ASX Small Caps Lunch Wrap: Who bought into the world’s worst real estate market today?

News

News

Hello homeowners.

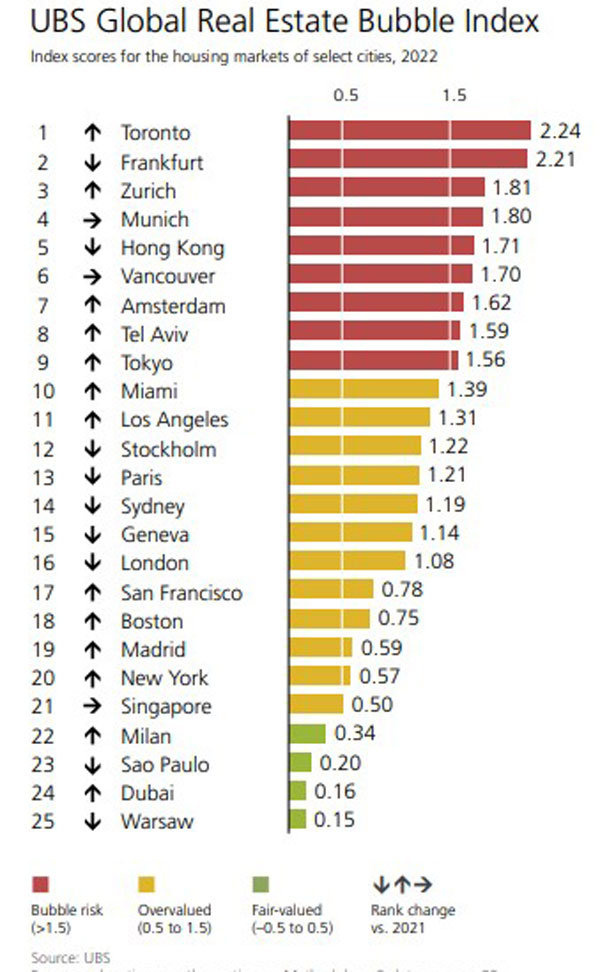

Let’s start the day before the weekend with a property update. UBS has dropped its Global Real Estate Bubble Index for 2022 and sadly, Sydney is nowhere near the top of it.

Before we get to the charts though, a note from UBS on when exorbitant increases in home prices will end. The past decade, it says, has been marked by a property market “long been supported by one major buttress in particular: central banks.”

“Ultra-low financing conditions and demand outpacing construction have led to increasingly optimistic price expectations among buyers. Even the most buoyant expectations have been exceeded in some cases in recent times.”

Yes, yes all very exciting. But will prices come down?

“Interest rates … have climbed.” Cool cool. “..several shocks have rocked financial markets worldwide.” We know that, go on. “Consequently, the willingness to pay for owner-occupied homes is likely to take a hit.”

Here it comes wannabe first-time homeowners, get excited!

“In cities with strong population growth, such an adjustment could manifest in the form of a prolonged stagnation in nominal purchase prices (squee)… But as real estate markets rarely trend sideways, this is not the most likely outcome.”

Sorry. Although congratulations Boomers, you win. Again. And welcome Sao Paolo – the first South American market to be included the report! To the charts!

First up – who’s in the biggest bubble? Not Sydney, not by a long shot; you’ve got plenty of growth to come:

Oh, Canada.

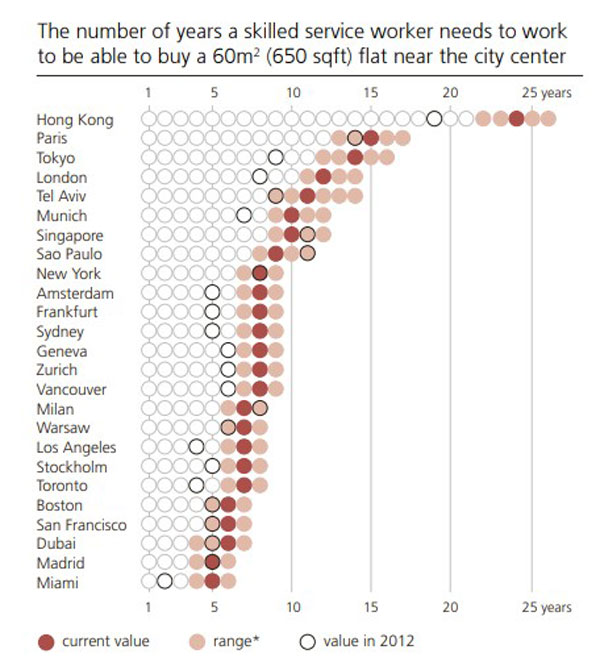

And here’s how many years it will take an average wage earner to pay back a CBD unit:

