Monsters of Rock: Chinese Government support and ‘price war’ sends EV sales racing back in April

Pic: Getty Images

April sales reports from China’s BYD, which shifted more than 313,000 units in a 50% year-on-year and 3% month-on-month lift, are giving hope China’s maudlin EV sector is returning to serious growth.

That is bullish for lithium producers, who saw prices tumble across the back end of 2023 and have just come out of what is likely to be their roughest quarter of the downward cycle after prices for hard rock lithium concentrate fell to US$850/t in January.

They’re back up to US$1215/t according to Fastmarkets, with chemical prices also tiptoeing higher last month.

Spot prices were little changed late last week thanks to a public holiday in China.

But word that Chinese authorities are again subsidising EV and hybrid vehicle sales has been treated positively by the battery metals sector.

“BYD and a host of other Chinese EV makers posted higher sales and

deliveries in April, raising hopes of stronger demand,” ANZ Research’s Madeline Dunk, Brian Martin and Daniel Hynes said in a note this morning.

“This comes as they responded to overcapacity in the industry with rounds of price reductions.

“This could be aided further by government support. Beijing announced it will offer consumers replacing cars with electric or hybrid vehicles up to the equivalent of nearly USD1400.”

It has gone hand in hand with rising copper prices, lifting on Friday as US payroll growth slowed from 315,000 in March to 175,000 in April and unemployment lifted 0.1% to 3.9%.

That saw the US dollar slide, dragging up demand for metals like copper and gold.

ANZ’s Dunk, Martin and Hynes, said growth in commodity demand was also increasingly coming from markets linked to renewables and EVs.

“Expectations that global supply (of copper) will struggle to meet growing demand from clean energy sectors has seen prices rally strongly. This has been aided by better-than-expected economic data from China,” they wrote.

“First quarter GDP growth rose to 1.6% q/q, suggesting a significant gain in growth momentum.

“However, the composition of growth continues to shift in favour of commodity demand. New power generating capacity continues to be dominated by renewable energy.

“The electric vehicle (EV) sector saw a strong rebound after a weak start to the year. Overall, the green economy has become China’s biggest growth driver for demand of some commodities, such as metals.”

WA gold miners look for life extensions

It was an indifferent day for the gold sector as bullion producers continue to look for ways to rerate and catch up to a lift in prices.

A couple things have hung over gold miners, who haven’t necessarily been bought with the same enthusiasm as gold bars themselves.

Firstly, there’s the question of costs. While prices have exploded since the Hamas invasion of Israel on October 7, gold miners have historically chewed up margins by letting their costs run out of control.

Secondly, a number of gold miners are sitting with a lack of expansion options, something that could take M&A to fix.

Westgold Resources (ASX:WGX) is one that has turned to M&A for growth, announcing a $2.2 billion merger to combine with TSX-listed gold producer Karora Resources, owner of the Beta Hunt mine in WA’s Kambalda gold district.

A major turnaround story last year, despite the rising gold price Westgold is up a spare 1% YTD after shutting its underperforming Paddy’s Flat mine. Along with wet weather, that forced WGX to revise its 2024 guidance from 245,000-265,000oz at all in sustaining costs of $1800-2000/oz to 220,000-230,000oz at $2100-2300/oz.

It would have been hoping on a sugar hit today from some high grade drill results at the Great Fingall project, a 45,000ozpa underground development near Cue where first ore is anticipated later this year.

