Mooners and Shakers: Long liquidations send Bitcoin plummeting, but ‘crucial levels remain intact’

Coinhead

Coinhead

Reckon volatility has returned to the crypto market, much? The past few days for Bitcoin and pals have been more up and down than a game of Sonic the Hedgehog.

But don’t take our word for it, here’s a CoinGecko chart, showing Bitcoin’s action so far this week…

That latest sharp drop happened overnight, and very suddenly as BTC shed about US$700 in a matter of minutes and has been reeling and staggering sideways/lower ever since. At the time of writing, it’s attempting to consolidate and stabilise near US$29k.

What caused the dip? According to reports and various Twittering trader types, a cascade of long-trading position liquidations.

Deep correction on the markets, as #Bitcoin can't hold at $29,700-29,800 and shoots downwards through a cascade of liquidations. pic.twitter.com/B8EigaXHo7

— Michaël van de Poppe (@CryptoMichNL) April 19, 2023

It appears that a huge sell-order on the Binance exchange, of 16,000 BTC, worth more than US$467 million, might have triggered the dump and “long squeeze”.

So somebody market sold off 16k $BTC on Binance

That seems like an aggressive move

— Johnny (@CryptoGodJohn) April 19, 2023

Dutch trader Michaël van de Poppe also posted, however, that “crucial levels for Bitcoin remain intact“. And he, and others are referring to the US$29k zone and slightly lower, around US$28.5 and above as a level of support that’s important for the asset to hold lest it dive quite a bit lower. (News flash: it appears to be heading down to those levels now.)

#BTC is still in the process of retesting the $28800 level$BTC #Crypto #Bitcoin https://t.co/nQj36Lr0kP pic.twitter.com/wxmtPc2bxq

