ASX Small Caps Lunch Wrap: Which prominent Transformer has been arrested this week?

Optimus Prime has been arrested while allegedly driving a stolen vehicle in Austin Texas. Pic via Getty Images.

Local markets were diving on Tuesday morning, after an apparent end to China’s gold-buying spree sent our gold producers into a tailspin, and some sour news about interest rate outlooks for Aussie borrowers soured investor appetite.

The ASX 200 benchmark opened lower and quickly sank -1.3% in early trade, and by lunchtime not much had improved, with every sector in the red two hours into the session.

I’ll get to the details on that shortly, but first to a quick news story from Austin Texas, where the headlines are screaming that a Transformer has been arrested while driving a stolen car.

Local media says that a man whose legal name is – for real – Optimus Prime Blakely, was pinched by the po-po driving an allegedly stolen vehicle through South Austin.

Following his arrest, Optimus Prime is being held on a US$8,000 bond, no doubt eagerly awaiting the arrival of the rest of the Autobots to arrive and spring him from jail, so he can lead them against the evil Decepticons that have clearly figured out how to disguise themselves as members of the Austin PD.

TO MARKET

Local markets have plummeted this morning, shedding around 1.3% very quickly when the doors opened this morning, with every market sector down amidst a sea of red so deep, there’s an old bloke with a beard out the front trying to part it.

That’s despite a positive lead-in from the US overnight, and largely due to a considerable sell-off among the goldies that has seen a number of large caps taking solid body blows all morning.

That’s due to a slump in gold prices while we were enjoying a day off for the King’s birthday, when China’s central bank announced that its stockpile hadn’t changed in size during the month of May.

It’s a sign that the Great National Gold Buying Spree has come to an end in China, and that in turn, saw the price of gold drop dramatically by around 1.5%.

The response on the ASX has been swift and brutal: Bellevue Gold was down -7.3%, Genesis Minerals dropped -7.8%, West African Resources fell -9.45%… the list goes on, and pretty much none of it is good news.

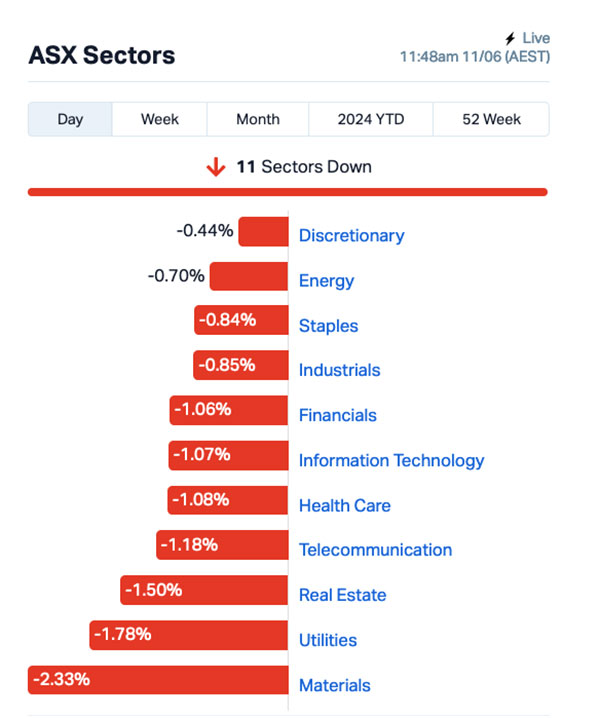

That’s left the ASX sectors looking like this:

