Mooners and Shakers: EU moves ahead with crypto regulations; Ledger under fire; Bitcoin flat

Coinhead

Coinhead

Bitcoin is trading flat this morning (AEST) as traders and investors bite fingernails as they ponder what the hell the US debt ceiling issue might mean for their portfolios. Meanwhile, the EU is pushing ahead with its clear crypto regulations legislation.

Known as MiCA (Markets in Crypto-Assets regulation), the proposed set of rules has been widely well received by the global crypto community. And that’s because it is at least a very strong attempt to provide absolute clarity for crypto businesses across the 27 European Union member countries.

The MiCA regulation was passed unanimously overnight (AEST) by the Economic and Financial Affairs Council of the European Union — comprising finance ministers of all member states.

The legislation includes strict guidelines but at least companies will know where they stand, unlike in the good ol’ US of Eh?… where the SEC regulator in particular seems to rely on a an enforcement-first narrative based on a set of guidelines made in the 1930s that are virtually impossible for crypto companies to meet for compliance.

🚨BREAKING🚨

The European Union's crypto regulation (MiCA) just passed.

Regulators did their jobs & created clear rules? Who knew that was possible? pic.twitter.com/7yPTNi56Nk

— Bankless (@BanklessHQ) May 16, 2023

In emailed notes about the EU news, shared with Stockhead this morning, Ilya Volkov, CEO and founder of web3 fintech YouHodler noted:

“We can only welcome this step in the development of the European regulatory framework. The crypto market operates globally, but is still regulated locally. Implementation of this kind of regulation is applicable not just for single countries but for the entire union. [It] fills the gap between the tech progress and formal rules at the state levels.

“MiCA can serve as an example for other regions to work harder on their own regulation development. Moving forward, it’s essential to adopt smart regulation at a global level or at least at an inter-regional level.

“I’m also confident that MiCA will help facilitate the incorporation of crypto in financial services.”

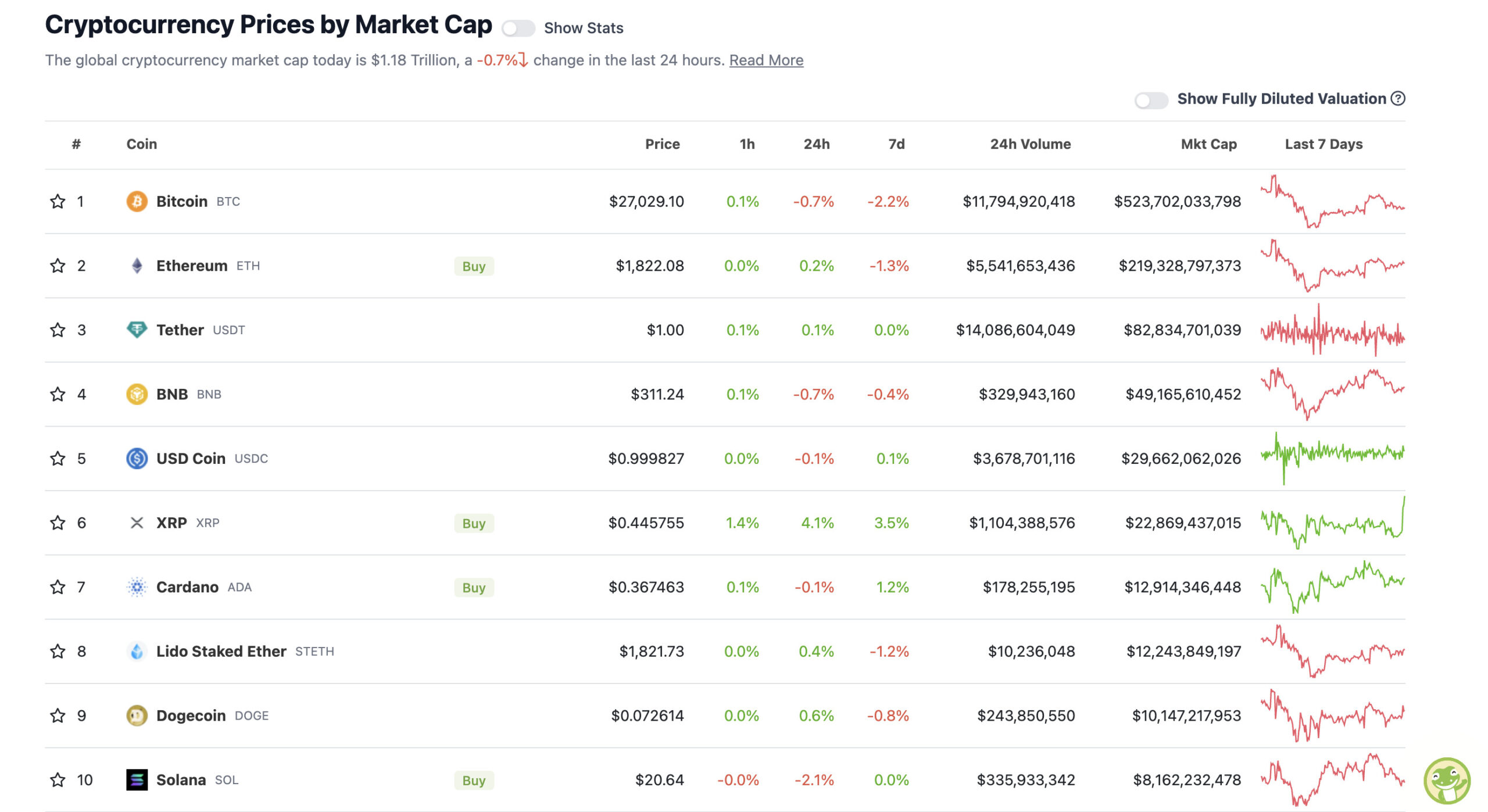

With the overall crypto market cap at US$1.18 trillion, down about 0.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

