Not you, lithium: The ultimate guide to the other battery metals vital to Europe’s energy transition

Mining

Mining

The commodities that are vital to electric vehicles (EVs) go beyond the posterchild that is lithium.

Battery metals also include nickel, copper, cobalt, zinc, and graphite – basically anything that can be used in any way for the production of electric vehicles (EVs).

And Europe is hungry for battery metals.

According to a report by KJ Leuven commissioned by the European Association of Metals (Eurometaux), the EU energy transition will require 10–15% more zinc annually than the region uses today, 35% more copper, 100% more nickel and 330% more cobalt.

There’s a huge supply/demand imbalance in Europe right now, where pandemic-related bottlenecks have been compounded by the Russian invasion of Ukraine.

And as if this wasn’t enough, Europe is experiencing increasing energy costs in winter driven by sanctions on Russian oil and gas – which is impacting smelters across Europe that have had to lower utilisation rates at times of peak power costs in Q1 & Q2.

“Europe is braced for more smelter disruption as we head into the winter heating season from September as energy prices are expected to rise again,” CRU Group’s Helen O’Cleary told Stockhead.

There are a few jurisdictional risks too – earlier this year Rio Tinto’s (ASX:RIO) licence to develop a huge lithium project was revoked by Serbia.

There is a broader concern though – the European Commission (EC) is assessing a proposal by the European Chemicals Agency (ECHA) to classify lithium carbonate, chloride, and hydroxide as dangerous for human health.

Rystad notes the classification “would not stop lithium usage”, but there’s a strong chance it would “have an impact on at least four stages in the EU lithium battery supply chain: lithium mining; processing; cathode production; and recycling”.

In a nutshell, if you’re mining lithium in the EU, there’s a chance you’ll simply be creating raw materials just to see them exported back out of Europe to create cathodes. And yeah, Albermarle’s talking about shutdowns already.

Whichever way you look at it, Eurometaux says Europe’s EV uptake is the driving force for battery metals demand.

And because raw materials are the largest cost component of an EV battery, the supply and price of the input battery metals will have the greatest impact on whether EVs will reach cost parity with, and replace, traditional internal-combustion vehicles.

For the purposes of narrowing down what is already a ridiculously long read, we’ve focused on a few companies with European cobalt, zinc, nickel, copper and graphite plays.

Cobalt is critical in the production of the lithium-ion battery, boosting energy density and battery life – and in turn the range – while ensuring the integrity and stability of the battery.

Eurometaux says that while producers are reducing the cobalt content of their batteries (child labour in the Congo, not good) the required demand remains strong in the next decade.

There’s the added hiccup that cobalt is usually mined as a by-product of copper and nickel, but the world’s overall cobalt demand is projected to grow to 270-370kt by 2030, and up to 500-800kt by 2050.

“Europe’s 2030 energy transition goal is projected to require between 10-20kt of cobalt in 2030, rising to 50-60kt in 2050 ((equivalent to up to 350% of today’s European cobalt demand),” the report says.

“The development of a European battery value chain, including cathode production capacity, would increase Europe’s cobalt demand strongly.”

Earlier this year, the cobalt and nickel play boasted record March quarterly revenue of US$105.1m from its Finland cobalt production facility, supplying the raw material in the production of cobalt and mixed metal (nickel-cobalt-manganese) cathode precursors for lithium ion and lithium polymer batteries.

The revenue was up 9% on the prior quarter with EBITDA of US$14.9m a four-fold increase on the December quarter haul after a rise in cobalt prices.

They have charged from US$20.7/lb in the June quarter last year to US$35.7/lb in the March quarter.

Jervois has left EBITDA guidance unchanged at US$50-55m for 2022, with sales volumes of 5750-6000t cobalt at a Q2-4 price of US$39.75/lb.

The $714.28m market cap company had US$88.2m cash at the end of March.

Late last month the company confirmed cobalt mineralisation has been identified in “multiple sections of diamond drill core” from the priority Middagshville target at Skuterud in Norway.

With five drill holes now complete, drilling will continue at the Middagshvile target until around mid-July, with around 2,500 metres of drilling completed to date.

MD Antony Beckmand told Stockhead the plan is to develop Skuterud asap to meet Europe’s growing need for ethically sourced cobalt.

“With most of the world’s cobalt metal supply controlled by China and sourced from either the Democratic Republic of Congo or Russia, there is a prevailing threat to security of supply for battery manufacturers,” he said.

