Laybuy has already beaten Afterpay in New Zealand – now it’s launching in Australia and bringing half a million Kiwis with it

While AfterPay (ASX:APT) might be synonymous with the ‘buy now, pay later’ concept in Australia, it’s a different story across the ditch.

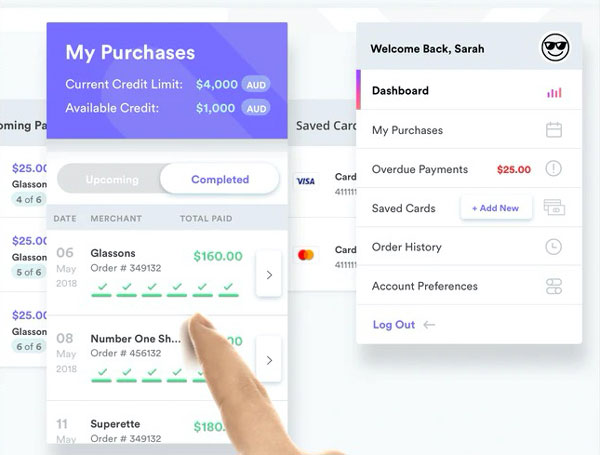

Not only has Laybuy already outgrown Afterpay in New Zealand, but now it’s launching in Australia and reckons it has a few major advantages in an already crowded market, including allowing customers to split their bill into six weekly repayments instead of four fortnightly ones.

“Laybuy also offers two unique features Laybuy Boost which allows customers to buy larger ticket items and Laybuy Global which gives Australian retailers access to our global customer base. We have offered these since day one and are very proud of being the only platform in the world that offers these features,” co-founder Gary Rohloff said in a note issued to Business Insider Australia.

In coming to Australia however, Rohloff believes that retailers will find them better value than its competitors.

“When we talk to Aussie retailers the first two questions we are asked are ‘are you cheaper?’ and ‘will it easily integrate with our existing system?’, and the answer is simple – yes,” he said.

“Not only do we absorb all credit, fraud and chargeback risk on any transaction, which totally safeguards our partners, our unique Laybuy Global feature means we can handle all foreign exchange fees on a retailer’s behalf due to our multinational capabilities. In a nutshell, our service is a win-win for retailers and consumers,” Rohloff said in a release announcing the launch.

In launching here, it joins the ranks of Sezzle, Kogan, Visa, and Citibank and others who have all recently entered a market already furiously competitive between incumbents Afterpay and Zip Pay.

Laybuy’s overall strategy is to charm Australian retailers first in order to win customers in turn. By competing on cost for retailers, Rohloff, who started the company with his 23-year-old son Alex, believes Laybuy can gain a foothold Down Under as retailers look for alternatives to Afterpay.

What’s perhaps even more enticing however is the customer base that Laybuy brings with it.

“Most of all for Aussie retailers is that we deliver over 500,000 Kiwi customers,” Rohloff said.

With Kiwis remaining one of the biggest communities in Australia, the opportunity to grow a customer base will remain the biggest incentive for businesses to partner with Laybuy.

Already 1,200 Australian retailers have joined the platform including fashion retailers Glassons and Ally Fashion, as well as footwear brand Senso.

“We’re very happy to have Laybuy onboard. ‘Buy now, pay later’ platforms continue to revolutionise online retail and we can see the benefits that having another option for our customers — especially international ones — will bring to our business,” Senso general manager Imogen Meller said.

New Zealand aside, Laybuy is also trying to make inroads in the UK, US, and European markets as well as it tries to scale its customer base.

With this most recent launch, it’s hoping to add Australia to that growing list.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.