‘Virtually zero interest’: The lucrative thermal coal imports trade to China is at a crossroads

The market for thermal coal imports in China is at an uncertain crossroads. Image: Getty

- Thermal coal shipments to China have slumped since July to a low in October

- ‘There is virtually zero interest in Australian coal from Chinese buyers currently’

- China may loosen import controls in December, but will target Indonesian coal

As an eventful 2020 draws to a close, the market for thermal coal shipments into China has arrived at a crossroads with analysts evenly divided over its future prospects.

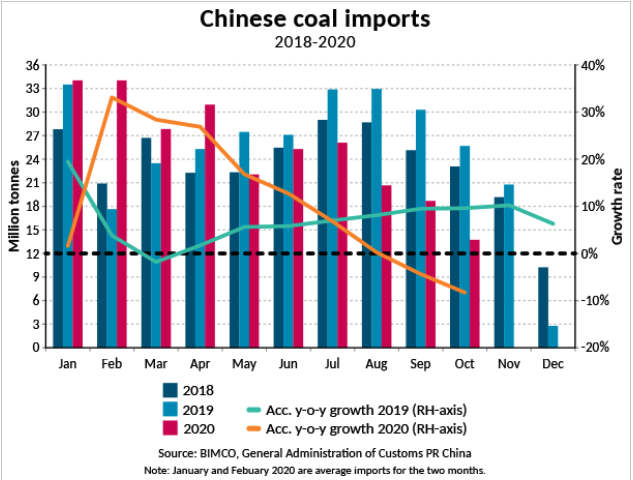

China’s intake of all types of imported thermal coal had been motoring along nicely, with volumes in line with previous years, until something changed around July-time.

From this point on thermal coal imports – including Australian – into China plummeted.

“There is virtually zero interest in Australian coal from Chinese buyers currently,” Wood Mackenzie principal analyst, Rory Simington told Stockhead.

A huge backlog of ships laden with thermal coal has developed off China’s coastline, and they are having to wait to enter Chinese ports to discharge their cargoes.

“Based on ship-tracking data from VesselsValue, there were 133 bulk ships waiting to discharge in Chinese ports in mid-November, 59 of which had been waiting for 20 days or more,” said Peter Sand, chief shipping analyst for BIMCO, reported Hellenic Shipping News.

In October, the latest month for available data, thermal coal shipments into China dropped 46 per cent year on year to 13.7 million tonnes.

This is strange, as prices for thermal coal have stayed relatively low. In fact it is cheaper for Chinese buyers to purchase cargoes of Australian thermal coal than domestic Chinese coal.

“Chinese imports are becoming more policy-driven than economically-driven as end users play by the quota book and import arbitrages stay wide open,” said Rodrigo Echeverri, head of research at commodity trader Noble, reported Argus Media.

He expected China’s thermal coal imports to remain flat next year.

China has imported 253 million tonnes of thermal coal in the 10 months ended October, 8 per cent lower than the similar 2019 period for which the imports total was 299.6 million tonnes.

The drop in October thermal coal imports represents 60 Capesize freight carrier cargoes.

Imports relaxation on the cards for December

There is market speculation that Beijing may relax its import quotas for thermal coal for the balance of 2020 to allow in up to 20 million tonnes of cargo starting in December.

These additional imports are needed as China’s domestic coal mines struggle to meet demand for the northern hemisphere winter.

Mine accidents in China’s coal-producing provinces of Shanxi, Shaanxi and Inner Mongolia have constrained production as mines conduct safety checks and proceed cautiously.

“There is still some 2020 quota remaining, but no clarity regarding how much,” said Simington.

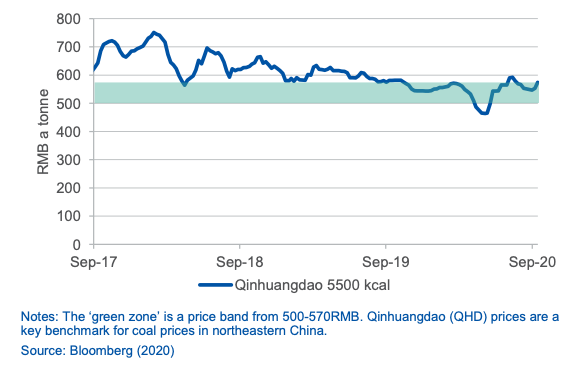

Another reason for allowing in imports in December is that market prices for domestic thermal coal in China have soared close to $US100 per tonne (RMB615/t), said reports.

Beijing has for some time operated a policy of price stability for Chinese thermal coal.

This aims to keep domestic thermal coal trading in a tight price range of RMB 500-570 per tonne.

“China’s government has tended to ease import restrictions when domestic prices exceed RMB 570/t [$US86/t], and tighten restrictions when the price goes below RMB 500,” said the Australian government’s chief economist in a September quarter commodities report.

