Mooners and Shakers: Finally, Bitcoin did something… while SpaceX reportedly sells off its BTC and August turns red

Coinhead

Coinhead

Yes, at last. Bitcoin did something. It, um, tanked more than 11%, tumbling below US$26k as August turns a distinct shade of red amid news that SpaceX has (apparently) sold off a large amount of BTC.

Bitcoin hit lows, earlier, not seen since June 20, dipping briefly below a $500 billion market cap.

Any good news? Yep, it’s no longer boring for the moment. Any gooder-er news? Bitcoin and the market have stemmed the bleeding somewhat since an early-hours bloodbath.

But you want the bad news contextualised, right? Jeez, you want it all on a plate, don’t you.

Okay, here goes… it’s the crappy macro, innit. The crapro-economic climate, largely stemming from the great storytellers of our time – China and the US. It’s inflation, it’s the hawkish Fed, it’s rising interest rates… it’s, it’s… Mabo… the vibe.

It’s also a few other very specicfically crypto-related things, too, mind. Which we’ll get to in a sec.

But first, our very own non-fungible Eddy Sunarto summed it up much better than we just did in his morning Market Highlights roundup, when he wrote:

Overnight, the S&P 500 tumbled further by -0.77%, blue chip Dow Jones by -0.84%, and tech heavy Nasdaq by -1.17%.

Sentiment has been hammered in recent days as a spate of bad news from China and the prospect of more Fed hikes have derailed the year’s rally.

Meanwhile, “Americans react” in soppy, eyelash-drooping fashion to this reasonably-well-expressed sentiment about the sh*tty US dollar from their country’s answer to Jonny Bairstow, which should’ve already been bleedingly obvious to most, if not all of them for quite some time now.

https://twitter.com/Pap1Yolo/status/1692194231509483979

“Damn, bro. Truth. He speaks truth.” (Thumps heart, closes eyes, tilts head and nods slowly with solemn meaning for the camera. – Three takes… got it.)

