Mooners and Shakers: Hot US inflation data sees Bitcoin and crypto dump, then pump. Carry on, then

Getty Images

So the US CPI inflation data hit and it was a little “hot”. Bitcoin, crypto and stock markets were then gang spear tackled AND flown first-class to a tropical resort for an essential-oil massage – all within the space of a couple of hours.

As you were then, because if you’re only just checking your portfolio since roughly this time yesterday, you’d be forgiven for thinking that not that much has occurred.

I keep hearing about this hot token CPI but can’t find it on any DEX.

— DeFi Dad ⟠ defidad.eth (@DeFi_Dad) October 13, 2022

Here’s what happened with the US Consumer Price Index data, though, if you’re interested in such things. The inflation figure was widely expected to come in at 8.1%. It was 8.2%. The CPI “core” figure (which takes food and energy out of the equation) was also fractionally hotter than expected.

Yesterday, US crypto-focused financial analyst Justin Bennett hinted that we might see “volatility in both directions” based on the CPI reading. He was right.

Is “Uptober” still on? That narrative wasn’t looking so great a short while ago when Bitcoin was languishing around US$18k.

But some of the analytical crypto minds we regularly follow are now sounding a bit more optimistic. Michaël van de Poppe is seemingly using his ears here to sound out the inflation top.

Inflation top is hear.

▫️Yields to fall over coming weeks.

▫️Dollar to stabilize/correct.

▫️Crypto & #Bitcoin to have relief rally to $30K.It’s time.

— Michaël van de Poppe (@CryptoMichNL) October 13, 2022

While Bennett’s tweeted analysis is still indicating potential Bitcoin (and Ethereum – see below) rallies ahead of the Fed’s next rate-hike meeting on November 2. And that, incidentally, has every chance of being another roadblock or headwind for risk markets, given the fresh CPI reading.

What a bullish reclaim from $ETH.

Bears in disbelief. Send it. #Ethereum https://t.co/2ctvlxgiWY pic.twitter.com/poTVf8NZ1e

— Justin Bennett (@JustinBennettFX) October 13, 2022

Imagine how much we'd have rallied if inflation had come in below expectations. 😂

— Sven Henrich (@NorthmanTrader) October 13, 2022

Onto some general daily crypto price action.

