Closing Bell: Super Sigma lifts benchmark after oil saps energy stocks

Via Getty

- The ASX benchmark rises +0.30pc despite mid-morning headwinds from Jim Chalmers

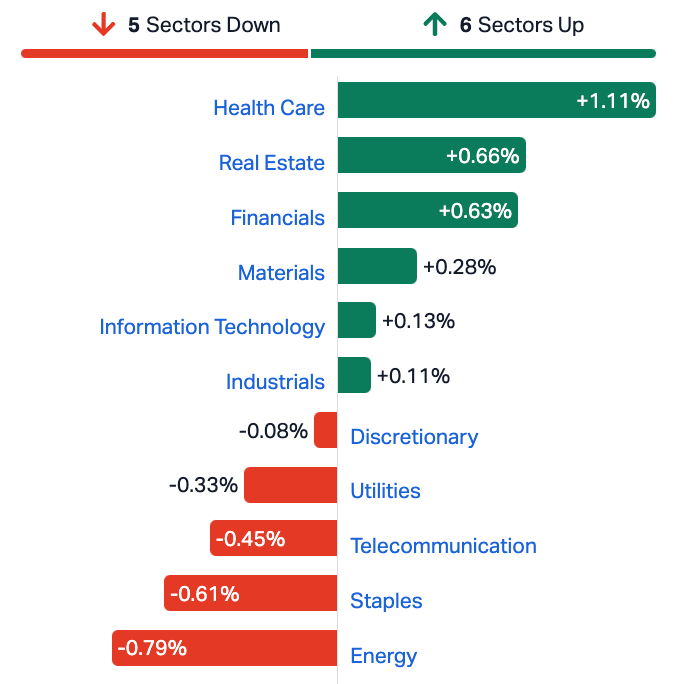

- Six of 11 Sectors ended higher with Health Care out in front

- Small caps led by Sigma as momentum for Chemist Warehouse merger builds

With the hope of any outsize gains shot through the heart with the Energy Sector to blame, local markets ended Wednesday slightly higher, but otherwise the same.

