MoneyTalks: Raise a glass of Moutai to Chinese equities, the place to be in ’23

Experts

Money Talks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

In this cracking assessment of where we are on China, Alice Shen, senior associate investment and Capital Markets at VanEck told Stockhead that the road through the Middle Kingdom’s eventual reopening is looking long, bendy and full of potential holes…

But the rewards on arrival are well worth the effort.

Alice says geopolitical tensions between the world’s two biggest superpowers has eased a notch from last week, as US President Joe Biden met with Chinese President Xi Jinping on the sidelines of the G20 summit in Bali.

China’s Foreign Ministry described the talks as ‘candid and in-depth’ saying Mr Xi assured his counterpart “the world is big enough for the two countries to develop themselves and prosper together”.

“Talks between the US President and his Chinese counterpart, which included an agreement to continue dialogue through unspecified plans for US Secretary of State Antony Blinken to visit Beijing, were mostly received with optimism.”

Other signs of a thaw for now – US Trade Chief Katherine Tai telling Bloomberg – ‘the meeting was a powerful signal to the rest of the world that both leaders can manage ties.’

The Chinese leader also had his first formal meeting with the wee Australian Prime Minister Anthony Albanese, at the summit. Those are tricky rifts, but Chen says talking is a good starting place.

“Both sides cautioned there was a long way to go before the relationship would return to normal.”

And for his part Xi said:

“Since China and Australia are two important countries in the Asia-Pacific region, we should improve, maintain and develop our relationship.”

So far, so good.

The slight thawing in geopolitical tensions comes as China incrementally eases its Covid policy, Alice Shen says.

“Despite continued lockdowns amid Covid-19 outbreaks, China’s National Health Commission (NHC) last week relaxed some of its Covid restrictions even as case numbers rose to their highest levels in nine months. 20 measures to optimise Covid prevention and control were unveiled by the NHC, which may mark the beginning of the end of zero-Covid policy.

“Optimising the measures does not mean China is relaxing or laying low on its epidemic control and prevention, but that China is adapting to the new characteristics of the epidemic.

