The Secret Broker: To BTC or Not To BTC?

Pic: d3sign / Moment via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

I was reading something in the FT this week that brought a tear to my eye.

I can get emotional when reading something in the financial press. This is difficult to explain to the lads at ‘my local’, who only get emotional when reading the sports section or looking at the pictures of players with matching sets of missing teeth.

A published letter to the editor of the FT by a prominent UK fund manager pointed out how the London Stock Exchange (LSE) had slipped as the leader of world stock exchanges.

I mean, how could this be?

My beloved LSE was being portrayed not only as a backwater for IPOs but also, as the letter stated, “a sort of Jurassic Park” of listed companies.

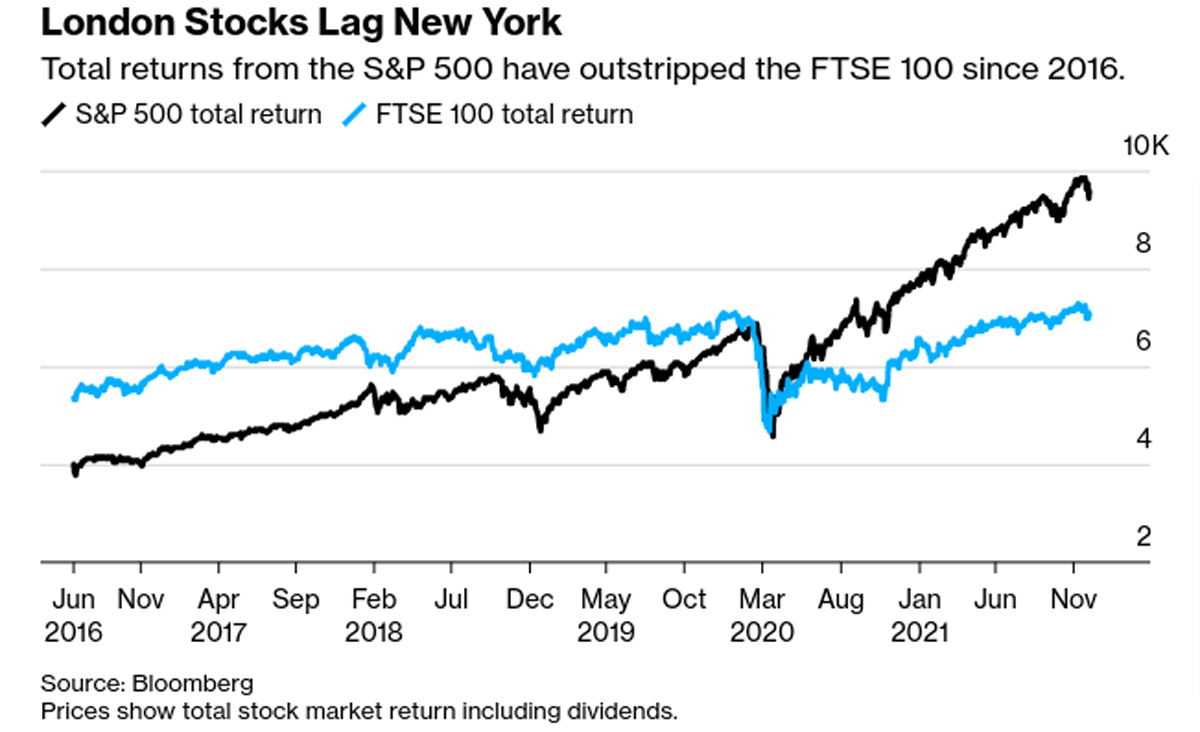

Since 2016, returns given by the FTSE 100 have underperformed the S&P 500, as you can see in the chart below:

The prominent fund manager was pointing out the fact that most UK investment funds only invest in dividend paying companies and not innovative companies.

He gave an example of a company in which his fund has a $220m holding and how, when it announced it would reduce its dividend and use those funds and reinvest them into renewables, it fell 5%.

They basically said that they would increase their investment into renewable energy by a rate of 2.5 times higher than previously stated. The news was greeted on the day with a thumbs down.

So, income funds sold them down and there was not a lot of support to soak up the selling. In a rational world, the opposite should have happened, as their second half results were also better than anticipated.

Many London roadshows to UK fund managers end with a tut tut, if, God forbid, a new CEO was suggesting cutting their income stream and reinvesting it into growing the business.

This type of investing, of just ‘clipping the coupon’, encourages rewards for the past but not for the future – and this was why the FTSE 100 was underperforming and I was crying.

I had only left them 30 years ago to their own devices. Look at what they’d achieved in that time.

On a typical day in the UK, the total turnover of the LSE could touch just over US$6bn, whereas in the USA, Tesla alone can trade US$20bn in a day.

A company like Apple can reach US$12bn.

This December alone, the ASX will welcome over 30 new listings, which brings the total number of new companies listed in Australia to over 200 in 2021. The LSE are only just starting to introduce new rules, in response.

From memory, Warren Buffett’s Berkshire Hathaway has only ever paid one dividend and he joked about it later in life, by saying he must have slipped out to the bathroom when it was voted through.

He just rewards his shareholders with capital growth and share buy backs.

In fact, he just spent a record $31 billion buying back Berkshire Hathaway shares in the 12 months to June 30 2021 and as we all know, less stock equals higher valuation.

At least all of these exchanges are regulated, unlike the CRYpto trading pits where another exchange appointed a liquidator and all trading accounts were frozen and many millions of dollars have disappeared into thin air.

This doesn’t make me cry, just angry, as it’s hard enough to hang on to a hard-earned dollar, let alone leave it in a market that pretends to have rules and regulations.

The very first officially listed Bitcoin ETF was not allowed to directly hold any Bitcoins. It could only hold contracts and options traded on the SEC regulated futures market.

That gives you an insight into what regulators are thinking and why you really do need to do your own research when picking a CRYpto exchange.

As the Governor of the RBA stated this week, “Bitcoin was just a speculative mania”. And also given that ASIC have stated that they have no mandate to regulate digital currencies, it really is buyer beware.

I’m happy to have my shares held by a broker and my capital in a separate Cash Management Account though with Bitcoin, they are held in a ‘cold wallet’ and never with a broker or an exchange, as they then control the asset and not you.

Trust me. FOMO will eat your money.

But what would I know? I’ve only been doing it for 40 years.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.