical Advanced Research and Development Authority. BARDA pledged to buy $US8m worth of Recell devices to be stockpiled in case of a mass casualty event in the US.

“Their job is to deal with nuclear weapons and preparation for catastrophic events. Obviously burns are a part of this,” McIntyre said.

We’re not saying BARDA deals with zombies but, you know, they probably would.

We’re not saying BARDA deals with zombies but, you know, they probably would.

2018 was the year it finally made progress with two watershed moments. The first was in April when it passed a 101-patient clinical trial.

Recell was shown to reduce donor skin required by 97.5 per cent compared to the current standard of care. The study also showed it could reduce total treatment costs by 44 per cent or more for large burns.

The second defining moment was in September when the FDA gave the product the green light. As sales began in the US, the stock really took off, rising from 10c to over 80c in early February this year.

Avita previously tipped 2,500 Recell unit sales for 2020. While that number may seem small, it would actually deliver the company $18.8m in revenue at an individual cost of $7,500 per unit.

“Once you get clinical data you have a fabric you can leverage to convince doctors to use the product,” McIntyre explained.

“The FDA is the high water mark and the standard for safety and efficacy. Without FDA studies it is difficult to get markets to convert.”

McIntyre believes the US burns market is just the beginning for Avita. The main target it has its eyes on is outpatient burns.

“The US is the world’s largest burn market, but this is the tip of the iceberg,” he said.

“We’re only in inpatient burns. There are about 14,000 patients per annum inpatient but it’s only a $US200m addressable market.

“Behind it is out-market burns and then adjacent to that is soft tissue reconstruction, which is car accidents where your skin is ripped off. These markets are larger than the one we’re in.”

Some regulatory bodies will require further trials, specifically in country. But the FDA study can be used as a platform in other markets such as Japan.

Avita’s other ambitions include breaking into the paediatric scalds and skin rejuvenation markets. The company told shareholders last month it was in late stage discussions for a sponsored research agreement for the latter.

READ MORE:

Dr Boreham’s Crucible: Avita in for a busy 2020 with big expansion plans

Here’s why passing an FDA exam is so important for small caps like Compumedics