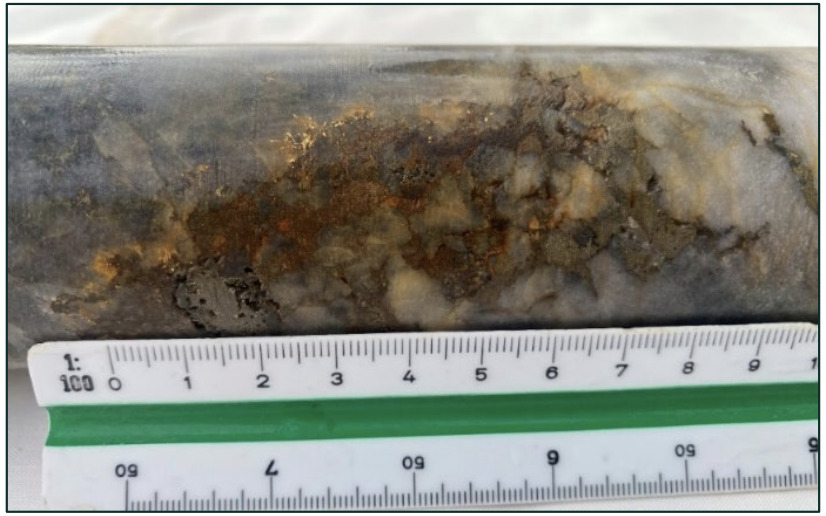

A hit of 3.03m at a sparkly 547g/t from 204.87m at the Fingall Flats area has been described as an ‘early mining opportunity’, part of a collection of new drill results including 17.05m at 8.88g/t and 6m at 22.13g/t.

Targeting high grade structures left behind by the old timers, grade control is expected to take place with access to the area planned for this quarter.

Meanwhile, Regis Resources (ASX:RRL) was also up around 1% after approving the development of two new underground mines at its Duketon operations in WA. The longevity of Duketon has come to the fore after a major blowout in capex for the McPhillamy’s project in New South Wales, it’s key development asset.

The new Garden Well Main and Rosemount Stage 3 mines are expected to add 100,000-120,000ozpa from FY27, though they come at low grades for an underground orebody.

Garden Well Main is expected to mine 60-70,000ozpa at costs of $2050-2150/oz, with $75-95m of capex required to develop the project. While it has 91,000oz of gold reserves at 2.4g/t, the mine plan is reliant on mineral resources and exploration targets, with the deposit hosting a larger inventory of 3.2Mt at 2.8g/t for 295,000oz.

Meanwhile, $45-55m will be required to be spent to develop Rosemont Stage 3, producing 40,000-50,000ozpa at $2400-2500/oz. Its mining inventory of 1.7Mt at 2.8g/t for 157,000oz contains a probable ore reserve of 490,000t at 2.6g/t for 41,000oz.

Both mines are expected to deliver stoping ore from Q1 FY26.

Regis was up at the close, but not everyone loved the news.

The biggest trick miners play is classifying sustaining/life extension as “growth”..

Few takeaways:

1. Duketon’s best days are well & truly behind it

2. With (1) and recent McPhil news RRL is in a

3. Accretive across range of gold px? Show us

4. My breakevens >A$3k/oz$RRL.AX pic.twitter.com/DjwwMVpSaf— Respeculator (@respeculator) May 5, 2024

Market closes up

The materials sector ended the day’s trade up 0.9%, with Fortescue (ASX:FMG) and Mineral Resources (ASX:MIN) among the large cap standouts.

In other market news Sierra Rutile (ASX:SRX) continues to feel the pinch at its Area 1 operations in Sierra Leone, where it recently stood down workers in protest at a return to tax arrangements it said would have made the rutile mine uneconomic.

The Government of Sierra Leone has now issued a notice telling SRX to resume operations by May 31, alleging a breach of the country’s mining act.

“For clarity, Sierra Rutile does not agree that it has committed the breach alleged by the GoSL in the notice,” SRX said in a statement.

“Sierra Rutile is considering its position and its response to the direction from the GoSL. In the meantime, Sierra Rutile will continue to seek to engage with the GoSL to resolve the issue in conjunction with the broader overall negotiations with the GoSL.”

Today’s Best Miners

Fenix Resources (ASX:FEX) (iron ore) +5.2%

Energy Resources of Australia (ASX:ERA) (uranium) +3.9%

Nickel Industries (ASX:NIC) (nickel) +3.7%

Sandfire Resources (ASX:SFR) (copper) +2.9%

Today’s Worst Miners

Syrah Resources (ASX:SYR) (graphite) -4.9%

West African Resources (ASX:WAF) (gold) -2.5%

Metals Acquisition (ASX:MAC) (copper) -2.1%

29Metals (ASX:29M) (copper) -2.1%

Monstars share prices today

ASX 300 Metals and Minings Index today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.