You might be interested in

News

ASX Small Caps Lunch Wrap: Local benchmark flattens out after early dip, energy stocks surge

News

Closing Bell: Sigma soars 22pc, Qantas feels heat from Qatar, and traders cash in on miners' rally

News

News

The ASX shifted from early gains to a mostly flat finish as investors turned to safer assets amid rising worries about escalating conflict in the Middle East.

Crude oil prices jumped 5% overnight, reaching their highest levels in over a year after Iran launched 200 missiles at Israel, leading to widespread sirens and residents seeking shelter. Israel has promised a strong response.

Concerns are now growing about another wave of global inflation following these attacks.

Iran controls the Strait of Hormuz, a vital route for oil shipments, handling around 20 million barrels a day, nearly 30% of the world’s oil trade.

Other significant oil-exporting nations, such as Saudi Arabia, Iraq, the UAE, Kuwait, and Qatar, depend heavily on the Strait.

Analysts from Capital Economics warned that if Iran were to block this route, oil prices could approach US$100 a barrel.

“But in any case, given the likelihood of a military response – probably led by the US – we doubt that Iran would, in practice, be able to close the strait for long,” the research firm wrote.

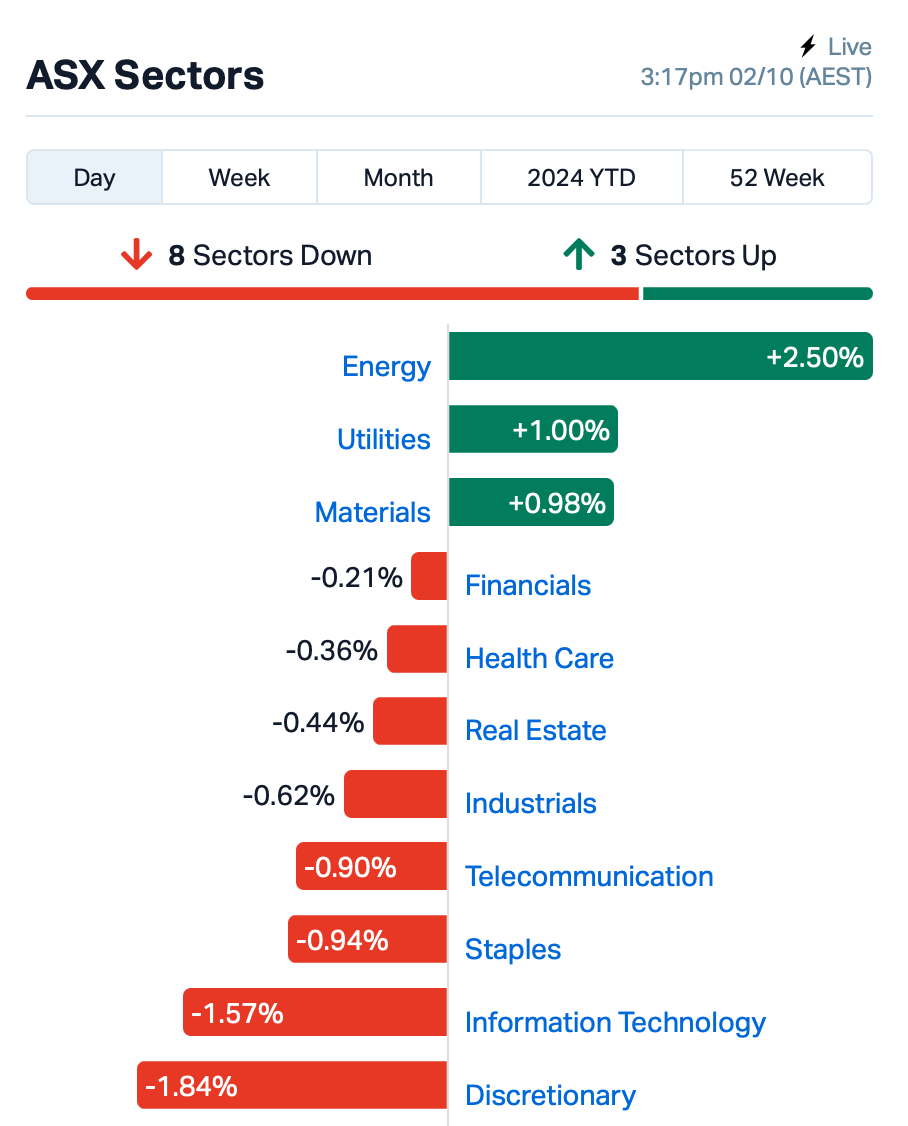

Most sectors on the ASX were down today, particularly Technology and Consumer Discretionary.

However, those losses were offset by the Energy sector, which was supercharged by the spiking oil prices.

As of the time of writing, Brent crude futures are trading around US$74.55 a barrel.

Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) led, each climbing about 3%.

Separately, Santos announced a deal with TotalEnergies Gas & Power Asia to supply liquefied natural gas (LNG). The agreement includes 20 cargoes, totalling about 0.5 million tonnes per year over three years, with the supply starting in the fourth quarter of 2025.

