Investors hungry for Wattle’s China infant formula deal, shares jump 13pc

Food & Agriculture

Shares in infant formula producer Wattle Heath surged 13 per cent on news the company has inked a distribution deal for mainland China.

The deal with International Supplied and Distribution Company (ISDC) — an Australian-owned company with strong business links to China — includes guaranteed minimum export volumes to China.

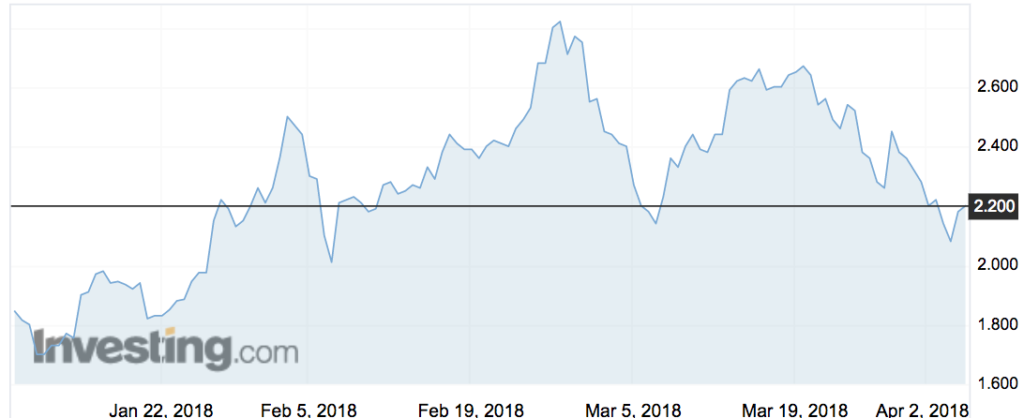

The stock (ASX:WHA) surged 13 per cent to $2.35 in early trade, before settling back to $2.20 by 12pm AEST.

Wattle’s shares are up more than 500 per cent over the past year as a key mover among ASX infant milk stocks exporting to China.

Under the deal, ISDC will buy 1.5 million units of the company’s conventional cow milk infant formula in the first 18 months — and the same again the following year.

Guaranteed volumes peak at 2.2 million units in the 12 months after that — at which point both parties will set new volumes.

The formula will be distributed through ISDC’s network of 2000 mother and baby stores and a wholesale network of chemists, supermarkets and convenience stores in China.

“This transaction represents significant volumes and allows us a certain amount of flexibility to transact in mainland China with a view to grow our product in the global landscape in the long term,” chairman Lazarus Karasavvidis told Stockhead.

The deal is awaiting a final stamp of approval from the China Food and Drug Administration and signing of a formal supply agreement.