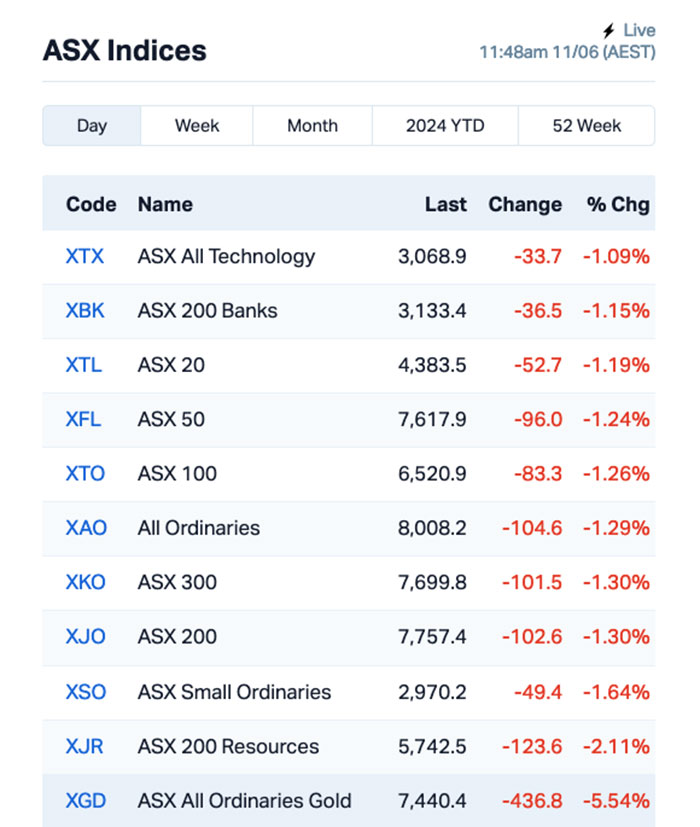

And the ASX indices looking like this:

As you can see, the XGD All Ords Gold Index was struggling hard, down more than -5.5% and dragging the rest of the market along with it.

The other headline news from the top end of town is unexpected news from Bapcor (ASX:BAP), owners of auto parts retailer Autobarn, following an unsolicited and quite juicy takeover bid late on Friday from Bain Capital Private Equity.

Bain’s offering $5.40 a share – well above Friday’s close of $4.36 on Friday – but the offer remains conditional and non-binding for now, with Bapcor taking some time to consider its options.

The auto parts retailer has seen a pretty tumultuous time over the past few months, with a lot of that stemming from former V8 Supercar racer Paul Dumbrell abruptly deciding to bail on plans to become CEO, just two days before he was due to start at the end of April this year.

And there was some grim news from Australia and New Zealand Banking Group’s (ASX:ANZ) policy wonks this morning, with the bank’s head of Australian economics Adam Boyton suggesting that the RBA is now unlikely to move rates in 2024.

“Since November 2022, we have expected that the first cash rate cut in Australia this cycle would be in November 2024. More recently, however, we have been cautioning that the risks around that view were skewed to a later start to the easing cycle,” Boyton said.

“The stronger than expected Q1 CPI also makes it hard to see the RBA being sufficiently confident that inflation will return to and stay in the band by the time the November meeting comes around.

“Accordingly, we now expect the first cash rate cut in February 2025 (from November 2024). We expect a follow-up easing shortly thereafter (most likely in April, although May is possible).”

Oof.

NOT THE ASX

Overnight, US stocks managed to eke out cautious gains following the release of better-than-expected US monthly jobs data, Eddy Sunarto reported this morning.

Investors had been hoping for a slowdown in job growth, but according to the data, the US economy added 272,000 jobs compared to economists’ forecast of 185,000, dashing hopes of an imminent interest rate cut by the Fed Reserve.

“The interest-rate guessing game goes on,” said Chris Larkin at E*Trade.

The S&P 500 rose by +0.26%, the blue chips Dow Jones index was up by +0.18%, and the tech-heavy Nasdaq lifted by +0.35%.

The big news from the US came after hours there, when tech giant Apple held one of its super-slick, all-singing and all-dancing Worldwide Developer Conference 2024, where the company announced – broadly speaking – that it is going to be folding AI into everything.

Apple revealed that it is partnering with OpenAI for the initial roll-out of its AI-enhanced gadgets, which the company will use to provide a “highly personalised experience” for iPhone users, thanks to AI being able to collate all sorts of info about you based on how you use your device.

Which, I’ll be honest, sounds utterly terrifying… and considering that Apple shares fell 1.91% in the wake of the announcement, I suspect that I’m not alone in that sentiment.

In other US stock news, Southwest Airlines jumped +7% after activist firm Elliott Investment Management urged the airline to make significant changes in its leadership team. Elliott says these changes are necessary to address what it perceives as years of poor performance by one of the largest US airlines.

