- Novo shoots up 25% on ASX debut

- Octava soars after buying remaining 30% of Talga

- Odessa completes maps >46km of pegmatite strike at Lockier Range

- Killi hits high grade copper and gold at Mt Rawdon West

Here are the biggest small cap resources winners in early trade, Monday September 11

Novo Resources (ASX:NVO)

After raising $7.5m on its IPO to the ASX, Canadian gold miner Novo Resources has shot up 25% on its market debut.

Novo holds one of the largest prospective tenures for gold and battery metals in WA’s Pilbara region for 10,500km2 and is concentrating on the development of its Egina JV with its biggest shareholder, De Grey Mining (ASX:DEG).

Back in June, De Grey Mining made a cornerstone investment of $35m to earn up to a 50% interest in Novo’s Becher gold project, 28km away from DEG’s massive Hemi gold deposit which forms part of the 11.7Moz Mallina gold project. In Victoria, Novo also owns the Belltopper project.

Shares were listed at 20c and rocketed 25% on inaugural trade today to 25c.

Octava Minerals (ASX:OCT)

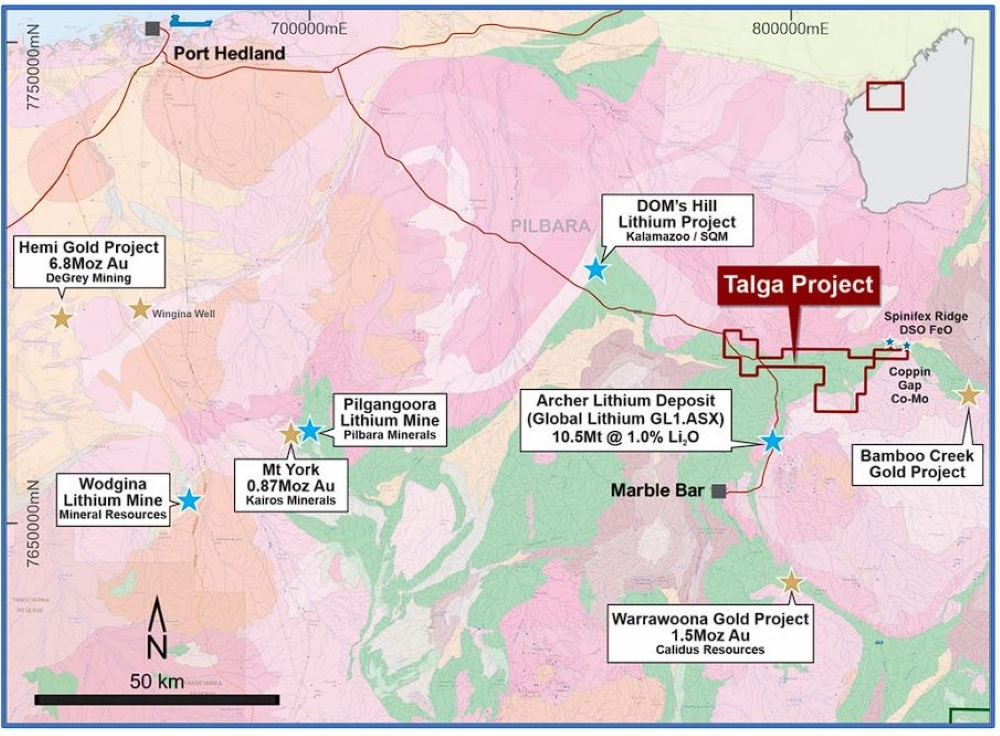

OCT now owns 100% of its Talga lithium project in the WA Pilbara after purchasing the remaining 30% from First Au (ASX:FAU).

This includes a 20% free carried interest held by FAU to a decision to mine via a $200,000 cash payment, the issue of 1.25 million shares to FAU to be escrowed for six months, and a 0.75% net smelter royalty.

Octava says the geology of its tenure is similar to the nearby 18Mt @ 1% Li2O Archer lithium deposit held by Global Lithium (ASX:GL1) and has significant gold prospects to boot.

The explorer says Talga also holds the potential for intrusion-related gold deposits, hosting the same mineralised Archean greenstone stratigraphy and structure as the nearby Warrawoona gold discovery made by Calidus.

“There is highly prospective geology at Talga that has already provided initial indications of the potential for discovery,” Octava MD Bevan Wakelam says.

“We will continue to actively conduct detailed exploration programs over the project area.”

With a $3.23m market cap, shares in Octava shot up 27% in early trade today to 8.9c/share.

Australian Critical Minerals (ASX:ACM)

(Up on no news)

ACM is pumping on no fresh news. Last the market heard was back at the end of August when the critical minerals explorer released results of maiden exploration at its Cooletha lithium project in the WA Pilbara.

Reconnaissance covered ~15% of the prospective pegmatite region and 94 rock chip samples have been shipped off to the lab for analysis.

“We are very encouraged by the visible spodumene identified during this program and whilst we wait for the results of the first batch of rock samples within 6-8 weeks, reconnaissance sampling will continue,” ACM MD Dean de Largie said last month.

Drilling is getting underway soon at its other project – the Rankin Dome REE prospect in the Youanmi Greenstone Belt near Southern Cross, WA – to test anomalous areas for mineralisation.

ACM is new to the ASX after successfully launching an IPO in July and has risen 25% today to trade at 45c per share.

Odessa Minerals (ASX:ODE)

Lithium-focused ODE is continuing on a tear after mapping >46km of strike of pegmatites at its Yinnetharra project at Lockier Range in WA’s emerging Gascoyne mining district.

Last week it announced mapping and sampling had been completed for >16km of the Robinson Bore prospect and Eastern Pegmatite Field target which are all within 4km of the Thirty-Three Supersuite granite that hosts fertile lithium-caesium-trantalum.

The explorer says ground works will be completed by the end of the month and will start identifying targets for an upcoming drill campaign.

Lockier Range is west-adjacent to Delta Lithium’s (ASX:DLI) Yinnetharra and Jamesons discoveries of which MinRes (ASX:MIN) owns a stake.

“The abundance of pegmatite outcrop in the areas of highly anomalous lithium geochemistry is highly encouraging and this work is designed to generate drill-ready LCT pegmatite targets,” Odessa MD David Lenegas says.

With a $15m market cap, shares in ODE were up almost 20% in early trade today and >100% over the last week, trading at 1.6c/share.

Killi Resources (ASX:KLI)

KLI has announced high grade copper and gold at surface from the Baloo prospect of its Mt Rawdon West project in QLD.

Hits of up to 7.2% Cu and 12.4g/t from 12 of 26 rock chip samples have been collected and in turn identified a 5.5km long x 2.5km wide copper-gold-silver corridor, with KLI believing there’s a much bigger system of mineralisation that previously thought.

“From the rocks, alteration, and visible mineralisation observed on the ground, we believe the Baloo area to be highly prospective for a porphyry copper gold system, with these rock chip results demonstrating we do have the grade needed,” Killi CEO Kathryn Cutler says.

After a low of 3.5c three weeks ago, shares in the $4.13m MC KLI shot up again 17% on open today to trade at 6.2c/share.

KLI says “further evaluation of the field data in conjunction with the geochemical data is being conducted to further understand the intrusions and develop targets for follow-up”.

Geophysical data is also being re-evaluated to add further information to the geological model.

At Stockhead, we tell it like it is. While Killi Resources is a Stockhead advertiser, they did not sponsor this article.

Read MoreSmall Caps