And here’s how angry mortgagees in Canada are planning to deal with gummints and central banks that don’t seem to care about their terrible financial choices:

HOMEOWNERS ACROSS CANADA HAVE STARTED TO HOLD PROTESTS AGAINST RISING INTEREST RATES WHICH IS CAUSING THEIR MORTGAGE PAYMENTS TO GO UP. pic.twitter.com/6XtQlXsqn4

— GURGAVIN (@gurgavin) October 11, 2022

More of this please. Although maybe we can rely on inflation to bring some sense to this madness.

Oh, wait.

Responded to yet another higher than forecast inflation print in the US by… rebounding with one of the biggest intraday turnarounds in recent memory.

Month-on-month inflation hit double the expectation, and CPI rose 0.6% month-over-month, which was ahead of estimates for a rise of 0.4%, even after excluding food and energy.

That sent the S&P down 2.4% but traders weren’t having it. A severe case of BTDs set in and pulled it back to level-pegging, then up through the roof by as much as 3% at one stage.

The catalyst? Anyone’s guess. Maybe bargain hunting, maybe confidence on reports the UK government could pullback on its disastrous mini-budget plans.

Over at Business Insider, Lori Calvasina, RBC’s Head of US Equity Strategy, has the news everyone wants to hear – the bottom could be in within the next few weeks. And the 2023 comeback could be measured in “double digits”.

Anyway, along with the S&P 500, the Dow Jones also rallied to finish 2.83% higher while Nasdaq was up 2.23%.

As Eddy “The Prez” Sunarto said in this morning onight wrap “the red hot inflation should make the Fed’s job easier come November when the next FOMC meeting is held”.

The usual “Bitcoin is an inflation hedge, huh” jeerers had some fun in the cheap seats early, but went quiet as the premier crypto also snapped back with 1.45% to US$19,366. Even Ether rose 0.09% to US$1,287.

There’s a lot more crypto news from Rob Badman in his Mooners and Shakers for the day, and it’s a lot more entertaining than what you’ll get here.

So what happened at home this morning? Hint: no. If you need one, this is not the website for you.

Let’s keep it simple and just copy what the ASX gives us, because we’re out of time.

The S&P/ASX200 is up sharply today, gaining 116.00 points or 1.75% to 6,758.60. The top performing stocks in this index are VIRGIN MONEY UK PLC and DOMINO’S PIZZA ENTERPRISES LIMITED, up 10.95% and 6.04% respectively. Over the last five days, the index is virtually unchanged, but is down 9.21% for the last year to date.

Tech is up 1.46%. Healthcare is up 1.78%. Banks are up 1.42%. Emerging Companies are up 0.58%. And Resources is the winner, up 1.80%. What a day.

Of the big boys, Woolies is having the biggest day out, popping 3.04%, while Block somehow still found a way to lose, dropping 0.10% and below the $90 waterline.