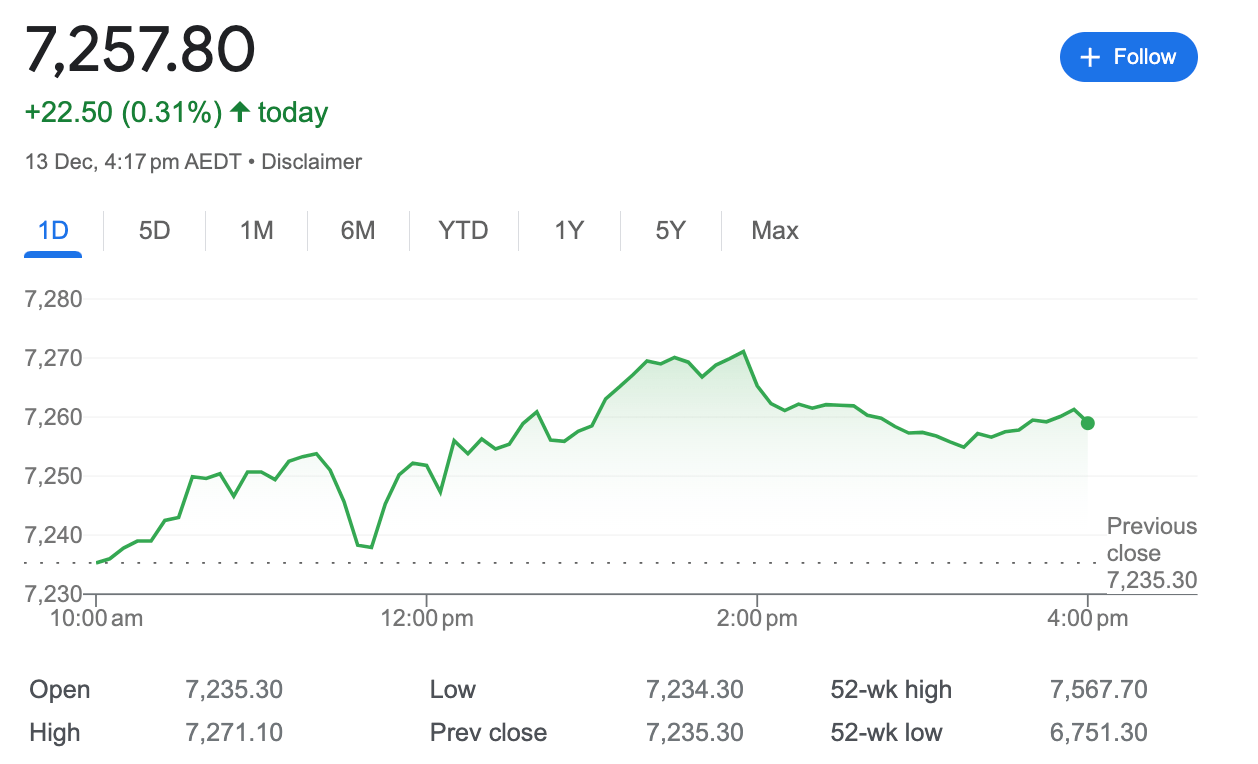

At 4.15pm on Wednesday December 13, the S&P/ASX 200 (XJO) index was up 22.5 points, or +0.31%.

Traders in Sydney looked to unscrew another champagne session, only. to close with a very divided bourse. It was a split decision on Wednesday, with six sectors in the green at the close, with Property again in the money, the big banks rising and Materials making some inroads.

Healthcare stocks and a diverse group ofg miners lifted the benchmark into positive territory, although there were undoubtedly higher hopes when Wall Street clocked its highest level in nearly two years on the inflation numbers of November which did not disgrace (the CPI came in largely as expected), which in this climate is certainly enough to bolster hopes the Fed won’t touch the rates trigger later tonight – or perhaps again for the current cycle.

At home healthcare led the horses in by closing +1.1% higher.

Sigma Healthcare (ASX:SIG) jumped more than a third s the clear beneficiary in a proposed Chemist Warehouse merger.

The heavyweight healthcare giant CSL (ASX:CSL) also rose +1%

ASX Sectors on Wednesday

Iron ore movement…

Iron ore (63.5%fe) for Tianjin moved above US$137 in December, equalling the 18-month high touched of early November month following hints of higher demand across major consumers.

Iron ore imports from China were up+3.4% from November, pointing to a pickup in demand from China’s key steel manufacturers, as per a production report.

That’s helped Fortescue (ASX:FMG) find a new record high and allowed Rio Tinto (ASX:RIO) to hit a new 3 year hclosing high.

BHP (ASX:BHP) lifted almost 1%.

The Chinese government has said it’d issue CNY 1 trillion in debt to target infrastructure and manufacturing projects, magnifying previous signals from lenders, miners, and metallurgists that infrastructure expenditure in China is likely going to to offset the debt crisis in the property sector.