“The danger to EU industry posed by a reliance on non-domestic supplies has been exposed with the Russian invasion of Ukraine, which has led to the EU announcing plans for energy independence from Russia.

“This will require more cobalt and other battery metals, ethically sourced, responsibly developed and from a secure supply source in Europe, for Europe.

“With Kuniko’s projects representing ethically sourced, responsibly developed battery metals from a secure local source, regional battery manufactures will also benefit in making strides toward their own lower emission goals because of the reduced length to the supply chain.”

The $43.88m market cap company had $4.9 million cash at the end of the March quarter.

In simple terms, EV batteries are charged and discharged by the flow of lithium ions between the graphite-containing anode and the cathode.

The cathodes contain nickel, which delivers high energy density, allowing the vehicle to travel further.

The world’s energy transition requirements for nickel are projected to range from 1,000-1,800kt in 2030, up to 1,800-4,000kt in 2050.

Again, Europe’s demand hinges on developing domestic battery cathode production.

Europe’s 2030 energy transition goal is projected to require between 90-190kt of nickel, rising to 300-400kt by 2050 (equivalent to up to 110% of today’s European nickel demand).

Last month Conico snagged the celebrated Greenland-whisperer Thomas Abraham-James as its newest non-executive director after the executive geologist stepped down as CEO of Conico subsidiary Longland Resources – responsible for exploration at Greenland’s prospective Ryberg and Mestersvig projects.

The $36.67m market cap company has been exploring the 4,500km2 Ryberg project with an eye on electromagnetic anomalies and high-grade surface expressions of copper, palladium, gold and also nickel, cobalt and platinum.

Field activities have kicked off at the project, including helicopter drop-in visits to newly identified targets from the regional magnetic survey from late last year which identified a number of anomalies of interest including Pyramiden, Quest and Qiterpiaaneq that will be followed up with reconnaissance mapping and sampling.

Last week $24.19m market cap stock Nordic Nickel revealed its MRE (mineral resource estimate) for the Hotinvaara prospect, which sits at 133.6Mt at 0.21% nickel and 0.01% cobalt for 278,520t of contained nickel and 12,560t cobalt.

In the Central Lapland Greenstone Belt of northern Finland, the Hotinvaara deposit starts at surface, with 227,000t contained nickel metal (81% of total) within 250m of the surface – great news on the heels of the company raising a hot $12m and listing on the ASX in June.

Central Lapland’s largest near-surface, low-grade disseminated nickel deposit is Kevitsa (307Mt at 0.21% Ni and 0.32% Cu), owned by Swedish mining company Boliden, which is located just 195km from Pulju.

“The main reason why we are confident with this near-surface material is because Boliden’s project is economic at around the same grade – they are also processing that material and have the full value chain in Finland, which is the only country in Europe with a nickel sulphide refinery and smelter,” MD Todd Ross said.

Copper is an essential component in EVs, and is used in electric motors, batteries, inverters and wiring.

Plus, copper is a key component of EV charging infrastructure and is found in cables, transformers and wiring to the electric panel.

Global demand for copper is projected to grow to 45Mt by 2030, and up to 70Mt by 2050, and Europe will require 1.25Mt of copper, rising to over 1.5Mt in 2040 (equivalent to 35% of Europe’s copper consumption today) by 2030.

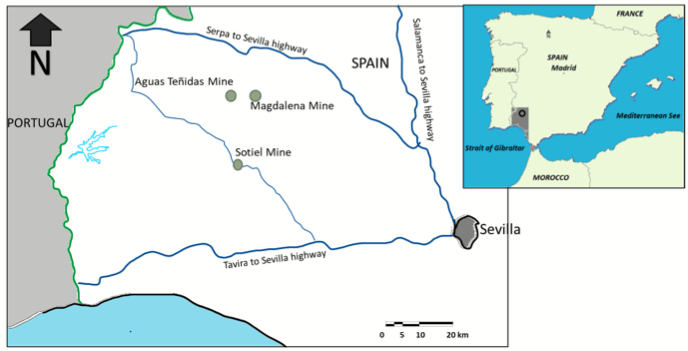

One of the most publicised copper deals of the last year was Sandfire’s US$1.8 billion deal ($2.6b) for the MATSA copper and zinc mine in Spain from Trafigura and Mubadala Investments.

MATSA contains three underground mines with a central processing plant capable of producing 100kt-120ktpa.

While the price was high, Sandfire’s charismatic boss Karl Simich had been quick to claim a bargain on the broader exploration potential of the asset, located near the original Rio Tinto copper mine in Spain.

