Tech-Heavy: Wall Street on a hair trigger; USD high as a kite; Nike must do it ‘cos it’s already lost 41% in ’22

News

News

US futures are down ahead of Monday morning in New York, after a week of aggressive central bank behaviour hoisted global interest rates and a USD on steroids hammered currencies and depressed US markets back to their 2022 lows.

From last Monday morning the Dow has fallen -4.6%, the S&P 500 -5%. And the tech-heavy plaything of the fiscal gods, the Nasdaq, gave back -5.6% of pure unadulterated volatility.

Wall Street is hurting. US stocks are hurting. The S&P 500 and Nasdaq are hurting too. The former breached its June low on Friday and ended down 1.7%. The tech-heavy Nasdaq Composite lost 1.8%. And The Dow Jones Industrial Average tore a new a fresh lower hole on Friday morning, briefly entering bear market territory. The stunned mullets who backed them have suffered the mostest.

Apple (NASDAQ:AAPL) has fallen from the tree this month, down about 8% since August 31.

Other notable leakers included IBM (NASDAQ: IBM), Nike (NYSE:NKE) (pls see below, so keep reading dammit!) and Microsoft (NASDAQ:MSFT) all doing their bit to drag the blue chip index to a hell lower than June, which many thought was not poss. But it was. Totally poss.

US treasury yields on the other hand are cruising in a frightening fashion, thanks to the US Federal Reserve’s third straight 75 basis points hike and the chair J Powell’s ensuing promises to not blink vs inflation and to continue on a steeper path of rate increases until the battle in done.

At the time of writing, circa lunchtime in Sydney, futures for the Dow Jones Industrial Average futures, the S&P 500 and the Nasdaq 100 are all around -0.6% lower.

Anxious US traders have again failed to cope with the hawkish melody of chair Jerome Powell who floated the bank could happily raise to around 4.6% before easing off the accelerator. The FOMC forecast has the Fed staying uber-aggressive until at least Christmas, lifting rates to 4.4% before this hellish nightmare we’re calling 2022 ends.

There’s dawning acceptance evidenced in falling stock values that the recession vs inflation fight will end in everyone strapping on a flimsy seatbelt and assuming crash positions for a very hard landing, which is going to rip the happy-joys from company guidance and leave a mark on decent civic-minded US corporate earnings everywhere.

Traders are anticipating the release of personal consumption expenditures data, the Fed’s preferred inflation gauge, on Friday. Durable goods and consumer sentiment numbers will also come out this week.

While The Fedmeeting is done, this is a week of non-stop Fedspeaking and will provide us all with ample evidence of Fedthinking, if that’s what they’ve really been doing.

Yes, they’re rolling out the red carpet for a week of unrelenting hawkish natter, which J Powell et al are clearly hoping will somehow get through to a Wall Street apparently inocculated from the cold hard facts of central banking.

An absolute hailstorm of of the FOMC’s best and frankest will be laying it down around the states throughout the week.

From Fed Vice Chair Lael Brainard, San Francisco Fed Pres. Mary Daly, Fed Governor Michelle Bowman , St. Louis Fed Pres. James Bullard and the chair himself J Powell are all on the circuit (see below) this week.

Other market moving macro moments include durable goods orders, consumer confidence, a likely slowing in home price gains and a fall in new home sales (all due Tuesday) and then there’s meek growth in personal spending for august (Friday).

The core personal consumption deflator inflation for August (Friday) is expected to show a rise to 4.8% yoy but remains well down from its February high of 5.3%.

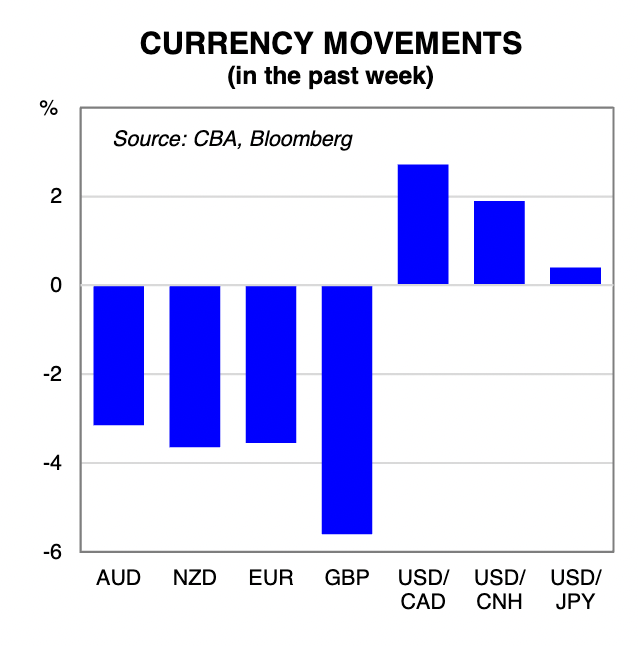

Tobin Gorey chief agri-strategist at CommBank says the US Dollar steamroller keeps on crushing all before it.

“The US Dollar surged on Friday to finish the week with its rally accelerating. The greenback’s gains are, or are on verge of, setting epoch-marking levels against the other jumbo currencies.

