The Secret Broker: What an interest-ing time to be alive!

Picture: Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Almost two months to go before the end of the Australian financial year and everyone’s been hit up with the 11th interest rate rise, just to kick ‘em where it hurts.

That’s right in the wallet, and on the floor you go, rolling around in agony.

A few deep breaths and put your head between your knees and you should soon recover. Or will you?

This last rate rise caught a few economists and bond traders a bit wrong-footed.

The economists just have bruised egos, whilst the bond traders have real financial losses to grapple with.

Then on top of this, another US bank gets saved from bankruptcy.

Regulators seized troubled First Republic Bank early on their Monday morning, making it the second-largest bank failure in US history.

All of its deposits and most of its assets were taken over by JPMorgan Chase, in a bid to end the turmoil that has raised questions about the health of the US banking system.

In Australia no one blinked.

The headlines were more about the footy and Charlie’s coronation, rather than trivial facts like the second largest bank failure in US banking history having just occurred.

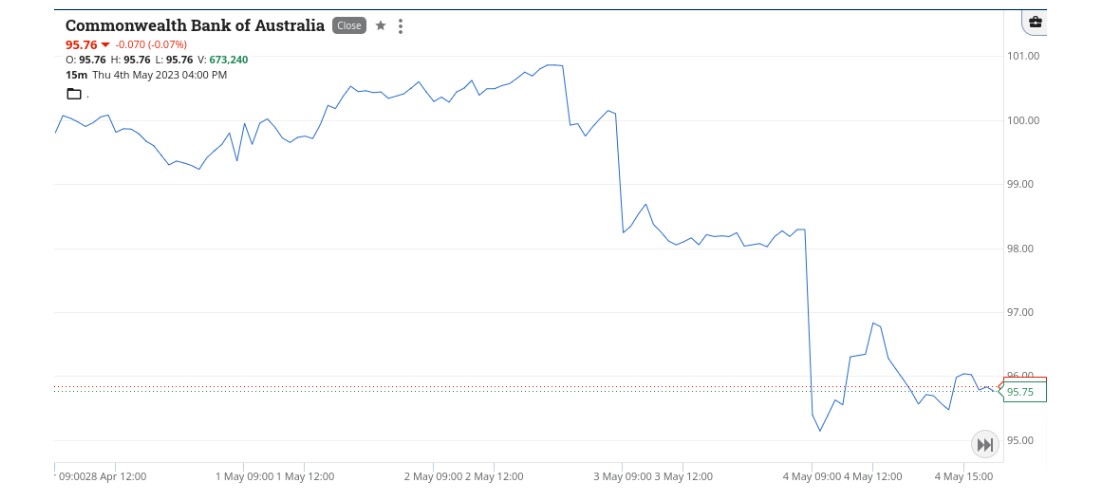

Here’s a chart of CBA from the start of the week, till Thursday. It took the RBA rate movement to really get things moving rather than just a minor thing, like a bigger bank failure since the last one caused the GFC to be set upon us all.

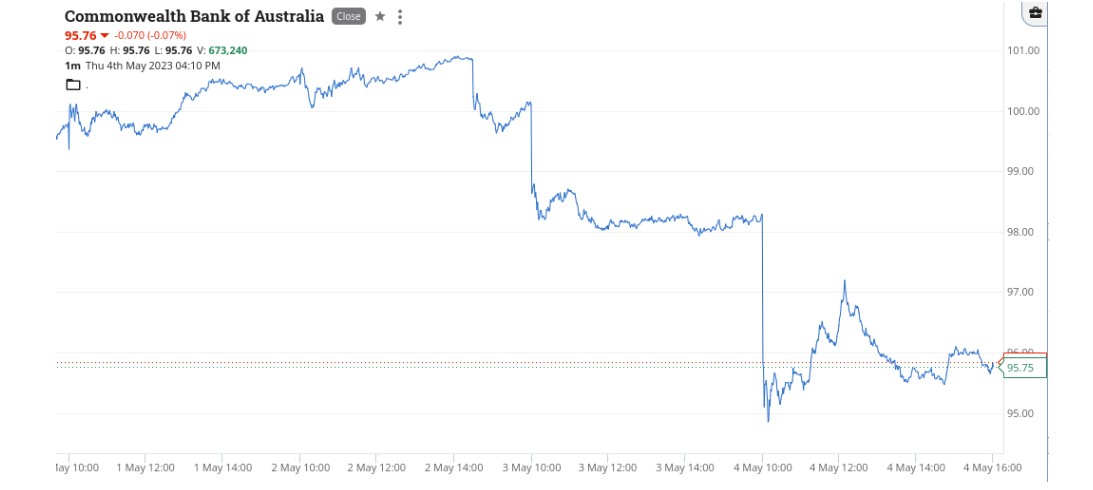

Or how about this view:

So, JPMorgan Chase has saved the world by buying the two largest bank failures in US banking history. First with Washington Mutual in 2008 and now with First Republic Bank in 2023, or 15 years later.

It would appear that everyone is thinking that another bank failure in the US can now be easily swept under the carpet and sorted out over a weekend.

Now here is something interesting to really sober you up and if you have a $1m plus mortgage, you may want to look away now.

The Australia 10 Year Government Bond reached a maximum yield of 6.793% on 16 June 2008, and and a minimum yield of 0.573% on 8 March 2020.

Currently it is 3.30% (5.00pm, 4 May 2023) and inflation is running around the 7% level. According to Google, in 2008, it was running at around 3.8%.

Not waving, drowning

I have this feeling that we have the sails up and it’s a warm Autumn day, with the sun shining on our backs and a light breeze, just before our gentle sail heads towards a hurricane.

It’s showing up on the weather map but the last few times it blew the other way. I’ve got my lifejacket on as the other sailors are just laughing at me, gin and tonic in hand and telling me I’m worrying over nothing.

Until we turn the corner!

I think that the reason that everyone seems so blasé is because there are no longer images of long queues of anxious customers outside of these banks, causing a run on them.

So far, Silicon Bank suffered a US$40bn withdrawal hit in one day (and that was only six weeks ago) and in the last quarter, First Republic Bank suffered withdrawals of US$100bn and 99% of all of these withdrawals were done online.

The digital world has softened everyone up.

‘Oh look honey, everyone on Twitter is saying we all need to get our savings out of our bank. Nothing to worry about, I’ll just login and transfer to another of our accounts.’

No need to even get out of your pyjamas and queue up in the rain with all the other losers. Just hit a few buttons on your phone and disaster avoided.

Oh to be a young one again, naively telling grandad that ‘you don’t know what you are going on about. This time it’s different and you just don’t understand it. You’re too old.’

I just show them some of my grey hairs and tell them each bunch of them represents past occasions of when ‘this time it’s different’.

Wait till they come running to me to help them with their mortgage and car repayments.

I’ll just have to go to the garden and dig up a few gold sovereigns I’ve been squirrelling away and tell them that they need to go and cash them in.

‘Can’t you just transfer me the cash, like everyone else?’

‘No I can’t. I’m too old to know how to do that. Remember? Oh is that a grey hair I see appearing. And at your age!’

‘Oh dear.’

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.