Here are the best performing ASX small cap stocks for October 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap REC Recharge Metals 0.215 39% 3,293,909 $6,168,225 CFO Cfoam Limited 0.004 33% 202,488 $2,201,522 TOY Toys R Us 0.032 33% 5,212,735 $20,684,668 WFL Wellfully Limited 0.03 30% 173,667 $6,410,036 1CG One Click Group Ltd 0.015 25% 434,214 $7,114,296 MCT Metalicity Limited 0.005 25% 1,000,000 $13,834,824 MRD Mount Ridley Mines 0.006 20% 4,403,400 $29,757,863 BPH BPH Energy Ltd 0.026 18% 9,509,434 $17,441,584 E25 Element 25 Ltd 1.04 16% 481,953 $137,439,332 DOC Doctor Care Anywhere 0.078 15% 48,993 $15,450,967 VAL Valor Resources Ltd 0.008 14% 2,827,500 $25,609,744 MGU Magnum Mining & Exploration 0.04 14% 898,746 $18,654,680 HXL Hexima 0.024 14% 140,048 $3,354,514 HT8 Harris Technology Gl 0.017 13% 1,531,883 $4,474,432 NSX NSX Limited 0.045 13% 1,309,614 $14,433,235 MBK Metal Bank Ltd 0.0045 13% 100,000 $10,460,991 PWN Parkway Corp Ltd 0.009 13% 3,298 $17,706,244 SHH Shree Minerals Ltd 0.009 13% 1,364,000 $9,907,895 SGC Sacgasco Ltd 0.019 12% 750,552 $10,331,003 M24 Mamba Exploration 0.145 12% 55,000 $5,482,750 ONE Oneview Healthcare 0.145 12% 365,311 $67,598,753 PHO Phosco Ltd 0.145 12% 36,911 $35,452,346 ESR Estrella Res Ltd 0.01 11% 6,903,181 $13,297,189 NTM Nt Minerals Limited 0.02 11% 131 $11,410,213 RR1 Reach Resources Ltd 0.005 11% 305,971 $8,595,228

Way, way out in front of the Small Caps contingent today is Recharge Metals (ASX:REC), which did exactly what it says on the box, bouncing back from less than stellar assay results in March which didn’t back up a rerating.

This time around, however, it looks like the good stuff has arrived in the form of electromagnetic surveys, with 3D pictures of treasure and all from its flagship Brandy Hill South project. How about them “extensive zones of massive, semi-massive to disseminated pyrite, chalcopyrite and pyrrhotite”?

The $9m market cap explorer is up 35% at the princely sum of 0.055c, and 10% year-to-date.

Also with the promising results is Sultan Resources (ASX:SLZ), where a single diamond drill hole is underway at the Kulin Hill nickel project in WA after an early stage aircore program returned promising results up to 0.86% nickel and 575ppm cobalt.

Reuben Adams has more on that here.

If you like that kind of investment news, in the week ahead, you might like to know that the 11th Annual Australian Microcap Investment Conference is being held in Melbourne on the 18th and 19th of October. It’s an exciting opportunity to hear firsthand from the CEOs of Australia’s leading microcap companies.

AND Stockhead readers have an exclusive discount offer ($300 off the ticket actually) using the code: STOCKHEAD2022

You’re welcome.

Here are the most-worst performing ASX small cap stocks for October 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap TD1 Tali Digital Limited 0.002 -33% 1,973,334 $3,697,892 KFE Kogi Iron Ltd 0.004 -20% 2,500,000 $8,160,389 SYN Synergia Energy Ltd 0.002 -20% 1,244 $21,044,477 MTH Mithril Resources 0.005 -17% 980,382 $17,641,398 ROG Red Sky Energy. 0.005 -17% 899,449 $31,813,363 MKG Mako Gold 0.042 -16% 4,540,312 $19,112,080 PRS Prospech Limited 0.029 -15% 403,147 $2,216,154 AD1 AD1 Holdings Limited 0.018 -14% 51,886 $14,715,357 AUH Austchina Holdings 0.007 -13% 875,000 $16,294,662 M8S M8 Sustainable 0.007 -13% 5,000 $3,927,268 PUA Peak Minerals Ltd 0.007 -13% 46,503 $8,330,966 UBI Universal Biosensors 0.255 -12% 4,239 $61,434,886 PFE Panteraminerals 0.11 -12% 18,181 $6,437,640 CD1 Cd Private Equity 1 0.81 -12% 39,715 $33,627,086 OEL Otto Energy Limited 0.015 -12% 9,311,240 $81,515,166 PKO Peako Limited 0.015 -12% 474,441 $6,446,093 NNL Nordic Nickel 0.25 -12% 350,431 $16,499,884 AKL Auckland Real Estate 0.66 -11% 22 $59,854,902 B4P Beforepay Group 0.35 -11% 20,778 $13,757,541 FZR Fitzroy River Corp 0.12 -11% 4,500 $14,573,824 FLX Felix Group 0.125 -11% 316,356 $18,589,729 MAU Magnetic Resources 0.805 -11% 70,149 $205,620,747

There. Now I’m going to hibernate, because apparently humans can do such a thing and it’s well beyond time science confirmed it.

See you in an age or two.