The Secret Broker: SOS to ASX re CHESS and DLT? FFS!

Picture: Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

In Australia, they love an acronym attached to a monopoly and this week, one of Australia’s biggest and brightest monopolies became a piercing white light shooting star.

It shone so bright that I had to turn down my monitor to dark mode, which incidentally I learnt to do back when they shut the market floor down, and I had to sit next to another trader at our computers.

He was so bad at trading that his monitor would glow red, acutally bathing him in a red glow. As he was bald and almost always had his hands on his head, the bits not covered by his fingers would shine like beacons.

Feeling sorry for him, we learnt how to turn his monitor to black and white and not disturb him as we left the office ahead of the weekend. It was either that or put a wig on him, but even we deemed that too cruel.

Anyway, the bit of information I was reading about, which caused me to adjust my screen brightness, was on the ASX. Apparently they were having trouble with their CHESS system before releasing ITE1, which needs approval from ASIC and the RBA.

There you go, five acronyms in one sentence and I’ve only just started to write my article.

ASX stands for Australian Securities Exchange (that’s right, securities replaced stock in 2006). CHESS stands for Clearing House Electronic Subregister System. ITE1 stands for Industry Test Environment 1 (as in the first one). ASIC stands for Australian Securities and Investments Commission.

And RBA stands for Right Bloody A…holes, according to one of my fellow golfers who supersized themselves up when trying to keep up with the Joneses. Now he tickles me up at the bar to borrow $100 so he can get the next round in, whilst whispering ‘you know how it is’ in my ear.

I won’t see him or my $100 ever again.

However, the ASX’s use of acronyms only gets better as the replacement for their clearing system CHESS has been seven years coming – and boy, do we have some doozies.

The replacement system was going to be on the blockchain, so they needed a DLT (Digital Ledger Technology) custom built and they employed DAH (Digital Asset Holdings) to do this but the ASX (securities, not stock) ended up needing EY (Ernst & Young) to write a report to find out why they never got to ETI2 (Industry Test Environment 2).

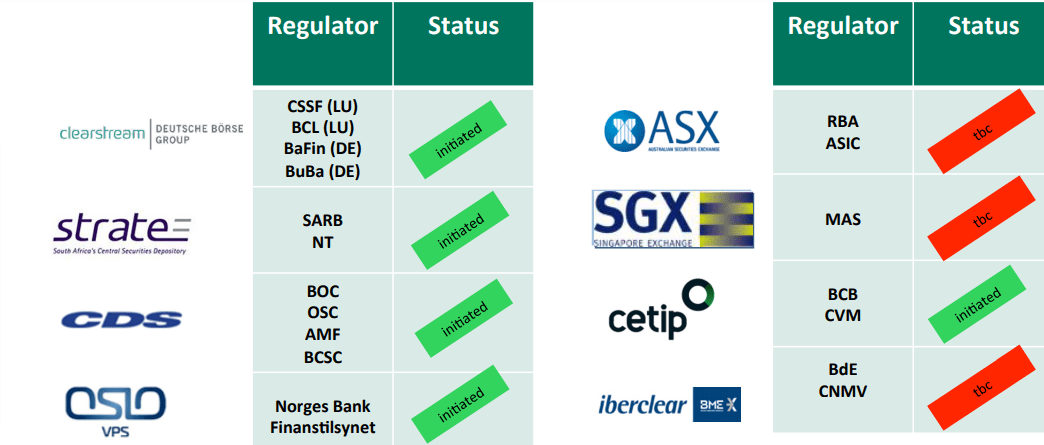

If you think I am making all of this up, here is one of the presentation slides that I found, that contains 17 acronyms and the ASX logo.

I’ve now got my sunglasses on!

Seven years and $250m later, the ASX have now abandoned the idea of using the blockchain. Having become a shareholder in DAH, it now turns out that after those seven years, only 63% of the project has been completed.

Now, you have to remember that the ASX is a listed monopoly (well 95% monopoly) and their CHESS system a 100% monopoly, so it has been in their shareholders’ interests to delay replacing it.

Being an ex-government run company means they are experts at drawing things out.

So much so, that the person heading the inquiry into the whole CHESS saga said: “However, we were underwhelmed by responses from the ASX, and the same culture seems to be continuing.”

Being a monopoly means that you can make up your own rules. Here are their rules on how stocks have to be grouped together at the open and not all at once.

Group 1 Letters A-B – 10:00:00 a.m. (+/- 15 secs).

Group 2 Letters C-F – 10:02:15 a.m. (+/- 15 secs).

Group 3 Letters G-M – 10:04:30 a.m. (+/- 15 secs).

Group 4 Letters N-R – 10:06:45 a.m. (+/- 15 secs).

Group 5 Letters S-Z – 10:09:00 a.m. (+/- 15 secs).

The above means that a company like ANZ can trade for nine minutes more than Westpac just because their name begins with an A. BHP trades for six minutes more than RIO does.

I don’t recall any other major exchanges doing this. Not even the French or Italian bourses, which I found out when I had to cover for someone once, in 1992.

I was going to end this article with the acronym SOS in the last paragraph but SOS is actually be a bit like “ASX” – a ‘backronym’.

This is because SOS was only used as a distress signal as it was quick and easy to send those three letters in Morse Code. It only became known as ‘Save our Souls’ later in life. Therefore SOS is a backronym, not an acronym.

So, instead I will end it with a more modern day acronym, that sums my thoughts on something that took seven years, cost A$250m and came in at only 63% completed.

Oh FFS!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.