Open door to extra imports may close quickly

The open door to cargoes of imported thermal coal may only last as long as it takes for domestic thermal coal prices to drop below RMB 570/t.

“However, we do not think 20 million of additional coal should be purchased for delivery to China in December,” said Wood Mackenzie senior consultant, Yu Zhai.

Several reasons are behind this, firstly the Chinese government does not want to cause an immediate spike in seaborne prices for thermal coal imports, and China’s ports are already clogged with existing demand.

“Unloading imported coal in Chinese ports will not be easy anytime soon as we estimate the ports are full of imported coal yet to clear [customs],” said Yu.

And, China’s coal-fired power sector is running at lower levels this year due to stronger electricity generation from its hydro-electric plants.

A more likely imports scenario for China in December is that it will wait to clear 10 million tonnes of cargo waiting to unload from ships, and then allow in 10 million tonnes of extra imports over the next few months.

Indonesian thermal coal is likely to be the main beneficiary of this imports surge, Woodmac said.

“We expect more than 10 million tonnes of Indonesian thermal coal will arrive in China in December,” said Yu.

“Indonesian products are mainly low-sulphur, low ash coal, which is needed for China’s generators to blend with domestic high-sulphur coal in winter, normally a high pollution period,” she said.

High sulphur content thermal coal can produce more air pollution when burned in power plants to generate electricity.

Outlook for China’s imports demand is mixed

Some market commentators believe that trade volumes into China for thermal coal will surge once the new year starts and China resets its import quotas.

“We don’t know what the quotas will be for 2021. However, we note that if the additional quota is allocated, imports will be higher than last year’s 300 million tonnes, and also higher than the 270 million tonnes in 2017 which the 2020 quotas were said to be based on,” Simington said.

Others in the thermal coal market are less bullish and suggest China’s demand for seaborne-traded thermal coal including Australian may soften.

This may be linked to China’s long-range pledge to reduce its emissions from carbon-based fuels including coal, in line with its 2060 net zero carbon pledge.

China tends to prioritise its domestic coal industry over imports which are seen as a top-up.

“In 2021 and 2022, with domestic mine output in China lifting more quickly than consumption, China’s imports should decline,” said the chief economist’s report.

Shipping industry depends on bulk commodities trade

The future of China’s trade in thermal coal imports is important for Australian coal producers, and for the global shipping industry which depends on the bulk cargo business.

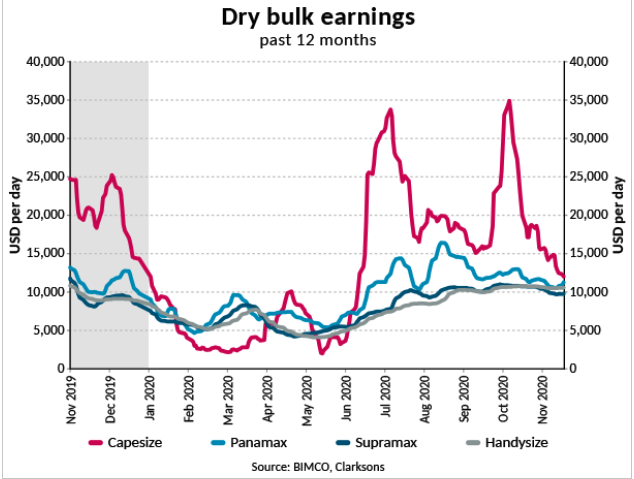

Shipping rates for large Capesize bulk carriers have been falling since peaking at $US35,000 per day in October and are trading around $US10,000 per day.

This is still above average earning rates for the year at $US2,200 per day for a Capesize ship, and lower than the $US15,000 per day required by ship operators to break even.

An added penalty for ship owners is that they have to cover the cost of delays for ships waiting to enter Chinese ports, if the vessel was booked on a cost and freight (CFR) basis.

In the short term, shipping delays reduce the available supply of ships to carry bulk commodities like coal, but once backlogs are cleared, an oversupply can appear.

“All forecasts now point to a slow recovery in 2021, which even a 20-year low in [vessel] fleet growth will not be able to make up for, leaving bulk shipping to face another trying year,” said Sand.

Thermal coal exports, mostly to Asian countries including China, are expected to net Australia an income of $15bn in the 2021 financial year, down $6bn on the 2020 FY.

ASX thermal coal companies are likely going to have to carefully navigate a period of uncertainty in terms of China’s import trade.

Several ASX companies have thermal coal mines including, BHP (ASX:BHP), New Hope Corporation (ASX:NHC), TerraComm Resources (ASX:TER), Yancoal Australia (ASX:YAL) and Whitehaven Coal (ASX:WHC), with differing exposure to China’s market.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.