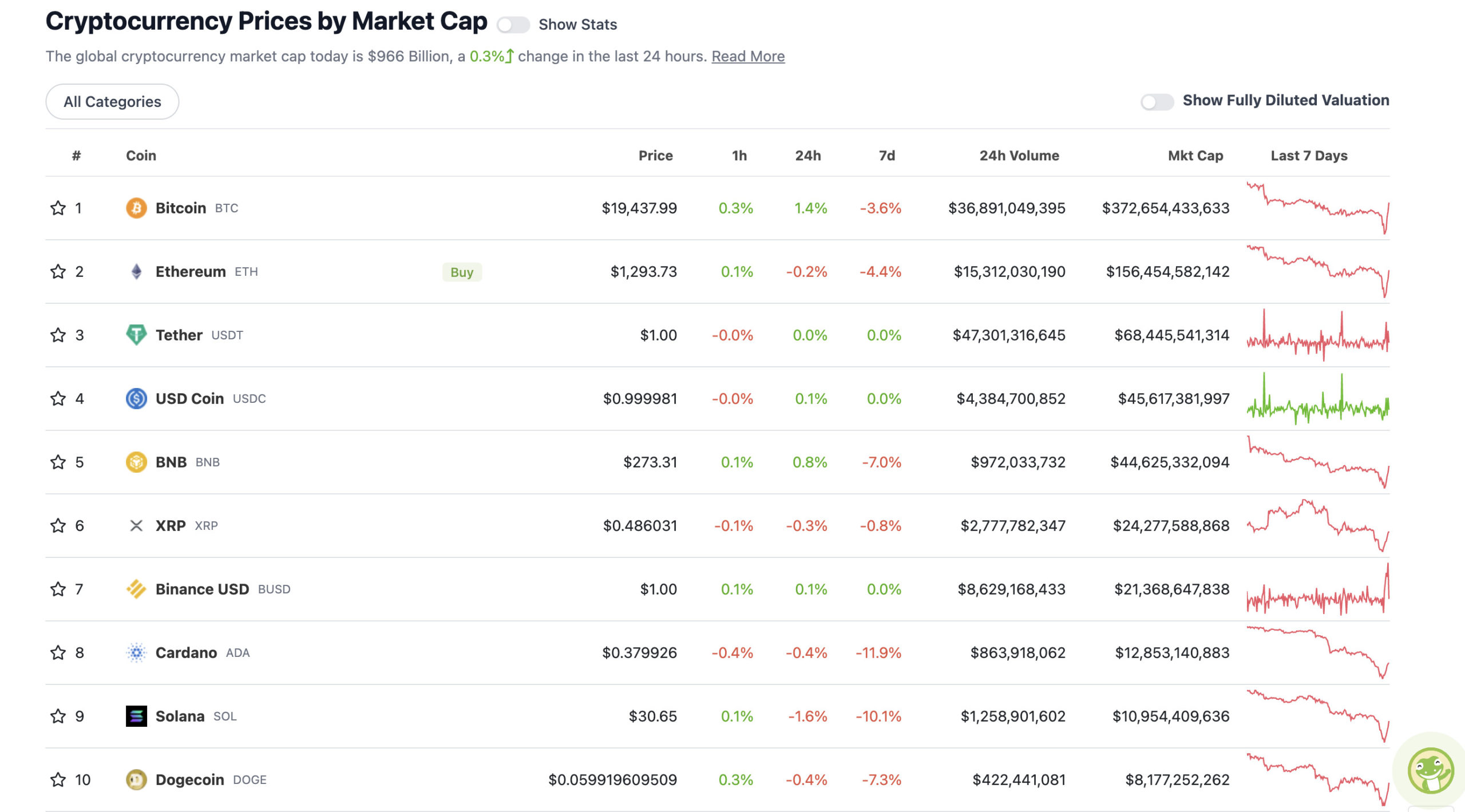

Top 10 overview

With the overall crypto market cap at US$966 billion, remarkably up a fraction of a percentage point since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s weird times for stocks and crypto price activity right now. Huge adoption news (Google, BNY Mellon and more) might have moved prices considerably this time last year. Now… crickets.

