The Secret Broker: Who’s got a burning ring of fire to deal with this week?

Picture: Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

On the 24th January 2023, a short seller produced a report that was so exquisite in its timing that it managed to wipe out US$90bn from the fortune of India’s richest man, in just one week.

At one point, he became richer than Bill Gates, with no computer coding in sight.

His wealth was based on Industrial grunt, not keyboard grunt. Oh, and a bit of sharemarket fairy dust (as it turns out).

The timing of the short seller report was as stated above, very exquisite, as the rich man’s listed flagship company was just about to finalise a US$2.5bn share placement, with all cheques to be in by Tuesday 31st January.

It was to be the largest Indian share fund raising ever held.

Their roadshow had started in November and included all the major financial capitals of the world. It was fully underwritten – or so we all thought.

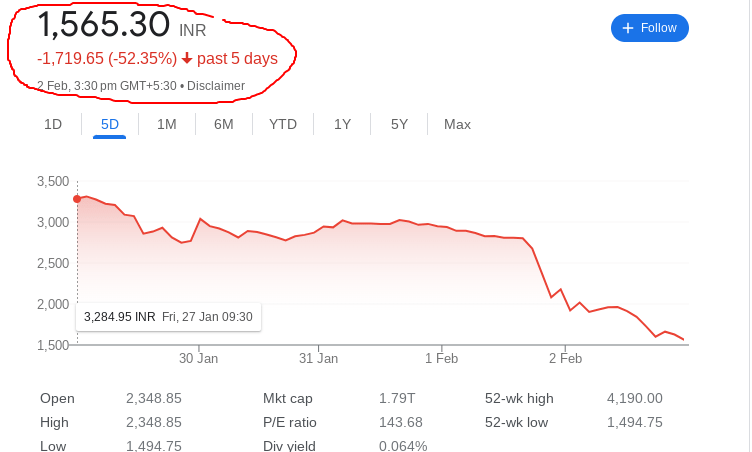

Here’s an image of what damage the shorters report did to the share price of the potential fundraiser’s investment:

Spicy!

The shorter is called Hindenburg, the rich man is called Adani. And since the two met, it has been gloves off in the financial boxing ring.

Currently, we have one on the canvas with two black eyes and the other without a single bead of sweat on their forehead.

And somehow in the mix of all of this financial circus is a rock band who were formed in 1968 but are now getting too old to play.

This has got to be one of the best stories of 2023 and we are only three days into February!

Down in flames

The title of the Hindenburg Research report, certainly held back no punches – Adani Group: How The World’s 3rd Richest man Is Pulling The Largest Con In Corporate History.

A heading that would make even Alan Bond blush, were he still alive.

The report was 106 pages long and took two years to put together and at the end of it, they asked for 88 questions to be answered.

Adani replied with a 413-page report – in three days! Of course it never truly addressed any of the concerns raised by Hindenburg.

Admittedly, I only gleaned information from the press and Hindenburg’s Twitter account, because I actually have a life to live. But from experience, which I have decades of, I can see why Adani Group are on the canvas, with the ref’s knockout count now heading somewhere beyond five.

However, when one side has a well-produced argument and the other side comes back with an emotional response, you can see who is going to come out on top.

Luckily for Hindenburg, Adani is/was a US$218bn conglomerate that has seven key listed companies. As I have pointed out before, a shorter can only make 100% on the shares they sell short. But in this case Hindenburg had seven going – happy days!

I know there is a large group out there who think shorting should be made illegal but as Cheryl Kernot said in Parliament, you need to “keep the bastards honest”.

Now, one of the report’s highlights was about this U$218bn group’s auditor which comprised of four partners and 11 employees and paid US$435 a month in rent for its head office.

The Adani Group had seven listed sister companies whilst the whole group had 578 subsidiaries in total. They carried out 6,025 separate related party transactions in 2022 alone.

That’s over 16 related transactions a day and in their 413-page response, they proudly announced that they would now appoint an auditor from one of the “Big 6”. Aye eee, not one of the Big 4.