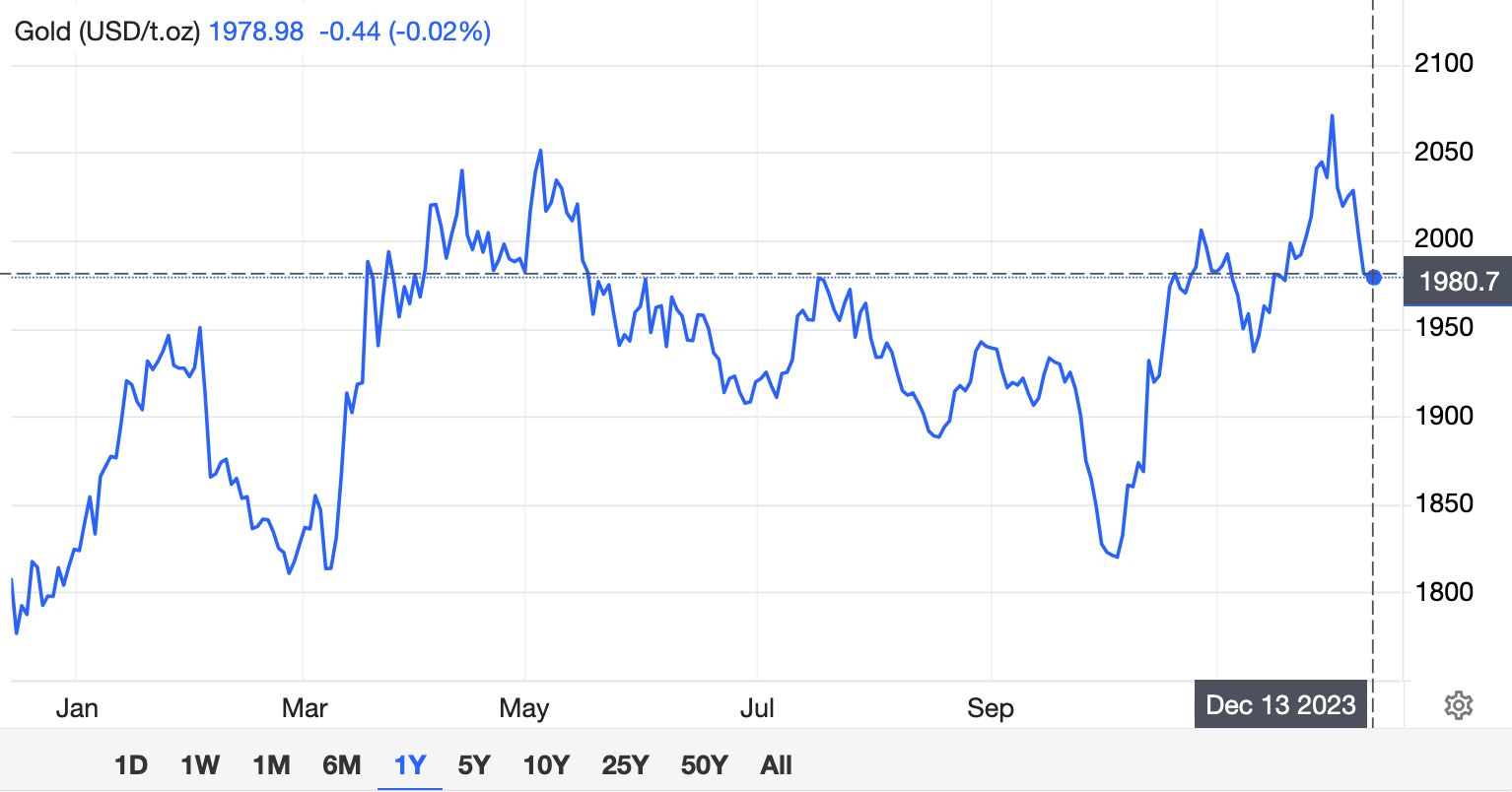

And damned if we’re not still watching gold…

Looking poised at US$1,990 on Tuesday – after two straight sessions of falling prices – the metal most associated with marriage, wealth and danger has had a subdued 24 hours, trading in a tight range at near 3-week lows after US November CPI was flat and before the US Federal Reserve’s looming interest rate decision.

And in the US…

The US Consumer Price (CPI) data for November which everyone’s been waiting for came in much unchanged last month.

US inflation – stripping out food and energy prices – eased to 4% year-on-year in November.

Wall Street closed higher and US bond yields tripped lower overnight as happy buyers of the mega-cap stocks could almost taste the rate cuts – Strong gains were seen from mega-cap tech names such as Nvidia (2.2%), AMD (2.4%) and Meta Platforms (2.8%).

Oracle however crashed -12.5% on a shocker of a trading update.

The S&P 500 ended up +0.45%, the Dow Jones, +0.5% and the Nasdaq Composite added +0.7%. New intraday 12-month highs all round.

Eight out of 11 sectors ended higher, led by technology, financials and materials, while the energy sector was the biggest laggard.

The US Federal Reserve concludes its 2-day policy meet on Wednesday (New York time) and comes out with a final 2023 decision on interest rates.

The Fed is broadly expected to keep its key rate unchanged to complete what would be a hat-trick of pauses.

According to the CME FedWatch Tool, there’s now instead a circa 80% chance of a rate cut in May.