It has provided the first evidence of that, releasing a first resource estimate last month of 147.2Mt at 1.4% copper, 3% zinc, 1% lead and 39.6g/t silver, containing 2.1Mt of the red metal, 4.4Mt zinc, 1.5Mt lead and 187.6Moz of silver.

Measured and indicated resource include 109Mt at 1.5% copper and 3.2% zinc, 14% up on the previous resource from the end of 2019 after depletion.

Sandfire says a new ore reserve and life of mine plan is due for completion in the September quarter, around the same time as the company’s DeGrussa mine in WA is due to wind up.

The overall resource also contains the first indication of the potential scale of satellite resources outside the project’s major Aguas Tenidas, Magdalena and Sotiel mines with the Concepción, Poderosa and Castillo-Buitrón deposits totalling 19.8Mt at 1.2% Cu and 1.6% Zn.

Sandfire is planning more than 35,000m of resource development drilling at MATSA in FY23.

The $1.62b market cap company had US$390.5 million cash at the end of the March quarter.

AERAMENTUM RESOURCES (ASX:AEN)

Ok this company hasn’t listed yet, but it’s worth a mention.

AEN is IPOing at $7m at $0.20 with plans to explore the Treasure (Black Pine) Project, in the Republic of Cyprus, which has numerous occurrences of high-grade nickel, copper, gold and cobalt in sulphides associated with a major transform fault.

There is also evidence of past mining activity with multiple underground adits and shafts – probably because back in the days of the Roman Empire, Cyprus supplied much of the world’s copper requirements.

Plus, around 74 million tonnes of massive sulphide ore extracted from around 30 deposits on the island between 1920-1970.

The company says previous exploration at its projects has returned grades up to 3% cobalt, 18% copper, 17 g/t gold and 11% nickel – and that the first target orebody at Laxia remains open at depth and along strike.

Zinc is largely used in construction and to extend the lifetime of steel through galvanisation, but EV production and solar panels are the main drivers for its energy transition demand.

It’s worth noting that while zinc-ion batteries don’t catch fire the same way lithium batteries sometimes do, they don’t have anywhere near the market saturation or rechargeability at present.

With that in mind, Eurometaux says global demand for zinc is expected to grow to ~20Mt by 2030, and up to ~25-27Mt by 2050.

And for Europe to meet its energy transition goals it will require 250-270Mt of zinc, rising to 300-320Mt by 2040 and then stabilising (equivalent to 10% of Europe’s zinc consumption today).

This company has assets in both zinc and cobalt.

AZI owns the Gorno Zinc Project in northern Italy, where a scoping study last year revealed an estimated total production target of 6Mt containing 77% indicated and 23% inferred mineral resources.

Positive financial metrics include a post-tax net present value (NPV) of around US$211m ($288M), a post-tax internal rate of return (IRR) of around 50%, and a payback period of 3.5 years from final investment decision and 2.5 years from first concentrate production.

Plus, when the scoping study was done the price of zinc was US$2,850 per tonne.

The company clearly knows the value of its assets, last month rejecting a takeover offer from VBS, calling the bid “neither fair nor reasonable” and recommended shareholders reject the offer.

AZI also has the Punta Corna Cobalt Project in northern Italy where recent sampling has returned high-grade cobalt, nickel, copper and silver results.

“Punta Corna has the potential to provide Europe with an ethically sourced, sustainable, domestic supply of cobalt, nickel and other green energy metals, and in the opinion of the directors has the potential to be a ‘company maker’ in its own right,” the board said.

The $37.21m market cap company had $6.102m cash at 31 March 2022.

The company just released a zinc dominant inferred resource at its Sala project in Sweden of 311,000t of contained zinc, 15Moz of silver, and 44,000t of lead.

The company says it considered the resource to be of a Stage One nature, with substantial growth expected given the mineralisation is open in all directions and drilling is ongoing.

“This is an outstanding maiden Resource which demonstrates the growing scale and quality of the Sala project,” MD Peter George said.

“The fact that we established such a substantial Resource in just over a year of taking ownership also highlights the strength of the mineralisation and the immense ongoing growth potential.”

The $30.31m market cap company is well-funded to continue to grow the Sala deposit with $6.1m cash as at 31 March 2022.

