Agriculture: Nothing can stop the South African takeover of Mareterram now

Pic: Getty Images

There’s nothing more to stop the takeover of Australian aquaculture stock Mareterram (ASX: MTM).

This morning, South African seafood processor Sea Harvest gave notice that the one remaining Defeating Condition to their takeover bid was met.

This was the requirement for Sea Harvest have at least 90 per cent of Mareterram shares and as of yesterday Sea Harvest had 92.76 per cent.

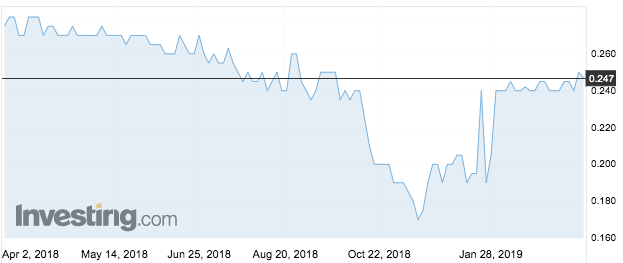

The offer, at 25 cents per share, will close on April 5 and Mareterram’s directors have recommended shareholders accept the offer.

As Stockhead previously reported, Mareterram first became a substantial holder in 2015 and in 2016 made a takeover bid at 35 cents. This offer was not accepted due to a control premium.

However, acquisition was seen as inevitable as Sea Harvest then held a majority of the company.

Mareterram sells seafood under the brand Running Wild and operates a prawn fisher in Western Australia’s Shark Bay – a World Heritage Site.

The company reported a profit of $327,000 in the 2018 calendar year, a sharp drop from the $1.5 million profit in 2017. In its most recent report it noted “one of the lowest industry wide total prawn catch volume on record since the late 1960s”.

Mareterram shares opened flat at 24.7 cents this morning.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

In other ASX agriculture news today:

CropLogic (ASX: CLI) has a solution for farmers to purchase their “hardware and software package”. It will offer farmers the option to lease its software. They can apply for finance and pay it off online and over a period of time.

The finance will be offered through German financier GRENKE. GRENKE company account director Brendan Kelly said they were “excited” about market trends making CropLogic useful.

Croplogic only received its first sale in their target region (Sunraysia) last December and has had several strategy shifts and board changes.

Farmers in Australia have struggled in recent months, with drought, fish kills and cyclones, so perhaps the issue is affordability. If so, the GRENKE deal could help.

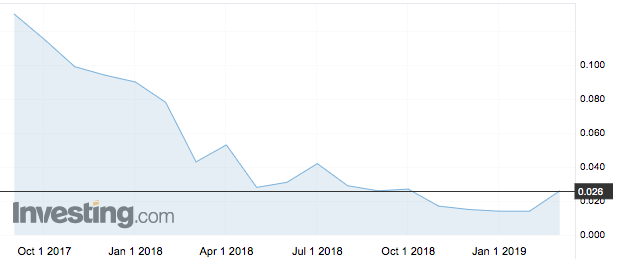

CropLogic listed at 20 cents but fell to 15 cents on its opening day and has been in freefall ever since.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.