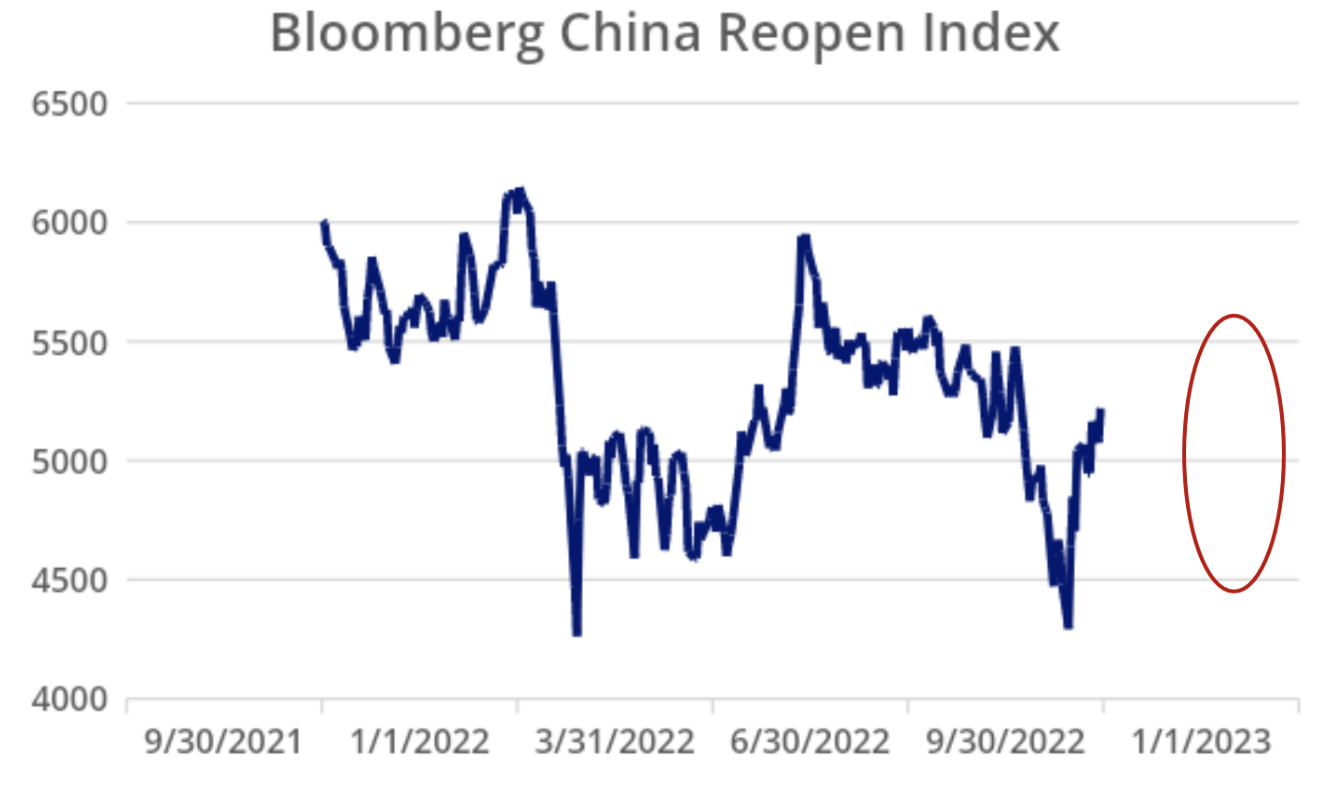

“Shares of Chinese stocks tied to the reopening rallied following the announcement of the measures,” Ms Shen told Stockhead.

Research by Citi Grioup, suggests right now there’s a number of positive indicators that point to China’s eventual reopening including the development of more vaccines – two new vaccines got approved in September and have been used as booster shots.

Also of critical reassurance – the pace of booster vaccinations seems to have accelerated, especially among older Chinese, who are largely economically vulnerable, historically mistrustful of vaccinations, and a vast, rapidly ageing demographic cohort.

New Bloomberg reports also concur that more Chinese cities will follow Shanghai’s adoption of an inhaled COVID-vaccine.

It’s encouraging if accurate, Chen says.

“The manufacturer said in its official social media account that 13 cities in China’s Jiangsu province are preparing to start using inhaled vaccines.”

Chen told Stockhead that the developer of the new inhalable Ad5-nCov-IH vaccine requires only a 1/5th dose when compared to an injected vaccine.

“And still looks like it could effectively neutralise the problematic Omicron sub-strain.”

“However, the performance of the 20 optimisation measures is yet to be seen, while another risk comes from the vaccine’s efficacy. Furthermore, mass testing is not economically sustainable and vaccination rates among the Chinese elderly remain low compared to the developed markets.

“This is the dilemma China faces right now.”

Further political signs on reopening could come from two important meetings in December according to Alice Chen.

“The Economic Politburo Meeting, and the Central Economic Working Conference. These meetings could signal to the market how China will strike a balance between the economic growth target and the potential exit of Covid-zero strategy coming into 2023.

“The recent optimisation announcement is in stark contrast to the messaging from the recent 20th Party Congress meeting held in October, in which the new Politburo Standing Committee was formed.

“President Xi expressed that China was entering a new era of “Chinese-style modernisation” and “high-quality development”, emphasising domestic innovation and focusing on macroeconomic policies to promote stability. Some might argue that with the political reshuffle, the policy decision-making will be more coordinated going forward as the Committee members are close allies of the President. At the meeting, the long-awaited Covid relaxation policies were not mentioned,” she says

Chinese stock markets certainly slumped on the first trading day after the twice-a-decade congress wrapped up on October 23 and then crashed a day or so later for emphasis.