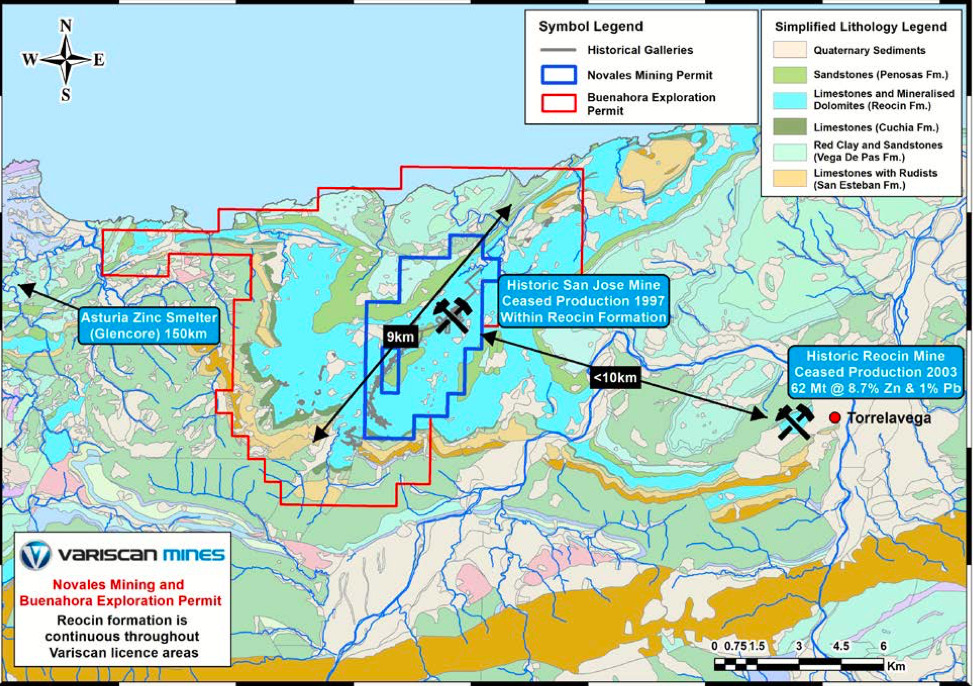

VAR owns two zinc-focused projects in Spain – its flagship Novales-Udias project, where the San Jose Mine resides, and Guarjaraz.

The company is confident that everything is moving in the right direction for future development and mining restart scenarios for the historical San Jose Mine, with a mineral resource pending.

“This is an asset which is a proven past producer, running at a head grade of around 7%,” MD and CEO Stewart Dickson told Stockhead.

“We also know that the ore is amenable to processing and concentrates of in excess of 55% had been produced using all the technology and again, we know that that was done profitably in a price environment which was three to four times lower than it is today.

“It’s worth remembering that Europe consumes 20% of metals globally, and only exports 3% so it’s a net importer of metal – and it’s hungry for metal.”

The $7.46m market cap company had $3.01m cash at 31 March 2022.

Graphite flies under the radar when discussing lithium-ion batteries but an EV battery contains around 50kg of the stuff, around 10 times the amount of lithium required.

It is the -100-mesh product (also known as natural graphite concentrate) used in the production of spherical graphite for anodes in lithium-ion batteries that has analysts predicting the graphite market will enter a period of unprecedented growth.

Benchmark reckons a structural deficit is looming as global demand begins to outstrip supply, Credit Suisse says there’s a chance graphite could become a better play than lithium, and the World Bank forecasts low-carbon energy technologies will require 4.5Mt of graphite per year by 2050.

There’s only a few operating mines in Europe at the moment, with China and Brazil providing a solid chunk of the EU’s supply of natural graphite.

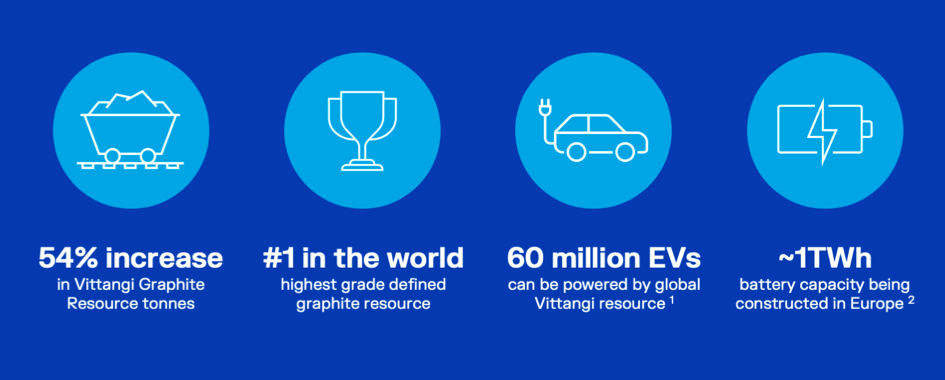

Back in May the battery materials company boosted anode growth ambitions after revealing a 54% increase to the Vittangi Graphite resource in Sweden – the largest natural graphite resource in Europe and the highest grade JORC graphite mineral resource in the world.