Advanced Micro Devices fell -4.5% after Morgan Stanley downgraded the stock from Overweight to Neutral, expressing concerns that investors’ expectations for the chipmaker’s AI business may be overly optimistic.

KKR, CrowdStrike, and GoDaddy are set to become new additions to the S&P 500 index as part of the latest quarterly adjustments in its weighting.

All eyes will be on US inflation in the coming days, as the consumer price index (CPI) reading for May is released.

This data will come in just ahead of the US Fed’s interest rate decision, as their two-day meeting concludes on the same day.

While interest rates are expected to remain unchanged, the Fed might offer insights into the possibility of rate cuts in 2024.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 11 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap JAV Javelin Minerals Ltd 0.002 100% 250,000 $2,501,231 1MC Morella Corporation 0.003 50% 5,441,339 $12,357,599 CNJ Conico Ltd 0.0015 50% 7,026,901 $1,805,095 CT1 Constellation Tech 0.003 50% 1,554,787 $2,949,467 LPD Lepidico Ltd 0.003 50% 7,237,937 $17,178,239 TD1 Tali Digital Limited 0.0015 50% 44,497 $3,295,156 VRC Volt Resources Ltd 0.006 50% 8,843,378 $16,634,713 HMD Heramed Limited 0.023 44% 849,866 $6,291,997 MHC Manhattan Corp Ltd 0.002 33% 1,000,005 $4,405,470 FRB Firebird Metals 0.21 27% 930,810 $23,489,631 H2G Greenhy2 Limited 0.01 25% 111,573 $4,785,473 TMR Tempus Resources Ltd 0.005 25% 671,300 $2,923,995 OZZ OZZ Resources 0.057 24% 304,464 $4,256,385 BEO Beonic Ltd 0.029 21% 305,734 $10,187,879 AVM Advance Metals Ltd 0.03 20% 2,551 $1,139,942 BRX Belararox 0.24 20% 159,828 $17,046,376 EEL Enrg Elements Ltd 0.003 20% 2,800,447 $2,524,913 BCC Beam Communications 0.155 19% 10,836 $11,234,850 THR Thor Energy PLC 0.019 19% 589,097 $3,246,943 HPR High Peak Royalties 0.07 17% 5,000 $12,483,583 A1G African Gold Ltd. 0.028 17% 172,470 $5,741,177 CLZ Classic Min Ltd 0.0035 17% 340,613 $1,366,324 GNM Great Northern 0.014 17% 10,000 $1,855,549 HOR Horseshoe Metals Ltd 0.014 17% 120,956 $7,773,344 POS Poseidon Nick Ltd 0.007 17% 1,434,594 $22,281,209

Up the top of the winners list on Tuesday morning was Conico (ASX:CNJ), on news that it has extended the deadline for its non-renouncable rights offer.

This is the seventh time the offer deadline has been extended since the rights offer was first announced on 09 April this year, with the new x7 deadline now set for 28 June, with the deadline to extend the offer again resting on 25 June.

Constellation Technologies (ASX:CT1) was also rising on Tuesday morning, thanks to a an agreement with leading facilities management company Compass Group which will see the deployment of Constellation’s Callisto Food Safety & Compliance product suite for an initial term of two years, with no minimum order quantities.

Ukrainian graphite producer and natural graphite anode developer Volt Resources (ASX:VRC) climbed early on news that the company has begun production trials on new purification technology for the production of ultra-high purity graphite for use as a precursor material for active anode material.

And medical data and tech company HeraMED (ASX:HMD) gained after revealing that the company has terminated “with immediate effect” its partnership with US-based Fembridge, following both parties being unable to agree on revised commercial terms.