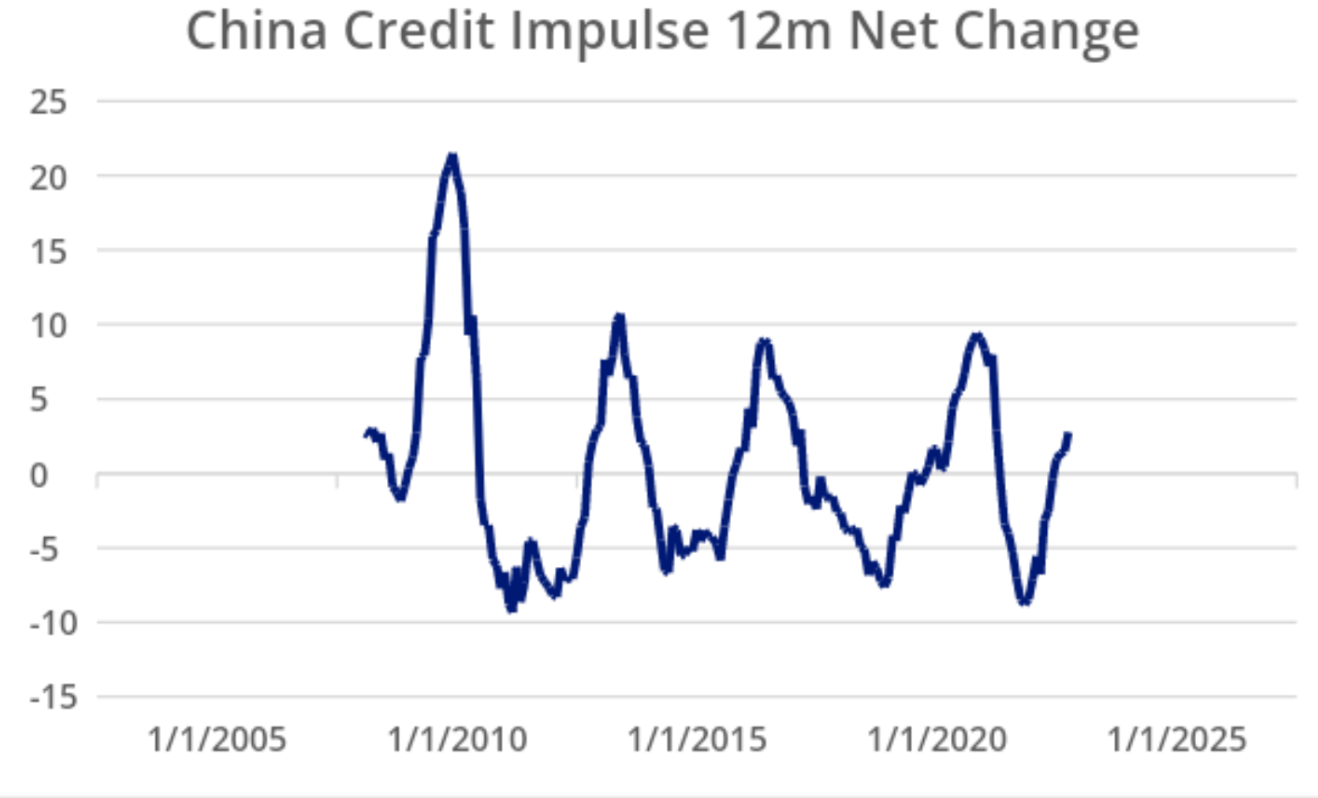

“Notwithstanding the somewhat confusing messaging coming out of China, we see steady improvement in the credit impulse since the end of 2021,” Chen says.

“The central government still has the dry powder for further monetary and fiscal stimulus. According to Citi, the “Chinese-style QE” tools such as Pledged Supplementary Lending (PSL) continued to expand strongly from September to October 22 (154bn CNY), which could be used to support infrastructure investment, in addition to ensuring home delivery.”

“Chinese authorities have also unveiled 16 supporting measures for the property market. The measures include credit support for debt-laden housing developers, financial support to ensure completion and handover of projects to homeowners, and assistance for deferred-payment loans for homebuyers.”

The plan came on the same day the NHC outlined the optimisation rules, she adds.

“Chinese and Hong Kong stocks surged quickly in response to the news, China’s CSI rising by around 1.6%, while the Hang Seng was up by 3%.”

“While China may face slowing growth in the short term, we encourage investors to stay the course,” Chen told us.

“The consumer sector, for example, has been beaten up by the pandemic related disruptions – the activity gauges indicate weak levels of consumption overall in the last two years.

“Given China’s savings rate is one of the highest in the world, we think that the pent-up demand must go somewhere eventually, on goods and services, as evidenced in the developed markets once the country pivots to reopening.

“We are starting to see momentum building in the consumer sector.”

(Ed: And Moutai is a good a place to start as any…. Back in the day, it was Christian and Wuliang Yi Bin!)

Kweichow Moutai (600519 CH) and Luzhou Laojiao (000568 CH), two of the largest white liquor producers in the country, have generated 17.6% and 19.0% month to date.

“While Q3 earnings sales growth was largely in line with expectations, the net profit growth of liquor companies was stronger than expected from product mix upgrades and expense savings.

“We believe the sector will react strongly once sentiment improves,” she says.

Via tradingeconomics.com

“We also continue to see growth prospects in the onshore domestic IT companies, e.g. semiconductor manufacturers, as China swiftly shifts its focus on to independence in the supply chain in technology.

“For example, Shanghai Bright Power Semiconductor (688368 CH) which manufactures and distributes semiconductor products, has rallied 44.3% MTD.

“While volatility is here to stay and patience is required,” Ms Chen says, “with the looming recession risk in the US and Europe, Chinese equities could be the place to be in 2023.”

“Happy hunting!”

Thank YOU Alice.

It’s nice to be encouraged to drink for once.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.