The Secret Broker: When Dan Dan the Borrowing Man gives you lemons, make… for the hills!

It's back-breaking work, this squeezing taxpayers. Picture: Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Continuing on from last week’s column about interest rates and the scary rise in bond yields, my focus this week continued on them as they nudged 4.66%… but also now I’m shifting a bit of my focus to the Australian dollar.

So much so, that I just got off the phone to our travel agent and cancelled, much to Mrs Broker’s horror, our European holiday.

I’m not going to be happy travelling around the world, shelling out more and more Australian dollars, for the exact same items that are now costing me 10% more than they did two years ago.

Nope.

We are now going to stay and holiday in Australia and if any of the relatives miss us, they can come and join us, as they will be paying 10% less to eat out than if they stayed in Europe.

As I explained to our travel agent (well, more bored her) on why I was cancelling our trip, it was because of ‘the correlation between bond yields and currency pricing’.

And it will only get worse for Australians travelling overseas.

As this week rolled on, I was observing the price of oil continuing to rise and the Australian dollar continuing to fall, (at one point to 62.8c) and this ain’t going to help the RBA in their gallant quest to tame the inflation beast.

Now, I am blaming all these politicians for the falling value of the Australian dollar, as they have been over-spending taxpayers’ income and then gearing so much so that it will take generations of higher taxed citizens to pay for their sins.

And they will be long gone or in the background somewhere, consulting for one of the big four accountancy firms.

Dan Andrews is a classic. Victorians will be taxed and taxed again to pay for his sins.

Only this week I was reading that he oversaw a $21m blowout for a project that had a budget of just – wait for it – $1m.

Victorians (remember this is just one state with just 6.7m people) now have a projected debt of $165 billion heading into 2025 0 and the state’s credit rating has fallen to AA.

That’s a debt of $24,600 for every Victorian.

Think of that as you are playfully throwing your three-year-old toddler into the air.

They are in debt to the tune of $24,600 and they are only three.

If you have a toddler now, my advice would be to move states, otherwise you will be required to answer some awkward questions when they reach the age of 10.

“Daddy, why is that man on TV crying?”

“Well darling, he is crying as he lives in Melbourne and he can’t afford a loaf of bread on his salary as he pays too much tax.”

“Can’t he use AfterPay like that other man did?”

“No darling he can’t. He’s not a politician.”

“What’s a politician Daddy?”

“I’ll explain to you later. Now eat your shoelace like a good boy.”