Elsewhere, gold mining stocks gained ground as investors flocked to safe-haven assets, while cryptocurrencies took a hit.

There wasn’t much exciting news from the ASX today, but KMD Brands (ASX:KMD), the owner of Rip Curl and Kathmandu brands, did announce that Brent Scrimshaw will be its new Group CEO.

He replaces Michael Daly, who has resigned after three and a half years. Scrimshaw has been a director since 2017 and has extensive experience in the sports footwear and apparel industry.

An index of Chinese stocks in Hong Kong jumped today 8% today, its biggest gain since November 2022, marking the 13th consecutive day of rallies.

In contrast, markets in Japan, Australia, and South Korea fell as the situation in the Middle East escalated.

The Israel Defence Forces reported many missiles were intercepted, and Prime Minister Netanyahu promised to respond.

Overall, there’s a cautious mood in global markets as traders wait for clarity on the conflict.

Meanwhile, copper prices rose, boosted by positive expectations from China’s economic measures.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HPC | The Hydration | 0.022 | 144% | 1,246,432 | $2,744,218 |

| AS2 | Askarimetalslimited | 0.036 | 64% | 4,738,617 | $2,157,543 |

| RBR | RBR Group Ltd | 0.002 | 50% | 179,603 | $1,634,405 |

| VFX | Visionflex Group Ltd | 0.006 | 50% | 2,390,499 | $11,671,298 |

| VPR | Voltgroupltd | 0.002 | 50% | 760,000 | $10,716,208 |

| RWD | Reward Minerals Ltd | 0.058 | 41% | 129,573 | $9,341,979 |

| 5EA | 5Eadvanced | 0.120 | 41% | 2,344,078 | $28,348,444 |

| DDT | DataDot Technology | 0.004 | 33% | 6,634,714 | $3,632,858 |

| H2G | Greenhy2 Limited | 0.004 | 33% | 1,567,441 | $1,794,553 |

| LU7 | Lithium Universe Ltd | 0.013 | 30% | 4,660,269 | $5,939,136 |

| KNB | Koonenberrygold | 0.014 | 27% | 1,451,028 | $3,165,662 |

| PR1 | Pureresourceslimited | 0.120 | 26% | 67,921 | $4,171,729 |

| BGE | Bridgesaaslimited | 0.025 | 25% | 149,934 | $3,186,683 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 2,674,099 | $6,338,594 |

