ASX Small Caps Lunch Wrap: ASX up 0.8pc, job vacancies fall and Star punts on $200m bailout

News

News

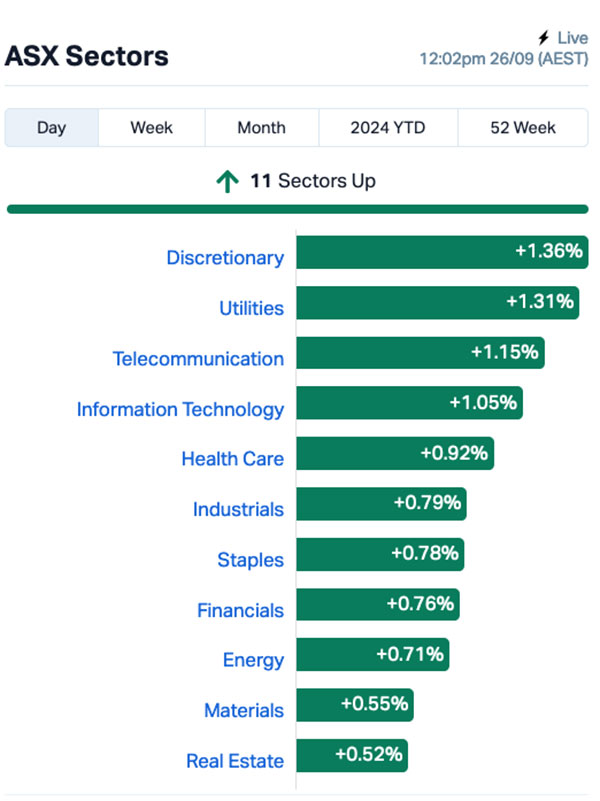

Local markets were up at lunchtime today, with the benchmark at +0.8pc and every sector in the green.

The solid morning performance is down to a few factors, not least of which is the helping hand the Aussie economy is getting from China’s recent stimulus news.

We’re expecting a fresh report from the RBA this morning, looking into how financially stable the nation is – I’ll do my best to wrap my weak little brain around that for you, but I’m making no promises.

And the news headlines this morning are focussed on two things – a well-timed report from consumer advocacy group Choice about just how pricey your groceries are was dropped this morning, and there’s some widely anticipated news from Star Entertainment Group around its plans to gamble its way out of debt.

Spoiler alert – Queensland’s state premier is not very happy with Star. No sir, not even a little bit.

Let’s get into it, shall we?

The ASX 200 benchmark was up 0.8% at lunchtime today, with the gains turning every sector green by at least 0.5% – a nice change from the variable scenes we’ve had over the past few sessions.

Investors are piling into the Consumer Discretionary sector today, and it’s out in front of the rest of the market thanks to retailers JB Hi-Fi and Harvey Norman both gaining more than 2.2% – and gambling-related stocks like Aristocrat Leisure and the Lottery Corp, which were up 1.3% and 0.3% respectively.

Resources stocks are likely to be in focus again today after iron ore prices rose further last night, this time by around 2%. The recent rise in iron ore prices has been driven by China’s monetary stimulus announcement.

However, the surge we’ve seen in the past two days appears to have slowed dramatically, with barely a ripple across the major commodities so far this morning, and last time I looked (about 1:00pm today), the SGX TSI Iron Ore price was down 0.24% to US$96.40/t.

Up the big end of town, Platinum Asset Management (ASX:PTM) has responded to last week’s takeover offer from Regal Partners (ASX:RPL) with a firm “yeah, nah…”, saying that the offer of 0.274 Regal shares and a fully franked special dividend of A$0.20 per Platinum share undervalues the takeover target.

The more salacious news from the big end of town is that Star Entertainment Group (ASX:SGR) is set to deliver its long-overdue financial results today, on the heels of a post-close announcement yesterday that it has struck a $200 million deal with financiers to help it get back on track.

