Resources Top 5: Can Aldoro keep climbing on niobium hope?

Mining

Mining

Your standout small cap resources stocks for Thursday, December 12, 2024.

The ASX’s latest niobium obsession continues to rack up the points, running another 30% plus higher on Thursday after reporting an unbroken chain of surface niobium mineralisation from its Kameelburg project in Namibia.

Similar to the initial surge ARN saw on the results of a line called Line 4, samples across Line 3 have picked up 190m of strike containing high grade niobium at surface.

That includes 128m from 176m to 304m along the 388m long line (direct length 340m) at 0.96% Nb2O5 and 90m from196m to 286m at 1.12% Nb2O5 on average.

Taking the whole of the line sampled so far, the average grade clocks in at ~0.7% Nb2O5. Luni, the major new niobium discovery made by WA1 Resources (ASX:WA1) in Australia’s West Arunta province, clocked in at 200Mt at 1% Nb2O5.

Only world leading CBMM and its dominant Araxa deposit in Brazil sit higher, reportedly running at around 2.5% Nb2O5.

Assays are still to be reported from another 168m of the line, which sits 500m southwest of the line samples from Line 4.

This is, thus far, pretty early stage stuff.

Diamond drilling has started with hole locations correlated to sample lines, which will illuminate how far and at what grades the niobium mineralisation extends at depth.

But that hasn’t stopped punters getting in early, with ARN stock now ~430% higher since hitting a 52 week low of 6.1c in June, giving the explorer a market cap of ~$45m.

You may remember Dundas Minerals as one of the cautionary tales of the great ‘visual mineralisation’ lesson handed to investors a couple years ago when they decided to front run drilling results on critical minerals projects.

DUN shares briefly frothed to 86c on the hope the explorer had made a new nickel discovery to finally follow the Nova nickel mine in the Fraser Range some 10 years after that deposit’s auspicious but ultimately unrepeated discovery by Sirius Resources.

Lab results, in the end, were nothing to call home about and the company’s shares returned to Earth. Dundas has, like many other critical minerals explorers, spent the past year moving strongly into gold as prices for battery commodities like nickel and cobalt and precious metals like gold have reversed.

The latest run, far more restrained at ~10% to 3.2c a share after running as high as 4c around the open, comes off the back of a first pass drill program at the Rockland prospect near the gold hub of Kalgoorlie. And this time it is drill assays doing the work.

The results of 23 reverse circulation holes on mining lease M24/974 included a swag of interesting shallow intercepts such as:

This all extends mineralisation over 1km of strike and, interestingly marks the first drilling below 50m deep, previously undertaken between 25 and 35 years ago.

Follow up drilling is planned, with assays also anticipated from the Baden-Powell gold deposit in January next year.

“This is an excellent start from first pass drilling at a project that Dundas acquired an option on only a few months ago. Most of the previous drilling at the project was limited to 50 metres, and undertaken 25-35 years ago when the gold price was below US$500 an ounce. Results from this first pass program have exceeded expectations,” Dundas managing director Shane Volk said.

“Importantly for the company, as we seek to grow the size of the gold mineralisation at the Windanya project area, is that Rockland gold mineralisation is within a granted ML located very close to the Goldfields Highway (5km), Kalgoorlie (60km) and multiple operating gold mills, including Paddington (15km).’’

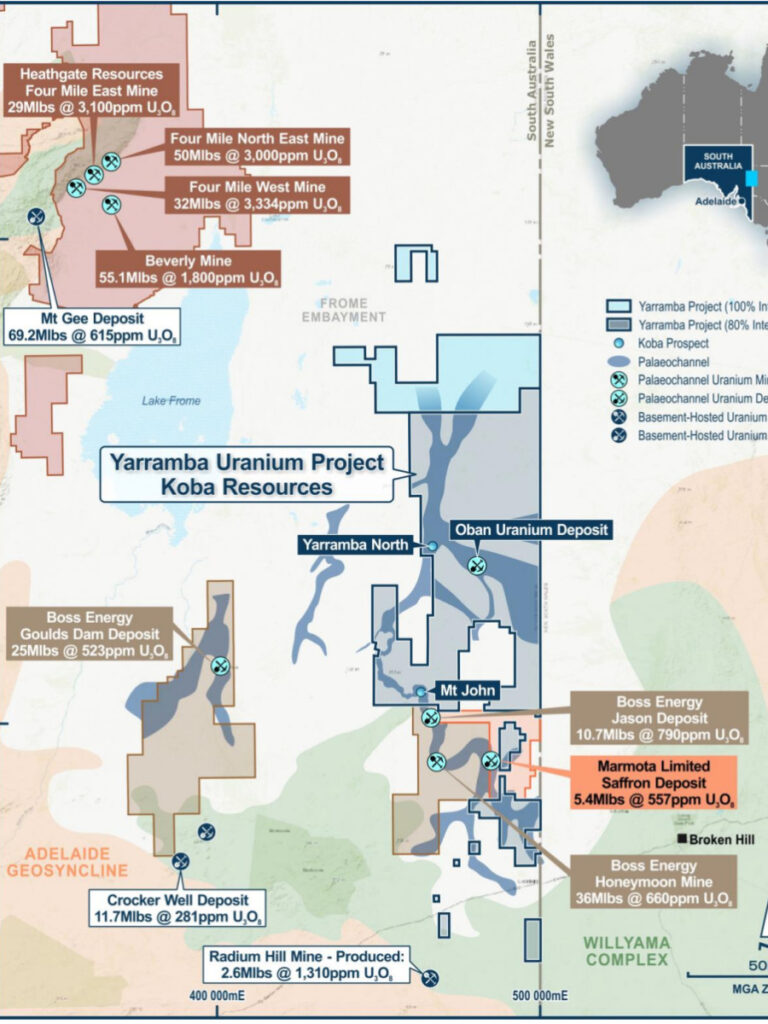

Koba Resources is on the hunt for the next Honeymoon-style uranium development in South Australia, with a string of prospects sitting not far from Boss Energy’s (ASX:BOE) 10.7Mlb Jasons satellite.