| CR9 | Corellares | 0.010 | 25% | 471,500 | $3,720,739 |

| PUR | Pursuit Minerals | 0.003 | 25% | 20,000 | $7,270,800 |

| M4M | Macro Metals Limited | 0.026 | 24% | 13,195,448 | $76,085,245 |

| BTH | Bigtincan Hldgs Ltd | 0.195 | 22% | 6,567,530 | $131,468,149 |

| SYR | Syrah Resources | 0.310 | 22% | 9,876,223 | $263,897,400 |

| AZ9 | Asianbatterymet PLC | 0.034 | 21% | 635,351 | $8,462,020 |

| FRS | Forrestaniaresources | 0.017 | 21% | 173,542 | $2,265,000 |

| OEC | Orbital Corp Limited | 0.105 | 21% | 254,912 | $12,706,952 |

| AR3 | Austrare | 0.175 | 21% | 1,195,706 | $22,904,743 |

Hydration solutions company The Hydration Pharmaceuticals Company (ASX:HPC) is crushing it today with a triple-digit gain after announcing that it has completed the sale of its non-US assets. HPC entered into a deal to sell its intellectual property to Prestige Consumer Healthcare, which includes the rights to certain technologies. HPC received about US$9.45 million from this sale.

Askari Metals (ASX:AS2) was up after a strategic review of its Mt Maguire gold project in WA’s Pilbara identified extensive gold mineralisation over a prospective 8km strike length of untested shear zones. Historical results include high-grade intercepts of 2m at 12.14g/t gold from 35m as well as broader gold intercepts such as 31m at 0.84g/t from 20m, including 1m @ 6.74g/t from 25m.

archTIS (ASX:AR9), a global provider of data-centric security solutions for the secure collaboration of sensitive information rallied today Somewhat topical, as its share price move is based on a military/defence angle, with the company announcing the signing of a $2.3 million contract to expand NC Protect licenses with the Australian Department of Defence.

This follows on from the $700K services contract awarded in June 2024 and, says the company, establishes its NC Protect product as the data-centric security option of choice for Defence SharePoint on-premises deployments.

Reward Minerals (ASX:RWD) has finally cut a slice into Kalium Lakes’ (ASX:KLL) failed Beyondie project, purchasing the project’s sulphate of potash (SOP) plant for $2.13m, so it can take it apart and build a new facility for its Carnarvon potash project.

After announcing the deal on Monday the company surged on the release of an investor presentation this morning. RWD had previously announced intentions to purchase the Beyondie project from collapsed miner Kalium Lakes in November last year, yet in a failed attempt to raise $22.7m for the transaction those plans fell through.

Now, it’s ended up with Beyondie’s SOP plant instead for a tenth of the cost, planning to reconstitute the infrastructure from the remote inland development close to the WA coast. That compares to the astonishing $466m of sunk investment that went into the project on its opening in 2021, before operational failures across the board and substantial cost blowouts forced its closure not even a year later and Kalium Lakes went down along with close to $80m of taxpayer funding.

BPM Minerals (ASX:BPM) is continuing its run up the charts as it raises $1.675m to drive exploration efforts at its Claw project where it will focus on follow up exploration of its 30m thick Louie gold discovery that grades at 1.84g/t. The explorer’s hunting ground is just south of Capricorn Metals (ASX:CMM) 3.24Moz Mt Gibson gold project, which is on track to become one of WA’s next big gold mines. It’s also waiting on whitecoats (lab jockeys) to assay 40 AC drill holes it completed across 2129m, while gearing up for a a planned 2500m RC drill campaign that’s pegged to kick off towards the end of the year.

Digging for red metal in one of the world’s richest copper regions – Chile’s Coquimbo – surface trenching at Culpeo Minerals (ASX:CPO)’s El Quillay South prospect at its Fortuna project have turned up thick intersections of copper including a best sample of 46m at 0.9% CuEq.

There’s a bunch of world-class copper mines in the country – the largest producer in the world. Coquimbo alone, located around 400km north of the capital Santiago, boasts major mines such as the 350,000tpa Los Pelambres, owned by Antofagasta – about the same output as BHP’s (ASX:BHP) entire South Australian copper division. The El Quillay structure has now been mapped over a strike length of >3km, with historic sampling returning copper mineralisation with widths of up to 43.1m at 1% copper and 1.31g/t gold.

Trigg Minerals (ASX:TMG) has triggered targets for drilling across the historical Taylors Arm antimony (Sb) project – which is known for the highest grades of the stuff ever discovered in Australia (63% Sb) and is in the vicinity of Larvotto Resources’ (ASX:LRV) well-known Hillgrove antimony deposit.