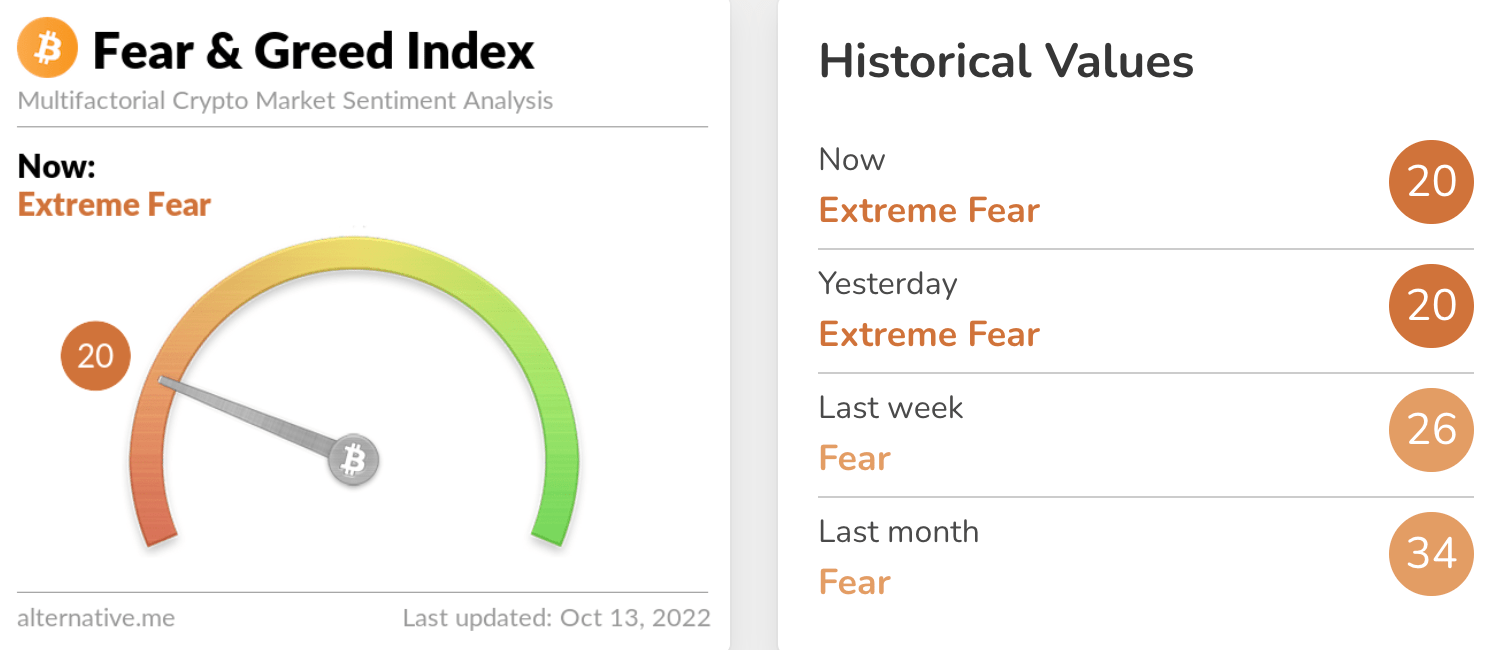

That said, perhaps bad news (CPI data and likely further Fed hawkishness) may not be having the full portfolio-wrecking effects that might also be expected at the moment. Grain-of-salt caveat – that could very well change with a hive-mind-like shift in Crypto Twitter sentiment, although it’s been pretty fearful for a long time now.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.1 billion to about US$381 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• TerraClassicUSD (USTC),(market cap: US$509 million) +18%

• Ethereum Name Service (ENS), (mc: US$500 million) +13%

• Arweave (AR), (mc: US$495 million) +10%

• Synthetix (SNX), (mc: US$531 million) +7%

• Basic Attention Token (BAT), (mc: US$447 million) +5%

• Evmos (EVMOS), (mc: US$485 million) +5%

DAILY SLUMPERS

• Klaytn (KLAY), (market cap: US$474 million) -7%

• EthereumPoW (ETHW), (mc: US$787 million) -6%

• Terra (LUNA), (mc: US$441 million) -6%

• Elrond (EGLD), (mc: US$1.26 billion) -4%

• Axie Infinity (AXS), (mc: US$1.15 billion) -3%

• ApeCoin (APE), (mc: US$1.44 billion) -3%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

I'm still bullish short-term. This is not the time to be bearish imo.

— il Capo Of Crypto (@CryptoCapo_) October 13, 2022

There are some bullish voices around today based on the honey-badger-like qualities Bitcoin has shown in the face of a crappy inflation-data reading. And not to rain on that parade too heavily, but just a reminder here about who’s lurking around the corner. Spoiler: it’s Fed boss Jerome Powell.

https://twitter.com/VailshireCap/status/1580670787060527104

In crypto-gaming news, Illuvium (ILV) – one of the most-hyped, most promising GameFi projects in development – has just bagged itself a listing on major exchange Coinbase. And yes, that has pumped the price a bit, but this is a bear market, so it’s complicated. Still – it’s big news for the Ethereum/IMX-based gaming protocol.

We’re so proud to share this important milestone with you all. 🤩

If all conditions are met, an $ILV↔$USD trading pair will open on @coinbase a few hours from this post, so get ready!This is a really big step for Illuvium, and the community as a whole! 🥳🚀 pic.twitter.com/c1bKcgOZPe

— Illuvium (@illuviumio) October 13, 2022

Illuvium co-founder Kieran Warwick was interviewed by NFT gaming platform and guild Balthazar just recently: “We have a 10, 15, 20-year vision here. And if we can pull it off, we will change gaming forever,” he enthused.

How does @KieranWarwick from @illuviumio handle the up and down markets of Web 3 Gaming? 📈📉

Check out the full interview 👇https://t.co/JfYYpABLVg

Or listen to the podcast version 👇https://t.co/nE4PUH08ge pic.twitter.com/tKfstfxROd

— Real World Gaming (@rwg_official) October 11, 2022

A real honour to be able to curate a roundtable and networking event with @RBAInfo to discuss the central bank digital currency pilot program as part of @blockchain_apac engagement activities. pic.twitter.com/ak54esdgQq

— Steve Vallas (@stevevallas) October 12, 2022

Meanwhile, at the Bitcoin Amsterdam conference currently underway…

Welcome to Bitcoin Amsterdam! Day one of the largest European #Bitcoin conference in history has come to an end. 🇳🇱

Watch the recap and get hyped for day 2 tomorrow! "Time for liftoff" 🚀 pic.twitter.com/i4uLiQ1moF

— Bitcoin Amsterdam (@BitcoinConfEUR) October 12, 2022

Like I got no idea of like what I’m like talking about, like bitcoin pic.twitter.com/ZvDBa041no

— DETERMINISTIC OPTIMISM 🌞 (@nvk) October 13, 2022

And apropos of nothing: Frozen pizza, anyone?

https://twitter.com/MikeBradleyMKE/status/1580381366314598401

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.