XRP is up 4.1% at the time of writing. And that’s likely because the asset’s founding firm Ripple has had a slight win in its frustratingly ongoing stoush with the SEC that attempts to quash, in court, the regulator’s claim that XRP was illegally sold as as an unregistered security at its original sale to investors.

https://twitter.com/WhaleWire/status/1658590960832466944

Ripple considers what’s known as “the Hinman speech” to be a key piece of evidence in its legal battle with the SEC. The agency, meanwhile, has failed in its attempt to suppress documents and internal emails related to the speech of former SEC director William Hinman made four years ago, in which he classified both Bitcoin and (more crucially) Ethereum as not being securities.

Other than this, on an absolute surface level, there’s not much to talk about regarding the crypto majors today, although at least Bitcoin and Ethereum seem to be holding their respective lines for now.

Sigh, #Bitcoin is again chopperino.

Rejects at first resistance point, has a must-hold zone between $26,800-27,000.

If that's lost, we'll probably cascade towards <$26,000 for a potential bullish divergence.

Holding here would be good, needs to break $27,500 then. pic.twitter.com/rjtDplSI0Q

— Michaël van de Poppe (@CryptoMichNL) May 16, 2023

We’ve been noticing some of the blockchain analytics firms posting potentially bullish metrics for Bitcoin just lately, however, so we might delve into some of those in a separate post.

The Recovering from a #Bitcoin Bear signal combines 8-metrics, across 4x areas of interest:

✅ Market trading above key price models?

✅ An uptick in on-chain activity?

✅ Is the market realizing in profits?

✅ Do HODLers dominate the supply?📊 https://t.co/cz2mpuwGcg https://t.co/yMjpy23QAg pic.twitter.com/QpDlv4o39m

— glassnode (@glassnode) May 16, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Conflux (CFX), (market cap: US$653 billion) +8%

• Render (RNDR), (market cap: US$702 million) +7%

• Lido DAO (LDO), (market cap: US$1.95 billion) +5%

• The Sandbox (SAND), (market cap: US$966 million) +4%

• Decentraland (MANA), (market cap: US$887 million) +4%

PUMPERS (lower, lower caps)

• Rollbit Coin (RBT), (market cap: US$96 million) +29%

• Ben (BEN), (market cap: US$32 million) +29%

• Dejitaru Tsuka (TSUKA), (market cap: US$44 million) +29%

SLUMPERS

• Pepe (PEPE), (market cap: US$690 million) -9%

• Kava (KAVA), (mc: US$481 million) -8%

• Flare (FLR), (mc: US$414 million) -4%

SLUMPERS (lower, lower caps)

• Milady Meme Coin (LADYS), (market cap: US$86 million) -39%

• Bob Token (BOB), (mc: US$33 million) -22%

• Wojak (WOJAK), (mc: US$19 million) -17%

• Turbo (TURBO), (mc: US$41 million) -14%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Ledger, the maker of widely used hardware wallets Ledger Nano S and Ledger Nano X, is under fire across the cryptosphere today.

And that’s because it’s announced it’s introducing a new security feature called “Ledger Recover”, for recovering lost seed phrases. According to most hardware wallet users, because this requires giving away the information that provides access to the wallet, it goes completely against the grain of self-custody and the privacy that’s required to keep digital assets completely safe from potential third-party access.

It’s created a right kerfuffle, but some misunderstanding, too, however, as this feature is purely optional. Ledger has no ability to gain access to the seed phrases of existing users who don’t opt in to this new “service”.

Nevertheless, the announced feature has upset many within the crypto community…

looks like @Ledger is the main character of CT today

DO NOT UNDER ANY CIRCUMSTANCES ENABLE THEIR SOCIAL KEY SHARING

It's not immediately urgent, but very important, that you migrate high-value and/or cold funds away from Ledger permanently.

what a fkn shambles

— notsofast (@notsofast) May 16, 2023

Looks like @ledger wants to transform into the "bank of tomorrow".

If you're unsure about the consequences, read this thread to understand why. 🧵👇🏻

(1/10) pic.twitter.com/uFbUuKrXRW

— Phil (@web3_Phil) May 16, 2023

reminder that several years ago, Ledger leaked the name and home addresses for all of their customers via a data breach

the absolute last thing you want on their servers is your private key https://t.co/z89xxLS6ie

— DCinvestor (@iamDCinvestor) May 16, 2023