The Secret Broker: Time to learn Latin. Again.

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Here we go again.

When the wheels fall off an IPO, all the finger-pointing starts, as everyone involved ducks for cover.

We saw it with the refloat of Dick Smith, when the financial engineers managed to shuffle figures around and turn a pig into a glistening 24 carat bonus bonanza for the IPO vendors.

The finger-pointing on that one led to full Senate enquiry and I get the feeling another one could be on the way, this time with the compliments of Macquarie Bank.

The ASX has the powers to veto any IPO and has its own set of investing public safety rules and regulations that need to be followed.

On top of that, you have ASIC adding another layer of protection to the investing public.

Or do they?

In my experience, you should never buy anything that private equity/banking is selling on their own behalf and not for a client.

They are all smart cookies and if they are selling, it’s not because they want to share their wealth with you.

No, no, no.

They are selling an IPO because they couldn’t find a trade buyer.

It’s very rare that a merchant bank or private equity ever plays ‘pass the parcel’ with each other. That’s mainly because the buyer knows the sellers in the room are cashing out and the big bonus cheques are in the drawer, ready to be signed and handed out.

It would be a very naive private equity player who would hand over a cheque for $100m, knowing that $20m of it was going as bonus payments to the guys on the other side of the table.

So, an IPO is normally a better option for the private equity or merchant banker players.

Remember that the fees on an IPO are not paid by the public applying for the shares. They’re paid by the seller, out of the funds raised.

Normally, a 5% fee (known as a ‘stamping fee’) will be paid out to brokers and financial planners on each application received.

So, when you apply for two grand’s worth of shares via your broker, they will get a commission cheque of A$100 from the seller, as a thank you.

So which IPO has got everyone from Macquarie Bank and an array of lawyers and accountants ducking for cover this time around?

Correct – Nuix.

In 2020, it was the largest valued technology play to be listed. In fact, an article in the AFR that appeared after the IPO stated:

“It was serendipity that created Nuix, the most valuable technology IPO of 2020, and serendipity that it listed in the week China stepped up its belligerent attitude to Australia.”

Six months after their IPO an AFR article appeared which stated:

“The corporate regulator has issued Section 19 notices to Nuix and Macquarie as ASIC considers whether Nuix overstated forecasts ahead of its listing in an investigation that has been running for weeks.”

In the space of six months, the Nuix IPO had gone from a joyful serendipitous ‘occurrence and development of events by chance in a happy or beneficial way’ to ‘ASIC turns blowtorch on who controlled Nuix IPO’.

Here is a graph of the Nuix performance, so far, since its floatation on the ASX:

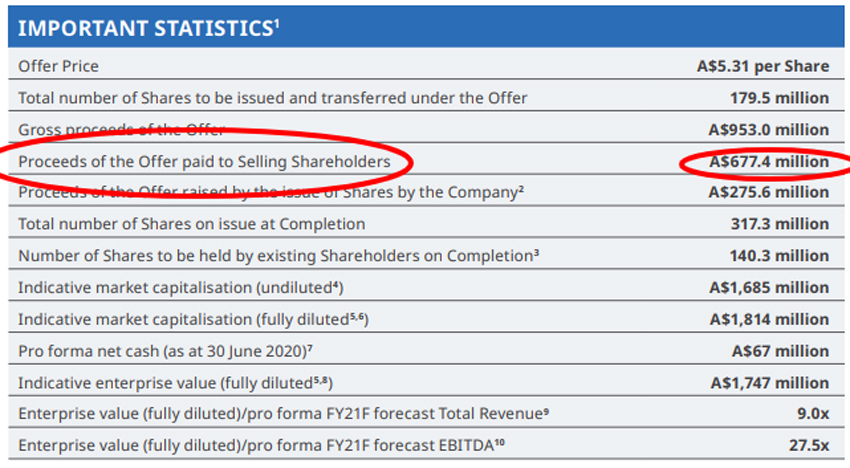

When Nuix raised its funds from the public, A$677.4m went not to the company, but to Macquarie Bank and other shareholders.

One chap, who was an advisor to the company, managed to cash out A$3000 worth of incentive options into A$80m of the A$677.4m payment shuffle.

There was even a dispute with a former CEO highlighted on page 237 of the prospectus. He claims he should have entitlement to 22,663,650 shares in the IPO but the company says it should only be 453,273 shares.

That to me is a hell of a rounding down figure.

A$120,343,981.50 worth of shares got rounded down to A$2,406,879.63 and for some reason, this resulted in court action and lawyer fees.

As the prospectus was 330 pages long, this meant that 299 pages were the ‘fat bit’, as my mate used to call it ahead of the application form. Seeing as the shares doubled on the market, no one really cared about all these facts and figures, until it was company reporting time.

This is when things started to go pear-shaped. When they had to issue information that six months later was not the same information as the prospectus contained, shares started heading south.

Sold on a valuation of A$1.8bn, it raised a total of A$953m, of which A$677.4m went to selling shareholders and with ASIC now taking action, it’s not a good look.

Their current valuation of A$840.88m (A$2.65 a share) – when you take into consideration that their IPO gave them A$275.6m in new capital and you take this away – actually comes to A$565.28m.

Considerably less than the sellers took off the table and pocketed.

The trouble is now, when that sort of money has been shuffled out of many hands and into so few, ASIC will have to stump up an eye-watering amount of money to see any meaningful result, as the fight could go on for years.

Luckily for me I learnt early on in life a Latin term that at the time annoyed me, but later in life financially saved me.

You see, whenever I bought a new girlfriend home from school, my father would always greet them at the door, with a big smile on his face and say ‘Caveat Emptor, my dear’.

His greeting, as I soon found out, meant I always had to avoid any girls who attended Latin classes. If they did, my modus of ‘we can study Latin together in my room if you like’ would be fully blown.

I would never get the chance to do with them what the vendors were able to do to all the new Nuix shareholders.

Thanks Dad!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.