And investors have a taste of what could be coming with drill results from resource drilling at the Yarramba project.

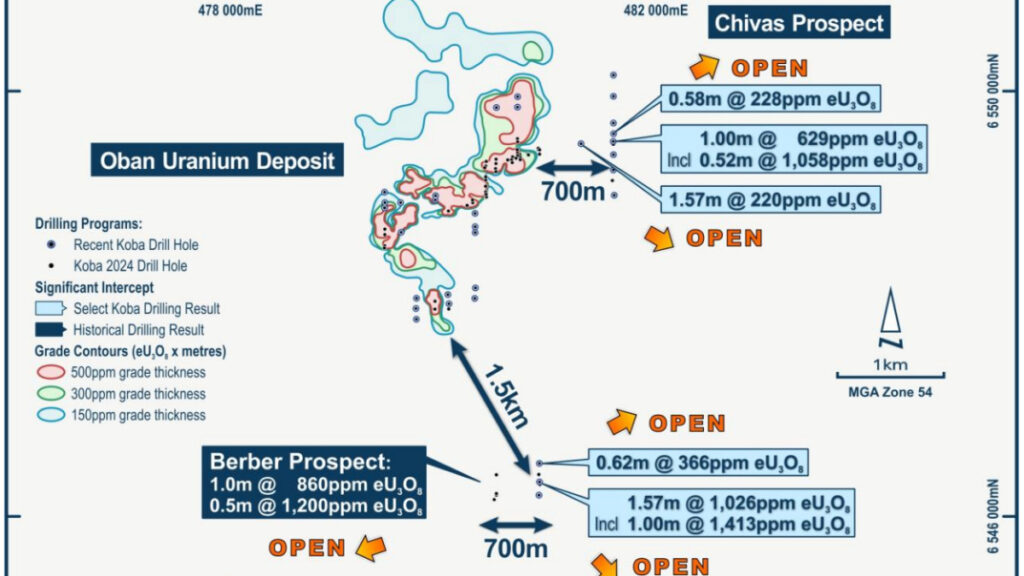

There, a string of targets named after prized whiskeys have delivered some high-grade results, with drill hits extending mineralisation at Berber and Chivas, 700m east of the Oban deposit.

Significant results included 1.6m at 1026ppm eU3O8 from 91.5m at Berber, which now runs to over 700m in strike.

A best hit at Chivas contained 1m at 629ppm eU3O8, from 83.1m, including 0.5m at 1028ppm from 83.3m.

A drill rig is currently mobilising to the Mt John prospect (disappointingly, not an alcoholic beverage), with further drilling at berber and Chivas due early next year.

“Our drilling program continues to show strong potential for resource growth through discovery at the Yarramba Uranium Project in South Australia, with significant high-grade mineralisation discovered in follow-up drilling at both the Berber and Chivas Prospects,” Koba managing director Ben Vallerine said.

“With 1.6m at 1,026ppm eU3O8 intersected at Berber, high-grade mineralisation now extends over 700m of strike and remains open in all directions. Berber remains very sparsely drilled and we believe there is considerable opportunity to delineate high-grade resources. Planning is well underway for further follow-up drilling in early 2025.”

Vallerine said Chivas is now a high priority target for next year.

“Having confirmed the presence of considerable mineralisation at the Oban Deposit, we have only just commenced exploratory drilling at Yarramba. And we have already discovered high-grade mineralisation in two new areas, the Berber and Chivas Prospects. This provides us with strong encouragement and, with 5000km2 of tenure and 250km of palaeochannels to explore, it is testament to the opportunity to discover multiple additional high-grade deposits,” he said.

“The drill rig has now mobilised to the Mt John Prospect, which is another exciting prospect located within the well-endowed Yarramba Palaeochannel just 4km along strike from the 10.7Mlb Jason deposit1 owned by Boss Energy, before it returns to both the Berber and Chivas in early 2025, for further follow up drilling.”

Oban has a 2004 JORC resource, but nothing reported to the 2012 JORC compliance standards required currently by financial regulators.

A couple quick hits to finish off.

Venus Metals had nothing new to report today, but did announce some high grade assays from rock chip sampling at the Hilltop gold project near Mt Ida in WA this week.

VMC, a big shareholder in Youanmi gold project owner Rox Resources (ASX:RXL), says little modern exploration has been undertaken at the site since 1941 when mining was halted.

Assays of up to 50.1g/t were sourced from mullock samples along the northern line of workings covering 125m of strike, while assays from auriferous (gold-rich) quartz veins graded up to 6.4g/t.

Evion, meanwhile, copped a double win, with the Madagascan graphite hopeful announcing progress in government and community engagement for its Maniry project.

Coming the same day as Syrah Resources (ASX:SYR) calling force majeure due to protests and political instability around its Balama mine in Mozambique, Evion has secured the support of Madagascar’s mines minster to convert its exploration licences to exploitation licences, meaning it will be permitted to develop and mine the operation.

EVG says it has also reached an agreement with the local community at Maniry to support a development pathway.

At Stockhead, we tell it like it is. While Koba Resources is a Stockhead advertiser, it did not sponsor this article.