At 4pm in Sydney, Futures tied to the 3 major US indices were ahead of the Wednesday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.003 | 50% | 81,860,999 | $6,047,530 |

| JAV | Javelin Minerals Ltd | 0.003 | 50% | 5,962,466 | $2,176,231 |

| SIG | Sigma Health Ltd | 1.1 | 48% | 61,513,528 | $810,346,458 |

| SCL | Schrole Group Ltd | 0.215 | 43% | 41,049 | $5,393,257 |

| AOA | Ausmon Resorces | 0.004 | 33% | 500,000 | $3,020,998 |

| ENT | Enterprise Metals | 0.004 | 33% | 1,000,000 | $2,398,413 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 6,815,840 | $11,677,324 |

| BAT | Battery Minerals Ltd | 0.08 | 33% | 3,086,996 | $8,061,870 |

| HXG | Hexagon Energy | 0.013 | 30% | 570,836 | $5,129,159 |

| AYT | Austin Metals Ltd | 0.009 | 29% | 153,170 | $7,111,123 |

| KNB | Koonenberrygold | 0.043 | 26% | 1,107,521 | $4,071,469 |

| ATS | Australis Oil & Gas | 0.0155 | 19% | 1,645,377 | $16,469,252 |

| 5GG | Pentanet | 0.069 | 19% | 124,756 | $21,676,178 |

| BCT | Bluechiip Limited | 0.019 | 19% | 466,116 | $12,593,409 |

| NYR | Nyrada Inc. | 0.026 | 18% | 8,166 | $3,432,191 |

| OAR | OAR Resources Ltd | 0.0035 | 17% | 54,843 | $7,923,183 |

| VAL | Valor Resources Ltd | 0.0035 | 17% | 3,000,020 | $11,620,004 |

| SWP | Swoop Holdings Ltd | 0.255 | 16% | 207,897 | $45,805,966 |

| CCE | Carnegie Cln Energy | 0.052 | 16% | 932,570 | $14,078,406 |

| WC1 | Westcobarmetals | 0.091 | 15% | 4,133,134 | $9,543,226 |

| VMC | Venus Metals Cor Ltd | 0.115 | 15% | 288,989 | $18,972,868 |

| ALM | Alma Metals Ltd | 0.008 | 14% | 310,625 | $7,798,006 |

| ASR | Asra Minerals Ltd | 0.008 | 14% | 5,871,033 | $11,402,970 |

| SLM | Solismineralsltd | 0.16 | 14% | 238,117 | $10,988,489 |

| PIM | Pinnacleminerals | 0.17 | 13% | 429,568 | $3,836,250 |

Leading the market today is Healthcare large capper Sigma Healthcare (ASX:SIG) , which has gone flying this morning on news of a multi-billion dollar merger being put together to allow retail behemoth Chemist Warehouse to backdoor list on the ASX, and flood it with suspiciously inexpensive designer label perfume.

The actual news from Sigma this morning was only tangentially related to that merger, as it was all about the completion of a fully underwritten 1 for 1.85 pro-rata accelerated non-renounceable entitlement offer to raise approximately $400 million.

Sigma CEO Vikesh Ramsunder said that the offer had been well-supported, and that Sigma plans to use the funds raised on increased working capital requirements and progress business growth initiatives, including relaunching Sigma’s Amcal and Discount Drug Store brands and expanding the company’s “private and exclusive label” product range.

Ramsunder also said that, in the event the proposed merger does go ahead, “some of the net proceeds from the Entitlement Offer may instead be used to partially fund the cash consideration by Sigma under the Proposed Merger”. So there’s that.

Koonenberry Gold (ASX:KNB) celebrated a win through an announcement featuring two words investors love to read: “visible gold”.

Drilling at the company’s the Bellagio gold prospect has hit widespread quartz veins below the weathered zone, containing visible gold down dip from the Koonenberry’s previously reported intercept of 10m @ 1.61g/t Au, which – just so we’re clear – did not have any visible gold.

“Below the strongly weathered zone, quartz veins are associated with sericite-silica hydrothermal alteration and trace arsenopyrite over a +125m wide zone,” KNB says.

“This is significant as sericite-silica alteration is a common feature of many orogenic gold systems” – orogenic referring to the crumple zone that makes mountain ranges when two tectonic plates collide.

I looked it up, so that you didn’t have to.

Another worth a mention in the winner’s list was American West Metals (ASX:AW1) , which is on the rise after revealing that it is sitting on the only known domestic Indium resource in the United States.