It comes after a corporate restructure at HeraMED led the company to approach Fembridge with plans to update the agreement, particularly in connection with provisions that gave Fembridge a broad exclusivity over the US market and payment to Fembridge of US$40,000 per calendar month for provision of business development, sales, and marketing services.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 11 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 44,276 $11,649,361 GTE Great Western Exploration 0.031 -34% 1,433,261 $16,356,499 EDE Eden Innovations 0.002 -33% 19,140,784 $11,034,813 PRX Prodigy Gold NL 0.002 -33% 3,484,500 $6,353,323 YPB YPB Group Ltd 0.002 -33% 168,912 $2,423,884 RLF RLF AgTech 0.04 -31% 372,017 $13,296,091 AMD Arrow Minerals 0.003 -25% 2,005,097 $40,557,460 SP8 Streamplay Studio 0.007 -22% 1,602,036 $10,355,614 MOM Moab Minerals Ltd 0.004 -20% 200,000 $3,559,815 ROG Red Sky Energy. 0.004 -20% 11,375,519 $27,111,136 SIT Site Group Int Ltd 0.002 -20% 800,000 $6,506,226 RC1 Redcastle Resources 0.021 -19% 259,726 $8,535,388 EOF Ecofibre Limited 0.064 -18% 471,157 $29,552,164 AYT Austin Metals Ltd 0.005 -17% 100,000 $7,945,148 MEL Metgasco Ltd 0.005 -17% 3,988,938 $7,493,320 SIS Simble Solutions 0.0025 -17% 150,794 $2,260,352 BKG Booktopia Group 0.042 -16% 50,375 $11,410,255 CXU Cauldron Energy Ltd 0.027 -16% 7,028,388 $39,248,980 CRR Critical Resources 0.0085 -15% 6,000,900 $17,803,503 BFC Beston Global Ltd 0.003 -14% 1,702,852 $6,989,664 DOU Douugh Limited 0.003 -14% 157,766 $3,787,241 ODE Odessa Minerals Ltd 0.003 -14% 55,000 $3,651,489 TMK TMK Energy Limited 0.003 -14% 7,430,483 $24,190,642 TMX Terrain Minerals 0.003 -14% 1,030,000 $5,010,847

ICYMI – AM EDITION

DY6 Metals (ASX:DY6) has received the formal grant of the Tundulu project licence from Malawi’s Department of Mines.

The project in southern Malawi is enriched in rare earths and niobium with historical drilling returning results of up to 101m grading 1.02% total rare earth oxides (TREO) and 3.6% niobium pentoxide from surface.

DY6 has engaged Perth-based consulting metallurgists Met Chem Consulting to review historical testwork work programs and assess the findings from the 2017 metallurgical report.

The company plans to initially focus on validating the beneficiation results achieved by previous laboratory test work before carrying out work to maximise both grade and recovery of rare earth and phosphate host minerals.

Future Battery Minerals (ASX:FBM) has agreed to defer part of the first deferred consideration payment from the sale of certain Nepean nickel project tenements to Rocktivity Nepean.

The company has agreed to receive $265,000 on 13 June as part payment of this payment with the remaining $2,435,000 to be paid by 13 September. Interest will also be paid on the balance of this payment from 14 June.

Other payments due to FBM are $2.5m payable 18 months from completion and $2m payable 24 months from completion.

Greenvale Energy (ASX:GRV) has secured a $100,000 co-funding grant under Round 17 of the Geophysics and Drilling Collaborations program administered by the Northern Territory Geological Survey for the acquisition of seismic at its EP145 helium project.

The 2D seismic line will be acquired in the central southeastern part of the permit as part of the extensive Wild Horse 2D seismic program that is scheduled to begin in August this year.

It is designed to optimally image the basement reflectors, thought to be as deep as 5km below sea-level, to de-risk any future exploration activities that target the Neoproterozoic sediments and basement structures.

This will help with the generation of prospective targets, resource evaluation and act as a guide to identification of valid drill targets in EP145.

Titanium Sands (ASX:TSL) has been granted the retention of key licence EL70 at its heavy mineral sands project in Sri Lanka.

All five of the company’s key exploration licences are now current, allowing it to continue with the environmental impact assessment process, which will be finalised on the issue of Terms of Reference from the Director General of the Central Environment Authority.

Once the EIA process is completed, the company will be able to advance to the issue of a mining licence for the project.

At Stockhead, we tell it like it is. While DY6 Metals, Future Battery Minerals, Greenvale Energy and Titanium Sands are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.