ASX thermal coal ‘rapidly finding new homes’, touches 20-month high

Mining

Mining

Surging demand from Asian buyers in Japan, South Korea and Taiwan for Australian thermal coal has driven prices at the Newcastle shipping hub to a 20-month high.

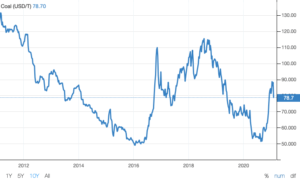

Spot market prices for higher-grade Newcastle 6,000 kcal/kg net-as-received thermal coal were trading this week at $US80 per tonne ($105/tonne) on a free-on-board basis at the port, down from $US90 per tonne in late January.

Colder winter temperatures in North Asian coal-consuming countries has brought some Japanese and Korean power generators on to the spot market to top-up their stocks.

“Thermal coal prices from Newcastle (6,000 kcal/kg NAR) lifted strongly in Q4 2020 as cold weather in North Asia pushed up heating and electricity demand,” said analysts at Commonwealth Bank of Australia (CBA).

Coal export volumes at the port of Newcastle reached a four-month high in December, and a one-year high for Queensland’s Gladstone port, said Westpac analysts in a report.

“The sharp improvement in December volumes is likely due to cold winter conditions in Asia; heavy rains in Kalimantan and rising demand out of Japan, South Korea and Taiwan, ” said the bank.

Korean power companies have been snapping up cargoes of Australian thermal coal in recent spot market tenders at prices around $US80 FOB Newcastle, 6,000 kcal/kg NAR basis.

“Demand was also strong enough to shrug off South Korea’s curtailment of 16 of its coal-fired power generators for three months from December (out of the country’s 60 coal-fired power generators),” CBA said.

South Korea has been pursuing a policy of reducing its winter consumption of thermal coal in order to decrease air pollution in urban areas.

Thailand in south-east Asia is also emerging as a buyer of Australian thermal coal, alongside neighbouring Malaysia and Vietnam with their growing energy-hungry economies.

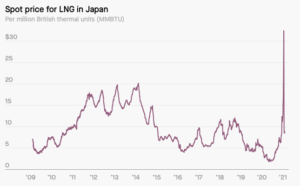

A parabolic rise in spot market prices for alternative generation fuel gas in its liquefied form has also pushed some power utilities into the thermal coal market.

Power utilities in Japan, Korea and Taiwan turned to thermal coal as a cheaper alternative to liquefied natural gas which has rocketed in price.

“Coal prices also found support from surging spot LNG prices, as demand proved more than anticipated,” CBA said.

February-delivery cargoes of LNG were changing hands in the Asian market at $US33/MMBtu in January, their highest level since spot prices were published in 2009.

Asian prices for LNG cargoes have since retraced to just under $US10/MMBtu this week as local temperatures started to increase and dampened demand for energy.

The rapid decline in LNG prices could trigger a similar decline in prices for competitor fuel thermal coal in the coming weeks.

“We expect thermal coal prices to decline from current levels as heating demand wanes and as seaborne supply responds to higher prices,” said CBA.

The bank forecasts a price of $US60 per tonne for Newcastle higher grade, 6,000 kcal/kg NAR thermal coal later this year.

There are a number of ASX coal companies that provide exposure to the thermal coal market including, BHP (ASX:BHP) with its Mount Arthur mine in NSW, Terracom (ASX:TER) with its Queensland Blair Athol mine, and Yancoal Australia (ASX:YAL) with its portfolio of NSW Hunter Valley mines.

Spot prices for LNG cargoes in Asia have plummeted after hitting record highs in mid-January. Image: S&P Global Platts

Thermal coal prices are also finding good support from a rebounding global economy after COVID-19, and strong economic stimulus measures, ANZ bank said in a report.

Recent disruption to the thermal coal market from China’s reduced buying interest for Australian cargoes is starting to be overcome as shippers find new homes for their product.

“Coal markets appear to be stabilising following the restrictions in Chinese imports, with new trade flows being established,” said ANZ.

“In particular, Australian coal shut out of China is rapidly finding new homes.

“This should see global benchmarks for both thermal and metallurgical coal recover from recent lows,” the bank added.

“Commodity markets are a zero sum game. When China pulls resources from another source that just means some other country has to find a new place to buy,” said ANZ analysts.

Also, Australia’s thermal coal market has tightened over the past year as large producer Glencore has instigated a series of production cuts.

China remains a strong consumer of imported thermal coal, its volume rose 1.4 per cent in 2020 to 304 million tonnes, but it has diversified away from Australian to other origins.

The drop-off in Chinese interest for Australian thermal coal is showing up in the 5,500 kcal/kg NAR grade of Newcastle product which has traditionally been favoured by China.

Prices for this grade hit an all-time low of $US38 per tonne FOB Newcastle in September, but have recovered to around $US62 per tonne this week, according to reports.

Analysis of shipping data by commodity markets consultancy CRU show China’s imports of thermal coal in the first two weeks of January equalled 70 per cent of its December intake.

“We expect China’s coal demand and imports to weaken after the Chinese New Year [in February] as temperatures rise and coal production normalises,” said Fitch Ratings.

An often overlooked issue for Australian cargoes destined to China is the cost of shipping delays as vessels are experiencing long waiting times outside Chinese ports.

Costs for these delays can quickly mount and can add around US$4 per tonne to the cost of a cargo of Australian thermal coal for each month a ship is waiting off a Chinese port.

Other origins of thermal coal including Colombian, Indonesian and Russian and recently South African, face fewer delays at Chinese ports.

“Russia and Indonesia filled the marginal tonnes of thermal coal demanded by China’s energy sector,” said CBA.

Indonesia’s thermal coal sector has signed a $US1.5bn three-year supply deal with China, which analysts interpret as a signal of Beijing’s intent toward Australian product.

“China’s preference for thermal coal from Russia and Indonesia increases the risks that any restrictions on Australian thermal coal may be extended,” CBA analysts added.