There are several things to note about this story.

Firstly, the financing. SGR has secured a two-tranche, $200 million debt facility – on top of its existing $450 million facility, which the company says has been reduced to $334 million, and which is fully drawn.

There’s a bunch of conditions around the $200 million lifeline, including the sale of the Treasury Brisbane casino building, but it’s the interest rate that’s getting all the headline attention.

The “all-in coupon” for the new facility is an eye-watering 13.5% – a smidge under the 14.9% you’re probably paying on your non-rewards credit card – with that rate now applied to the existing $300 million term facility.

Star says there is a reduction in the coupon subject to the Group’s Adjusted Net Leverage Ratio falling below 4.0x – but hasn’t made the reduction rate public as yet.

Queensland Premier Steven Miles spoke to reporters this morning about the deal, explaining that his government had considered offering Star some form of tax relief, but negotiations had “reached a stalemate”.

“There will be no consideration of any kind of arrangement while their executives insist on paying themselves performance bonuses,” Miles said.

“Those bonuses run into the tens of millions of dollars, we won’t be returning to the negotiation table. We were very reasonable in considering tax deferral which is a common arrangement where you have taxpayers who can’t meet their tax obligations.

“But we wouldn’t entertain that arrangement while executives are paying themselves performance bonuses,” Miles said.

Take a moment and let that sink in… and it’s probably best we move on at this point.

There’s fresh economic data today to sift through – and I won’t have time to get through all of it before deadline today, but here’s my best shot at it.

First up: The Australian Bureau of Ascertaining Numerical Values (ABS) has released its latest quarterly job vacancies data, and it’s showing a 5.2% fall in vacancies for August, a drop of 18,000 on the heels of a 3.5% decline in the May quarter.

“The gradual decline in job vacancies continued, with the quarterly fall in August 2024 the ninth in a row, and vacancies now well below the series peak of 473,000 in May 2022,” ABS head of labour statistics David Taylor said.

“However, while the number of job vacancies has fallen over the past two years, they remain 45.1% higher, or 102,000 more, than before the COVID-19 pandemic.”

Meanwhile, the RBA has derived its bi-annual delve into the nation’s financial stability, and the take-home from that is this nugget of depressing reality: the number of borrowers whose essential living costs and mortgage payments are more than they’re collecting in their pay packets has remained at 5%.

But even for those in that situation, it’s kind-of okay – provided they’re well entrenched on the mortgage treadmill, as the rapidly escalating cost of housing is helping to keep them from falling into a negative equity spiral.

The RBA showed its warm and fuzzy side, noting that most borrowers “would be able to sell their properties and repay their loans in full before defaulting on repayments”, so… hooray?

Gotta leave it there, I’m afraid… I really wanted to cover the report from Choice this afternoon, but tempus fugit, and I have sadly lost my wings.

Overnight, the S&P 500 slid by 0.19% after a wobbly session as investors mulled over the Fed’s rate-cut plans and sifted through housing market data.

The blue chips Dow Jones index was also down by 0.7%, and the tech heavy Nasdaq closed flat.

In stock news, Micron Technology saw its shares jump 14% in after-hours trading after posting earnings that beat estimates and unveiling a strong revenue forecast fuelled by demand for AI.

Nvidia also climbed around 0.7% following the news.

Sports betting stock Flutter Entertainment jumped as much as 8% to reach an all-time high after the company revealed a US$5 billion share buyback plan and said the US online gambling market will grow by 60% more than it forecast two years ago.

Other wagering stocks also rose, with DraftKing rising by 5%.

Meanwhile, Warren Buffett’s Berkshire Hathaway has trimmed its stake in Bank of America again, selling off 21.6 million shares and raking in about US$862 million in profit. BofA’s shares were down 0.5%.

In Asia this morning, the mood is definitely upbeat. At lunchtime today, Japan’s Nikkei was up 2.5%, the Hang Seng was 1.75% higher and Shanghai markets were up 0.8%.