Indium is one of those rare critical minerals that most people have never heard of, but without which they wouldn’t be able to play Candy Crush or send shockingly lewd Tinder messages to each other, as it’s a pretty important element in the manufacture of things like mobile phones and emojis.

AW1’s Indium resource isn’t just unique in terms of its geological placement, but also pretty big – the company is reporting a JORC compliant resource of some 23.8Moz of indium at the site, nestled cheek-by-jowl with an equally impressive total of 119 Koz of gold, 1.3Mt zinc, 49Kt copper and 10Moz silver.

A late run through the afternoon came from West Cobar Metals (ASX:WC1) , which has been running hot for a few days now, with pretty much no visible reason for doing so.

If that sounds a bit mean spirited, please take note that two days ago, the watchdogs at the ASX noticed things moving fast for West Cobar, and asked for an explanation – receiving in return a well-written shrug of the shoulders.

Annnnd…

Come on up fans of Battery Age Minerals (ASX:BM8) which climbed nicely on news that assays have confirmed the presence of significant lithium mineralisation from surface at the company’s Falcon East Extension within the Falcon Lake Lithium Project in Ontario, Canada.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.001 | -50% | 925,232 | $6,590,311 |

| AVW | Avira Resources Ltd | 0.001 | -33% | 529,000 | $3,200,685 |

| VPR | Volt Power Group | 0.001 | -33% | 1,117 | $16,074,312 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 1,750,000 | $3,671,126 |

| KPO | Kalina Power Limited | 0.003 | -25% | 125,129 | $7,623,685 |

| TKL | Traka Resources | 0.003 | -25% | 1,500,332 | $3,501,317 |

| MSG | Mcs Services Limited | 0.015 | -25% | 150,000 | $3,961,993 |

| RCR | Rincon | 0.028 | -22% | 5,008,063 | $6,395,864 |

| WEC | White Energy Company | 0.034 | -21% | 2,397,781 | $2,941,466 |

| 8CO | 8Common Limited | 0.051 | -20% | 30,000 | $14,342,074 |

| AUH | Austchina Holdings | 0.004 | -20% | 24,090 | $10,389,418 |

| GCM | Green Critical Min | 0.009 | -18% | 965,100 | $12,502,435 |

| TMG | Trigg Minerals Ltd | 0.009 | -18% | 30,000 | $4,122,318 |

| PLN | Pioneer Lithium | 0.18 | -18% | 141,289 | $6,253,500 |

| ADY | Admiralty Resources. | 0.005 | -17% | 50,000 | $7,821,475 |

| IVX | Invion Ltd | 0.005 | -17% | 5,002 | $38,529,793 |

| NVQ | Noviqtech Limited | 0.0025 | -17% | 131,964 | $3,928,336 |

| SGC | Sacgasco Ltd | 0.01 | -17% | 916,100 | $9,282,993 |

| IVR | Investigator Res Ltd | 0.039 | -15% | 5,125,238 | $66,109,821 |

| AAP | Australian Agri Ltd | 0.017 | -15% | 27,551 | $6,101,990 |

| NNL | Nordicnickellimited | 0.145 | -15% | 123,778 | $9,938,201 |

| PAT | Patriot Lithium | 0.175 | -15% | 66,239 | $14,046,012 |

| LTP | Ltr Pharma Limited | 0.27 | -14% | 3,238,252 | $22,177,729 |

| NC1 | Nicoresourceslimited | 0.3 | -14% | 46,515 | $37,275,201 |

| CCZ | Castillo Copper Ltd | 0.006 | -14% | 2,334 | $9,096,537 |

TRADING HALTS

Invictus Energy (ASX:IVZ) – pending an update on final wireline logging and fluid sampling results from Mukuyu-2 Side Track well.

Linius Technologies (ASX:LNU) – pending the release of an announcement to the market concerning a capital raising initiative.

HeraMED (ASX:HMD) – pending the release of an announcement to the market about the planning and executing a capital raising.

Venture Minerals (ASX:VMS) – pending the release of an announcement with regards to a proposed capital raising.

Future Metals (ASX:FME) – pending the release of an announcement regarding a capital raising.

South Harz Potash (ASX:SHP) – pending an announcement to the market in relation to the outcome of a capital raising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.