The company has gained a lot of interest over its recent antimony acquisitions across the Taylors Arm portfolio and the nearby Spartan project in NSW. That’s because antimony is in high demand after becoming another victim of China’s export restriction roulette and forcing the rest of the globe to shore up supply chains of the stuff elsewhere.

Usually produced as a by-product, prices of the material used in high tech applications are now pushing past the US$25,000/t mark, allowing miners to now consider antimony as a primary source of income from a projects. That’s exactly what TMG is looking at doing with its acquisitions and has just generated additional targets to 71 historically producing ultra-high grade antimony workings and mines. The explorer is now going over all the data with a fine-toothed comb to generate high-priority targets.

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CNJ | Conico Ltd | 0.001 | -50% | 29,045,000 | $4,403,055 |

| PAB | Patrys Limited | 0.003 | -50% | 23,677,411 | $12,344,684 |

| PLG | Pearlgullironlimited | 0.012 | -40% | 139,159 | $4,090,836 |

| LPD | Lepidico Ltd | 0.002 | -33% | 2,565,244 | $25,767,375 |

| ATH | Alterity Therap Ltd | 0.003 | -25% | 2,674,690 | $21,281,344 |

| TIG | Tigers Realm Coal | 0.003 | -25% | 8,930,590 | $52,266,809 |

| VRC | Volt Resources Ltd | 0.003 | -25% | 2,251,123 | $16,634,713 |

| KFM | Kingfisher Mining | 0.074 | -22% | 692,849 | $5,102,925 |

| CC9 | Chariot Corporation | 0.120 | -20% | 3,341 | $13,444,179 |

| NAE | New Age Exploration | 0.004 | -20% | 2,040,000 | $8,969,495 |

| FFG | Fatfish Group | 0.009 | -18% | 100,873 | $15,472,303 |

| GLA | Gladiator Resources | 0.014 | -18% | 127,500 | $12,891,046 |

| RIL | Redivium Limited | 0.005 | -17% | 5,930,373 | $16,481,129 |

| NYR | Nyrada Inc. | 0.088 | -16% | 2,882,838 | $19,131,913 |

| FTZ | Fertoz Ltd | 0.026 | -16% | 60,000 | $9,190,276 |

| AVM | Advance Metals Ltd | 0.021 | -16% | 10,000 | $4,212,479 |

| IBX | Imagion Biosys Ltd | 0.046 | -15% | 1,043,656 | $1,924,914 |

| AHK | Ark Mines Limited | 0.150 | -14% | 83,849 | $9,703,122 |

| G88 | Golden Mile Res Ltd | 0.012 | -14% | 849,643 | $5,757,120 |

| MNB | Minbos Resources Ltd | 0.050 | -14% | 10,116,152 | $50,960,103 |

| ASO | Aston Minerals Ltd | 0.013 | -13% | 1,379,662 | $19,425,964 |

| AAU | Antilles Gold Ltd | 0.004 | -13% | 1,903,072 | $7,422,971 |

Shares in antibody drug developer Patrys (ASX:PAB) lost half their value after the company cancelled its lead drug program PAT-DX1 as a result of manufacturing “challenges”.

The company said while the drug material met manufacturing standards, it did so with a lower margin than previously and thus was deemed unsafe to use in human trials.

The company adds that given its experience with “potential product deterioration” when PAT-DX1 is stored long term, “the risk of potential safety issues from using this batch of PAT-DX1 is not acceptable.”

Future Battery Minerals (ASX:FBM) has wrapped up an initial soil sampling program at its Miriam lithium project in WA, with assays expected later this month. Exploration efforts are continuing across the company’s newly staked ground in WA’s Goldfields for both lithium and gold mineralisation. FBM has submitted an exploration incentive scheme application and a program of work for an initial Miriam drill program, aimed to commence in H1 next year.