Time for a very quick look at today’s Small Caps winners, and… crap, there’s loads of them.

*sigh*

Here are the best performing ASX small cap stocks for 26 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap RIL Redivium 0.005 66.7 4,489,149 $8,240,564 AAU Antilles Gold 0.004 33.3 2,577,025 $5,567,228 ATH Alterity Therapeutics 0.004 33.3 2,327,003 $15,961,008 OAR OAR Resources 0.002 33.3 5,050,000 $4,951,252 PLC Premier1 Lithium 0.013 30.0 12,336,017 $1,745,741 NMT Neometals 0.14 27.3 3,169,039 $75,888,790 BMO Bastion Minerals 0.007 27.3 5,702,900 $2,785,818 GTI Gratifii 0.005 25.0 2,722 $8,596,785 RGL Riversgold 0.005 25.0 7,127,502 $5,309,850 VML Vital Metals 0.0025 25.0 50,899 $11,790,134 BKY Berkeley Energia 0.39 23.8 47,996 $140,425,965 GLA Gladiator Resources 0.016 23.1 1,173,577 $9,857,859 QEM QEM 0.11 22.2 39,161 $13,625,254 SRR Sarama Resources 0.03 20.0 1,136,038 $4,170,554 CTN Catalina Resources 0.003 20.0 3,024,191 $3,096,217 WMG Western Mines 0.26 18.2 19,855 $18,733,237 JRV Jervois Global 0.013 18.2 4,215,045 $29,730,402 TTT Titomic 0.135 17.4 2,086,885 $118,666,054 1AI Algorae Pharma 0.007 16.7 615,169 $10,124,368 POS Poseidon Nickel 0.0035 16.7 584,353 $12,611,626

Alterity Therapeutics (ASX:ATH) was up by quite a lot, well ahead of it delivering its Annual Report this afternoon, which I haven’t read because it wasn’t live by the time I wrote this. We’ll cover its contents in Closing Bell this afternoon.

Premier1 Lithium (ASX:PLC) – formerly known as SensOre – was rising early after releasing the results of a strategic review of all exploration assets for their gold and copper potential based on all available historical exploration data. The company says the review has identified “significant untapped potential within the Yalgoo project area” in WA’s Murchison region, where historical drilling has revealed “numerous high-grade gold intercepts at near surface that have been largely untouched since the 1990s”.

Bastion Minerals (ASX:BMO) was up after announcing that it has secured the services of Canadian Northwest Territories geological experts Aurora Geoscience to prepare an exploration plan to follow up historical work and gain a better understanding of a “large >520m long mineralised quartz vein” identified by previous owners Mariner Mines, during previous exploration that intersected grades up to 18.4% Cu.

Vital Metals (ASX:VML) was on the winner’s list, but the announcement today is just notice of the upcoming AGM – and the price movement was from $0.0020 to $0.0025.

Gladiator Resources (ASX:GLA) was rising sharply on news of a high-grade uranium find at the Mkuju Uranium Project, located in southern Tanzania, where drilling has confirmed 6 mineralised intervals including 7.1 metres averaging 1,963ppm eU3O81, from 63.1 metres depth.

Catalina Resources (ASX:CTN) was up after it delivered its annual report, which is 73 pages long. I am assuming its good news as the share price jumped 20% this morning – we’ll cover it in Closing Bell in more detail.

Western Mines Group (ASX:WMG) was up after announcing assay results for three Phase 3 RC drilling holes at Mulga Tank, which show “broad zones of nickel sulphide mineralisation – elevated Ni and S coincident with highly anomalous Cu and PGE”. The intercepts include 188m at 0.28% Ni, 129ppm Co, 57ppm Cu, 23ppb Pt+Pd from 112m S:Ni 1.1.