The latest update, based on 2021 drilling, brings the Vittangi Graphite Project global mineral resource estimate to 30.1 million tonnes of graphite ore at 24.1% contained graphite, adding an additional 10Mt.

TLG managing director Mark Thompson said that with more than 960GWh of lithium-ion battery capacity using graphite anode tech planned across Europe, this resource boost “sets the company up to become a major supplier to the world’s fastest growing lithium-ion battery markets.”

The estimate also includes a maiden mineral resource for the new Nunasvaara East discovery, the delineation of which continues to support the high continuity of graphite grade between known deposits.

Vittangi graphite deposits remain open along strike and at depth, with further drilling planned to underpin continued resource growth.

The $335.47m market cap company had $22m cash at the end of the March quarter.

Last month Volt announced plans to raise $2m as it looks to recommence production at the Zavalievsky Graphite mine and processing facilities in Ukraine.

The company says the funds will also be used to continue the production of test work samples for battery anode material for lithium-ion battery cell manufacturers, ultra high purity graphite for alkaline batteries (Urban Electric Power), and lead acid batteries (Apollo Energy Systems).

“The decision to recommence the graphite mine and processing operations in western Ukraine is a positive step forward for the Zavalievsky management and staff, local communities and businesses that depend on the graphite business for their livelihoods,” MD Trevor Matthews said.

“Volt has a lot of activities in progress as we work to develop the integrated graphite material mine-to- cell-maker supply chain.”

The $18.68m market cap stock finished the March quarter with $0.73m cash.

There’s more than just straight miners or producers in the EV supply chain – battery recyclers are becoming more and more prevalent.

In fact, Eurometaux says recycling will take a much bigger role in meeting increasing demand from 2035 onwards.

The report estimates that around 65-75% of Europe’s 2050 cathode needs could come from recycling – as long as there are process improvements and economic viability.

However, by 2050, 40–75% of Europe’s clean energy metal requirements could be met by local recycling if the bloc invests heavily now and fixes bottlenecks.

“Recycling is Europe’s best chance to improve its long-term self-sufficiency,” says the report.

“It’s a step-up that our clean energy system will be based on permanent metals which can be recycled indefinitely, compared with today’s constant burning of fossil fuels.”

The company reinvented itself as a battery recycling stock after selling out of its minority stake in the Mt Marion mine a few years ago.

In March, the company’s battery recycling JV, Primobius, officially opened its 10tpd commercial lithium-ion battery (LIB) recycling plant in Germany. It is expected to commence operation soon.

In May, it executed a cooperation agreement with iconic German carmaker Mercedes-Benz’ recycling subsidiary LICULAR which it just announced this week was now legally binding.

The $512.73m market cap company had $65.2m in the bank at the end of the March quarter.

Notably, the company is partially owned by NMT and in February – as part of its plans to pivot focus to recycling lithium-ion batteries – executed a Heads of Agreement with Greenhouse Investments providing it with right to expand its lithium battery recycling commercialisation activities into the United Kingdom, Ireland, Italy, and the Balkans.

The company’s sub-licences and rights now cover territories incorporating 49% of the population of the EU and 38% of all motor vehicles registered in the EU, which it says gives it “tremendous leverage to the rapidly growing European LiB recycling sector, and specifically countries with the highest penetration rate of electric vehicles.”

Hannans executive director Damian Hicks says it’s abundantly clear that Europe needs a scalable, safe, and sustainable, lithium battery recycling solution.

“We believe the technology we will hold sub-licences to will help stakeholders in our licenced jurisdictions meet their circular economy ambitions and legal obligations to recycle,” he said.

The company will raise up to $3.5m at 3.5 cents per share to fund activities in the new territories, and if shareholders approve the proposed transaction, Greenhouse will be issued 19.9% of Hannans’ consolidated capital base (pre capital raising).

The $60m market cap stock had $4.5m cash at 31 March 2022.

At Stockhead we tell it like it is. While Alicanto, Variscan Mines, Altamin, Nordic Nickel and Conico are Stockhead advertisers, they did not sponsor this article.