Closing Bell: Local markets accelerate after passing an RBA again on hold

News

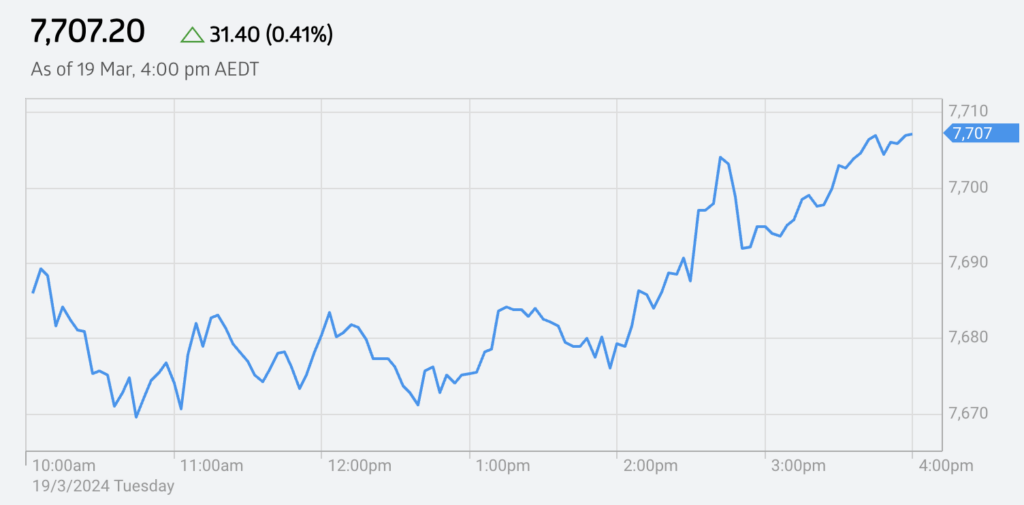

The ASX has ended Tuesday higher after the Reserve Bank of Australia kept rates on hold for another month.

At 4.15 pm on Tuesday, the S&P/ASX200 closed higher, up 27 points or 0.36%.

With the wait for more of the same on rates from the RBA done with, traders waded back into the local markets on Tuesday arvo.

The Reserve Bank governor Michele Bullock and her rates team kept the cash rate at 4.35%, insisting that the board won’t be ruling anything in or out over the months ahead.

This week’s smorgasbord of central banking decisions is far from over, with the US Fed and the Brits at the BoE on the collar as well.

Once the central bank decision dropped, the Aussie dollar fell, and then held at around US65.20c

The other market driver was iron ore prices, which had collapsed into a seven-month low of US$98 a tonne on Friday, but have since recovered about 6% in Singapore.