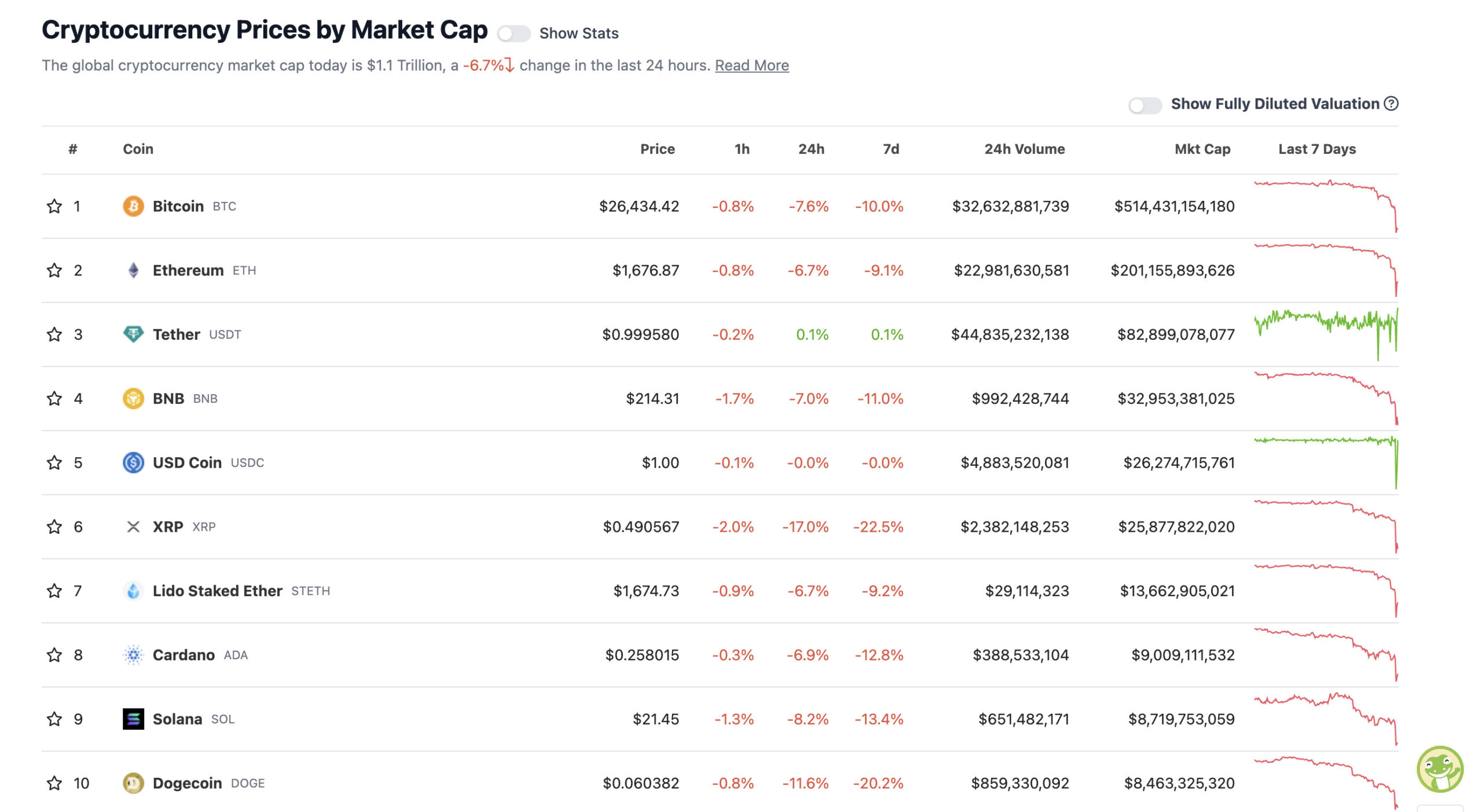

With the overall crypto market cap at US$1.11 trillion, down 6.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Well then, about a quarter of Australia is cursing as they check in on their crypto portfiolios today, with a sea of red across the magic internet money market.

Bitcoin and Ethereum led the losses, but then the altcoins took that ball and really ran hard with it up the sideline… unfortunately just in the opposite direction from the correct tryline.

XRP, in particular, had a shocker overnight, continuing some recent bad form. There’s a reason for this, and it’s because the SEC’s Gary Gensler is rubbing his hands together and cackling like the Wicked Witch from the West (aka Elizabeth Warren).

It’s been reported that a judge has granted the SEC approval to file an appeal in the Ripple/XRP case, that recently saw a favourable outcome for Ripple.

That ruling decreed that XRP is not a security, therefore letting Ripple off the hook from SEC claims that XRP was sold to investors as an unregistered security product.

The appeal approval seems like a blow to Ripple, but here’s another take and clarification:

#XRPCommunity #SECGov v. #Ripple #XRP The Court has set a briefing schedule for the SEC’s request to file a Motion for Leave to File an Interlocutory Appeal. This does not mean an interlocutory appeal has been authorized. It just means the SEC is allowed to request it. pic.twitter.com/vjsUSJELU6

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) August 17, 2023

Meanwhile, Dogecoin is also slumping big time. We think we know why. Elon. Musk.

It’s been revealed SpaceX, you see, has “written down the value” of its BTC holdings. According to a report in The Wall Street Journal, SpaceX recorded US$373 million worth of Bitcoin holdings on its balance sheet in 2021 and 2022 but has since written down its value and has supposedly sold out of a large part of its position in the asset.

However, as Watcher.Guru notes here, full confirmation on whether the entire $373 million worth of the asset was sold is still up in the air.

We are unable to confirm reports that SpaceX sold $373 Million worth of #Bitcoin

The report by WSJ is unclear and states, "SpaceX wrote down the value of #Bitcoin it owns by a total of $373 million last year and in 2021 and has sold the cryptocurrency."

As of now, there is no… pic.twitter.com/75EcdLzBzS

— Watcher.Guru (@WatcherGuru) August 17, 2023

Why’s this affected Dogecoin? Only because the price of DOGE appears to correlate pretty much directly to everything Musk does or says – positive or negative. That’s just the way it rolls. Stoopid? Yep.

