Guy on Rocks: A 300koz gold resource for less than 1c per share? I’ll drink to that

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Metals look set for rebound

An unusual week with both gold and the USD moving up in sync.

Gold finished the week up US$6/ounce to US$1,961/ounce while the DXY also closed up 1.1% to close at 101.6. The 2-10 year gap was nearing record highs and widened to 98 basis points. The bond market continues to point to an impending recession in the US while volatility as measured by the VIX remains at very low levels at 13.6.

Silver lost 1.3% to end the week at US$24.55 after a big move up the previous week, with platinum down US$8 for the week to finish at US$962/ounce. Palladium closed up 1% to US$1,260 per ounce.

Copper was off 8 cents for the week to close at US$3.81/lb, however the three-month forward contract remains in a 3 cent contango.

Uranium had a strong week rising 1.6% to close at US$56.25/lb with the Sprott Physical Uranium Trust now holding 61.7Mbbls of uranium but trading at a 12% discount to its net tangible asset backing.

It was a tough first half of 2023 on the equities and commodities front, however, with a fair amount of value destruction since the start of the bear market in April 2022, it is a good time to think about positioning in the metals and equity markets.

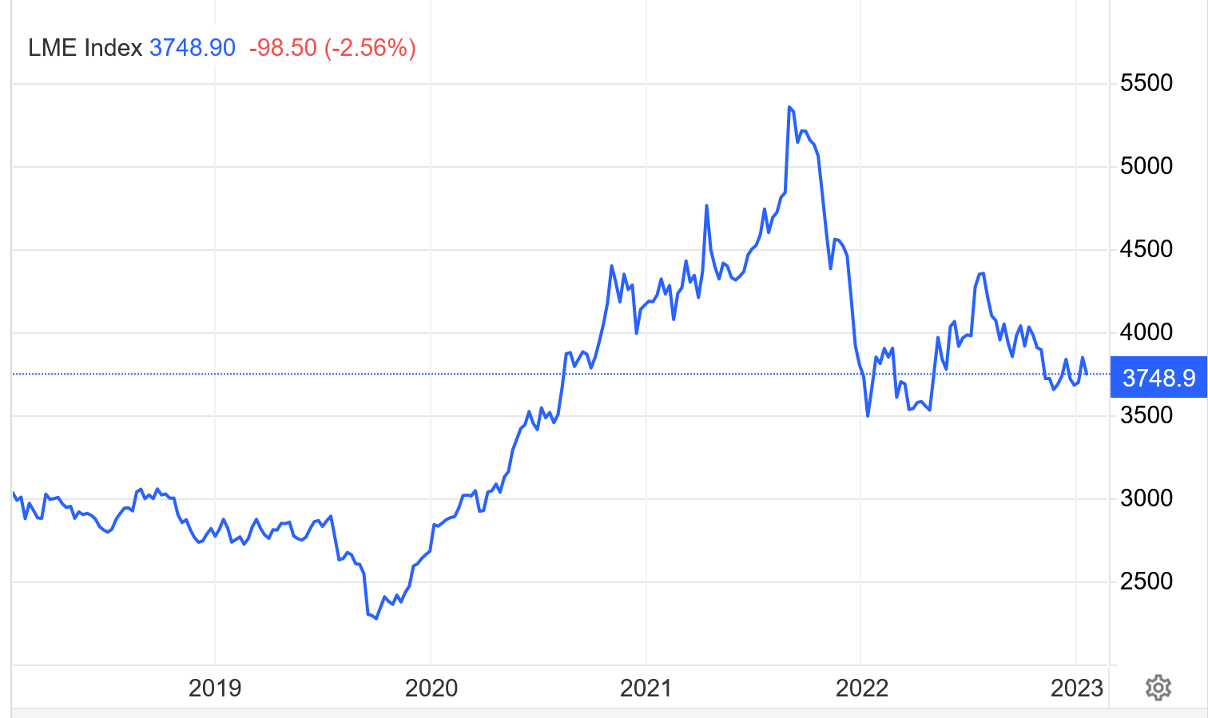

The London Metals Exchange (LME) Index of base metals retreated from a high of just under 5,500 in late 2021 and is now sitting at 3,748 (figure 1).

The index consists of six metals with the following weights: aluminium (42.8%), copper (31.2%), zinc (14.8%), lead (8.2%), nickel (2%) and tin (1%). These weightings are derived from global production volume and trade liquidity averaged over the preceding five-year period with the value calculated as the sum of the prices for the three qualifying months multiplied by the corresponding weights, multiplied by a constant.

This year started with expectations of a super-charged Chinese rebound after last year’s stringent lockdowns, however global economic weakness spread around the major economies with China, Europe, the US also experiencing manufacturing slowdowns.

The clean energy drive appears to have put a floor under metal prices, so, as we edge closer to a broader global economic recovery, we should see quite a rebound in prices.

As Richard Mills (Ahead of the Herd, January 2023) pointed out, electric vehicles used twice the copper compared to gasoline vehicles (30kg). Or as Daniel Yergin, S&P Global vice chairman put it, copper is the “metal of electrification” (figure 2).