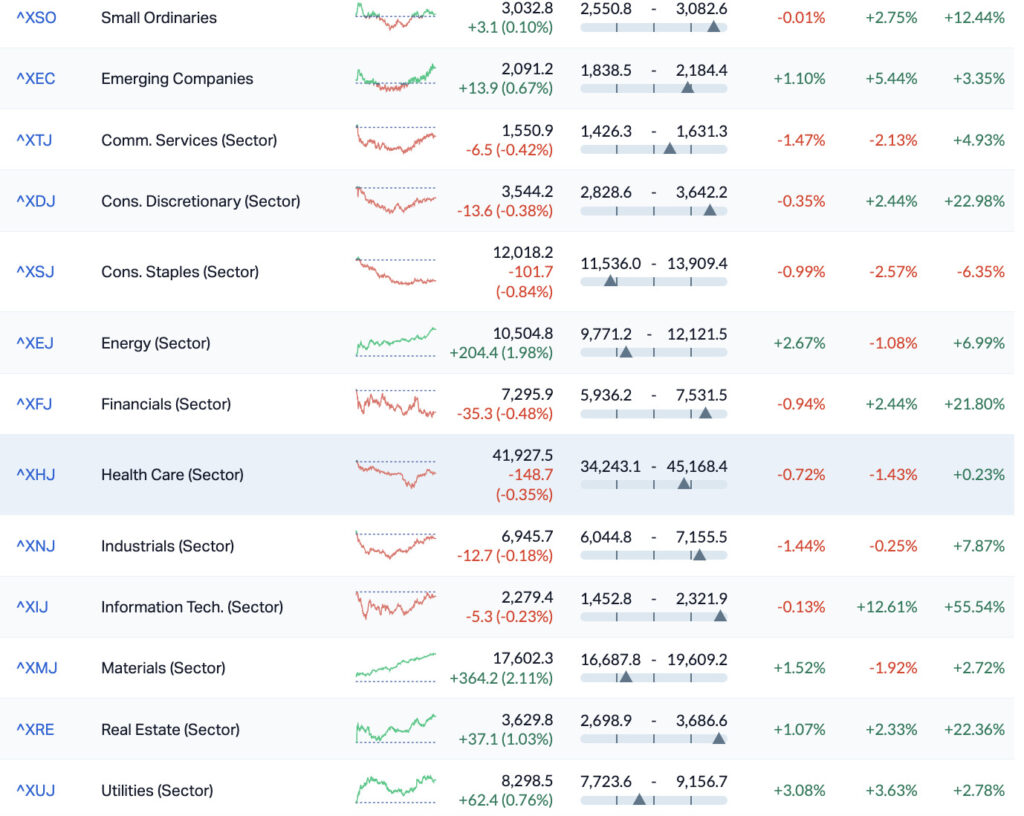

Of the 11 ASX sectors, Materials led the gains, up over 2.1%.

Although seven sectors ended lower, resources, Property and Utilities all moved strongly ahead by the close.

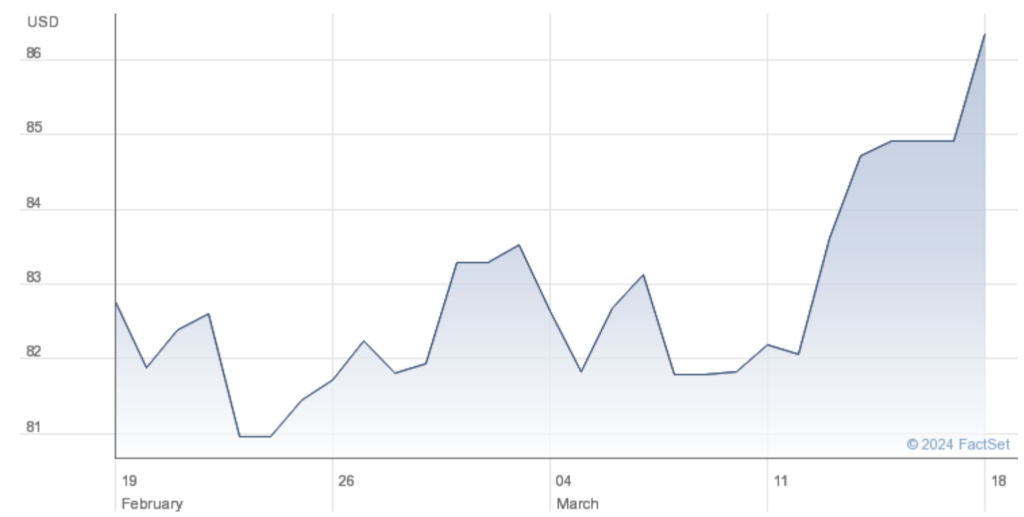

Brent Crude is a little lower on Tuesday, while WTI crude futures have settled above US$82 on Tuesday.

Oil prices are hanging out, looking relaxed at their highest levels since last November.

It’s been a lovely month so far for fans of expensive petrol.

We’ve been over this, but hey – with Kiev lobbing drones at major Russian oil refineries (and big ones too, circa 10% of Russia’s total processing capacity) the jitters are in for oil analysts.

Across into the Middle East, Iraq is cutting crude exports, reportedly because Tehran’s been overshooting its OPEC+ quota since Christmas.

Next door the House of Saud has culled crude exports for a second month but perhaps it’s the promising rebound in China’s industrial production and retail sales that signals the return to form of the world’s biggest importer.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| OSX | Osteopore Limited - Rights 22-Mar-24 Def | 0.015 | 114% | 485,270 | $723,008 |

