No Spin: The education election promises that will affect ASX stocks

As the major parties switch up the spin cycle ahead of the May 18 federal election, we’ve hunted down the policies that will affect listed companies — so you don’t have to.

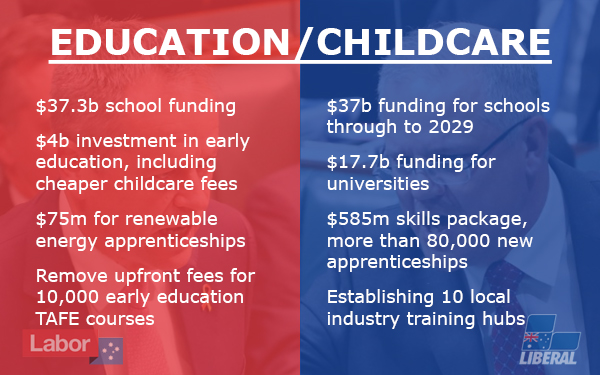

Both the Coalition and Labor have promised big dollars for education, childcare, and apprenticeships.

The biggest beneficiaries of these will be ASX-listed childcare companies and renewable energy companies.

What the experts say

RBC Capital Markets analyst Garry Sherriff said federal Labor’s childcare policies appear to be “incrementally positive” for listed childcare operators, from a demand, occupancy, wage and childcare worker supply perspective.

“Labor’s childcare policy proposals appear favourable from a listed investor viewpoint, relative to the existing policies of the current federal Coalition government,” he said.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

In-depth: The details affecting listed companies

Labor has committed $4 billion to cut childcare costs for families and has also promised a 20 per cent government-funded increase for childcare workers over the next eight years.

Both these initiatives are a win for the only two listed childcare operators — $1.3b behemoth G8 Education (ASX:GEM) and $171.7m Think Childcare (ASX:TNK).

This is because lower childcare costs are likely to translate into increased demand for childcare services.

Lower childcare rates will benefit around 900,000 families nationally, according to RBC.

The rebate for families will range from 100 per cent for families earning less than $69,527 to 60 per cent for families earning over $100,000.

Under the current system, the sliding scale starts at 85 per cent for families earning less than $69,527 and goes down to 50 per cent for families earning over $100,000.

The Coalition has not proposed any changes to the current system if it wins government again.

Labor also plans to remove upfront fees for 10,000 Early Education TAFE courses to increase the pipeline of childcare workers.

However, it also said it would consider national pricing caps on childcare fees if it believes price gouging is occurring.

While RBC sees this as a negative for childcare operators, it believes it is unlikely to happen.

“We believe should Labor win government, operators are likely to act rationally and limit fee increases to 3-4 per cent per annum, to minimise the risk of future government intervention,” Sherriff said.

Apprenticeships

Both parties have outlined multi-million-dollar commitments to boost apprenticeship numbers.

Labor has promised $75m for renewable energy jobs, while the Coalition has outlined a $585m skills package, including 80,0000 new apprenticeships for industries facing skills shortages.

Labor’s apprenticeships election policy could benefit companies like Genex Power (ASX:GNX), MPower Group (ASX:MPR), Tilt Renewables (ASX:TLT), Infigen (ASX:IFN), ReNu Energy (ASX:RNE), Pacific Energy (ASX:PEA) and Windlab (ASX:WND).

The move is expected to create 70,000 jobs and includes $45m for renewable energy apprenticeships, $20m for TAFE facility upgrades, and a $10m renewable energy training fund.

Employers could be eligible for up to $8,000 per trainee.

The Coalition’s policy, on the other hand, is not targeted at one particular industry and could benefit several industries, including resources.

The Coalition also plans to establish 10 local industry training hubs in areas of high youth unemployment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.