I’ll talk about uranium, rare earths and lithium in a little more detail in the coming weeks however copper (I know I have been banging on about this for some time) is intriguing due to the very low inventory levels (figure 3), questionable supply outlook and low spot price of US$3.81/lb which is marginally above the incentive price to bring new production online.

Total China inventories (SHFE and bonded warehouses) were reported by UBS to have peaked in late February/early March of this year at around 425kt, and seasonally adjusted, China inventories are believed to be at the lowest level in recent years with significant fluctuations in LME inventories attributed to flows in and out of Asia.

The Stockhead faithful will be well aware from reading this column that we are facing a 10-15Mt (depending on who you listen to) copper deficit in the next five years or so.

Goldman Sachs earlier this year estimated that another US$150 billion would need to be spent by mining companies in the next decade to bridge this gap.

UBS have undertaken research on global copper supply showing it is indeed a mixed bag with major world producers such as Chile down 14% year-on-year equal to its lowest level in over 10 years.

While the major producers such as Antofagasta and Glencore appear to be confident of ramping up production in 2H 2023, UBS remain unconvinced.

Add to that ongoing disruptions in Peru and major mine development knockbacks in stable jurisdictions such as the US, the projected supply shortfall could be worse than many commentators thought.

There will no doubt be a lot riding on the likes of Kamoa in the DRC which is projecting a whopping 400Ktpa of copper production per annum.

As I am reminded by a number of analysts I speak to, to get a serious lift in metal prices you need an increase in demand.

The demand outlook in the short term according to UBS is soft, however the switch from backwardation to contango, particularly in the three-month copper futures contract, would suggest improving demand. Backwardation at the Shanghai futures exchange has also moderated.

So, what will an increase in copper demand (and fall in supply) do to copper prices?

According to Goldman Sachs the red metal should breach US$12,000 by 2024 citing low levels of new projects being approved as partial justification for a lift in copper prices. Notably only two major copper mines came online between 2017 and 2021 – namely Ivanhoe’s Kamoa Kakula (DRC) and Anglo American’s Quellaveco Mine in Peru.

The rate of discovery has also been declining with S&P Global Market Intelligence reporting that of 224 sizeable copper deposits discovered in the past 30 years, only 16 have been found in the last decade.

With a very small pipeline of copper projects and a tight copper market ahead of us (once the bond market stops telling us we are heading for a recession?), we should see a pick-up in copper positioning by the funds (figure 4).

Stock of the Week: Riedel edges closer to maiden resource

I rolled out Arizona gold explorer Riedel Resources (ASX: RIE) back in April 2021 and then again in May 2023 after it took a dive down the “S” bend along with the rest of the junior gold explorers, hitting an all-time low of $0.004/share (figure 5).