| ICU | Investor Centre Ltd | 0.023 | 64% | 2,358,318 | $4,244,773 |

| UBI | Universal Biosensors | 0.245 | 53% | 24,827,596 | $33,979,110 |

| CCZ | Castillo Copper Ltd | 0.006 | 50% | 3,950,620 | $5,198,021 |

| GCM | Green Critical Min | 0.006 | 50% | 186,609 | $4,546,340 |

| NGY | Nuenergy Gas Ltd | 0.031 | 41% | 4,754 | $32,581,021 |

| SHO | Sportshero Ltd | 0.014 | 40% | 616,945 | $6,178,328 |

| YAR | Yari Minerals Ltd | 0.007 | 40% | 324,246 | $2,411,789 |

| BYH | Bryah Resources Ltd | 0.011 | 38% | 8,617,954 | $3,483,628 |

| MAG | Magmatic Resrce Ltd | 0.09 | 36% | 1,779,019 | $25,188,171 |

| ZNO | Zoono Group Ltd | 0.07 | 35% | 1,519,138 | $11,111,224 |

| AUK | Aumake Limited | 0.004 | 33% | 248,000 | $5,743,220 |

| MEL | Metgasco Ltd | 0.008 | 33% | 944,347 | $6,383,320 |

| TGN | Tungsten Min NL | 0.085 | 33% | 634,106 | $50,330,513 |

| AL8 | Alderan Resource Ltd | 0.005 | 25% | 240,000 | $4,427,445 |

| KOR | Korab Resources | 0.01 | 25% | 173,000 | $2,936,400 |

| MCT | Metalicity Limited | 0.0025 | 25% | 6,003,624 | $8,970,108 |

| NVQ | Noviqtech Limited | 0.005 | 25% | 1,895,041 | $5,937,781 |

| TMR | Tempus Resources Ltd | 0.005 | 25% | 1,867,499 | $2,923,995 |

| YOJ | Yojee Limited | 0.055 | 25% | 492,623 | $11,076,989 |

| FLX | Felix Group | 0.18 | 24% | 35,000 | $29,652,458 |

| HXG | Hexagon Energy | 0.027 | 23% | 5,554,239 | $11,284,150 |

| ICE | Icetana Limited | 0.033 | 22% | 271,433 | $7,144,968 |

| AXN | Alliance Nickel Ltd | 0.04 | 21% | 292,711 | $23,952,707 |

| SCL | Schrole Group Ltd | 0.2 | 21% | 577,645 | $5,932,583 |

The headline act on Tuesday was from local telco and cloud gaming outfit Pentanet (ASX:5GG) ,which doubled down on its landmark partnership with artificial intelligence beauty queen Nvidia (NVDA) after soaring on Friday when it extended to New Zealand the relationship with the world’s fourth-largest company.

On Friday Pentanet jumped 80% on that announcement and this morning the Perth-based scale-up revealed further details of NVDA’s role in the company’s infrastructure model and cloud gaming tech – GeForce NOW (GFN).

Pentanet’s been working with US AI-darling Nvidia to upgrade its Gen 3 cloud infrastructure with NVDA’s L40 GPUs, to bring Pentanet into the NVIDIA Graphics Delivery Network (GDN).

The GDN’s already available in some 130 countries and 5GG says it taps directly into Nvidia’s global cloud-to-edge streaming infrastructure “to deliver smooth, high-fidelity, interactive experiences.”

According to Pentanet’s MD, Stephen Cornish, becoming part of NVIDIA GDN will help expand 5GG’s compute capabilities beyond just GeForce NOW cloud gaming (GFN) and enable it to “take advantage of additional industrial and commercial opportunities with its NVIDIA cloud infrastructure.”

GFN reportedly sidesteps the usual expensive gaming hardware helping gamers to use supported titles in the cloud, streaming gameplay directly from the company’s RTX Blade Servers.

“Joining the NVIDIA global Graphics Delivery Network will open a pathway to new commercial opportunities beyond gaming. The L40 GPU infrastructure brings the most advanced NVIDIA RTX capabilities to help power next-generation graphics and 3D interactive experiences.”

Also well ahead is the Tanzanian-focused graphite developer Black Rock Mining (ASX:BKT), which has confirmed it now has the key approvals in place for the US$153m in debt facilities required to develop the Mahenge Graphite Project.

BKT says it’s received the key approvals for US$40m in facilities from Tanzanian lender CRDB, comprising a US$20m working capital facility and a US$20m cost overrun facility.

“Several other Tanzanian lenders have also expressed interest in participating in these facilities but are yet to receive credit approval and discussions are ongoing,” the company says.

“Ultimately, funding for the Project to reach production will require both debt and equity.”

According to a September 4th BKT announcement, Black Rock signed an MOU with its Strategic Alliance Partner, POSCO International Corporation (POSCO) for a potential cornerstone equity position in Black Rock of up to US$40m and final approvals for this investment are expected near term.

The company is targeting first production from Module 1 in 2026.

Keeping the nearologists honest is Magmatic Resources (ASX:MAG).

The share price is up over 30% on Tuesday with enthusiasm around news the company’s exploration plans are about to kick off at its 100%-owned Wellington North project, right next door to Alkane Resources’ (ASX:ALK) 15.7Moz Au-equivalent Boda-Kaiser discovery in NSW’s Lachlan Fold.