Josh Gilbert, Market analyst over at eToro, told us this, via an emailed note:

“Whenever you have a big name in the industry selling bitcoin, especially someone as influential as Elon Musk, it will put the price under pressure.

“Arguably, Elon Musk has one of the most influential voices in the world, and when he makes moves in crypto, the market moves accordingly.”

With that in mind, keep half an eye on DOGE, because the bloke (Musk, not Gilbert) owns Twitter/X and is turning the thing into a payments/everything app, remember?

For some further context about today’s crypto dippage, we thought we’d quickly cut and paste some choice insights and analysis sent to us by Caroline Bowler’s people over at BTC Markets – one of Australia’s best crypto exchanges. (Not sponsored – it just is.)

Here you are:

“In the past 24-hour period, the cryptocurrency market, has seen an unprecedented sell off considering the low volatility and market consolidation of the past few weeks.

“This type of negative price action is usually attributed to major market events such as was seen in the FTX sell off in November of last year that saw the market lose 14% in a single day.

“Similarly, an instance earlier in 2022 involving the Luna de-peg also demonstrated the potency of such market forces.

“In the absence of major market news, we looked at the total liquidations on Coinglass, a prominent platform specialising in cryptocurrency futures trading and data dissemination.

“They reported a staggering 175,000 traders have been liquidated within the past 24-hours, totalling losses of US$1.05 billion.

“Of note, is a single liquidation order on Binance on the ETHBUSD trading pair, costing an eye-watering US$55.92 million.”

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$547 million) +9%

• FLEX Coin (FLEX), (market cap: US$668 million) +8%

SLUMPERS (11-100 market cap position)

• ApeCoin (APE), (market cap: US$553 million) -16%

• Litecoin (LTC), (market cap: US$4.72 billion) -15%

• Bitcoin Cash (BCH), (market cap: US$3.49 billion) -14%

• Aptos (APT), (market cap: US$1.24 billion) -12%

• Shiba inu (SHIB), (market cap: US$4.78 billion) -11%

Shiba Inu is copping flak/FUD from sections of the cryptoverse after launching its “Shibarium” blockchain, with reports that more than $1.7m worth of ETH has been stuck in the bridging process over to the new chain.

BREAKING:

More than $1.7M worth of ETH stuck in the Shibarium bridge

— WhaleFUD (@WhaleFUD) August 17, 2023

POV: you bridged your ETH to Shibariumhttps://t.co/YZcxKqzznp

— LilMoonLambo (@LilMoonLambo) August 17, 2023

If a ‘meme’ coin was going to launch their own L2, then really… they would need to do something incredibly memeable

Like getting $1.7 mil dollars stuck in their bridge and likely unrecoverable

More evidence nobody knows what they’re doing

Keep up the good work #Shibarium pic.twitter.com/uoMgqXCBBw

— Stabletoshi Neighkamoto 🐎💨 (@sneighkamoto) August 17, 2023

Here’s the more hopeful angle from “Shib Dream”… which obviously has a vested interest…

Do I think #SHIBARIUM is being worked on? Yes

Do I think that a lot of FUD was caused by this? YES

Do I think the $SHIB Developers and the team at @UnificationUND will have all working exactly as promised? Absolutely 100%.

Like I said, I believe in what is being built and as I… pic.twitter.com/0qT9Sy7s0N

— Shib Dream * Shib Army News * Shib Army Social 💎 (@theshibdream) August 17, 2023

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Why is everyone so stressed here?

Bitcoin looks great. pic.twitter.com/bTjtN7LHsw

— K A L E O (@CryptoKaleo) August 17, 2023

Well, at least we're not going sideways anymore.

Time to buy some more Crypto.

— Ben Simpson (@bensimpsonau) August 17, 2023

(Ahem, not financial advice there.)

NEW: 🇦🇷 Pro-#Bitcoin Argentine Presidential candidate Javier Milei vows to shut down the country's central bank if he wins.

He says it has “no reason to exist.” pic.twitter.com/CBYLVmpXtD

— Bitcoin Magazine (@BitcoinMagazine) August 16, 2023