When I read this, it was the biggest red flag I have ever seen. Without a shorter in the ring, they would have carried on as normal.

Some of those auditors who signed off on some of those subsidiaries were 23-24 years old, so I’m afraid Adani has a lot further to fall.

Rock on

You may by now be wondering how a rock band formed in 1968 is connected to all of this?

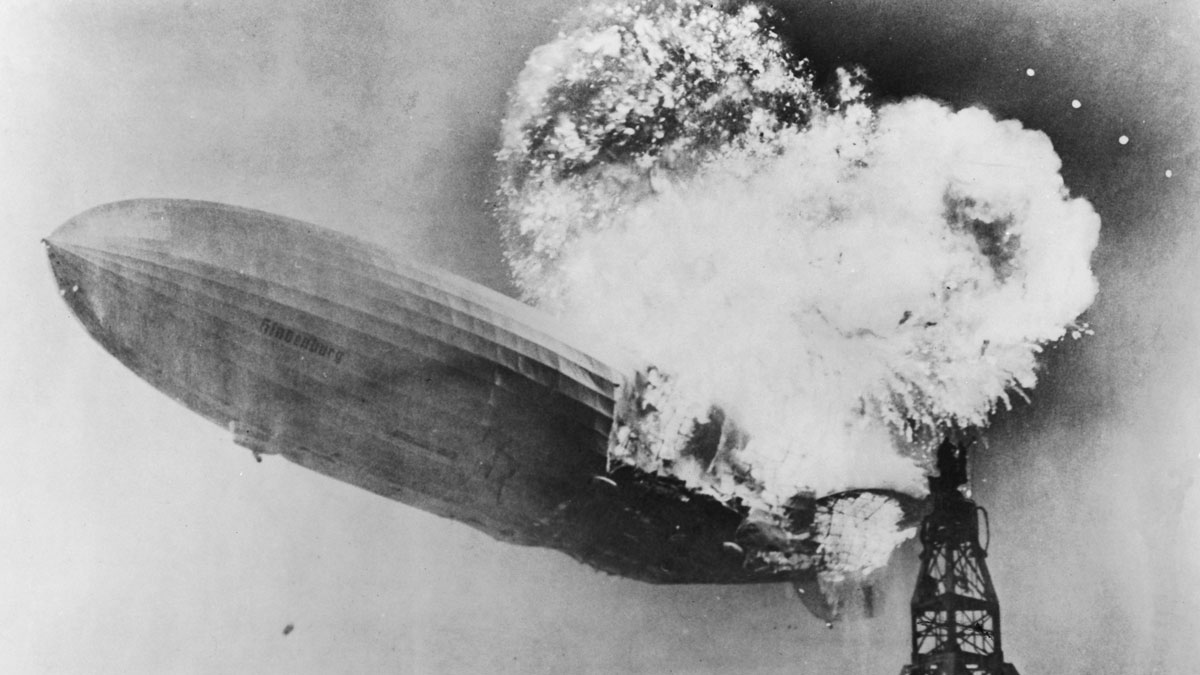

Well, the Hindenberg was an airship that spectactually went up in flames in 1937, when they used the wrong gas to allow it to float in the air, as it was cheaper.

The Hindenburg was built by the Zeppelin Company and in 1968, Keith Moon suggested to Jimmy Page and Robert Plant that the name of the band they were thinking of using would go down like a ‘Lead Zeppelin’.

So as not to confuse people, they took out the ‘a’ in case they said “lead” (as in “first”) instead of the metal and thus Led Zeppelin were born. On the front cover of their debut album is this famous photo of the Hindenburg going up in flames.

How’s that for an un audited bit of information?

Oh and by the way, I now truly believe that the Adani Group has been well and truly put into the curry, as Spike Milligan would say. And there is no Stairway to Heaven for any of their shareholders.

Now, can you pass me the poppadoms please?

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.