Argent Minerals (ASX:ARD) has reported high-grade surface rock chips from a sampling program carried out at its Trunkey Creek gold project in NSW. The best of the lot was 24 g/t gold, further confirming surface gold mineralisation. Managing director Pedro Kastellorizos said the latest results, combined with old mine workings, bolster the “significant exploration potential” of the project area. Six high-priority IP targets have been defined and are ready to drill, with almost no modern drilling having taken place.

Over in Chile, Culpeo Minerals (ASX:CPO) has returned thick surface mineralisation from an outcropping copper-gold system at its Fortuna project. Highlights from the phase 1 trenching program included 46 metres at 0.90% copper equivalent Trenching is ongoing at El Quillay South to define targets and extend mineralisation, which is open to the south.

Trigg Minerals (ASX:TMG) is wasting no time in the wake of China’s export restrictions after acquiring two ultra high grade antimony projects in NSW, identifying high-priority targets at its Taylor Arms project. The company conducted a high-resolution satellite imagery analysis over the project, adding to the 71 historically producing ultrahigh-grade antimony workings and mines in the portfolio. Trigg is concentrating on massive stibnite outcrops and is well-funded for the maiden exploration program.

In a bid to emulate recent successes at Medenovac, Strickland Metals (ASX:STK) is shifting its focus to another prospect, Gradina, moving drill rigs and kickstarting a 10,000m diamond drill campaign. Both prospects are outside the project’s now 5.4 Moz gold equivalent resource, with the company well-funded to continue spinning the rigs ahead of a mineral resource update. Four rigs are active across Rogozna at the moment, with assays pending on multiple holes.

Brightstar Resources (ASX:BTR) has completed the acquisition of the gold rights at the Montague East Gold project (MEGP) from Gateway Mining (ASX:GML), in a move that has bumped up its group resources to a massive 2 Moz. That’s in addition to Brightstar acquiring Alto Metals to consolidate the Sandstone district, which is set to push Brightstar’s resources towards and beyond 3 Moz Au. The company says the strategic addition of shallow ounces aligns with its strategy of commercialising multiple assets in the near term.

Western Yilgarn (ASX:WYX) is putting its foot on the pedal, fast-tracking exploration activities at its Ida Holmes Junction (IHJ) project following encouraging EM results. The company is buoyed by results at the IHJ prospect and anomalous copper-PGE results at the Hells Gate prospect. WYX will now look to complete a 6-9 hole RC drilling program aimed at testing the IHJ coordinator, along with plenty of other drilling.

Pan Asia Metals (ASX:PAM) has entered into two binding option agreements to purchase the Tama Atacama lithium project from the Rajo Partnership back in December 2023, with each option agreement had an annual option payment of US$100,000 in cash. PAM has now advised that Rajo Partnership has agreed to adjust the annual option payments to 50% in cash and 50% in shares, at PAM’s election. The company has agreed to pay the first 50% of each option in shares at A$0.06 per share.

“This is a good outcome for the company and the vendors, strengthening our relationship as lithium producers start to realise that brine projects will survive the lithium price cycles as they are the lowest cost source of lithium, and that Chile produces the lowest cost lithium globally,” managing director Paul Lock said.

“The adjustment to the option payment terms allows PAM to deploy its cash resources into exploration and development.”

Tama Atacama is one of the most strategically placed pre-drill lithium projects in South America, in an infrastructure rich environment, only 75km from two major ports and on rail and road to Antofagasta, an emerging lithium chemical manufacturing hub.

The project is also situated in highly active mining regions at ~1,000m altitude, which is 1,300m lower than Salar de Atacama, where the lowest cost lithium is currently produced.

Next steps for the company include geophysics and drilling, targeting the areas that are interpreted to be prospective to intersect lithium brines.

Australian Pacific Coal (ASX:AQC) – Proposed cap raising

Frontier Energy (ASX:FHE) – Discussions regarding tranche two of placement

Live Verdure (ASX:LV1) – Proposed cap raising

At Stockhead, we tell it like it is. While Pan Asia Metals, Future Battery Minerals, Argent Minerals, Culpeo Minerals, Trigg Minerals, Strickland Metals, and Brightstar Resources, and Western Yilgarn is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.