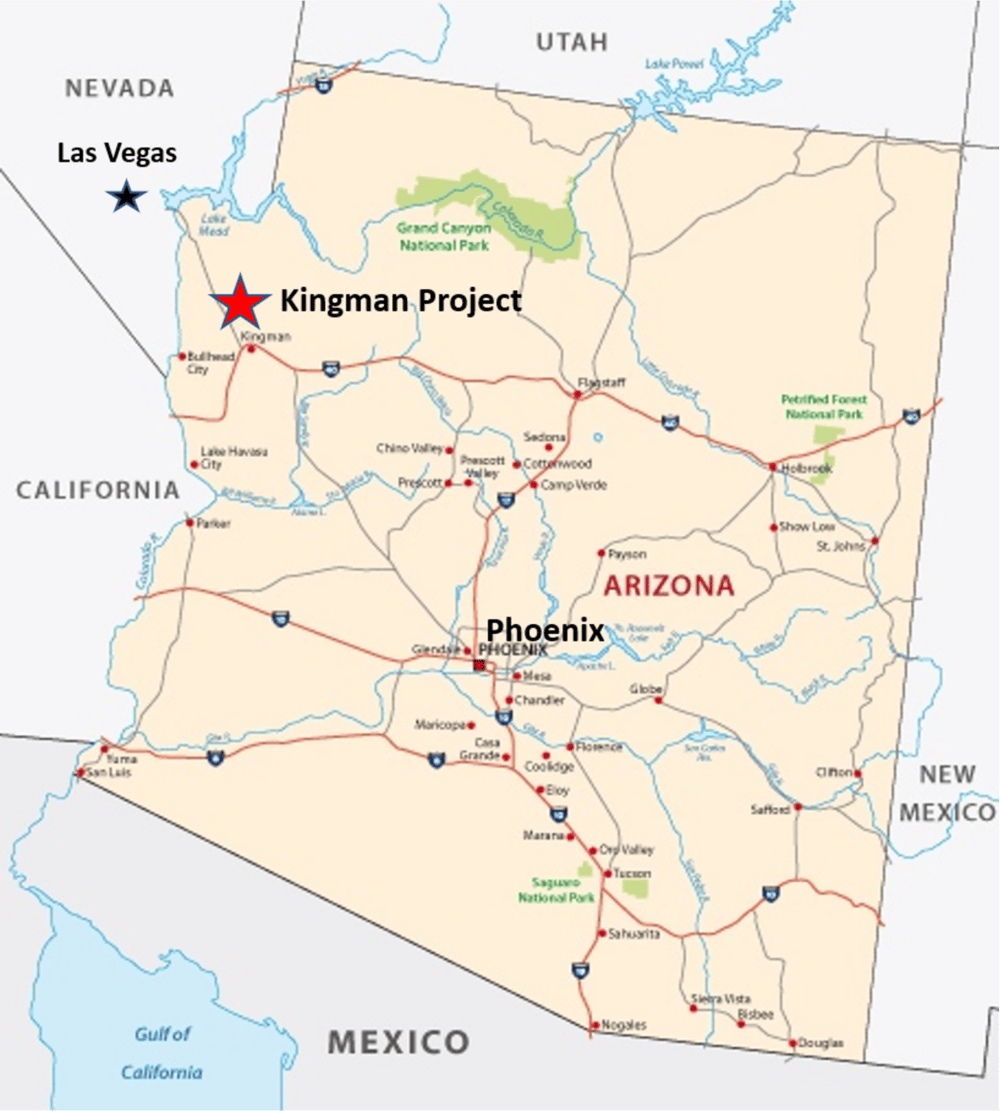

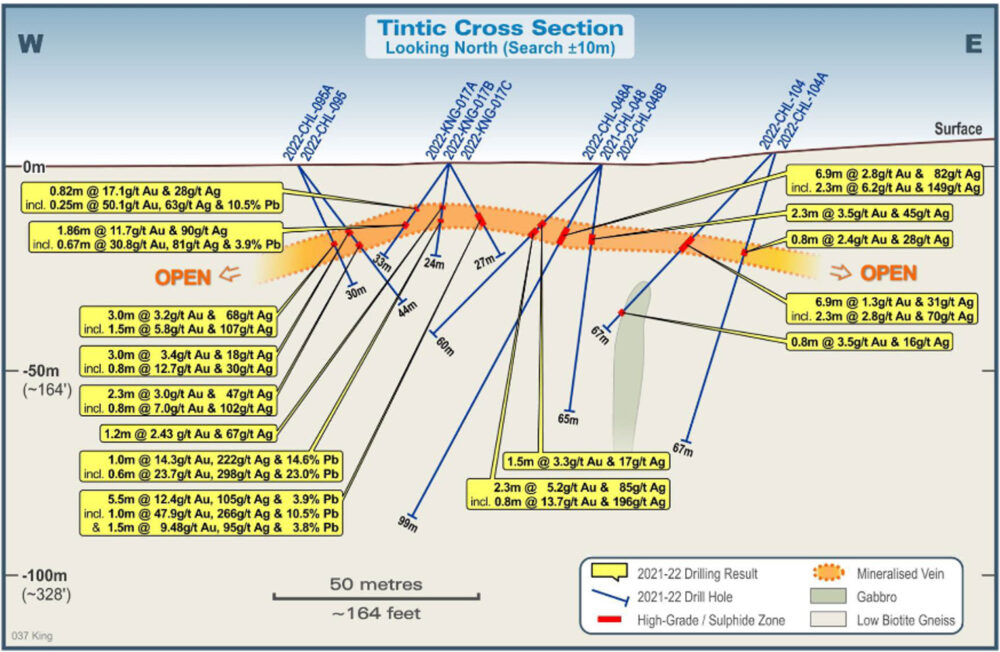

The stock has staged somewhat of a comeback to $ $0.007/share, albeit on low volume, as it progresses its 7,000 metre RC and diamond drilling project at the Tintic prospect (figure 6), part of the Kingman Project in northwest Arizona.

As the Stockhead faithful will recall, I believe there is excellent potential for a +300Koz near surface gold resource at >5g/t gold or better with treatment options within 40km via a sealed road. Negotiations on access/terms around processing of their ore will obviously be critical to success of the project assuming it progresses through to a Mining Study.

I anticipate the maiden JORC statement late in CY 2023 with the recent round of drilling targeting extensions to the north and south of Tintic and a number of regional targets (figure 7).

Previous drilling has returned numerous encouraging intercepts including :

- 8m @ 98.9g/t gold & 151g/t silver from 20.6m

- 6m @ 12.43g/t Au, 52g/t silver from 45m

- 3m @ 18.1g/t gold & 24g/t silver from 23.6m

The bear market has been savage on small to mid-cap gold explorers/developers so I see value in stocks like this that have the ability to monetise near surface (20-30m deep) high-grade resources without the need for significant capital deployment in the form of a processing plant.

I think the project has the potential for a 20-30Koz per annum gold producer generating revenues in the order of US$35-50m in attributable revenue per annum at decent margins assuming a gold price of US$1,900/ounce.

At a market capitalisation of $14 million, I think this is relatively cheap with short to medium term upside to an enterprise value of +$30 million or 1.2-1.3c per share based on 300Koz of gold at a value of $100/ounce.

I think there is significantly more upside if the company can bring the Kingman Project online.

Riedel has been making fine crystal wine glasses since 1756. I will source an appropriate Nappa Valley cabernet to fill one of these fine glasses and toast the imminent success of this last round of drilling…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.