Tobin says the greenback is the last-standing safe-haven game in town.

“The Yen is near quarter-century lows now and the next comparison point is three decades ago. The Euro has fallen to 20-year lows. (And for reference the absolute low is just over 82¼¢ versus 96¾¢ now).

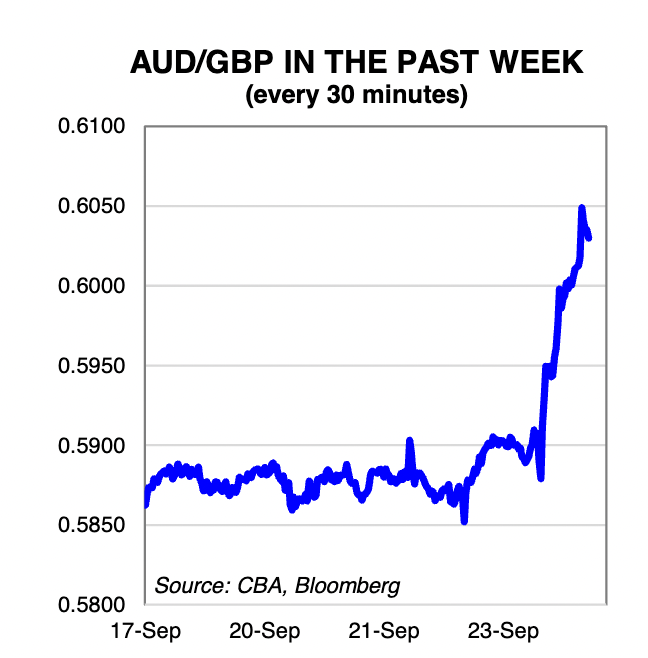

“The Australian Dollar, down the best part of 1¼¢, also fell heavily. The Aussie, pandemic aside, has not been this low since the teeth of the Global Financial Crisis gale,” Mr Gorey added, way too calmly…

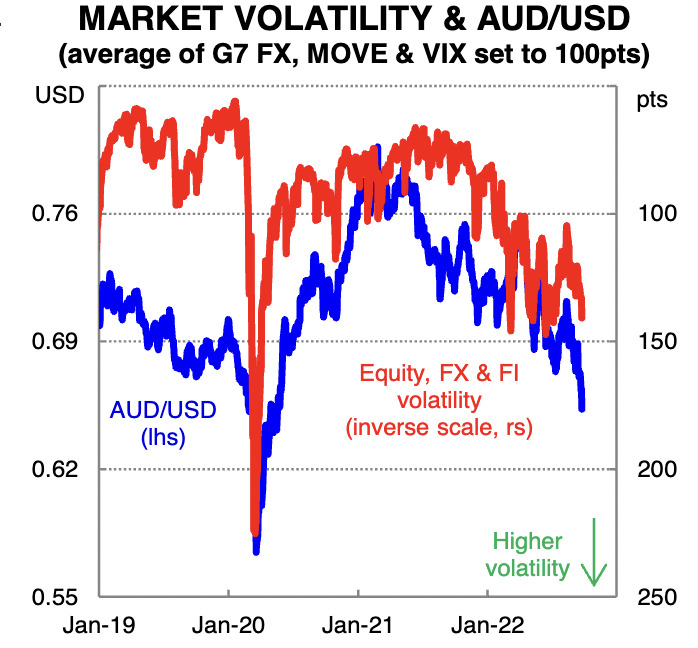

CBA’s currency guru Joseph Capurso warns that the pick-up in financial market volatility also supports the USD ‘cos of its safe haven status adding that the greenback can happily track on higher again this week.

“The economic policy divergence between the US and other economies supports the USD. If a sense of crisis about the world economy were to emerge, the USD could jump significantly.The poor situation in the UK exacerbates support for the USD.”