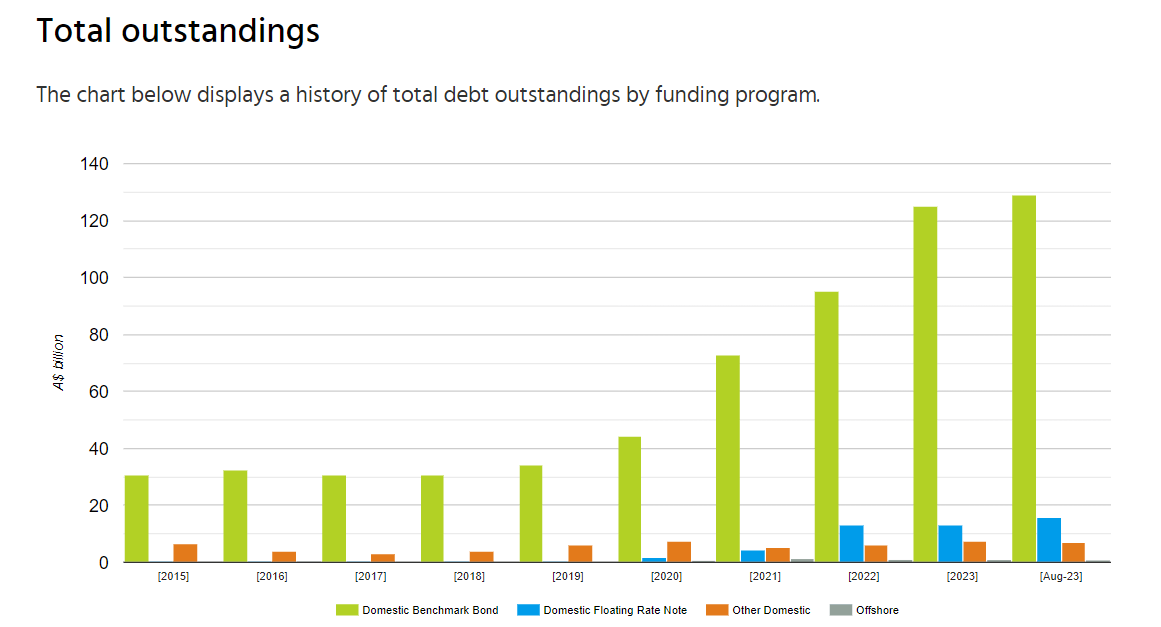

To explain a bit more on how all of this works, the Victorian Treasury Department have very kindly put it all together in a chart, with the heading ‘Outstanding’.

It certainly is outstanding but for all the wrong reasons!

So this is just one state in Australia, whose projected interest bill will be hitting $8bn a year in 2025 (using 5% as their credit rating has slipped).

Now if you add in all the other states and then the country’s overall debit, then holy moly, this is a powder keg about to explode and take the Australian dollar with it (as I pointed out to my now very bored, waiting-to-go-to-lunch travel agent).

I can’t remember a time when Australian interest rates were marked below the American interest rates. In my living memory, Australian rates were at a premium to the Yankee ones, as that was the only way that Australia could attract investment dollars.

If rates in America were 5%, then Australian rates would be at 6.5% as they needed to pay a premium to attract those investment dollars.

In 2000, the Australian dollar hit a low of 47.87 and a few speculators still lost money by getting their timing wrong, including Gerry Harvey, who lost $1m in 2002 when he took a non gee-gee punt and became a currency speculator.

If he had rolled over his A$ futures contract, he would have made A$20m instead. Ha!

If you live in Australia and earn Australian dollars, then don’t go punting it. You can only lose and rip up more, so why do it?

Over in the land of another nation that produces great steak, Argentina, their debt has reached $276bn and inflation has hit 100%. No one wants to hold their Argentinian pesos, only US dollars.

Luckily for all of us, states can’t print money, otherwise inflation would be more out of control than any bush fire they have tackled in recent years.

All they can do is kick the can of debt down the road. This they do by issuing more bonds as others come into maturity and unless they can show some financial discipline, their newly minted bonds will need to attract a higher interest rate.

Ooh, my pips!

It was only in May that Dan Dan the Borrowing Man was making headlines because he just shrugged off Moody’s and S&P’s credit warnings – and now he’s gone. Dear oh dear (or dear oh dearer, as I predict).

The only way that the Victorian debt can attract a lower rate of interest is by them tightening the belt and cancelling major infrastructure projects.

So, things that are important, like a rail line to their major international airport, gets canned ($10bn saved) which is why I hated doing business there. No direct train.

Thank God for Uber, is all I can say, and looks like I will still be saying in 20 years time.

I’m predicting at some point over the next two years, there will be a short raid on the A$ and this will leave RBA in a very tight spot as if they need to raise rates to support their currency.

Then those poor old Victorians really will have their pips squeezed even more and as the barman says at the golf club, you can only squeeze a lemon so much, as eventually it will have nothing left.

I will coin it the ‘Lemon Republic State’, after Paul Keating’s great quote when he called Australia a ‘Banana Republic’ (run by monkeys?).

Moral of the story for me is don’t speculate in your own mother currency and enjoy what you can do with it in your own motherland.

Having said that though, Mrs Broker doesn’t know this but I am planning to take her to Argentina and pay for accommodation in U$ dollars when we get there.

Haven’t booked it yet as I may be a few hours on the phone to our travel agent, as I explain to her why we are going to Argentina and not Victoria, then getting her to google the term Lemon Republic State before I hand over my hard earned A$ dollars.

Now off to buy a rose and book a few tango lessons.

Wish me luck!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.