— Rekt Capital (@rektcapital) April 19, 2023

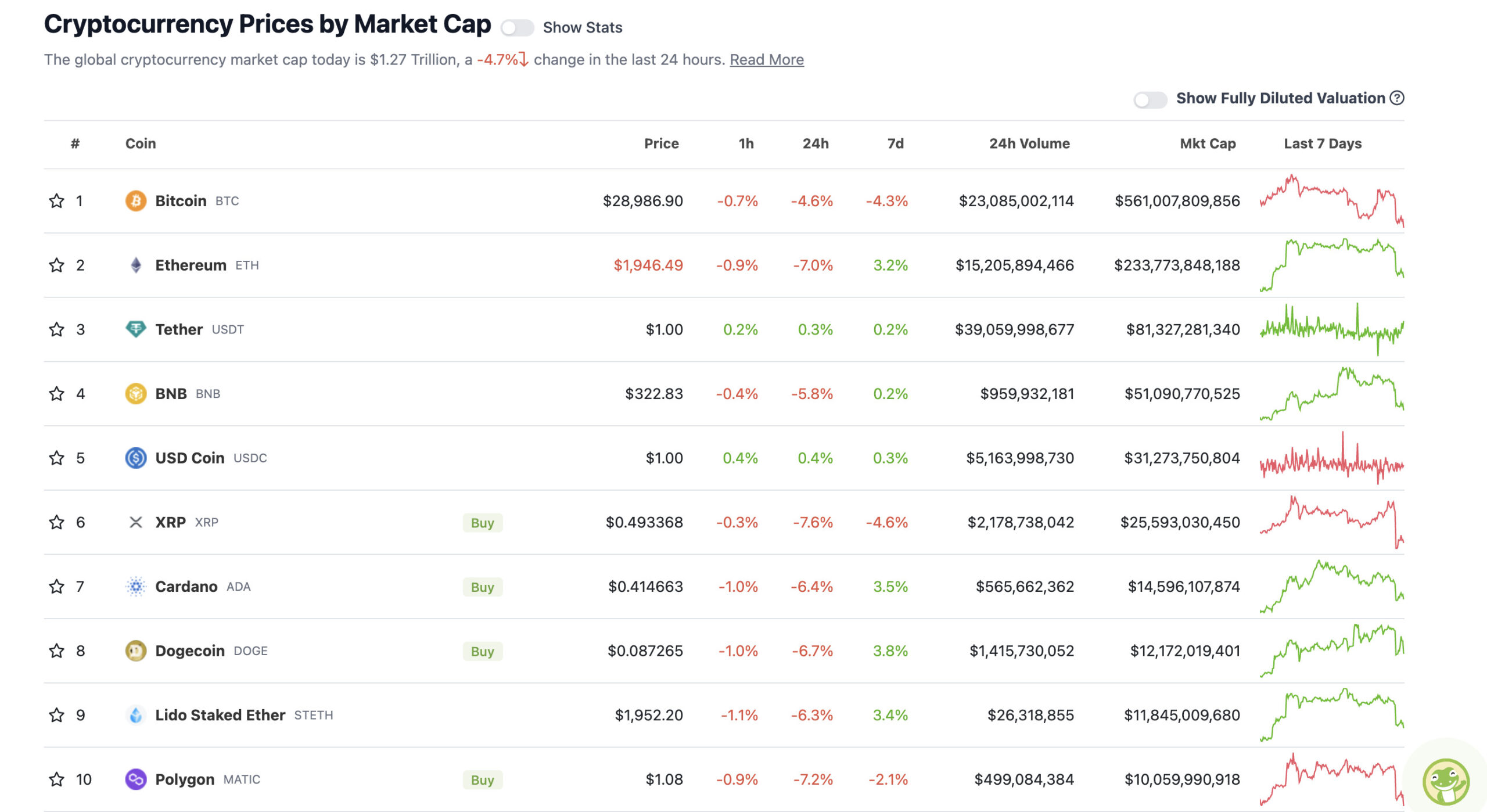

With the overall crypto market cap at US$1.27 trillion, down 4.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Since we began this article, BTC has dipped below US$29k and ETH might be struggling to maintain US$1,900, too. Are we heading to a bearish, bloody end to the week? It appears so at the moment.

Meanwhile, everyone’s an expert on Crypto Twitter and it’s the usual soupy mush of wildly different price-movement predictions.

US trader/analyst Justin Bennett has been dubious about the strength of the latest crypto rally lately. Here he is using Ethereum’s dip below US$2k as his signal to call time for the bulls.

$ETH is flirting with a massive area today.

Close below this $2k area, and bulls can pack it up, IMO.

Daily close is key.#Ethereum pic.twitter.com/SZixoVxsvX

— Justin Bennett (@JustinBennettFX) April 19, 2023

Fellow chart-watching American Roman Trading, on the other hand, is looking at the Bitcoin dominance chart, which, if it continues to fall, he believes could spark another run on the altcoins, as we’ve seen just lately.

$BTC 1D

Many are becoming bearish on #bitcoin , however, $BTC.D is showing a highly bullish case with a CLEAN HS reversal formation at major resistance.

Alts will fly and $BTC will most likely continue upwards if this plays out.#cryptocurrency #cryptotrading pic.twitter.com/IEzC6GAAdB

— Roman (@Roman_Trading) April 19, 2023

Sweeping a market-cap range of about US$8.8 billion to about US$459 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• BitTorrent (BTT), (market cap: US$666 million) +10%

Annnnd, that’s all (for now), folks.

SLUMPERS

• Radix (XRD), (market cap: US$1.17 billion) -17%

• Mina Protocol (MINA), (mc: US$657 million) -14%

• Conflux (CFX), (mc: US$665 million) -13%

• Litecoin (LTC), (mc: US$645 million) -12%

• Fantom (FTM), (mc: US$1.3 billion) -12%

• Arbitrum (ARB), (mc: US$1.88 billion) -12%

• Avalanche (AVAX), (mc: US$6.15 billion) -11%

• Aptos (APT), (mc: US$2.11 billion) -11%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

https://twitter.com/BitcoinMagazine/status/1648652866272256003

https://twitter.com/twobitidiot/status/1648732457448120321

Coinbase just got a license in Bermuda to launch a futures trading service.

Not long before the main Coinbase exchange leaves the USA too IMO unless something changes at the SEC.

— Lark Davis (@TheCryptoLark) April 19, 2023

A 2.4K #BTC drop sounds scary, but is only a 10% correction of a 2x move. pic.twitter.com/eJqvbbrevp

— dave the wave🌊🌓 (@davthewave) April 19, 2023