It was the discovery of Boda in 2019 — also in the same neighbourhood as Newcrest Mining’s (ASX:NCM) mammoth 50moz Cadia operations — which lit a fire underneath a bunch of nearologists like MAG.

Pay a visit to Stockhead’s Father of the Month, Reuben With Resources Adams, for more on MAG, BKT and any other ASX resources troublemakers on Tuesday.

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RWD | Reward Minerals Ltd | 0.03 | -40% | 2,155,361 | $11,392,657 |

| SIH | Sihayo Gold Limited | 0.001 | -33% | 55,000 | $18,306,384 |

| SIT | Site Group Int Ltd | 0.002 | -33% | 900,000 | $7,807,471 |

| OLH | Oldfields Holdings | 0.08 | -27% | 138,712 | $21,973,154 |

| ADX | ADX Energy Ltd | 0.18 | -22% | 26,059,560 | $98,631,612 |

| BEO | Beonic Ltd | 0.02 | -20% | 160,022 | $10,612,374 |

| ECT | Env Clean Tech Ltd. | 0.004 | -20% | 39,498 | $14,321,552 |

| ESR | Estrella Res Ltd | 0.004 | -20% | 49,002 | $8,796,859 |

| KPO | Kalina Power Limited | 0.004 | -20% | 10,471,469 | $11,050,640 |

| SGC | Sacgasco Ltd | 0.008 | -20% | 310,824 | $7,796,871 |

| ABE | Ausbondexchange | 0.021 | -19% | 144,977 | $2,929,371 |

| NIM | Nimyresourceslimited | 0.055 | -18% | 319,762 | $9,408,382 |

| KAM | K2 Asset Mgmt Hldgs | 0.05 | -17% | 27,780 | $14,465,112 |

| 88E | 88 Energy Ltd | 0.005 | -17% | 37,672,590 | $150,744,375 |

| BLZ | Blaze Minerals Ltd | 0.005 | -17% | 260,222 | $3,771,349 |

| GTI | Gratifii | 0.005 | -17% | 171,141 | $8,215,336 |

| LPD | Lepidico Ltd | 0.005 | -17% | 3,950,248 | $45,829,848 |

| MEM | Memphasys Ltd | 0.01 | -17% | 3,802,295 | $16,412,907 |

| MOM | Moab Minerals Ltd | 0.005 | -17% | 258,922 | $4,271,781 |

| MTB | Mount Burgess Mining | 0.0025 | -17% | 3,338,340 | $3,134,440 |

| OLL | Openlearning | 0.02 | -17% | 59,311 | $6,428,858 |

| SNS | Sensen Networks Ltd | 0.02 | -17% | 700,893 | $18,563,412 |

| LYK | Lykosmetalslimited | 0.027 | -16% | 20,000 | $6,027,378 |

| AYT | Austin Metals Ltd | 0.006 | -14% | 3,000,000 | $8,996,339 |

| CDT | Castle Minerals | 0.006 | -14% | 636,779 | $8,571,451 |

LTR Pharma (ASX:LTP) has begun the dosing phase in its pivotal bioequivalence clinical study of SPONTAN nasal spray to treat erectile dysfunction.

Galan Lithium (ASX:GLN) is making steady progress in advancing its low-cost, high-grade Hombre Muerto West lithium project in Argentina, with Pond 2 now being filled as part of the company’s 5,400tpa lithium carbonate equivalent (LCE) Phase 1 target.

A complimentary IP geophysical survey on Mako Gold’s (ASX:MKG) Ouangolodougou permit at its Korhogo project in Côte d’Ivoire has identified subsurface manganese bands for future drilling.

Victory Metals (ASX:VTM) has used low-cost physical screening to upgrade the regolith-clay grades by an average 63% at its North Stanmore project near Cue in Western Australia.

Miramar Resources (ASX:M2R) has outlined multiple drill targets with similarities to the giant Norilsk nickel-copper-cobalt-PGE deposits at its Mount Vernon and Trouble Bore projects in WA’s Gascoyne region.

Indiana Resources (ASX:IDA) successfully produced a 4.2% TREO concentrate from beneficiation test work of select clay-hosted rare earth samples at its Minos project in South Australia.

And Elevate Uranium (ASX:EL8) is on track to update the inferred resource for its Koppies project in Namibia early next month following completion of the latest round of drilling and ahead of beginning a scoping study later this year.

At Stockhead, we tell it like it is. While Elevate Uranium, Galan Lithium, Indiana Resources, LTR Pharma Mako Gold, Miramar Resources and Victory Metals are Stockhead advertisers, they did not sponsor this article.