Titomic (ASX:TTT) was rising this morning on news that it has sold its first D623 cold spray system to an Australian client, United Industrial Solutions, a specialist in coatings and corrosion mitigation for the resource sector, for $174,000. Titomic says the system’s primary application will be “the deposition of corrosion-resistant coatings on critical oil and gas assets, primarily in Western Australia”.

Earlier, Arika Resources (ASX:ARI) – formerly known as Metalicity – was up on news that assays received from a further 9 holes at the Pennyweight Point prospect within the Yundamindra gold project, have returned “further exceptional results”, such as 30m @ 2.36 g/t Au from 64m, and 23m @ 2.84 g/t Au from 53m. Arika currently holds an 80% stake in the project, alongside 20% stakeholder Nex Metals (ASX:NME).

Here are the most-worst performing ASX small cap stocks for 26 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap IEC Intra Energy 0.001 -50.0 652,303 $3,381,563 BCT Bluechiip = 0.002 -33.3 11,110 $3,552,937 OVT Ovanti 0.002 -33.3 11,481,001 $4,669,045 SI6 SI6 Metals 0.001 -33.3 568,225 $3,553,289 WEL Winchester Energy 0.001 -33.3 1,100,000 $2,044,528 PGO Pacgold 0.105 -27.6 456,255 $12,201,089 MRQ MRG Metals 0.003 -25.0 559,851 $10,846,075 NRZ Neurizer 0.003 -25.0 289,662 $8,724,477 RLG Roolife Group 0.003 -25.0 1,673,878 $3,176,585 RIM Rimfire Pacific 0.06 -24.1 13,583,549 $181,323,518 VEN Vintage Energy 0.007 -22.2 594,022 $15,025,782 KGD Kula Gold 0.008 -20.0 5,736,108 $6,432,119 TTI Traffic Technologies 0.004 -20.0 300,825 $4,864,426 VAR Variscan Mines 0.008 -20.0 817,339 $4,430,004 CRR Critical Resources 0.009 -18.2 5,429,779 $19,583,853 EQS Equity Story Group 0.023 -17.9 365,000 $3,051,817 IXU Ixup 0.015 -16.7 3,969,468 $27,859,547 DTR Dateline Resources 0.005 -16.7 2,937,262 $14,968,079 FTC Fintech Chain 0.005 -16.7 602,364 $3,904,618 CTT Cettire 1.88 -14.5 4,115,747 $838,724,084

Legacy Minerals Holdings (ASX:LGM) is catching the eye of investors today, after wide spaced reconnaissance drilling at the Bauloora project in New South Wales returned high grade hits of shallow silver, zinc, lead and gold.

A headline strike of 468g/t silver within a 0.6m at 10.8g/t gold equivalent intercept from 108m downhole was one of a number of tantalising strikes from the drilling, which was undertaken in the first phase of a $15 million joint venture earn-in funded by the world’s biggest gold mine Newmont, owner of the legendary nearby Cadia mine.

“The latest results have delivered shallow and high-grade hits up to 468g/t Ag, 22% Zn+Pb and 3.8g/t Au from wide-spaced reconnaissance drill testing,” Legacy managing director Christopher Byrne said.

“This is encouraging as we’re confirming multiple vein trends with strong mineralisation that until now had never before been drill tested.

“The success at these targets further highlights the potential of the large anomalous areas that remain undrilled and the potential of the Bauloora system that remains open in all directions.”

Mithril Silver and Gold (ASX:MTH) will soon also be known under the ticker (TSXV:MSG), after the company announced that effective Friday, September 27, 2024 Toronto time, the company’s ordinary shares will commence trading on the TSX Venture Exchange (TSXV).

Mithril says that the company’s TSXV classification is a ‘Junior Mining’ company, its trading symbol is MSG, and the transfer agent is Computershare Investor Services, and that it will retain its primary listing on ASX under the trading symbol MTH.

At Stockhead, we tell it like it is. While Legacy Minerals and Mithril Silver and Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.