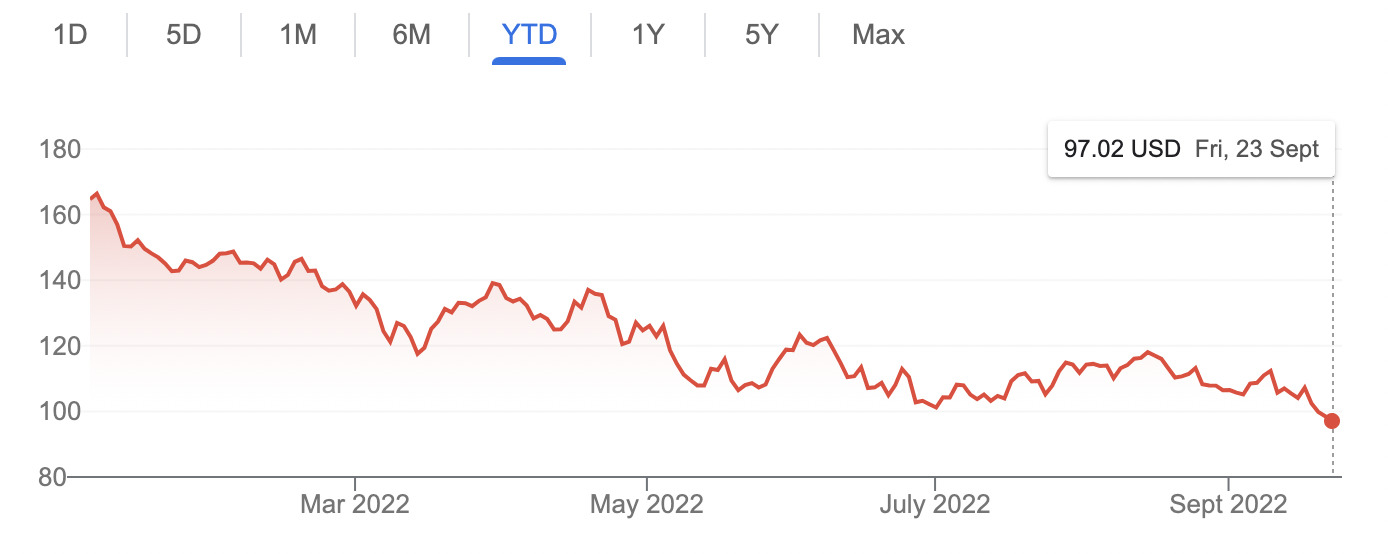

Just out of (rising) interest, check this out:

This morning (Monday) the Aussie was trading a shade over 65.25¢.

US Q3 earnings start… again.

It seems like only yesterday that we were wrapping up a relatively strong Q2 earnings season in the US, but Q3 earnings are already upon us and the big name to watch this week will be Nike, says eToro’s Josh Gilbert.

And given Nike is the single largest sports apparel brand in the world, this set of earnings are a handy gauge for what the consumer is doing, both in the states and around the world.

“Nike has had a difficult year with supply chain issues and rising inflation, but its strong brand presence has kept sales healthy,” Gilbert told Stockhead.

“Its direct-to-consumer strategy is accelerating, laying the groundwork for further long-term growth.

“However, the short-term headwinds moving into this latest report, including sales volatility in China, currency headwinds, and excess inventory, will make for a challenging quarter.”

The street has expectations for Nike earnings of US$0.92 per share and revenue of USD$12.3 billion.

“Nike continues to face supply-chain disruptions and tight COVID restrictions in China, its second-largest market,” he added.

And it’s also semiconductor week here on Stockhead and a good a time as any to meet Micron Technology Inc. (MU) where Q4 sales dropping this week expected to come in at the lower end of previous guidance.

MU specialises in the manufacture of DRAM, NAND Flash, and other widely-adopted semiconductor memory devices, and following the flurry of COVID-19 semiconductor panic, the street expects customers to have spent the quarter eating into their stockpiles of unused chips.

As well as being a key player in the development and commercialisation of several new memory technologies. Micron’s products are used across a whole bunch of applications, including consumer electronics, computers, networking, automotive and industrial.

MU last reported in June – a beat for its Q3 earnings of $2.62 per share, along with revenue of $8.6 billion.

At the time the company reckoned fQ4 earnings were likely in the range of $1.43 to $1.83 a pop, adding that revenue estimates for Q4 were in the range of $6.8 billion to $7.6 billion.

With the stock price down around 50% ytd, Mu could well be a buying opportunity considering the intense geopolitical jostling around the future of the sector.

The focus on semiconductor’s follows Congress passing and President Joe Biden signing a $52 billion package designed to boost semiconductor manufacturing in the US and for its allies into law.

Squarely aimed at hobbling China’s role in the chipmaking supply chain, the US, South Korea and Japan are busy making semiconductor alliances, underscoring the critical role these chips play in both aligned economies and their mutual national security while also revealing the determination to throw a stick into the ambitions of China.

Everyone’s favourite SpaceX founder Elon Musk appeared to confirm on Friday that he will make Starlink available in Iran.

Worried about nationwide upheaval across the pariah state, US Secretary of State Antony Blinken tweeted that the American government had gone and taken action to increase internet freedom for Iranians.

Musk replied “Activating Starlink …”

Whether this was timed to throw shade at someone, anyone… or whether it just seemed like a good time to point out Starlink’s cool name (and to say the cool word “activating,” only Elon knows.

And also… Only Elon knows:

— Elon Musk (@elonmusk) September 25, 2022

MONDAY

US August Chicago Fed activity index

TUESDAY

US August durable goods orders

US July FHFA house prices 0.1% 0.0%

US July S&P/CS home price index

US September consumer confidence index

US Richmond Fed index

US August new home sales

US Fedspeak (Gov J Powell)

WEDNESDAY

US August wholesale inventories

US August pending home sales

Fedspeak (Messrs Daly, Bostic, Bullard, Evans)

THURSDAY

US Initial jobless claims

US Q2 GDP, annualised

Fedspeak (Messrs Bullard, Mester, Daly)

FRIDAY

US August personal income / personal spending

US August PCE deflator

US August core PCE deflator

US September Chicago PMI

US September University of Michigan sentiment

Fedspeak (Messrs Brainard & Williams)